Based by three pseudonymous builders, Berachain, a layer-1 blockchain set to compete with Ethereum and Solana, launched its mainnet on February 6, 2025.

The community makes use of a brand new consensus mechanism referred to as proof-of-liquidity, which goals to higher align the incentives of community individuals whereas bettering safety of the chain.

The brand new EVM-identical blockchain aimed to unravel the “chilly begin drawback” that the majority early blockchains face, offering customers and early purposes with “significant interactions” from day one.

Right here’s every thing it’s worthwhile to know.

‘EVM-identical’

Berachain is designed as a “excessive efficiency, EVM-identical” layer-1 blockchain, which means it goals to be an identical to the Ethereum Digital Machine on the execution layer. Due to this fact, any main upgrades to Ethereum mainnet, just like the upcoming Pectra improve, can then be replicated on Berachain.

Along with community upgrades, builders can simply deploy any apps or protocols designed for EVM-compatible chains straight on Berachain, eradicating boundaries for builders that want to distribute their merchandise on new networks.

Using a novel proof-of-liquidity consensus mechanism, which “borrows” from Ethereum’s proof-of-stake design, the chain launched its first testnet in January 2024.

On the time, Berachain’s v1 Artio testnet used the Cosmos SDK, however the builders quickly realized that Cosmos “couldn’t deal with the quantity of transactions” the testnet was receiving. That in the end led to the creation of its personal modular and customizable consensus layer, BeaconKit. Developed by Bearchain, it claims to offer a number of technical efficiencies for EVM chains whereas transferring the community from a monolithic to a modular structure.

Although the community goals to be practically an identical to Ethereum in execution, it varies drastically from different blockchains with its proof-of-liquidity consensus mechanism and multi-token mannequin.

Proof-of-liquidity

Bitcoin makes use of the energy-intensive proof-of-work mannequin, whereas Ethereum makes use of proof-of-stake to validate blocks, however Berachain will use a novel consensus mechanism referred to as proof-of-liquidity.

The community calls proof-of-liquidity an “extension” of proof-of-stake that “realigns incentives between validators, purposes, and customers.” With this new consensus mechanism, two tokens are utilized—one for gasoline and community safety (BERA), and one other for governance and rewards (BGT).

The cycle begins with a validator staking a minimum of 250,000 BERA tokens, just like how an Ethereum validator requires a minimum of 32 ETH. As validators suggest blocks, they then earn rewards from Berachain, paid in BGT.

Validators subsequent distribute that BGT to reward vaults, or allowlisted good contracts by which customers deposit eligible belongings like BERA with a view to earn BGT rewards. For offering liquidity to whitelisted protocols, customers earn a receipt token, which might then be staked contained in the rewards vaults, in the end yielding BGT rewards.

That BGT reward can then be redelegated to the validator of the consumer’s selection, doubtlessly boosting it for extra rewards.

Berachain tokens

Finally, Berachain has three native tokens: BERA, BGT, and HONEY, every of which serves a barely completely different function.

BERA

BERA is the community’s native gasoline token, just like how ETH is the native token for the Ethereum blockchain. In different phrases, to finish transactions on the Berachain community, customers will want some quantity of BERA tokens to pay for charges. It’s also the token required for staking by way of Berachain validators.

BERA is accessible for buying and selling on fashionable centralized exchanges like OKX, Binance, and Coinbase.

BGT

BGT is non-transferable and acts because the Berchain governance and rewards token. Not like BERA or HONEY, BGT can solely be earned by partaking in “productive actions” throughout the community. In different phrases, which means customers can earn BGT solely by interacting with protocols and purposes which have allowlisted reward vaults.

Most frequently, BGT shall be acquired by supplying liquidity, like with Berachain’s native decentralized trade, BeraSwap. Because the governance token, BGT can be utilized to vote on governance proposals individually, or customers can delegate it to validators to make use of on their behalf.

Although BGT is non-transferable, it may be burned in a 1:1 ratio for BERA, the native gasoline token. Nevertheless, the method solely works a method, which means that customers can’t burn BERA for BGT.

HONEY

Lastly, Berachain has its personal native stablecoin, or a token designed to be pegged to the worth of fiat forex. On this case, HONEY is soft-pegged, or in between a set or floating fee peg, to the worth of the U.S. greenback.

