Crypto strikes quick, and so do the blockchains that energy it. However most networks nonetheless function like separate islands, every with its personal guidelines, tokens, and apps. Blockchain bridges resolve this downside by linking these islands collectively. On this information, we’ll break down what a crypto bridge is, why it issues, and how one can safely use one to maneuver your belongings throughout chains with out getting misplaced within the technical jargon.

What Is a Crypto Bridge?

A crypto bridge (additionally known as a blockchain bridge) is a device that lets customers transfer digital belongings or knowledge from one blockchain community to a different. Every blockchain—like Ethereum, BNB Chain, or Solana—runs by itself guidelines and technical requirements, which usually makes direct transfers inconceivable. A crypto bridge solves this by making a connection between two separate blockchains in order that tokens, sensible contract directions, or different data can go between them securely.

A bridge primarily “locks” or information your tokens on the supply chain after which points an equal illustration on the vacation spot chain. This lets you use your belongings in ecosystems that weren’t initially designed for them with out promoting or swapping them on an trade first.

Consider every blockchain as its personal nation with its personal forex and banking system. Usually, cash from one nation can’t be spent instantly in one other. A crypto bridge works like a safe customs checkpoint that takes your funds in a single nation, verifies them, after which points an equal voucher or receipt you may spend within the different nation.

Why Do We Have to Bridge Crypto?

Blockchains function as separate ecosystems. Ethereum, BNB Chain, Solana, and others every have their very own guidelines, tokens, and functions. This isolation makes it laborious for customers to maneuver belongings or use companies throughout totally different blockchain networks. Crypto bridges resolve that downside by connecting totally different networks so customers aren’t locked right into a single one.

The important thing causes we’d like bridges:

Entry to dApps on different chains. You possibly can transfer belongings to a sequence the place a particular DeFi platform, NFT market, or sport is predicated with out promoting your tokens.

Decrease charges and sooner transactions. Bridges allow you to shift funds to blockchains with cheaper gasoline prices or higher efficiency.

Liquidity and yield alternatives. By bridging, you may provide or stake belongings throughout a number of chains to earn increased returns or diversify danger.

Improved usability for multi-chain tasks. Builders could make their apps obtainable on a number of blockchains whereas nonetheless serving the identical person base, usually by utilizing cross-chain bridges.

Learn extra: Prime 10 dApps

Why Can’t Blockchains Discuss to Every Different?

Every blockchain is constructed with its personal structure, consensus guidelines, token requirements, and programming languages, which make it a self-contained system somewhat than a part of a single community. As a result of there isn’t any common protocol for communication between chains, one blockchain can’t routinely confirm what’s taking place on one other.

Networks equivalent to Ethereum and Bitcoin use totally different consensus mechanisms. Their addresses and token requirements observe totally different codecs, and their sensible contracts are written in several languages. On prime of that, sturdy safety boundaries stop exterior knowledge from being accepted with out verification, as a result of a malicious actor may spoof data from one other chain. Since blockchains are designed to be safe and decentralized on their very own, to not talk with others, they can’t “discuss” instantly. Bridges act as translators and couriers, verifying occasions on one chain and safely reflecting them on one other.

