A divergence has fashioned within the crypto futures market in the course of the previous week as Bitcoin and Solana have seen deleveraging in opposition to the others.

Bitcoin, Solana Have Seen A Drop In Perpetual Futures Open Curiosity

In a brand new submit on X, on-chain analytics agency Glassnode has talked concerning the newest pattern within the Open Curiosity for Bitcoin and different prime cash within the cryptocurrency sector.

The “Open Curiosity” right here refers to an indicator that measures the overall quantity of perpetual futures positions associated to a given asset which might be at the moment open on all centralized derivatives exchanges.

When the worth of this metric goes up, it means the buyers are opening up recent positions on the perpetual futures market. Typically, the overall leverage current within the sector rises when this pattern develops, so the asset’s value can turn into extra unstable following it.

However, the indicator registering a decline implies holders are both closing up positions of their very own volition or getting forcibly liquidated by their platform. Such a pattern normally results in a discount in leverage, which might make the value act in a extra steady method.

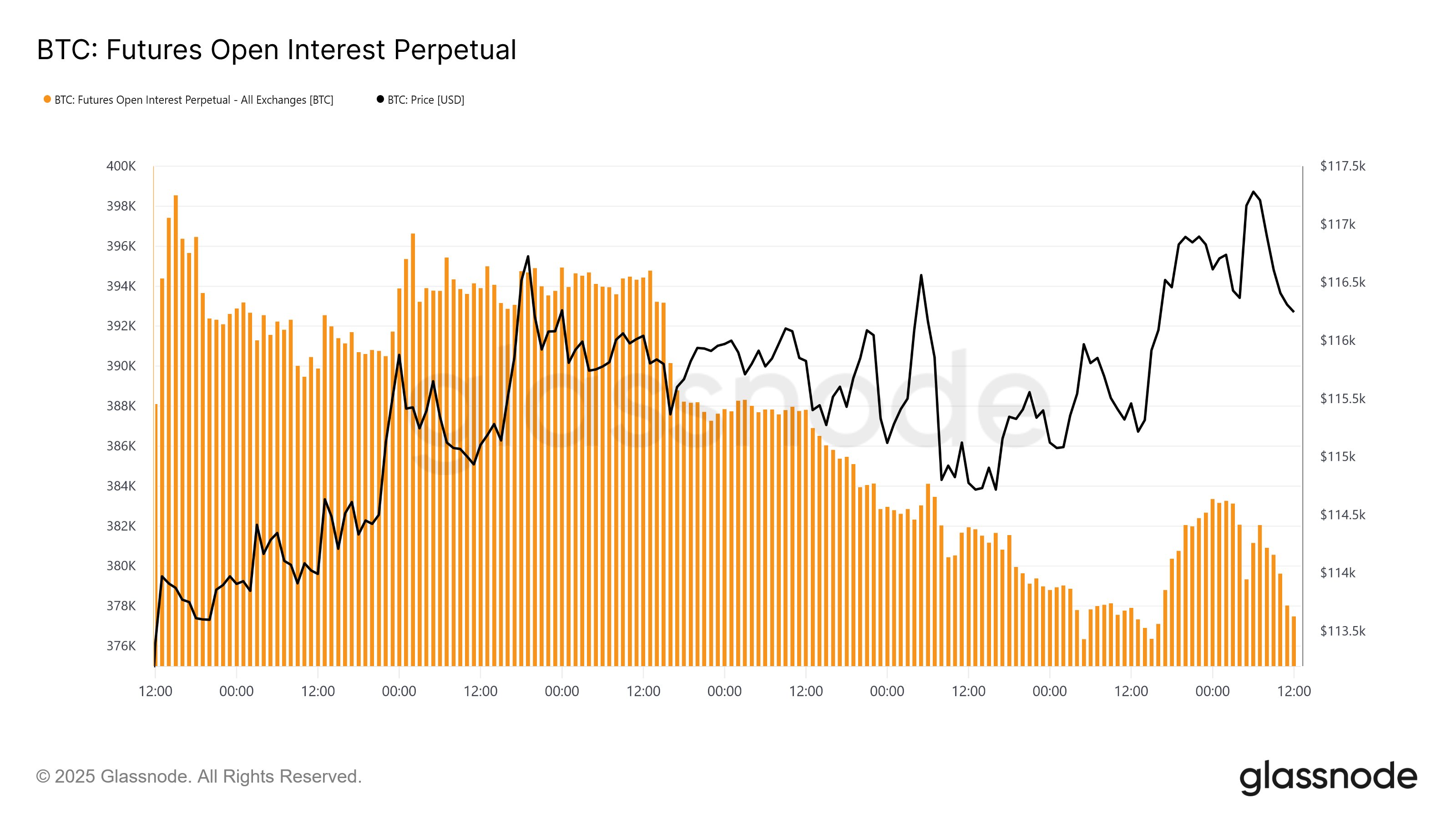

Now, first, right here’s a chart that reveals the pattern within the Open Curiosity for Bitcoin over the previous week:

The worth of the metric seems to have gone down inside this window | Supply: Glassnode on X

As displayed within the above graph, the Bitcoin Open Curiosity has adopted an total downward trajectory on this interval, an indication {that a} internet quantity of positions have disappeared.