The Berachain stablecoin may be swapped into by way of decentralized exchanges, aka DEXs, or may be minted by depositing allowlisted collateral into an accepted vault.

Berachain airdrop

After a lot teasing, Berachain introduced tokenomics and an airdrop eligibility checker for its BERA airdrop on February 5.

The undertaking’s native gasoline token has a provide of 500 million BERA tokens, with an expectation of 10% annual inflation.

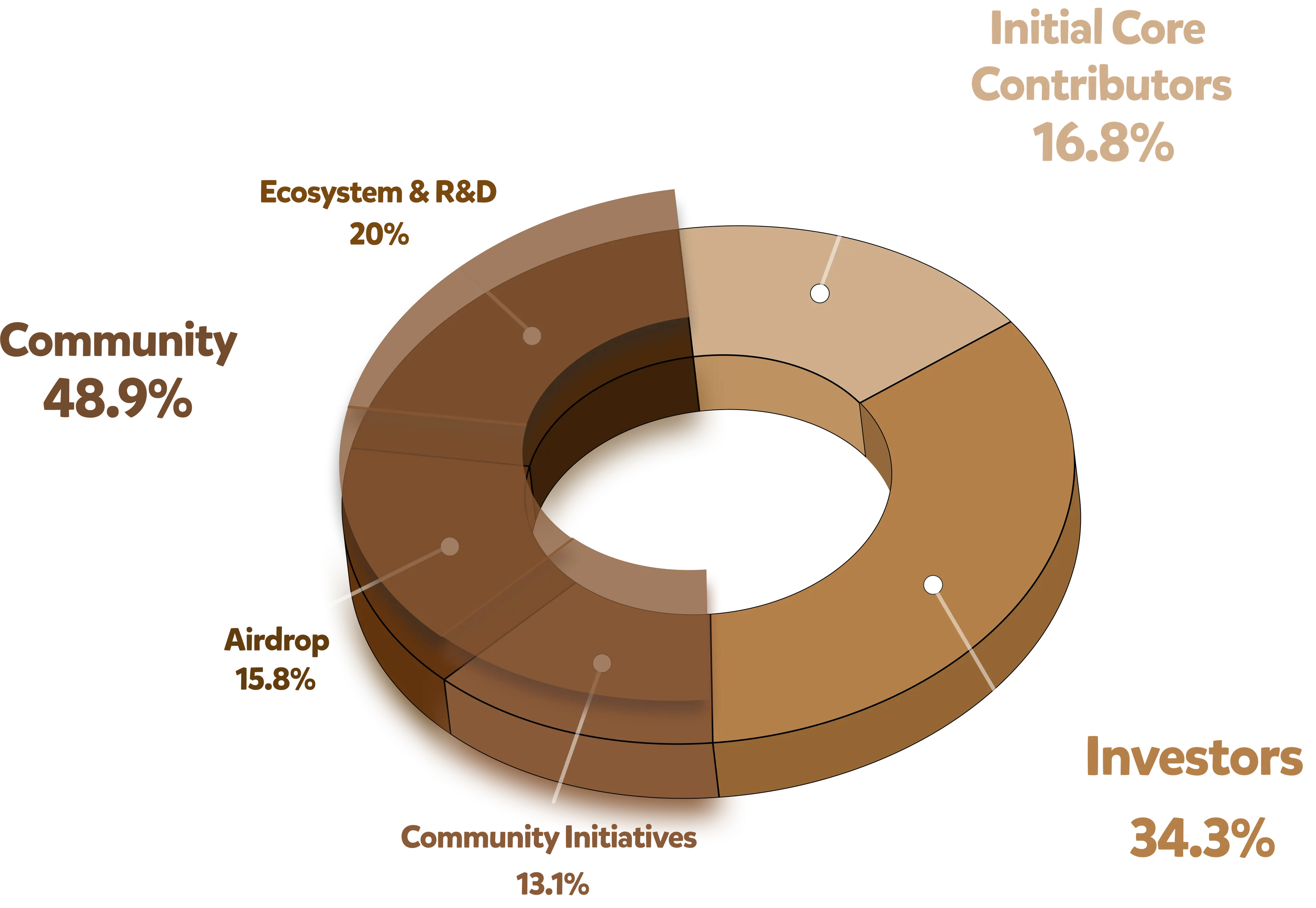

From that 500 million tokens, practically 49% is slated for the neighborhood, which incorporates allocations for Berachain NFT holders, ecosystem analysis and growth, and future initiatives. Of the 48.9% allotted to the neighborhood, 15.8% or 79 million BERA tokens have been airdropped to the neighborhood beginning on February 6, a price of greater than $1.1 billion at peak value on the day of launch.

