Amid persistent inflation, a weakening U.S. greenback, escalating commerce wars, and waning belief in fiat currencies, the 2 property most incessantly mentioned by traders right this moment are gold and Bitcoin.

From fears of devaluation to the will to protect buying energy, the race to grow to be the “secure deposit field” of the twenty first century has by no means been extra intense.

Gold and Bitcoin Surge Amid Financial Uncertainty

Spot gold costs surpassed $3,500 per ounce on April 22, marking a brand new all-time excessive. JPMorgan forecasts the typical gold value in 2025 to succeed in $3,675/oz, doubtlessly climbing to $4,000/oz if excessive rates of interest persist over an prolonged interval.

Knowledge exhibits that China now holds over 2,292 tonnes of gold, accounting for six.5% of its complete international trade reserves. The Folks’s Financial institution of China has been steadily accumulating gold for a number of consecutive months, fueling world demand and accelerating the pattern towards de-dollarization.

Supply: UK Investing

Bitcoin has additionally made important strides. As of April 23, BTC is buying and selling round $93,500, up greater than 20% year-to-date. BlackRock’s spot ETF (IBIT) has attracted over $39.7 billion, changing into a key driver in Bitcoin’s institutional adoption. Funding giants resembling Constancy, ARK Make investments, and VanEck are additionally rising their BTC allocations in long-term portfolios.

When Money Is No Longer Enticing

On a coverage degree, Bitcoin’s function has been elevated following U.S. President Donald Trump’s government order to determine a “Strategic Bitcoin Reserve” beneath the Division of the Treasury. This transfer not solely carries symbolic significance but in addition formalizes Bitcoin as a part of the nation’s reserve property. In the meantime, gold continues to function a standard pillar in central financial institution reserves worldwide.

In line with information revealed by CoinShares on April 22, each gold and Bitcoin act as efficient hedges in opposition to declining buying energy in inflationary environments. Buying energy, the power of a unit of foreign money to purchase items and providers has been constantly eroded amid rising inflation.

The Client Worth Index (CPI) stays a standard device to measure this decline, and in such a panorama, gold and Bitcoin stand out as two of the few property able to preserving actual worth.