Curiously, this pattern has developed alongside a restoration surge within the BTC value to the $117,000 degree. Typically, rallies entice speculative exercise so the indicator tends to rise with them, however it might seem that it hasn’t been the case this time round.

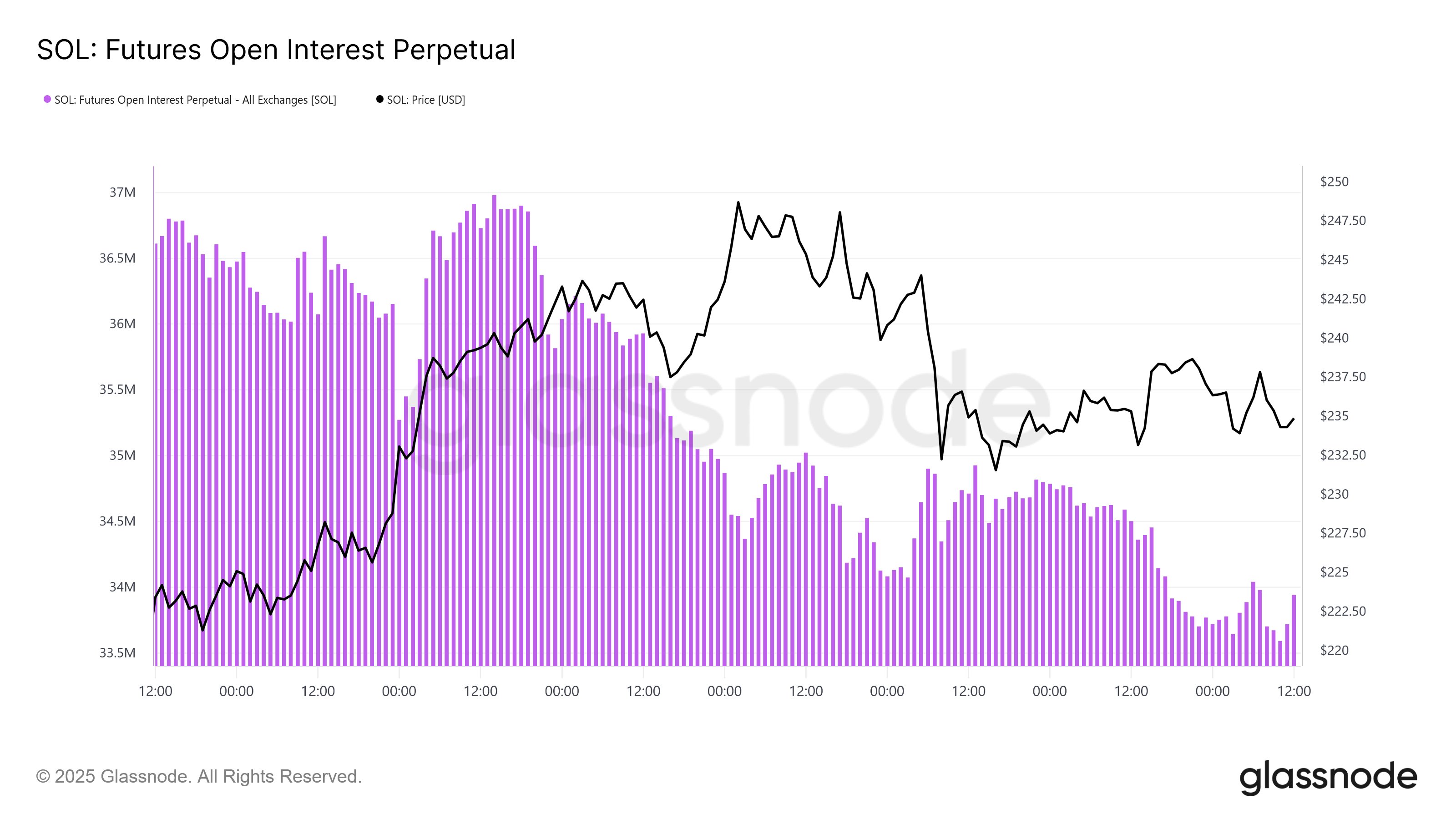

Solana, the cryptocurrency sixth largest by market cap, has seen the same trajectory in its Open curiosity in the course of the previous week, because the beneath chart reveals.

