Final evening, President Trump signed the “Digital Property” govt order (EO), and let’s simply say Bitcoiners are feeling… bitter. Initially, rumors swirled that this could be the lengthy anticipated Strategic Bitcoin Reserve (SBR) laws. However nope — not even shut. Bitcoin reserve didn’t get a single point out.

As a substitute, the EO stated:

“The Working Group shall consider the potential creation and upkeep of a nationwide digital asset stockpile and suggest standards for establishing such a stockpile, doubtlessly derived from cryptocurrencies lawfully seized by the Federal Authorities via its regulation enforcement efforts.”

Translation: This EO appears to be like like a obscure “let’s research shitcoins” roadmap moderately than a daring step towards a Strategic Bitcoin Reserve. In case you have been hoping for a nation state orange tablet second, this ain’t it.

However earlier than you rage tweet, take a deep breath. There’s a silver lining. The EO does outlaw CBDCs — an enormous win for freedom cash and a extra Bitcoin-aligned future.

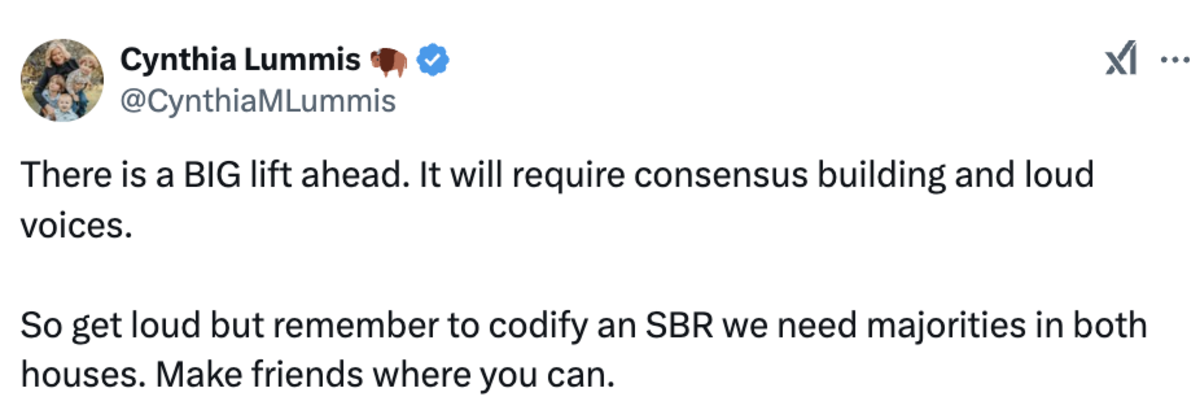

And, as Senator Cynthia Lummis reminded us yesterday, her Strategic Bitcoin Reserve Invoice is “a BIG elevate”:

Why is that this excellent news? Let’s break it down:

Govt Orders Are Fragile: EOs are fast to implement however might be simply reversed by the subsequent administration. They’re political Put up-it Notes, not everlasting fixes.Laws Is Sturdy: Legal guidelines handed via each homes of Congress are far more durable to repeal. Lummis’ long run technique goals to cement Bitcoin’s position within the U.S. economic system for generations, not simply the subsequent election cycle. She is taking the low time desire route, and I salute her for that.

Senator Lummis stated it herself in an X DM she allowed me to share:

“Even when the EO had been an outright Strategic Bitcoin Reserve, the subsequent administration (after Trump) might undo it (what’s executed administratively can typically be undone administratively). So, so as to get the 20-year minimal HODL, which my invoice requires, and meaningfully handle America’s debt, we have now to undergo the legislative course of (passage via each the Home and Senate) to get it to the President’s desk for signature.

It’s actually essential that we have now momentum for a marathon, not a dash. I don’t need individuals getting discouraged. The trajectory is to the moon however we have now to keep it up and work the method. Tons to do however the EO was an important jumping-off level to get us there.”

So sure, the EO looks like a fast win for crypto execs desirous to pump their baggage. However the actual battle for Bitcoin’s future is simply starting.

A congressionally authorised SBR is healthier than an SBR through Govt Order. Full cease!

Bitcoin has all the time thrived in adversity. Whether or not it’s bans, restrictions, or now the “nationwide digital asset stockpile” nonsense, Bitcoin’s resilience is unmatched. As Senator Lummis works to push the Strategic Bitcoin Reserve Invoice via Congress, particular person states are already main the cost. States are introducing Bitcoin-specific reserve laws, not obscure “digital asset” plans.

In the meantime, international momentum is constructing. Putin didn’t say, “nobody can management digital property,” he stated “nobody can management Bitcoin”. Nation states aren’t about to FOMO into $TRUMP or FARTCOIN. They’re watching, studying, and inching nearer to Bitcoin.

Bitcoin wins as a result of it’s superior cash. Each piece of stories, even setbacks, is finally bullish for Bitcoin as a result of it exposes weaknesses in fiat and strengthens Bitcoin’s narrative. So keep affected person. The sluggish burn will probably be price it.

See you in Vegas — and keep in mind: finest cash wins.

This text is a Take. Opinions expressed are completely the creator’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.