How Crypto Bridges Work

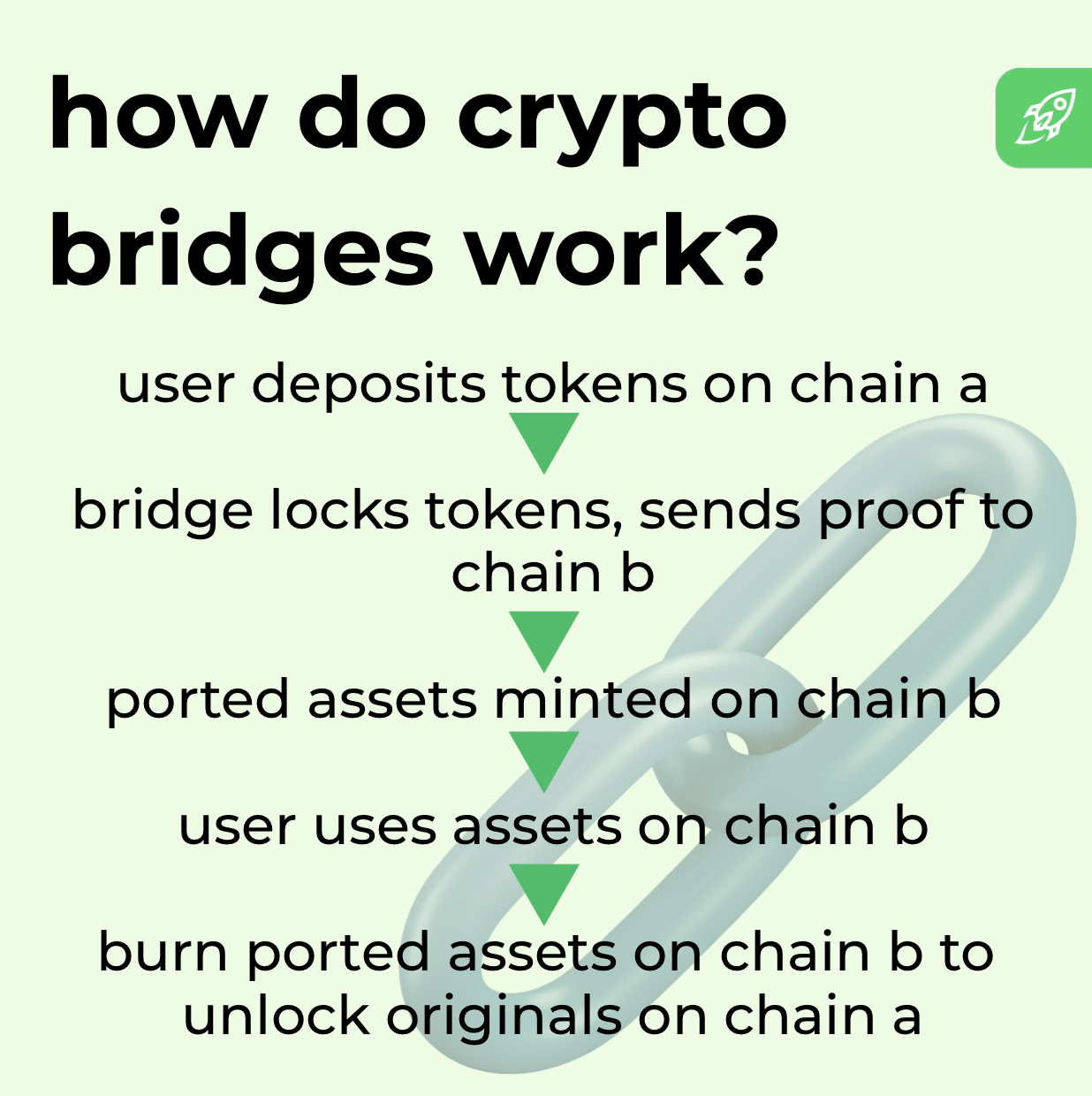

A crypto bridge is greater than a easy “lock-and-mint” mechanism. It’s a set of sensible contracts, off-chain parts, and safety checks that hyperlink two unbiased blockchains. Whenever you transfer tokens by a bridge, the unique belongings keep on the supply chain. A sensible contract there locks them, information the deposit, and points a message or proof that’s relayed to the vacation spot chain. Relying on the bridge design, this relay may be dealt with by a centralized operator, a gaggle of validators, or an automatic contract.

On the vacation spot chain, that proof triggers the minting or launch of a ported asset, typically known as a wrapped token. This ported asset represents the unique token you locked, backed one-to-one by the cash sitting on the supply chain. You should utilize it in dApps, DeFi protocols, or trades similar to a local token on the goal chain, despite the fact that the unique hasn’t moved.

Whenever you ship the ported asset again throughout the bridge, it’s burned or returned on the goal chain, and the bridge unlocks or releases the unique tokens on the supply chain. Some bridges as an alternative use liquidity swimming pools on every chain handy you present tokens on the vacation spot chain instantly, whereas your deposit refills the pool on the supply chain.

Kinds of Crypto Bridges

Crypto bridges aren’t all constructed the identical manner. They differ in how they deal with safety, custody, and verification. Under are the principle classes you’ll come throughout.

Trusted (Centralized) Bridges

Trusted bridges depend on a central operator or a gaggle of validators to handle the switch course of. Whenever you ship tokens, they’re held by this middleman, which then points the corresponding tokens on the opposite blockchain. As a result of a single entity or consortium controls the bridge, customers should belief it to safeguard funds and course of transactions truthfully. These bridges are sometimes simpler to make use of and sooner to arrange, however introduce counterparty danger.

Trustless (Decentralized) Bridges

Trustless bridges take away the necessity for a central custodian. As an alternative, they use sensible contracts and cryptographic proofs to confirm that belongings are locked on one chain earlier than minting or releasing them on one other. No single social gathering holds the funds. On trustless bridges, safety comes from decentralized validators and on-chain logic. This design lowers reliance on third events however may be extra complicated and will carry increased charges or slower affirmation instances relying on the community.

Cross-Chain Bridges

A cross-chain bridge is a broad time period for any system that permits belongings, knowledge, or sensible contract calls to maneuver between two or extra blockchains. Each trusted and trustless designs may be cross-chain. The important thing function is that it allows interplay between separate chains, letting customers entry dApps, liquidity, and companies throughout a number of networks with out having to promote or swap their tokens first.

