Please see this week’s market overview from eToro’s world analyst crew, which incorporates the most recent market information and the home funding view.

Robust Huge Tech earnings can’t take away US election nervousness

Final week, Alphabet, Meta, Microsoft, Amazon, and Apple all delivered their earnings reviews for the most recent quarter. Alphabet and Amazon shocked with stronger-than-expected outcomes, whereas Microsoft dissatisfied with a warning of slower progress as a result of capability constraints. Mixed, the 5 tech giants generated $450 billion in income, which they’re set to take a position closely in AI. Amazon CEO Andy Jassy even referred to it as a “once-in-a-lifetime alternative”.

Huge Tech is reportedly seeing prospects spend extra time on AI-enhanced platforms, resulting in extra advert impressions and product gross sales. This pattern justifies additional will increase in capital expenditure budgets, with a mixed run price of $250 billion per 12 months. Microsoft (in partnership with OpenAI), Alphabet, and Meta are investing closely in their very own giant language fashions, whereas Amazon and Apple select to construct on the efforts of a number of exterior suppliers.

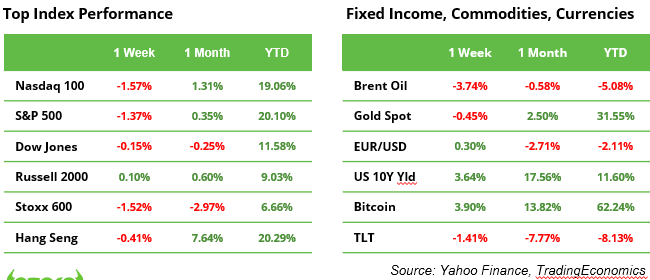

Huge Tech earnings couldn’t stop fairness markets from retreating although. Uncertainty surrounding the end result of the US elections and issues about ballooning authorities debt despatched the S&P 500 and Nasdaq down by 1.4% and 1.6%, respectively. Bond traders demanding a better threat premium for holding authorities debt pushed the US 10-year rate of interest as much as 4.4%. Nonetheless, new macroeconomic information on progress, inflation and the roles market recommend that the Fed’s almost definitely transfer this week is to chop the coverage price by 0.25%. In response to an outlook of weaker world progress and a drop in oil costs of almost 4% over the previous week, OPEC+ determined over the weekend to postpone a deliberate manufacturing enhance.

The market is awaiting the US election final result earlier than selecting a course in the direction of 12 months finish.

Fed seen to chop its coverage rate of interest with one other 0.25% on Thursday

The newest US financial information didn’t present a best-case state of affairs for Wall Road however remained acceptable for traders, reinforcing expectations for a small Fed price minimize on Thursday. The market has almost absolutely priced in a 0.25% discount to a spread of 4.50% to 4.75%. The info pointed to a cooling labour market, barely slower progress, and stagnant core PCE inflation. Whereas these alerts assist a “comfortable touchdown”, recession dangers have elevated because of this, which can lead traders to invest on additional price cuts within the medium time period. Fed Chair Powell’s press convention may present essential insights into the longer term course of the rate-cutting cycle.

US presidential election: will it’s Trump or Harris?

The end result of the US elections carries important weight, because the successful candidate will set the tone for the approaching years. Nonetheless, it stays difficult to gauge how a lot a president can genuinely affect GDP progress or inventory market efficiency. Extra crucial than political management is the general well being of the financial system, which presently positions the US comparatively strongly. The Federal Reserve retains ample flexibility to answer sudden developments. Whereas current dangers enhance vulnerability to shocks, the long-term outlook stays constructive. Even so, the financial influence of political selections shouldn’t be underestimated.

On the core of this heated election-year debate lies tax coverage, a key concern sharply dividing the candidates. Republicans advocate tax cuts to stimulate financial progress, with Trump proposing a drastic 60% tariff on Chinese language imports—a dangerous transfer with potential repercussions for US customers. In distinction, Democrats are calling for tax hikes on the wealthiest to deal with rising revenue inequality, a shift that might profoundly influence sectors like luxurious items, telecommunications, and monetary companies.

Trump’s insurance policies may favour the defence sector, whereas a Harris victory may convey the healthcare sector into sharper focus. By way of vitality coverage, fossil fuels and renewables stand in stark opposition, creating uncertainty for companies. Nonetheless, there’s bipartisan consensus on the urgent want for funding in US infrastructure and on the significance of sustaining technological management over China.

Earnings and occasions

Rate of interest selections by the Fed and the Financial institution of England are the principle macroeconomic releases the market will deal with this week. Moreover, China and Germany will publish new commerce steadiness information. All this exercise takes place on Thursday 7 November.

Many firms report earnings this week, together with 100 out the S&P 500. A range:

Earnings releases:

4 Nov. Palantir, Constellation Vitality

5 Nov. Ferrari, Deutsche Submit, Unicredit

6 Nov. Qualcomm, Arm, Novo Nordisk

7 Nov. Barrick Gold, Cameco, Arista Networks, Rivian, Airbnb, The Commerce Desk

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding goals or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.