On-chain knowledge exhibits that the Bitcoin Mining Hashrate has bounced just lately, suggesting miners are again to increasing their services.

Bitcoin Mining Hashrate Has Rebounded From Its Latest Lows

The “Mining Hashrate” refers to an indicator that retains monitor of the computing energy the Bitcoin miners have at the moment related to the community. It’s measured in models of terahashes per second (TH/s).

When the metric’s worth goes up, present miners are including to their services, and new miners are becoming a member of the community. Such a pattern implies the miners are discovering the community engaging.

Then again, a decline within the indicator suggests some miners have determined to disconnect from the blockchain, doubtless as a result of they’re not discovering mining worthwhile.

Now, here’s a chart that exhibits the pattern within the 7-day transferring common (MA) of the Bitcoin mining Hashrate over the previous yr:

The worth of the metric seems to have been going up in latest days | Supply: Blockchain.com

As displayed within the above graph, the 7-day MA Bitcoin Mining Hashrate had come all the way down to round 610 million TH/s earlier within the month from an all-time excessive of 667 million TH/s in late July. The explanation behind this pattern might be the bearish momentum BTC had witnessed through the interval.

Miners make most of their earnings by way of the block subsidy, which is given out at a hard and fast BTC fee and a hard and fast time interval. Thus, the one variable associated to those rewards is the USD value of the cryptocurrency. The asset’s earlier drawdown had a drastic impact on miner funds.

BTC had gone as little as below $50,000 on this crash, however the asset has since made some notable restoration, though it’s nonetheless removed from the $70,000 stage that it was at close to the top of final month.

Curiously, regardless of the inadequate restoration, the 7-day MA Mining Hashrate has proven a pointy rebound over the previous week, hitting a 650 TH/s two days in the past. It could seem that some miners could also be betting on a greater consequence for the asset shortly.

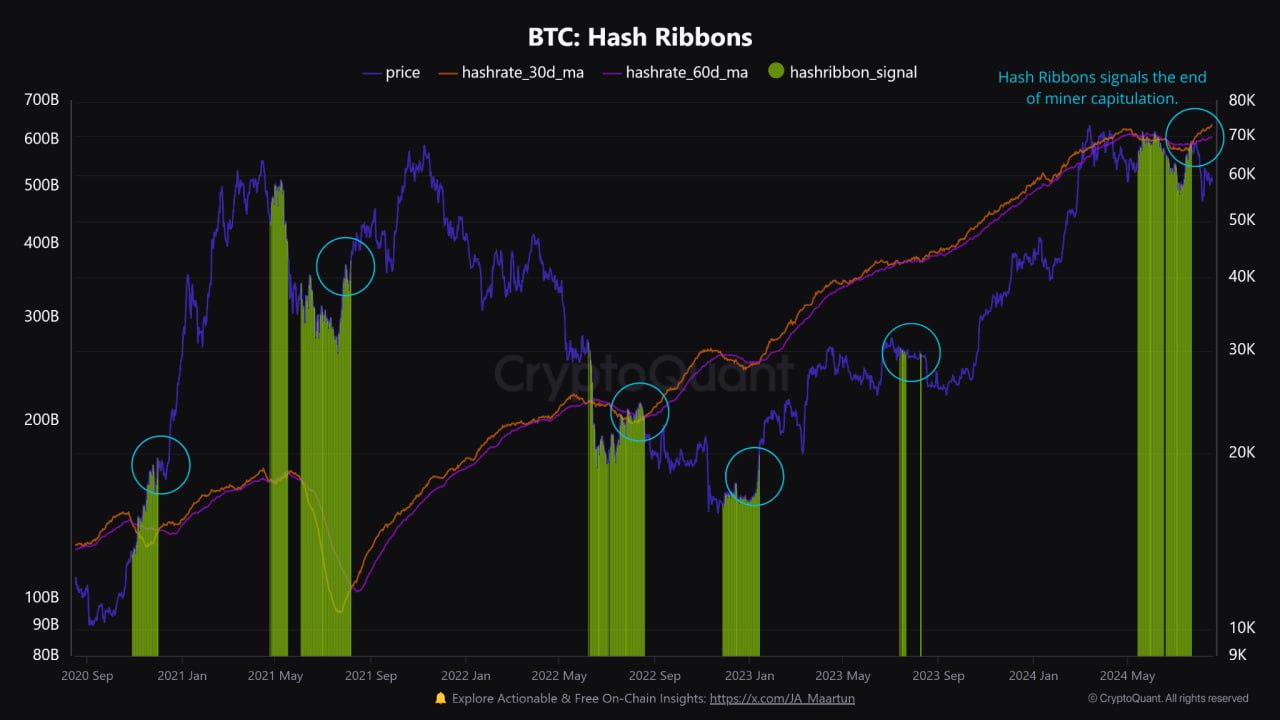

A preferred indicator used to maintain monitor of the BTC miners’ state of affairs primarily based on the Hashrate is the “Hash Ribbons.” The ribbons right here seek advice from the 30-day and 60-day MAs of the Hashrate.

When the previous crosses below the latter, miners are thought of to be going by way of a part of capitulation, as they’re quickly taking their computing energy offline, traditionally, BTC has tended to see some backside when miners have been distressed.

The on-chain analytics agency CryptoQuant has mentioned the newest pattern on this metric in a brand new submit on X.

The information for the Hash Ribbons over the previous few years | Supply: CryptoQuant on X

The chart exhibits that the Bitcoin Hash Ribbons had been giving a capitulation sign earlier, however the 30-day MA has since crossed again above the 60-day.

“Though the indicator isn’t meant to pinpoint the precise value backside, it typically precedes increased costs by signaling a discount in promoting stress from miners,” explains CryptoQuant.

BTC Worth

On the time of writing, Bitcoin is buying and selling at round $58,800, down 4% over the previous week.

Seems like the worth of the asset has been transferring sideways over the previous few days | Supply: BTCUSD on TradingView

Featured picture from Dall-E, CryptoQuant.com, chart from TradingView.com