Blockchain Bridge Varieties by Mechanism

Bridges will also be grouped by the technical mechanism they use to maneuver worth between chains. The 2 most typical approaches are wrapped asset bridges and liquidity pool–primarily based bridges.

Wrapped Asset Bridges

A wrapped asset bridge works by locking your unique tokens on the supply blockchain and minting an equal “wrapped” model on the vacation spot chain. For instance, should you bridge ETH to a different community, the bridge holds your ETH on Ethereum and points Wrapped ETH (wETH) on the opposite chain. Whenever you return the wrapped tokens, the bridge burns them and releases your unique ETH. This methodology retains a one-to-one backing between the wrapped token and the underlying asset.

Liquidity Pool–Based mostly Bridges

Liquidity pool–primarily based bridges don’t mint wrapped tokens. As an alternative, they depend on swimming pools of tokens already deposited on every chain. Whenever you ship tokens to the bridge, it withdraws an equal quantity from its pool on the vacation spot chain and sends it to you. In the meantime, your deposited tokens add to the pool on the supply chain. This strategy can enable sooner transfers and an easier person expertise, nevertheless it is determined by the depth and administration of the liquidity swimming pools to take care of easy operation.

Keep Secure within the Crypto World

Discover ways to spot scams and defend your crypto with our free guidelines.

Examples of Standard Crypto Bridges

There may be all kinds of well-known cross-chain bridges that give customers quick access to functions, liquidity, and belongings throughout chains. These platforms present the cross-chain performance that allows you to transfer tokens between two totally different blockchain networks with out going by an trade.

Among the most generally used bridges embody:

Polygon Bridge, which connects the Ethereum community to Polygon, permitting fast cross-chain transfers of ETH and ERC-20 tokens.

Arbitrum Bridge, a cross-chain bridge that strikes belongings between Ethereum and Arbitrum’s Layer 2, serving to customers lower gasoline charges whereas staying contained in the blockchain ecosystem constructed across the Ethereum blockchain.

Binance Bridge, a blockchain bridge that hyperlinks Binance’s BNB Chain and different chains to Ethereum, usually utilizing unified liquidity swimming pools to hurry up transfers.

Avalanche Bridge, a high-capacity blockchain bridge for shifting belongings from Ethereum to Avalanche and again.

Every of those bridges is designed to make the blockchain ecosystem really feel extra related, so customers can entry dApps and liquidity on a number of networks with out promoting or swapping their tokens first.

Advantages of Utilizing Crypto Bridges

Bridges supply a number of significant benefits that assist increase how and the place crypto can be utilized:

They allow cross-chain transfers so you may transfer tokens between totally different blockchain networks with out turning them into one other asset first.

You acquire entry to dApps, liquidity, and protocols in chains you couldn’t attain in any other case, unlocking extra yield and use instances.

By shifting belongings to chains with decrease charges or sooner throughput, you may cut back prices and enhance transaction velocity.

Bridges assist develop interoperability within the blockchain ecosystem, making it smoother for customers and builders to work throughout a number of networks.

They cut back dependence on centralized exchanges: as an alternative of promoting on one chain and shopping for on one other, you may merely bridge your present belongings.

In some instances, bridges allow cross-chain governance, lending, and composability, letting your belongings take part in additional complicated cross-network methods.

Dangers of Utilizing Crypto Bridges

Whereas bridges unlock highly effective cross-chain performance, in addition they introduce important dangers and assault surfaces. Among the major risks embody:

Sensible contract vulnerabilities are frequent as a result of bridge code is usually complicated, and bugs or flaws in logic can let attackers drain funds.

Bridges typically depend on a small set of validators or operators, and if one is compromised the system may be manipulated or funds stolen.

Bridges usually import knowledge or messages from different chains or off-chain sources, and if these inputs are faked or tampered with the bridge can course of fraudulent transactions.

If a community related by a bridge is attacked (for instance, through a 51% assault), the compromise might propagate to different chains through the bridge linkage.

Bridges are among the many most focused components of Web3, and over $2 billion has been misplaced in bridge hacks in recent times, together with massive exploits like Poly Community.

Bridges utilizing liquidity swimming pools might face imbalances or inadequate reserves, making transfers much less environment friendly or extra pricey.

In some designs, changing bridged tokens again to their unique type can incur delays or dependency on off-chain processes, introducing the chance of caught funds.

Due to these dangers, it’s important to decide on well-audited, decentralized bridges with sturdy safety practices (and to restrict publicity when bridging!)

