Bearish sentiment is at one among its highest ranges since 2000 regardless of shares’ minor dip from document highs. The Every day Breakdown digs in.

Friday’s TLDR

Sentiment is extremely bearish

Can the market backside?

Bonds discovering a groove

The Backside Line + Every day Breakdown

We’re virtually two months into 2025 and it’s been a bumpy trip. The S&P 500 is about flat on the 12 months and down about 2% over the previous three months. The sugar excessive we noticed instantly after the election has worn off as shares, shopper confidence, and sentiment have all come underneath stress.

Talking on that final notice — sentiment — we’ve seen fairly an fascinating improvement. There are a number of sentiment readings on the market, just like the NAAIM, the CNN “Concern & Greed” Index, and the AAII survey. (Be at liberty to bookmark these for the long run, too).

For immediately’s dialogue, I’ll be specializing in the bull and bear sentiment surveys from AAII, beginning with the bulls:

Since 2000, the bottom bull studying was 15.8, whereas this week rang in at 19.4. Readings beneath 20 have a tendency to come back into play close to a trough in sentiment.

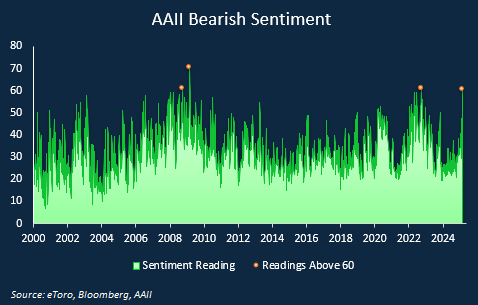

On the flip aspect, bearish sentiment tends to spike throughout instances of uncertainty. Discover how prior spikes above 60 occurred close to the depths of the monetary disaster, the lows of the 2022 bear market…and proper now:

Sentiment extremes are likely to act as contrarian indicators. That means that when we’ve got a “washout” in sentiment — the place bullish readings are actually low and bearish readings are actually excessive — shares are likely to kind a backside.

(The alternative could be true on the upside, too. When bullish readings get towards an excessive excessive and bearish readings close to an excessive low, markets are likely to prime and pull again).

The fascinating factor right here is, the S&P 500 was about 3% off its all-time excessive when this week’s survey was launched. That’s not one thing we are likely to see when sentiment is that this low.

Making Sense of the Mindless

It’s arduous to say what precisely is driving this response, however a number of issues stick out. First, although 9 of the S&P 500’s 11 sectors are constructive on the 12 months, the 2 sectors which are decrease — tech and shopper discretionary — are main holdings for buyers.

In the event that they’re doing dangerous, after all sentiment is taking successful.

Second, financial coverage uncertainty is hovering. Within the US, this measure is at its third highest stage since 2000, with solely the monetary disaster and Covid coming in larger. Globally, it’s the very best it’s been since Covid…and it’s near surpassing that determine proper now.

The back-and-forth tariff threats are carrying on buyers, even when they’ve been extra bark than chunk to date.

The Backside Line

With sentiment nearing an excessive, keep watch over markets to see if shares and crypto can discover their footing. If they’ll, let’s see what kind of rally develops. If they’ll’t, it’s attainable that sentiment stays dampened and creates a type of self-fulling prophecy by way of decrease costs.

Need to obtain these insights straight to your inbox?

Join right here

The setup — Bonds

One of the crucial-traded bond ETFs is the TLT, which has been in demand in current buying and selling. Actually, it’s up about 4.5% to this point this 12 months and has had some current pep in its step after breaking out over downtrend resistance.

That mentioned, there’s no sugarcoating it: The TLT has struggled over the long run and is down virtually 2% over the previous 12 months. Word that the TLT continues to be beneath its 200-day transferring common (in crimson).

As yields have come underneath stress, rate-sensitive property like bonds, dividend shares, and REITs have loved current good points.

Some energetic buyers could choose a minor pullback first — which is ok — however as long as TLT can keep above the $87 to $88 space, bulls might preserve current momentum. For sustained momentum although, they’ll have to see TLT regain the 200-day transferring common.

On the draw back, a break of $87 to $88 might open up TLT to extra promoting stress.

Choices

For some buyers, choices might be one different to invest on TLT. Keep in mind, the danger for choices patrons is tied to the premium paid for the choice — and shedding the premium is the total danger.

Bulls can make the most of calls or name spreads to invest on additional upside, whereas bears can use places or put spreads to invest on the good points truly fizzling out and TLT rolling over.

For these seeking to be taught extra about choices, contemplate visiting the eToro Academy.

Disclaimer:

Please notice that attributable to market volatility, a few of the costs could have already been reached and eventualities performed out.