Decentralized Finance (DeFi) is not a crypto area of interest. By 2025, it’s not only a child business, however a full-grown one, altering how individuals deal with cash, get hold of credit score, make investments, and commerce. It’s fast, borderless, permissionless, and provides energy to thousands and thousands who’ve been left behind by the normal banking system.

In the event you’re contemplating constructing a DeFi app, you’re not too late. You’ve arrived simply in time for the subsequent wave of innovation. However first, it helps to know what constructing a DeFi app truly appears like — from brainstorming, by structure and improvement, to safety and launch.

So let’s information you thru each to convey your DeFi product into existence.

Know What Downside You’re Fixing

Each good DeFi app improvement journey begins by fixing an actual monetary downside. It’s 2025, and people are nonetheless dealing with excessive remittance charges, restricted entry to loans, sluggish transaction speeds and few yield alternatives. Your app doesn’t have to unravel every part; it simply wants to assist ease one ache level.

Some widespread paths embrace:

Yield farming aggregators to ensure that customers to maximise their returnsCrypto lending platforms providing microloansInflation-Susceptible Area Stablecoin Saving AppsBorderless cross-border funds and instantaneous exchangesOn-chain insurance coverage protocols for safeguarding digital possessions

Take GoldBridge, as an illustration. It allows residents of hyperinflation-affected nations to transform their native foreign money right into a stablecoin backed by gold. And it doesn’t faux to be one other Uniswap: it solved a selected subject superbly.

Uncover your “why” even earlier than you write a line of code. Every part else will observe it.

Select Your Blockchain Properly

Ethereum might have been the primary, however it’s not the one participant on the town. Chances are you’ll contemplate one of many following, relying on how you might be utilizing this:

Ethereum in case you want essentially the most decentralization and liquidity.Polygon for reasonable and quick transactions.BNB Chain to facilitate integration, and with a big retail consumer baseArbitrum or Optimism, if you wish to attain Ethereum-level safety with velocity enhancements.Solana if you would like the flexibility to execute transactions within the blink of a watch, like when buying and selling one thing in actual time or enjoying a sport with blockchain-based finance parts.

Suppose you’re constructing a real-time yield payout system, the place each few seconds, customers see up to date adjustments. You’ll be higher with Solana velocity than Ethereum block finality. Analyze when it comes to scalability, cost-effectiveness, instruments and the way sturdy the ecosystem is.

Create and Take a look at Your Good Contracts

Your good contracts would be the base of the entire app. In the event that they don’t, your entire construction falls aside: typically completely. Leap in with Solidity (for Ethereum-compatible chains) or Rust (for Solana). Persist with modular, minimalistic contracts, after which check aggressively.

For instance, let’s say you might be making a staking protocol. With Hardhat, you possibly can simulate what occurs when 10,000 customers stake directly or when any person tries to sport a reward calculation.

Safety is non-negotiable. Furthermore, take into account that bugs in DeFi don’t simply crash apps: they take the cash and run.

Constructing The Finest Web3 UI/UX

Web2.0 customers are spoiled with non-frictionless interfaces. In contrast, Web3 improvement is meant to approve MetaMask pop-ups, deal with gasoline charges, and hope each transaction goes by.

You’ll be able to change that. It must be as intuitive to make use of as Venmo or Revolut. A superb DeFi app appears and feels the identical in 2025 because it does immediately: nice design, takes no time to arrange and can be utilized throughout any platform. Meaning:

A easy pockets connection movementGasoline payment estimations and explanationsGentle/darkish modes for higher accessibilityTooltips for DeFi phrases (APY, impermanent loss, and many others.)Dispensation outcomes as quickly as a transaction completes or can’t be accepted

Have a look at Zapper or Zerion. They’ve made monitoring your portfolio enjoyable, together with for many who are new to the cryptomarket. Now convey that very same readability and spark to your personal product.

Combine Wallets and Identification Options

Your customers will want wallets to make use of your app. However wallets usually are not simply technique of fee: they’re identities. Let customers join with:

MetaMask (for browser customers, hottest)Coinbase Pockets (rising rapidly in North America)WalletConnect (for cell customers)Phantom (for Solana-based apps)

However even pockets login won’t be all that’s wanted.