The best way to Use a Crypto Bridge: A Step-by-Step Information

Utilizing a crypto bridge is normally simple. Right here’s a transparent, beginner-friendly walkthrough you may adapt to virtually any bridge interface:

Select a bridge that helps your belongings and chains. Ensure the bridge works between the 2 blockchains you need to join (for instance, the Ethereum community and BNB Chain) and that it handles your token.

Join your pockets. Open the bridge web site or app and join a appropriate crypto pockets (equivalent to MetaMask or WalletConnect). Approve the connection so the bridge can view your balances.

Choose the supply and vacation spot chains. Choose the blockchain you’re sending from and the blockchain you’re sending to. Verify that you simply’re on the right community in your pockets.

Select the token and quantity. Enter how a lot you need to bridge. Some bridges solely help particular tokens or require minimal quantities.

Overview charges and estimated time. Test the gasoline charges on the supply chain and any service charges the bridge might cost.

Approve and ensure the transaction. Your pockets will immediate you to approve the token switch after which verify the bridging transaction.

Look ahead to affirmation. The bridge locks your tokens on the supply chain and points (or releases) equal tokens on the vacation spot chain. This could take from seconds to minutes relying on the networks.

Confirm your steadiness on the vacation spot chain. Change your pockets to the vacation spot community to see the bridged tokens.

Greatest Practices and Security Ideas for Utilizing Blockchain Bridges

When shifting belongings between blockchains, it’s essential to grasp how and why bridges work to guard your self. Earlier than trusting a platform, look carefully at its monitor document and audits. Ask your self: How do blockchain bridges work normally, and does this one work reliably? Has it suffered downtime or safety points? Excessive-profile incidents such because the Wormhole Bridge exploit present that even massive, well-funded tasks constructed on cutting-edge blockchain know-how may be weak.

At all times begin with a small take a look at transaction to verify that the switch behaves as anticipated earlier than shifting bigger quantities. That is particularly essential in case you are bridging high-value belongings like BTC representations of the Bitcoin blockchain into decentralized finance protocols on one other chain. Use official URLs and verified apps to keep away from phishing websites, and hold your pockets software program updated. {Hardware} wallets or multisig setups add one other layer of safety.

Test which tokens and networks a bridge formally helps. Unsupported belongings could also be delayed or misplaced if despatched by the improper channel. Take note of community charges and estimated instances earlier than confirming a switch—congested chains can enhance prices or sluggish remaining settlement. After the transaction, change your pockets to the vacation spot community and confirm the arrival of your tokens earlier than deploying them into decentralized finance methods.

Lastly, keep knowledgeable by following a bridge’s official bulletins and safety updates. Bridges are evolving shortly throughout the blockchain know-how house, and their security is determined by energetic upkeep and clear communication. Deal with bridging as you’ll any high-value monetary transfer: confirm first, act cautiously, and hold safety a precedence.

Last Ideas

Crypto bridges are shortly changing into the glue of a multi-chain world. They make once-isolated networks a part of an interconnected ecosystem, letting customers transfer belongings, faucet into decentralized finance, and discover apps with out switching wallets or promoting tokens. Because the know-how matures, anticipate safer and user-friendly bridges—but in addition keep alert to dangers. By understanding how they work and following finest practices, you may benefit from cross-chain alternatives whereas conserving your funds secure.

FAQ

What does a crypto bridge do?

A crypto bridge enables you to switch belongings from one explicit blockchain to a goal chain, performing as a hyperlink that allows communication in an interconnected community of blockchains.

Are blockchain bridges secure?

Sure… and no. Security varies: well-audited or federated bridges may be safe, however exploits have proven that cross-chain blockchain bridges stay high-value targets within the crypto business.

What’s the hottest crypto bridge?

Essentially the most extensively used bridges usually contain the Ethereum community, equivalent to Polygon or Arbitrum, as a result of they deal with massive volumes of cross-chain exercise.

How lengthy does bridging crypto take?

Bridging normally takes just a few seconds to a number of minutes relying on the bridge, the networks concerned, and congestion on the goal chain.

What sort of pockets do I must bridge crypto?

You want a pockets that helps a number of chains—like MetaMask or a {hardware} pockets—so it could possibly work together with each the supply and the goal chain.

Why do individuals bridge as an alternative of simply shopping for crypto on one other chain?

Bridging lets customers hold the identical asset throughout chains and entry apps or liquidity with out promoting, which may be cheaper and sooner than shopping for it once more on one other blockchain.

Is crypto bridging the identical as swapping tokens?

No. Swapping exchanges one token for one more on the identical chain, whereas bridging strikes the identical token between chains in an interconnected community.

Disclaimer: Please observe that the contents of this text should not monetary or investing recommendation. The knowledge offered on this article is the creator’s opinion solely and shouldn’t be thought-about as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this data. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be acquainted with all native rules earlier than committing to an funding.