Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Tron (TRX) is at present navigating a protracted consolidation part that started in December 2024, with costs oscillating between key ranges and no clear breakout route in sight. Regardless of this range-bound motion, Tron stays firmly within the highlight as elementary developments seize market consideration.

Probably the most important information got here two weeks in the past, when studies revealed that Tron is getting ready to go public through a reverse merger with Nasdaq-listed SRM Leisure. This potential itemizing may mark a serious milestone for the blockchain platform, doubtlessly making it the primary main crypto community to enter US public markets straight.

Associated Studying

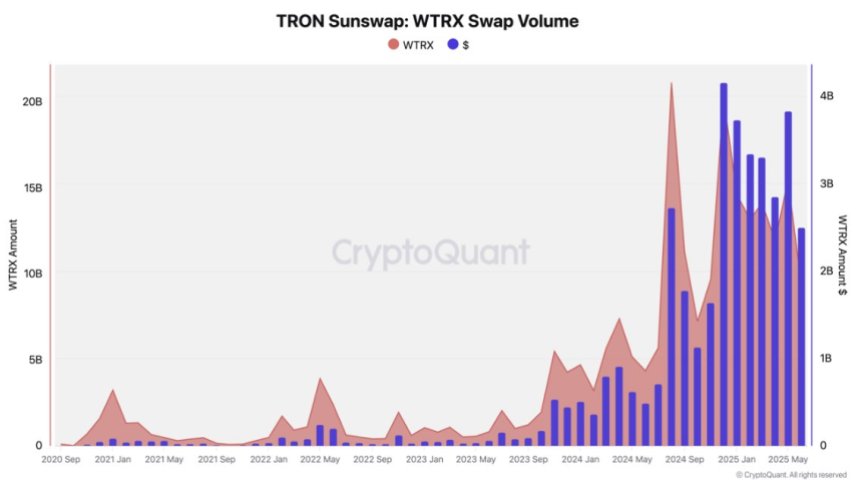

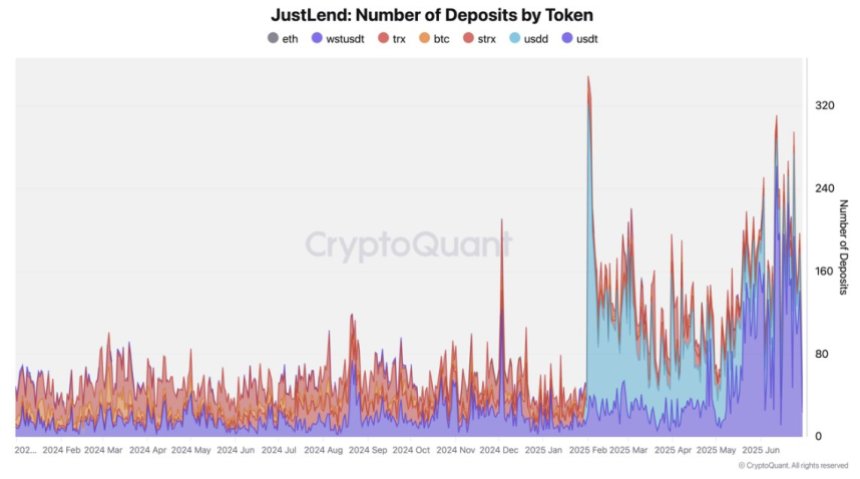

On the similar time, on-chain knowledge indicators rising momentum beneath the floor. Based on insights from CryptoQuant, DeFi exercise on the Tron community has been steadily increasing. Rising transaction volumes, growing deposits in JustLend, and document swap exercise on SunSwap level to deepening liquidity and person engagement.

These developments spotlight a maturing ecosystem, however the market has but to cost in a breakout transfer. As consolidation continues, merchants and buyers are carefully looking ahead to the following main catalyst. Whether or not Tron’s public itemizing or accelerating DeFi traction triggers it stays to be seen, however momentum is quietly constructing.

Tron DeFi Development Indicators Underlying Power

Tron is testing important worth ranges after months of sideways motion, consolidating between $0.211 and $0.295. This vary has acted as a structural base since late 2024, and a clear break in both route may decide Tron’s subsequent main development. A breakout above $0.295 would seemingly set off recent momentum towards new native highs, whereas failure to carry assist may expose the asset to deeper corrections.

Whereas the broader crypto market anticipates upward enlargement—supported by the rally in US equities and a extra steady macro backdrop—Tron stays trapped on this tight band. Volatility persists, and with out a decisive breakout, market members stay cautious. Nonetheless, underlying fundamentals recommend TRX could also be quietly gathering energy.

Based on CryptoQuant knowledge, DeFi exercise on the Tron community is rising quickly. SunSwap has surpassed $3 billion in month-to-month swap quantity constantly all through 2025, with Might setting a document at $3.8 billion. In the meantime, JustLend deposits have greater than tripled year-to-date, peaking at $740 million. These developments level to deepening liquidity and rising demand throughout Tron’s DeFi ecosystem.

Stablecoin inflows and growing borrowing exercise additional reinforce Tron’s increasing utility, suggesting the community is changing into a strong settlement layer. Whereas the value stays range-bound for now, the basics trace at a robust basis for future upside, as soon as the technical breakout lastly materializes.

Associated Studying

TRX Worth Consolidates Close to Resistance

TRX is at present buying and selling round $0.2813, sustaining its place close to the higher boundary of the long-standing consolidation vary that started in December 2024. The asset has proven resilience above the 50-day, 100-day, and 200-day transferring averages, all of that are trending upward, supporting the bullish outlook. The 50-day SMA at $0.2508 and the 100-day SMA at $0.2289 are offering dynamic assist, indicating sturdy purchaser curiosity on dips.

Worth motion all through June remained sideways, with low volatility and quantity according to a traditional consolidation part. Regardless of a number of rejections beneath the $0.295 resistance, TRX has not proven any indicators of structural weak spot, holding firmly above $0.26–$0.27 and regularly constructing stress towards a breakout.

Associated Studying

Quantity has remained steady, although not but signaling the form of breakout momentum that may verify a transfer into larger worth discovery. Merchants are watching carefully for a clear candle shut above $0.295 to validate a bullish continuation. If profitable, TRX may rally towards the $0.32–$0.35 zone, with minimal overhead resistance.

Featured picture from Dall-E, chart from TradingView