Please see this week’s market overview from eToro’s international analyst group, which incorporates the newest market information and the home funding view.

Increased Inflation causes headwinds for shares and bonds

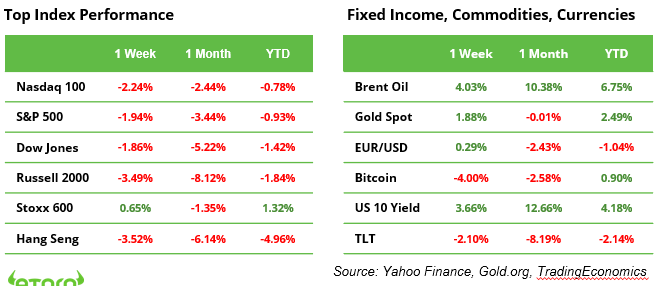

A stronger-than-expected jobs report and renewed issues about inflation led main US fairness indices to say no by almost 2% final week. The ten-year Treasury yield surged to 4.75%, pushed by fears that the US financial system could also be too sturdy for the Federal Reserve to proceed decreasing its funding charge towards the focused 3%. In distinction, European shares confirmed resilience, with the STOXX 600 index rising by 0.7%. Oil costs rose by 4% following elevated US sanctions on Russia.

This week guarantees to be eventful, that includes a sequence of macroeconomic information releases (see subsequent web page), the kickoff of the This autumn earnings season (particulars beneath), and the discharge of OPEC’s month-to-month oil market report. Moreover, any sudden political developments are more likely to seize consideration forward of Donald Trump’s inauguration subsequent Monday.

This autumn US earnings season: monetary sector more likely to drive earnings development

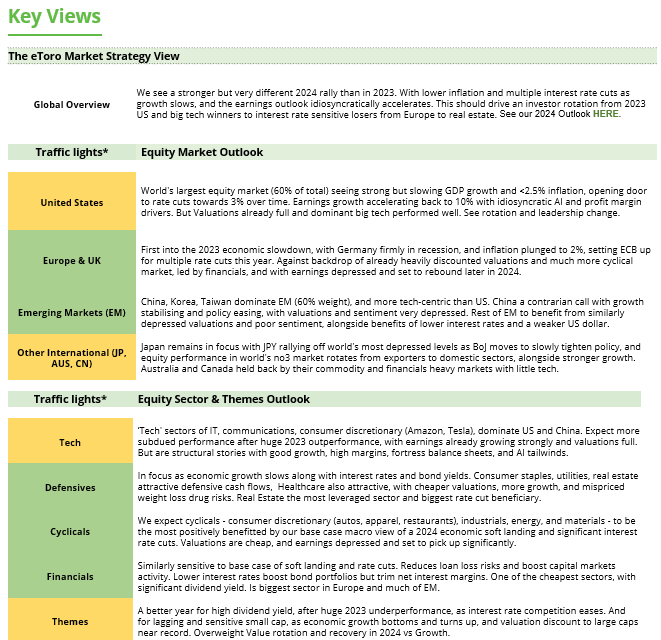

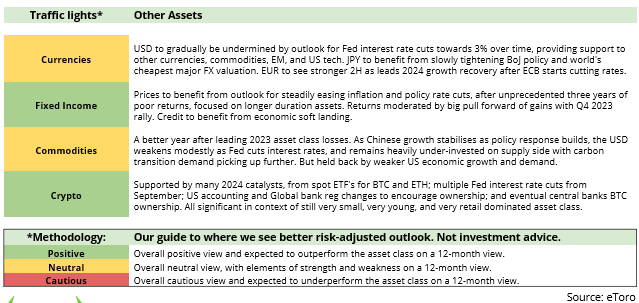

The US earnings season unofficially kicks off subsequent week, with explicit consideration on the massive banks. This focus arises not solely as a result of monetary establishments sometimes report first but additionally as a result of the monetary sector has carried out exceptionally properly since Donald Trump’s election, buoyed by expectations of lowered regulation. The sector is projected to ship the strongest earnings development within the S&P 500, a powerful 39.5% year-on-year.

On Wednesday, main gamers like JP Morgan, Wells Fargo, Goldman Sachs and Citigroup are set to launch their outcomes, adopted by Financial institution of America and Morgan Stanley on Thursday.

Throughout the earnings season, outcomes from 11 sectors are analysed and in contrast. Whereas the monetary sector is anticipated to guide, the know-how sector is projected to attain earnings development of 14.0%, securing third place (see graph). This determine stays above the S&P 500’s general anticipated development of 11.9%, which might mark the strongest earnings development since This autumn 2021 and considerably exceed the 10-year common of 8.5%. Gross sales development for the index is estimated at 5.1%.

The political panorama continues to introduce uncertainty. Donald Trump’s inauguration on Monday, January 20, may immediate a cautious, wait-and-see strategy from buyers. Nevertheless, important deviations from earnings expectations or main bulletins from the banks may disrupt market stability and drive volatility.

Inflation is a key focus on this week’s international macroeconomic information releases

On the macro entrance, will probably be a busy week of key information releases from the US, the UK, and China. For the US and the UK, CPI information might be essential to gauge whether or not core CPI and companies inflation, key metrics from a coverage perspective, are displaying any indicators of acceleration. Given final week’s hawkish US labor market information, buyers will not be seeing any charge cuts till June. CPI information might be one other cue to gauge the tempo of the speed reducing cycle forward. Retail gross sales from the US, the UK, and China may even be monitored intently to gauge general shopper spending well being and whether or not inflationary pressures are inherent on a micro stage. Lastly, China will launch its GDP numbers whereas, in Japan, Deputy Governor Himino’s remarks might be intently watched for indicators of the BoJ’s interested by hotter inflation.

Quantum computing ctocks see wild swings

Google made headlines a month in the past with the breakthrough announcement of Willow, its superior quantum computing chip. The information initially sparked pleasure throughout the market, resulting in a pointy rally in quantum computing shares like Rigetti, D-Wave, and IonQ. Nevertheless, optimism was short-lived. NVIDIA CEO Jensen Huang tempered expectations final week with a sobering remark, stating that helpful quantum computing remains to be 15 to 30 years away. Following Huang’s remarks, shares within the sector skilled a dramatic reversal, plummeting as investor sentiment shifted.

In the meantime, consideration within the semiconductor sector is popping to Taiwan Semiconductor Manufacturing Firm (TSMC), which is ready to report its earnings this Thursday. The outcomes are anticipated to offer crucial insights into the well being of the broader semiconductor trade, particularly as demand faces uncertainty within the present financial atmosphere.

Macro and earnings information releases

Macro

US PPI (14/1), US CPI, UK CPI & PPI (15/1), US retail gross sales (16/1), China information package deal (17/1, together with GDP, industrial manufacturing and retail gross sales). OPEC month-to-month oil report (15/1)

Earnings

15 Jan. JP Morgan, Wells Fargo, Goldman Sachs, Citibank, Blackrock

16 Jan. TSMC, Infosys, UnitedHealth, Financial institution of America, Morgan Stanley

17 Jan. Schlumberger

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out considering any explicit recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.