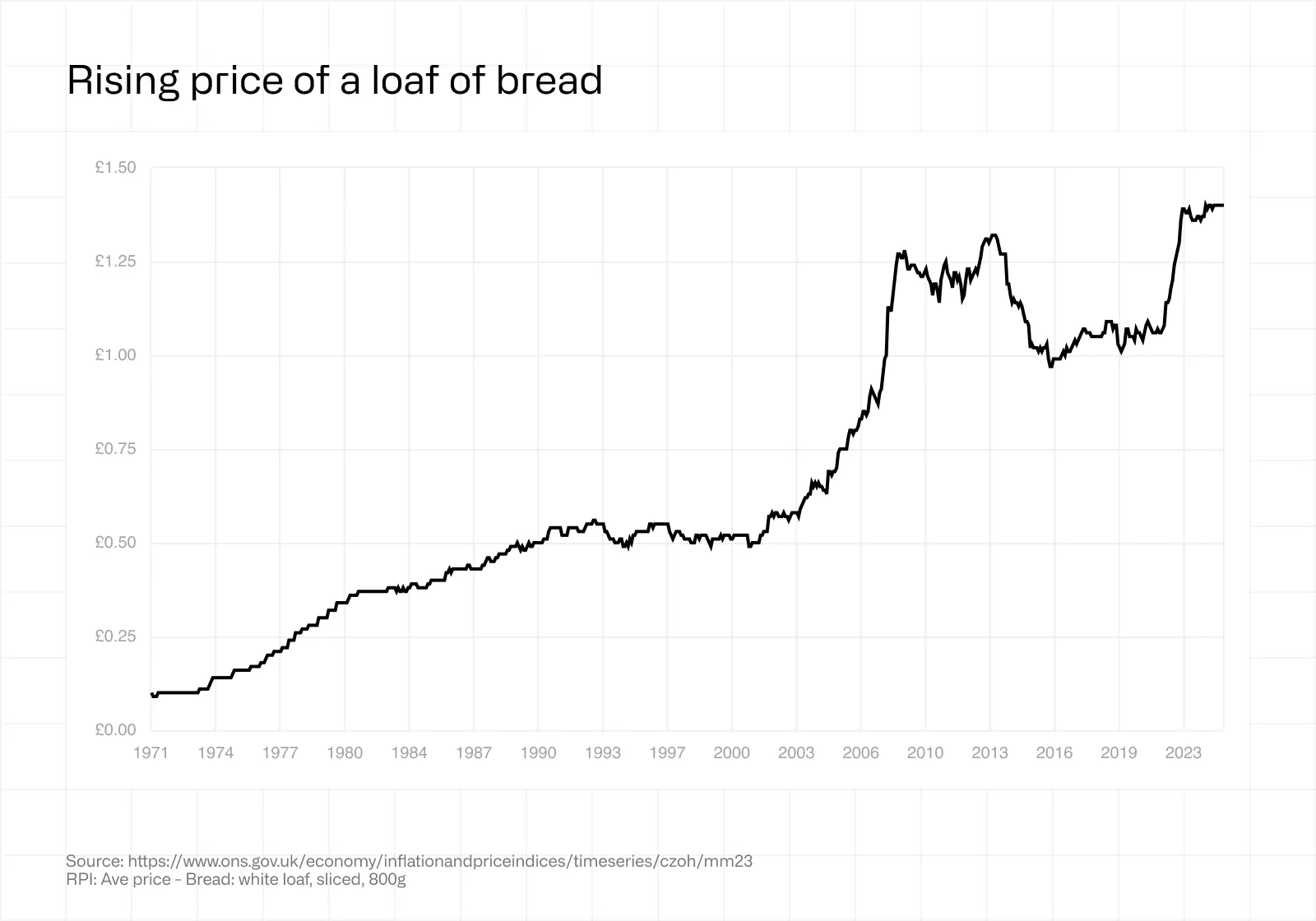

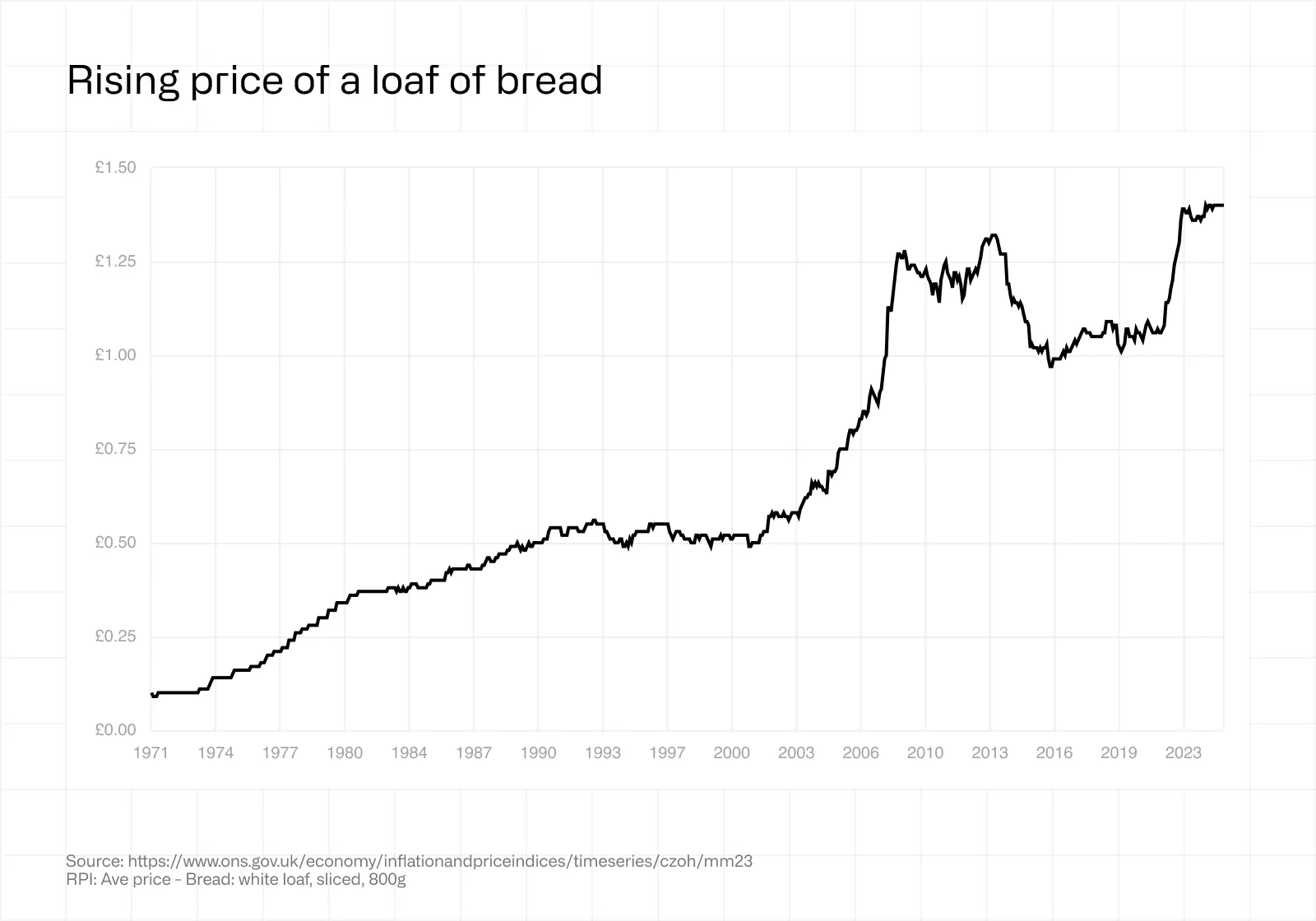

The report cites examples resembling the UK, the place the worth of an 800-gram loaf of white bread has elevated steadily since 1971, reflecting important depreciation of the British pound. In Lebanon, the place inflation peaked at 268% in April 2023, residents have been pressured to desert their native foreign money in favor of gold and Bitcoin to protect buying energy.

These are clear indicators that fiat currencies can fail of their function as a retailer of worth, prompting a shift towards “exhausting property.” Bitcoin has emerged because the digital successor to gold, significantly favored by youthful generations and communities excluded from the standard banking system.

Bread Worth – Supply: UK Investing

In sensible phrases, Bitcoin presents superior flexibility in storage and switch. In contrast to gold, Bitcoin shops in chilly wallets and strikes globally in minutes with low value. A quickly evolving safety infrastructure, that includes multi-signature wallets, offline storage, and digital asset insurance coverage can also be strengthening its enchantment.

Gold and Bitcoin: Which one is best?

Volatility – as soon as seen as Bitcoin’s greatest disadvantage, is displaying indicators of stabilization. In line with information from CoinMetrics and Bloomberg, Bitcoin’s 30-day volatility at the moment sits at 46%, its lowest degree in two years. In distinction, the Gold Volatility Index (GVZ) is climbing to its highest level for the reason that pandemic, signaling a resurgence in short-term hypothesis.

