Purpose to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum is at present buying and selling at a essential resistance degree as bulls try to regain momentum and push for a recent excessive. The broader market stays underneath stress as international uncertainty escalates, largely fueled by ongoing commerce tensions between the USA and China. Final week, US President Donald Trump introduced a 90-day tariff pause on all international locations besides China, intensifying issues about an prolonged commerce battle that would destabilize international monetary markets.

Associated Studying

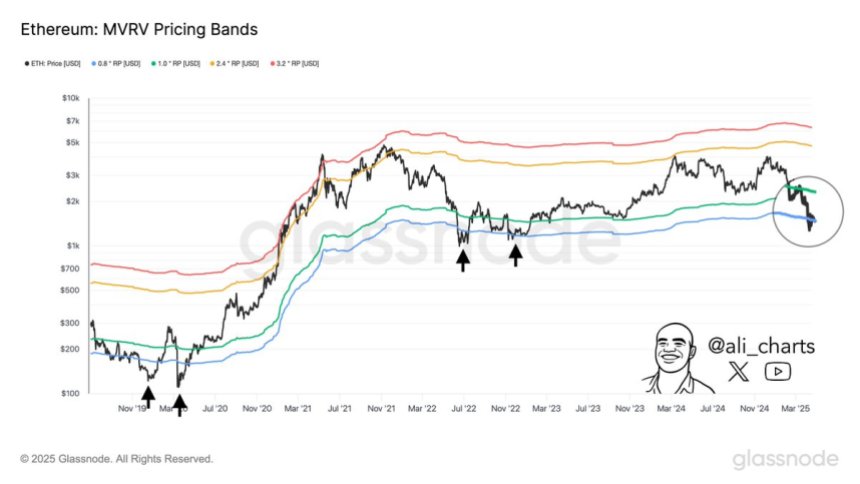

On this high-stakes surroundings, Ethereum’s value motion is drawing shut consideration from traders and analysts. Prime crypto analyst Ali Martinez shared that traditionally, the very best Ethereum shopping for alternatives have emerged when the worth drops beneath the decrease MVRV (Market Worth to Realized Worth) Worth Band—a degree that indicators potential undervaluation. Notably, ETH is now buying and selling exactly in that zone.

This alignment between technical situations and macroeconomic instability means that Ethereum may very well be coming into a section of accumulation, with long-term traders trying to capitalize on discounted costs. Nonetheless, sustained upward momentum will rely on whether or not bulls can overcome speedy resistance and whether or not macro situations enhance. The approaching days might show pivotal for ETH because it checks each technical and psychological thresholds.

Ethereum Dips Into Historic Alternative Zone

Ethereum is at present buying and selling beneath key resistance ranges after enduring a number of weeks of promoting stress and weak market efficiency. Since dropping the essential $2,000 assist degree, ETH has fallen roughly 21%, a transparent indication that bulls have but to regain management. Broader macroeconomic pressures, particularly rising international tensions and unsure commerce situations between the US and China, have additional dampened market sentiment. These situations have pushed many traders to exit riskier belongings like cryptocurrencies, resulting in elevated volatility and lowered market participation.

Regardless of this downtrend, some analysts imagine Ethereum may very well be nearing a pivotal turnaround zone. In keeping with Martinez, top-of-the-line historic indicators for Ethereum accumulation has been value motion dipping beneath the decrease certain of the MVRV Worth Band—a metric that compares market worth to realized worth to evaluate whether or not an asset is over- or undervalued. At the moment, Ethereum is buying and selling beneath that decrease band.

Martinez emphasizes that this positioning has sometimes preceded sturdy upside reversals, particularly in periods of utmost market pessimism. Whereas short-term volatility could persist, ETH’s entry into this zone might current a uncommon alternative for long-term traders to build up at traditionally discounted ranges—if market situations stabilize and sentiment shifts.

Associated Studying

ETH Stalls In Tight Vary

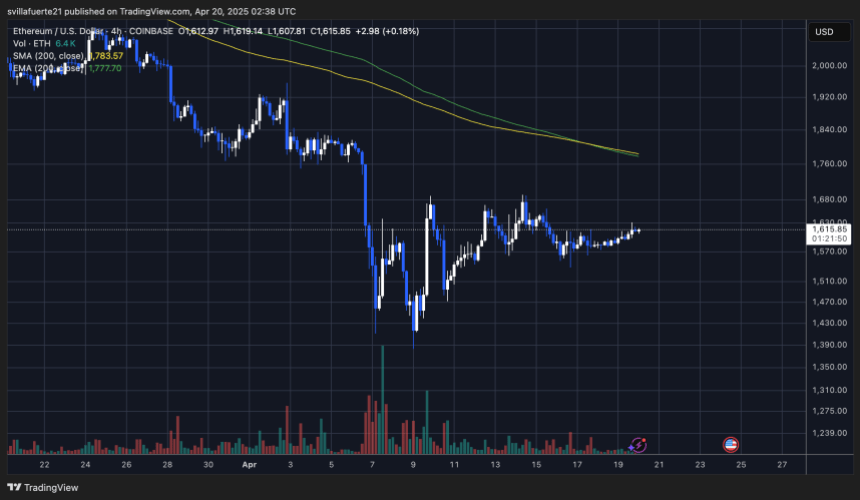

Ethereum is at present buying and selling at $1,610 after almost every week of low volatility and sideways motion. Since final Tuesday, ETH has remained locked in a good vary between $1,550 and $1,630, reflecting the market’s uncertainty and hesitation to take a transparent directional stance. This slender buying and selling zone highlights a interval of value compression, typically a precursor to a bigger transfer in both route.

For bulls to regain momentum and shift sentiment, Ethereum should reclaim the $1,700 degree and push decisively above the $2,000 mark. These ranges not solely function key psychological boundaries but additionally symbolize essential zones of earlier assist which have now changed into resistance. A breakout above $2,000 would doubtless set off renewed shopping for curiosity and set the stage for a possible restoration rally.

Associated Studying

Nonetheless, if bearish stress builds and the $1,550 flooring is breached, Ethereum might shortly check the $1,500 assist zone. A breakdown beneath that degree would affirm additional draw back threat, doubtlessly accelerating sell-offs and deepening the present correction. Till a breakout or breakdown happens, merchants ought to put together for extra consolidation and volatility because the market awaits a macro or technical catalyst.

Featured picture from Dall-E, chart from TradingView