Extra DeFi apps are placing ENS domains, Lens Protocol handles and even Soulbound tokens to make use of to assist their customers construct fame and social proof on-chain. This might imply that lending apps present higher charges to those that have proven a great document of compensation, or to those that take part in governance.

Guarantee Safety at Each Degree

2025 has had loads of DeFi hacks and exploits already. Hundreds of thousands will be misplaced to even the kind of small bugs discovered. So don’t take your probabilities with in-house testing alone.

Do that as a substitute:

Guarantee testing unit and integration exams Simulate edge circumstances with fuzz testingHave interaction an unbiased audit agencyArrange a bug bounty on any of the platforms Imposition of bounds on protocol publicity.

Launch Your MVP on Testnet

Deploy your app to a testnet like Goerli (Ethereum), Mumbai (Polygon) or Devnet (Solana) earlier than going stay. Get early adopters to strive the system and offer you suggestions. Observe how actual customers work together:

The place do they drop off?What frustrates them?What steps really feel complicated?

You’ll be able to incentivize testers with NFTs, early entry bonuses, or airdropped governance tokens. This kind of gamified testing creates loyal fans.

And higher but, it’ll floor edge circumstances that you simply and your dev group seemingly missed.

Go Mainnet with a Rollout Plan

Deploy the Mainnet with a full go-live plan to reduce threat and maximize stability of your dApp. Deploy in tiers to strive issues out, deal with points as they come up, and monitor efficiency —not simply flipping the change. Phased method, real-time changes, and a safer launch. Loads goes into constructing scalable manufacturing purposes; nonetheless, with correct foresight within the software, you possibly can all the time have redundancy and scaling in place to make sure a strong software.

Do it in phases:

Restricted Beta: Each few trusted wallets given entryLaunch to public: With real-time monitoring in placePut up launch audit: Discover bugs in real-time environmentsGovernance onboarding: Permit token holders to vote

Additionally, put together for site visitors spikes. In case your app goes viral in a single day on Crypto Twitter or Reddit, it’s essential to scale up, quick. Leverage analytics instruments corresponding to Dune or The Graph to get forward of efficiency bottlenecks. In the event you’re launching a token, don’t overlook to tell token aggregators like CoinGecko and CoinMarketCap.

Add Governance and Group Layers

In 2025, the best DeFi apps usually are not merely instruments: they’re communities.

After you’ve received customers, have them direct the roadmap with governance tokens. Platforms like Snapshot or Tally allow token holders to vote on proposals corresponding to:

Adjusting rates of interestAllocating liquidity mining rewardsIncluding new propertyMaking protocol upgrades

Uniswap is an ideal instance. Its token holders vote on choices affecting billions in TVL—a way of possession that even essentially the most centralized apps can’t replicate.

Past governance, contemplate:

Discord/Telegram channels to provide suggestions to somebody.A weekly surfaced on Twitter/X to bounce round adjustmentsAmbassador applications to let the regional ambassadors promote your app

Monetize With out Compromising

Sure, you possibly can nonetheless make cash with a DeFi app and stay decentralized.

Right here’s how:

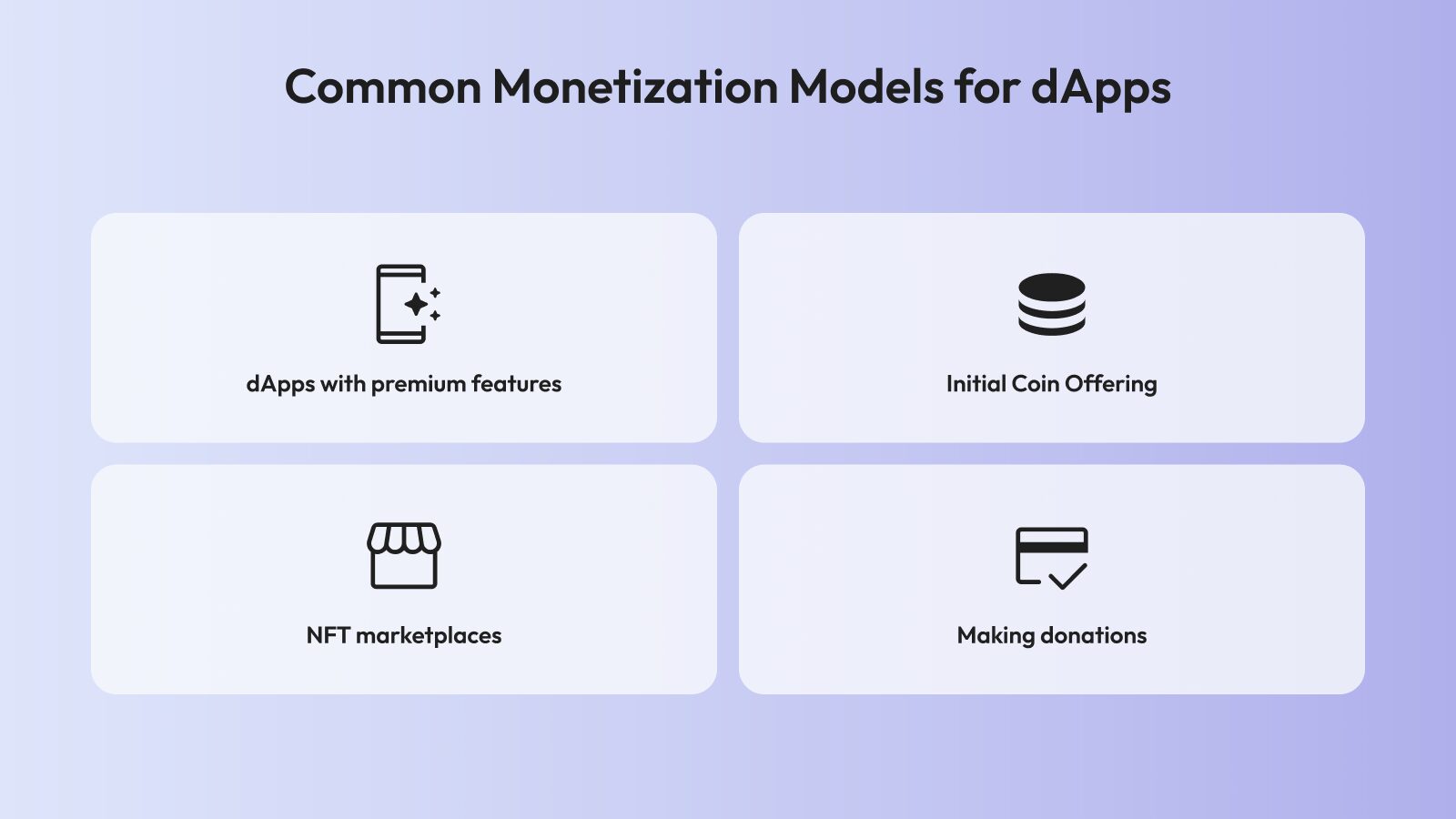

Protocol charges: Charging a small payment on every commerce, staking or lending associationPremium options: Present professional customers with superior evaluationToken worth: Empower governance along with your native token or acquire entry to perksBootstrapping Liquidity: Construct Sturdy Upfront With LP Incentives

For instance, each Balancer and Curve cost charges on trades, however their respective DAOs determine what to do with that income, whether or not it’s to distribute it to customers or use it. You don’t have to select between revenue and decentralization. You have to merely be clear and honest.

Preserve It Compliant (Even when That’s Arduous)

Rules are catching up. A number of nations have rolled out DeFi infrastructure in 2025. Even in case you’re a pure crypto app, you may nonetheless have to contemplate:

KYC for lending, stablecoin appsTransaction monitoring instrumentsGeo-restrictions for sanctioned nationsAuthorized disclosures and disclaimers

Work with authorized counsel early. Even decentralized apps want readability. You must also register in DeFi-friendly jurisdictions like Switzerland, Singapore or the UAE. You’re not trying to get round regulation: you’re making an attempt to interact responsibly inside a quickly altering business.

Closing Ideas

In 2025, it’s not all simply code for a DeFi app, but it surely’s been about belief, usability, scalability and group. It means mixing good contracts with good design. It’s about listening to your customers, securing your protocol, and iterating quick. And most of all, it means being a part of a motion that’s basically altering finance.

Whether or not you’re an unbiased developer or a group, there’s area to your concept on this decentralized future. And what’s the better part? You don’t want permission: solely imaginative and prescient, ability and a complete lot of testing.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. At all times conduct due diligence.

If you wish to learn extra articles like this, go to DeFi Planet and observe us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

“Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”