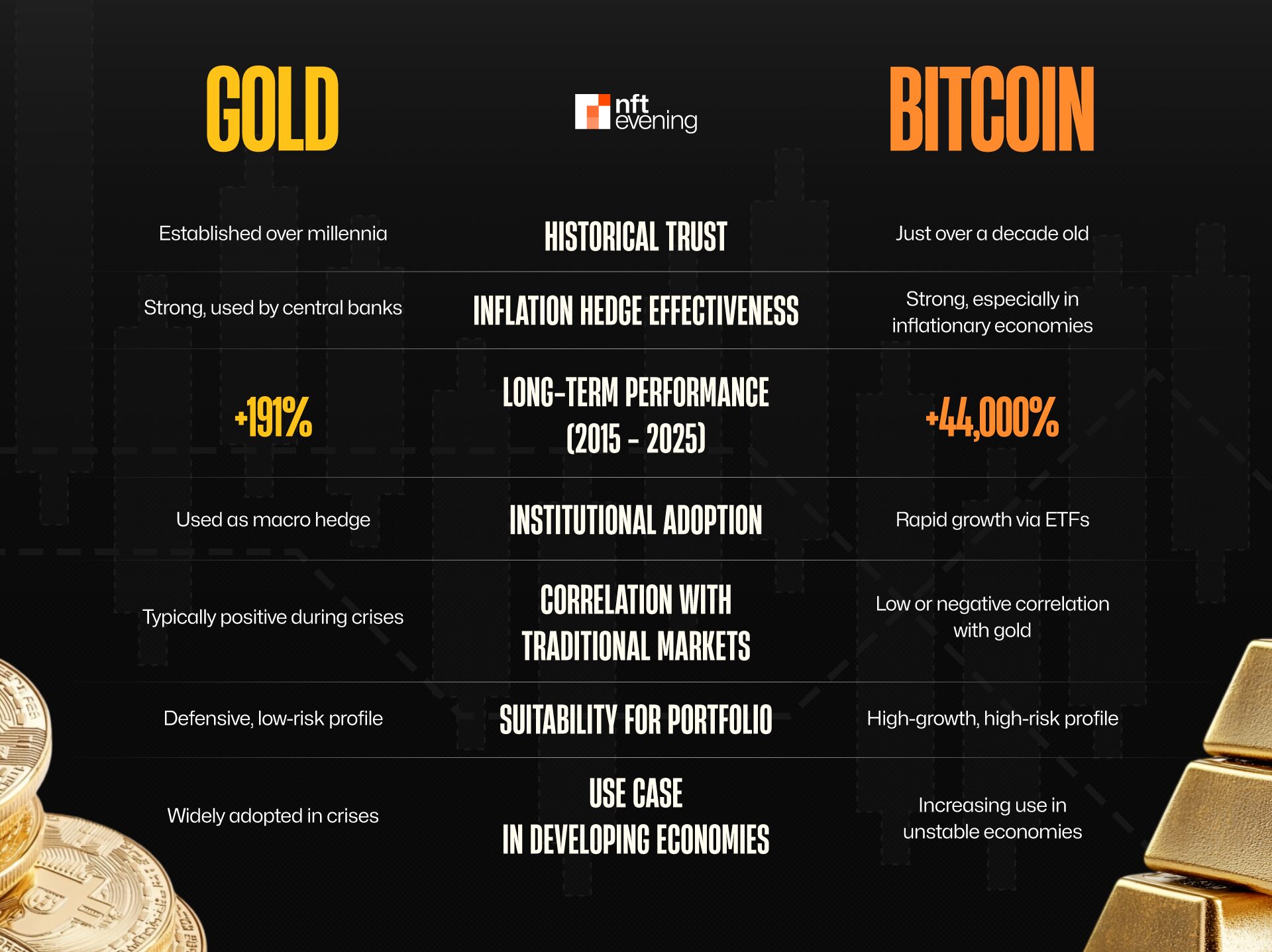

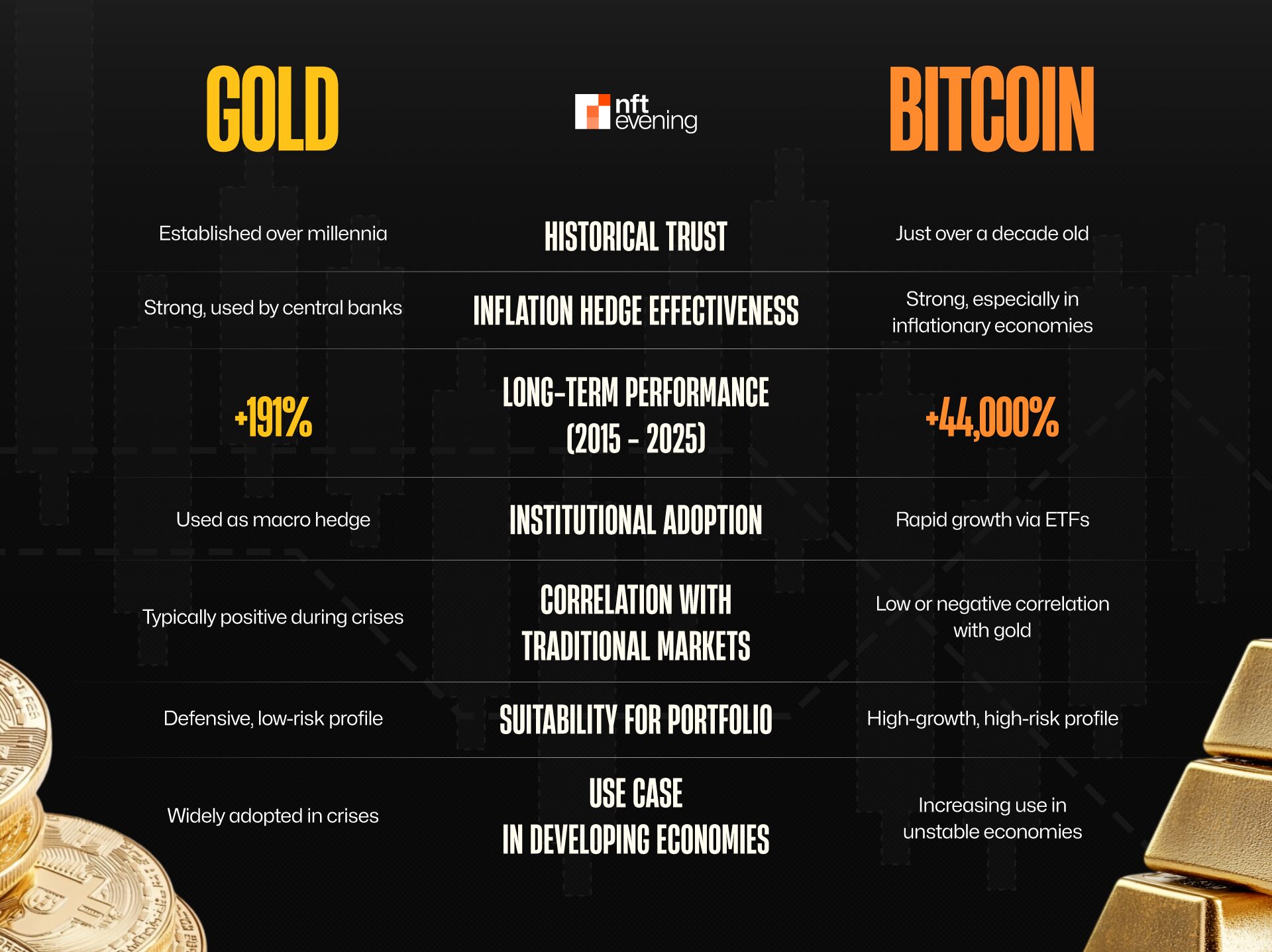

Lengthy-term developments supply a compelling view: by way of buying energy development since 2011, Bitcoin has considerably outperformed gold. Nevertheless, resulting from its greater volatility, Bitcoin is best suited to long-term traders with a excessive threat urge for food, whereas gold stays the defensive asset of alternative.