Most customers eligible for the airdrop had tokens routinely airdropped to their wallets. Nevertheless, Berachain NFT holders wanted to bridge their NFTs from Ethereum to Berachain mainnet with a view to declare.

Contributors to the Berachain ecosystem and its traders assist make up the opposite 50% allotted for BERA token provide.

Roughly 100 million BERA tokens shall be unlocked at launch of the community’s mainnet. The opposite 400 million tokens are pursuant to the identical vesting schedule: a one 12 months cliff, at which level one-sixth of the tokens unlock, after which linear unlocks for the remaining share over the next 24 months.

Pre-launch initiatives

Not like different blockchain launches, Berachain put substantial effort into gathering liquidity and creating incentives earlier than its mainnet launches.

Most notably, the undertaking supplied two liquidity bootstrapping initiatives with its pre-launch vaults and Boyco, the undertaking’s pre-launch liquidity platform.

Put merely, customers have been in a position to deposit eligible belongings like choose stablecoins and Bitcoin and Ethereum to stack rewards forward of the community launch.

This in flip offers a beneficiant headstart in liquidity on the community, permitting protocols, purposes, and customers to reap the benefits of these belongings from launch.

“When new blockchains launch, they usually wrestle to draw liquidity, leaving customers unable to entry the depth and performance obligatory for significant interactions,” wrote pseudonymous Berachain staff member Knower Bera. “With out significant interactions, these customers rapidly lose curiosity, and dapps miss out on a primary alternative for consumer acquisition.”

In its pre-launch initiatives, Berachain gathered greater than $3.3 billion in belongings, which if ranked by complete worth locked would make it fifth-largest in that class, forward of blockchains like Base and Arbitrum, in keeping with February information from DefiLlama.

Berachain apps

Upon its launch, Berachain mainnet supplied a number of native purposes together with a token bridge, stablecoin minter, a block explorer, and BeraHub, a spot for customers to utilize Berachain belongings.

The BeraHub is a focus for native apps, permitting customers to swap tokens with the built-in decentralized trade aka DEX, deposit into reward vaults, and increase validators with BGT.

To get belongings onto Berachain mainnet, customers can use the native token bridge, which is powered by LayerZero and helps any token inside Uniswap’s token listing. Nevertheless, with a view to bridge a token to Berachain, it will need to have a local model deployed on Berachain. Fashionable belongings like USDC and Wrapped Bitcoin have already been deployed on the community.

Berachain’s roots

The Berachain community first grew out of a “rebasing” NFT assortment referred to as Bong Bears, which debuted in early 2021. A preferred time period in computing, rebasing on this sense ensured that holders of Bong Bear NFTs earned further Bera NFTs by way of airdrops with every “rebasement.”

This led to the creation of Bond Bears, Boo Bears, Child Bears, Band Bears, and Bit Bears. One remaining rebase is predicted to happen on Berachain mainnet.

As a rabid neighborhood fashioned across the Bera NFTs, Berachain slowly started to emerge, in the end elevating greater than $100 million to construct out its proof of liquidity blockchain.

“The NFTs got here earlier than the chain, and the NFT holders have been a number of the longest-standing and most supportive members of the Berachain neighborhood, with numerous holders having progressed to beginning their very own dapps or neighborhood initiatives throughout the ecosystem,” wrote the community in its tokenomics launch.

The undertaking was created by three pseudonymous founders—Smokey the Bear, Homme Bera, and Dev Bear—all of which use bear-themed monikers.

Edited by Andrew Hayward

Editor’s be aware: This story was initially printed on February 5, 2025 and final up to date on February 7 with new particulars.

Day by day Debrief E-newsletter

Begin day by day with the highest information tales proper now, plus authentic options, a podcast, movies and extra.