The pattern within the SOL Open Curiosity | Supply: Glassnode on X

Thus, it appears each BTC and SOL have seen a cooldown in speculative exercise regardless that their costs have witnessed a internet enhance over the previous week. The identical pattern, nevertheless, hasn’t been seen with a few of the different prime digital property.

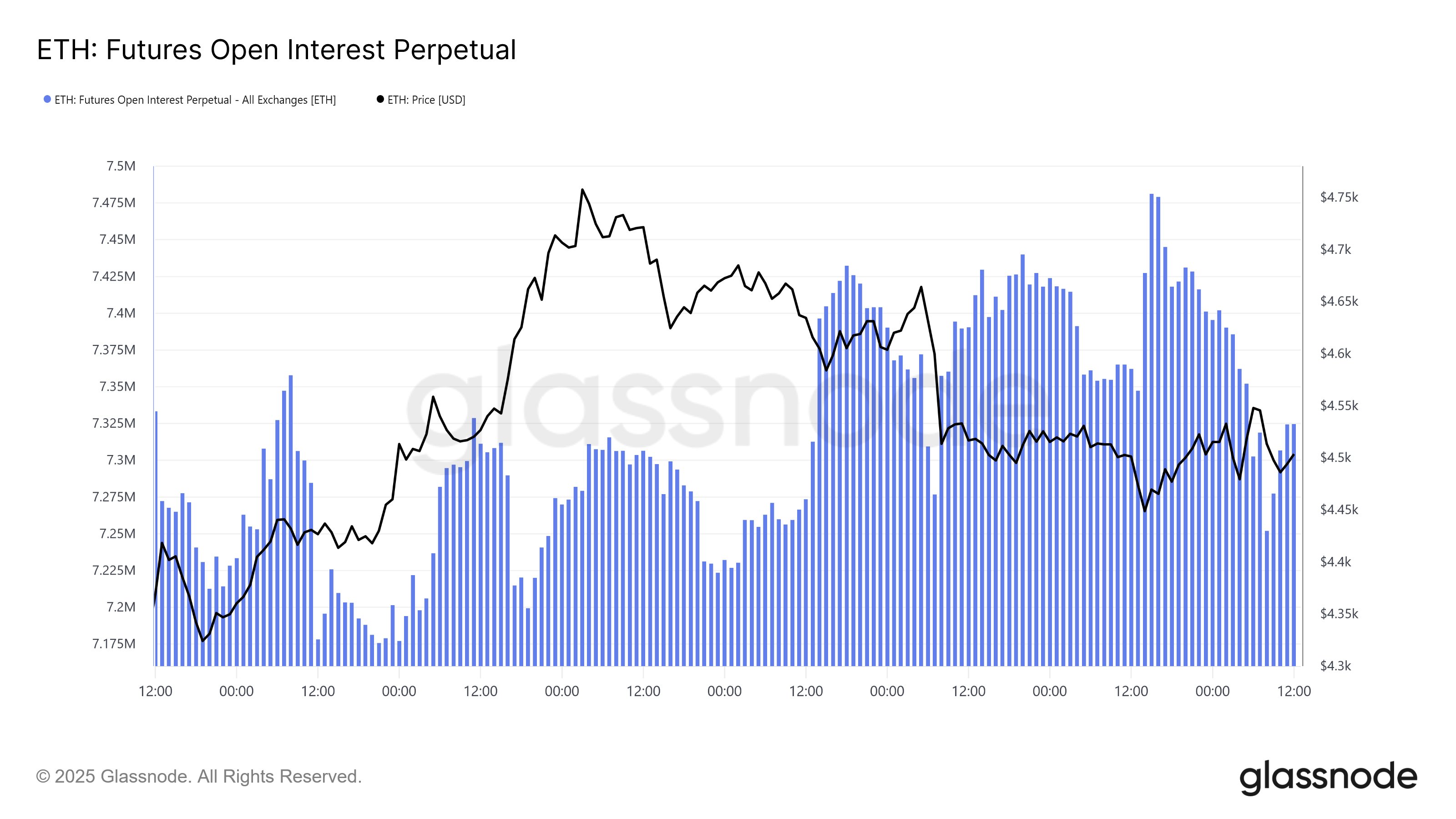

The cryptocurrency quantity two solely to Bitcoin, Ethereum, has witnessed a surge within the Open Curiosity, implying a rise in demand among the many buyers for leveraged positioning.

Seems just like the metric has gone up for ETH | Supply: Glassnode on X

The analytics agency has identified that XRP and BNB have additionally noticed the same pattern. Given this divergence that has fashioned between the property, it’s attainable that ETH and firm could also be in for increased volatility than BTC and SOL.

BTC Value

Bitcoin recovered to $117,900 on Wednesday, however it appears the coin has seen a minor pullback since then because it’s now again at $117,000.

How the value of the asset has moved over the past 5 days | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our workforce of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.