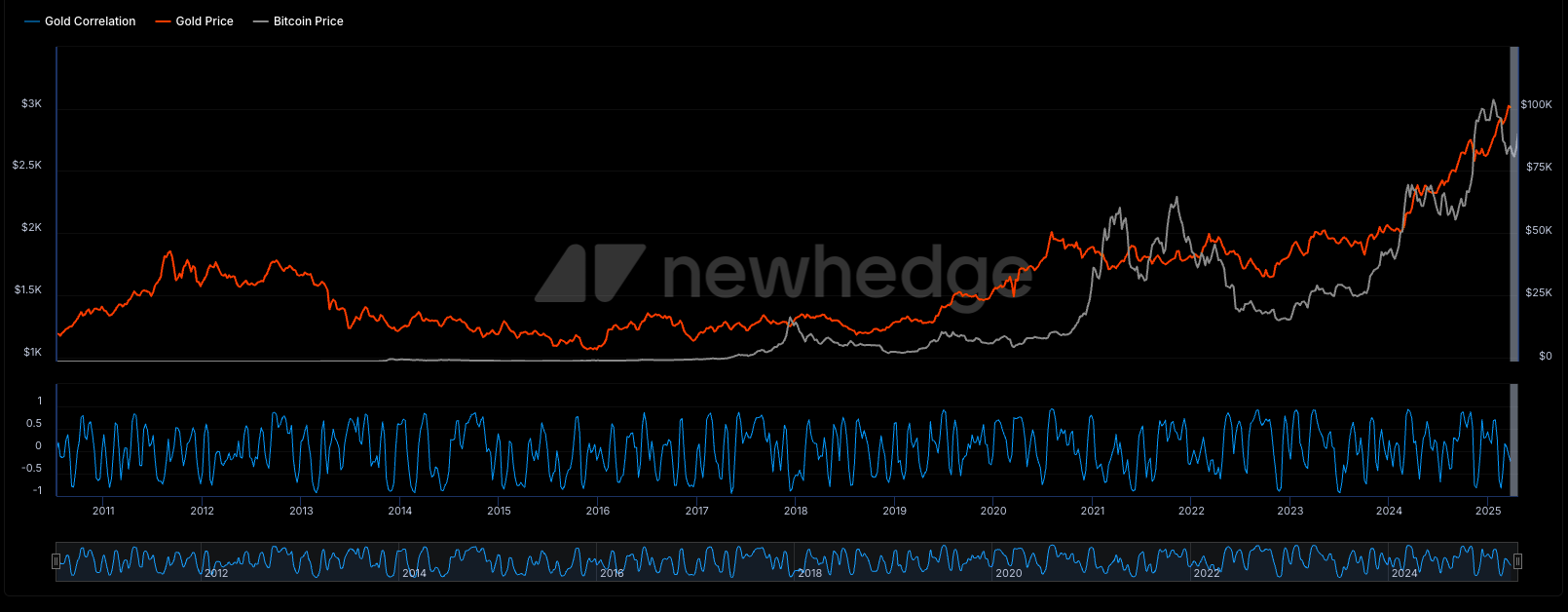

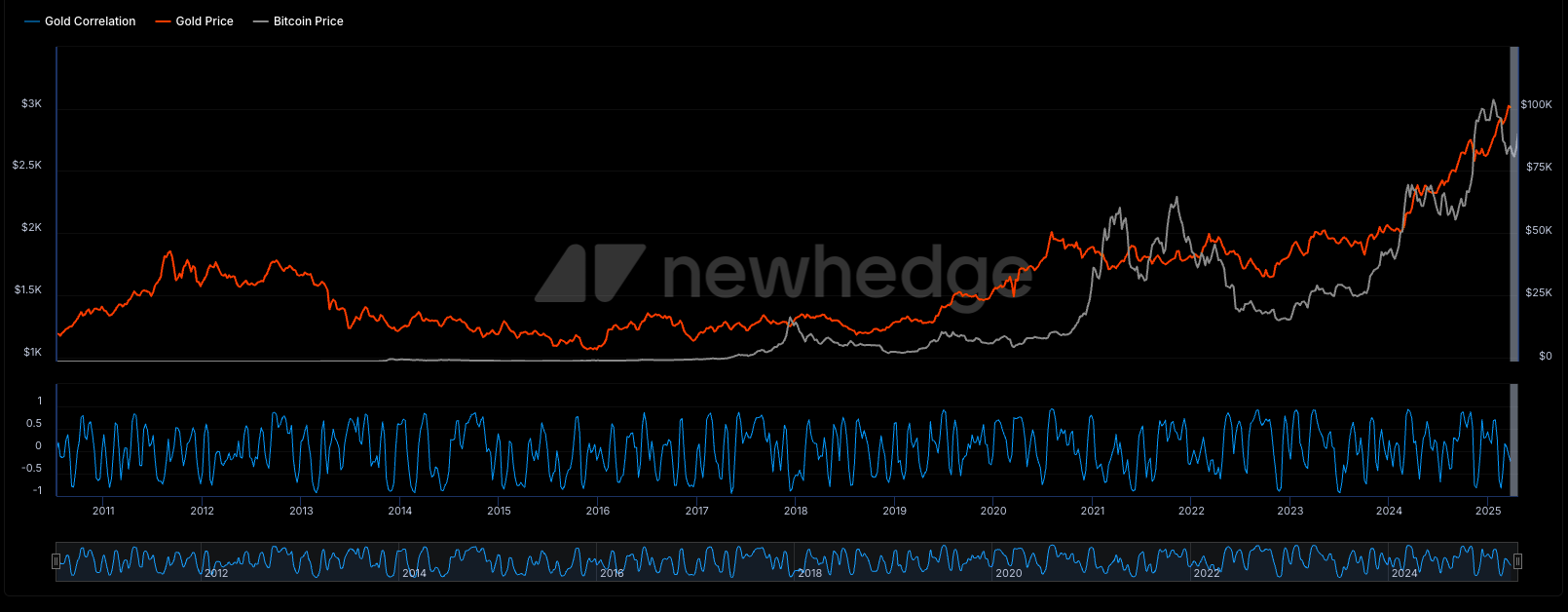

Research present Bitcoin and gold keep weakly or negatively correlated, particularly in market stress. Newhedge information exhibits the Bitcoin and gold correlation not often stays above 0.5, typically turning damaging.

Notably, throughout main Bitcoin drawdowns (2018, 2022) or sharp rallies (2021), its correlation with gold tends to say no. This proof exhibits gold reacts to threat, whereas Bitcoin responds to development and liquidity shifts.

Bitcoin and Gold correlation – Supply: Newhedge

Because of this, combining each property in a portfolio can enhance risk-adjusted returns by means of diversification. Traders more and more view Bitcoin and gold as complementary property in trendy allocation methods.

Main institutional gamers now favor twin publicity: gold for macroeconomic stability and Bitcoin for uneven development potential. ARK Make investments holds gold as a hedge and raised Bitcoin publicity to 12% in 2024.

SkyBridge Capital allocates 85% to gold and bonds and 15% to Bitcoin and tech shares. This balanced technique has confirmed efficient amid more and more risky market cycles.

Conclusion

Whereas gold presents consistency and belief constructed over millennia, Bitcoin gives adaptability and scalability for a digital future. Historic efficiency, institutional momentum, and evolving financial insurance policies counsel that the optimum technique for traders is to not choose sides however to diversify intelligently. Allocating a portion of 1’s portfolio to each property, balancing gold’s defensive power with Bitcoin’s development trajectory, might supply the most effective probability at preserving and increasing wealth within the twenty first century.

Learn extra: Day Buying and selling Crypto: A Newbie’s Information