Analyst Weekly, November 11, 2025

Bitcoin: Much less Noise, Extra Conviction

After six straight days of ETF outflows, Bitcoin simply flipped the script with practically $240M in inflows marking its sharpest rebound in weeks. It’s a signal that Bitcoin’s market construction is maturing.

The outdated four-year growth–halving–bust cycle is fading quick. With over 93% of Bitcoin already mined, halvings now transfer sentiment greater than provide. Institutional gamers like BlackRock, Constancy, and ARK are absorbing cash whereas leveraged merchants exit. It’s a quiet switch of energy: from speculators to allocators.

A New Part for Bitcoin

Roughly 400,000 BTC have shifted from long-term holders to institutional traders in simply the previous month. Every dip is met with accumulation, not panic. Volatility is compressing, now under 30%, a degree unseen since pre-ETF days, signaling that Bitcoin is behaving extra like a structural asset than a speculative one. It’s beginning to decouple from gold and the Nasdaq, transferring to its personal rhythm.

If inflows maintain and leverage stays muted, Bitcoin’s evolution from cyclical commerce to long-term allocation might be underway. Recoveries are sooner, drawdowns smaller, conviction stronger.

Crypto: Structural Rotation Underway

Institutional flows proceed to favor Bitcoin’s readability over Ethereum or Solana however that doesn’t make the latter any much less essential. We keep structurally bullish on each: Ethereum and Solana are rising as the 2 principal roads to the tokenized future, powering stablecoins, real-world belongings, and DeFi infrastructure.

Earnings Preview: Week of November 10, 2025

Utilized Supplies (AMAT): Utilized Supplies (AMAT) will ship its fiscal This autumn 2025 earnings on Nov. 13 because the semiconductor tools chief contends with US export curbs which have curtailed gross sales to China and a cautious chipmaking capex setting. Buyers are targeted on whether or not surging demand for AI server chip instruments can offset softer orders from reminiscence and logic clients. AMAT had warned of a drop on this quarter’s income as a consequence of Chinese language chipmakers pausing new tools purchases and if administration’s steering or feedback on its backlog point out that the trade downturn is bottoming, which might drive the inventory’s response.

JD.com (JD): JD.com (JD) is slated to report Q3 2025 earnings on Nov. 13, and its outcomes will present how China’s e-commerce setting is faring amid a lukewarm client and intense competitors. Analysts anticipate roughly 13% YoY income development however a pointy drop in revenue as JD’s heavy investments in new providers (like meals supply and on the spot retail) have squeezed margins. Buyers will look ahead to indicators that JD’s pivot to an “efficiency-first” technique is paying off; if the corporate can translate strong gross sales development into improved money stream and margins, it might mark a turning level from current cautious sentiment to renewed optimism on the inventory.

Tencent Holdings (TCEHY): Tencent Holdings (TCEHY) is predicted to put up strong Q3 2025 development, with forecasts for roughly 13–14% greater income and mid-teens earnings good points pushed by a rebound in its gaming and internet advertising companies alongside enhancing margins. Market consideration will heart on whether or not Tencent’s heavy investments in AI and cloud (the corporate budgeted round RMB 100 billion in AI capex this yr) are sustaining its momentum, new hit sport launches and AI-enhanced advert know-how have buoyed outcomes, and the way China’s macro setting or tech laws would possibly mood its outlook, as these components will affect investor response.

Sea Restricted (SEA): Sea Restricted (SE) will launch Q3 2025 outcomes on Nov. 11, and the market is anticipating sturdy top-line development (~40% YoY income surge to almost $6 billion) pushed by its Shopee e-commerce and SeaMoney fintech models. Nevertheless, profitability is below the microscope, the corporate’s gross sales and advertising and marketing bills have spiked (~30% YoY final quarter) and a few analysts warning Sea is “more likely to commerce margins for development” so traders will watch whether or not Sea can present enhancing margins or value self-discipline even because it chases development, which shall be essential for the inventory’s post-earnings response.

Occidental Petroleum (OXY): Occidental Petroleum is scheduled to put up Q3 2025 outcomes on Nov. 10, and Wall Avenue anticipates declines from a yr in the past (round $6.7 billion income, -6% YoY, and ~$0.48 EPS, -50% YoY) as final yr’s oil worth surge. Key focal factors shall be OXY’s manufacturing volumes and capital returns; the corporate has elevated output within the Permian and aggressively reduce debt (reducing curiosity bills by $410 million) to bolster margins, together with any commentary on commodity worth developments or shareholder payouts, which might sway the inventory’s response.

Cisco Techniques (CSCO): Cisco Techniques (CSCO) will announce its earnings after the Nov. 12 shut, with consensus round $14.8 billion in income (+~7% YoY) and $0.98 in EPS. Buyers shall be watching if Cisco’s core networking enterprise can maintain sturdy development, fueled by a multi-year improve cycle in AI infrastructure and enterprise campus refreshes and whether or not administration’s steering and order backlog verify surging demand (Cisco practically doubled its AI-related gross sales goal final quarter), as these components will closely affect the inventory’s post-earnings transfer.

Walt Disney Co. (DIS): Walt Disney (DIS) experiences fiscal This autumn 2025 outcomes forward of the Nov. 13 open, with consensus projecting about $1.02 in EPS (-10% YoY) on $22.8 billion income (+~1% YoY). Buyers shall be eyeing Disney’s streaming subscriber developments and theme park momentum versus continued weak spot in its conventional TV networks, these metrics, together with any new cost-cutting or strategic updates (comparable to plans round ESPN or content material spending), will set the tone for a way the inventory reacts to the earnings.

Valuations Are Stretching However So Is the Market’s Breadth

The highest of the S&P 500 remains to be dwelling giant. The median price-to-earnings (P/E) a number of of the highest 5 S&P 500 names sits at 30.2x, towering over the broader market’s 23x and the median inventory’s 19x. Buyers are nonetheless paying a steep premium for the largest gamers.

What’s attention-grabbing this yr, although, is that the typical inventory, not the megacaps, has seen the larger valuation bump. The “S&P 493” (the remainder of the index minus the Magnificent Seven) has really skilled extra a number of enlargement, which means traders at the moment are keen to pay extra for every greenback of earnings even exterior Large Tech.

That’s helped carry the general market a number of, but it surely’s additionally flashing a gentle warning signal. At 19x, the median inventory’s valuation is now simply two turns under its 2021 peak of 21.3x, which marked the final main market high. Fundamentals stay sturdy, however valuation tailwinds are getting drained. Costs can’t preserve rising simply because traders really feel good, finally, earnings need to do the heavy lifting.

Earnings Beat Expectations, and Then Some

Company America remains to be cranking out income. Third-quarter earnings season got here in up 14% year-on-year, blowing previous preliminary forecasts that known as for mid-single-digit development. That’s regardless of a backdrop of slowing job development and a brief authorities shutdown, each of which, surprisingly, barely dented earnings outcomes. We anticipate a macro slowdown in This autumn is slower, as hiring cools down, but the company backside line hasn’t flinched. That has, to this point, helped maintain investor confidence.

No shock: the Magnificent Seven, Apple, Microsoft, Alphabet, Amazon, Meta, Tesla, and Nvidia, proceed to dominate on each income and efficiency. Their earnings development has powered a lot of the S&P 500’s good points for a number of quarters. That mentioned, by the second half of 2026, the hole in earnings development between the Magazine 7 and the remainder of the S&P 500 (the “493”) might begin to compress.

Meaning earnings breadth could lastly widen as extra sectors contribute to revenue development, not simply tech titans. It’s the form of shift that tends to make bull markets extra sustainable and fewer top-heavy.

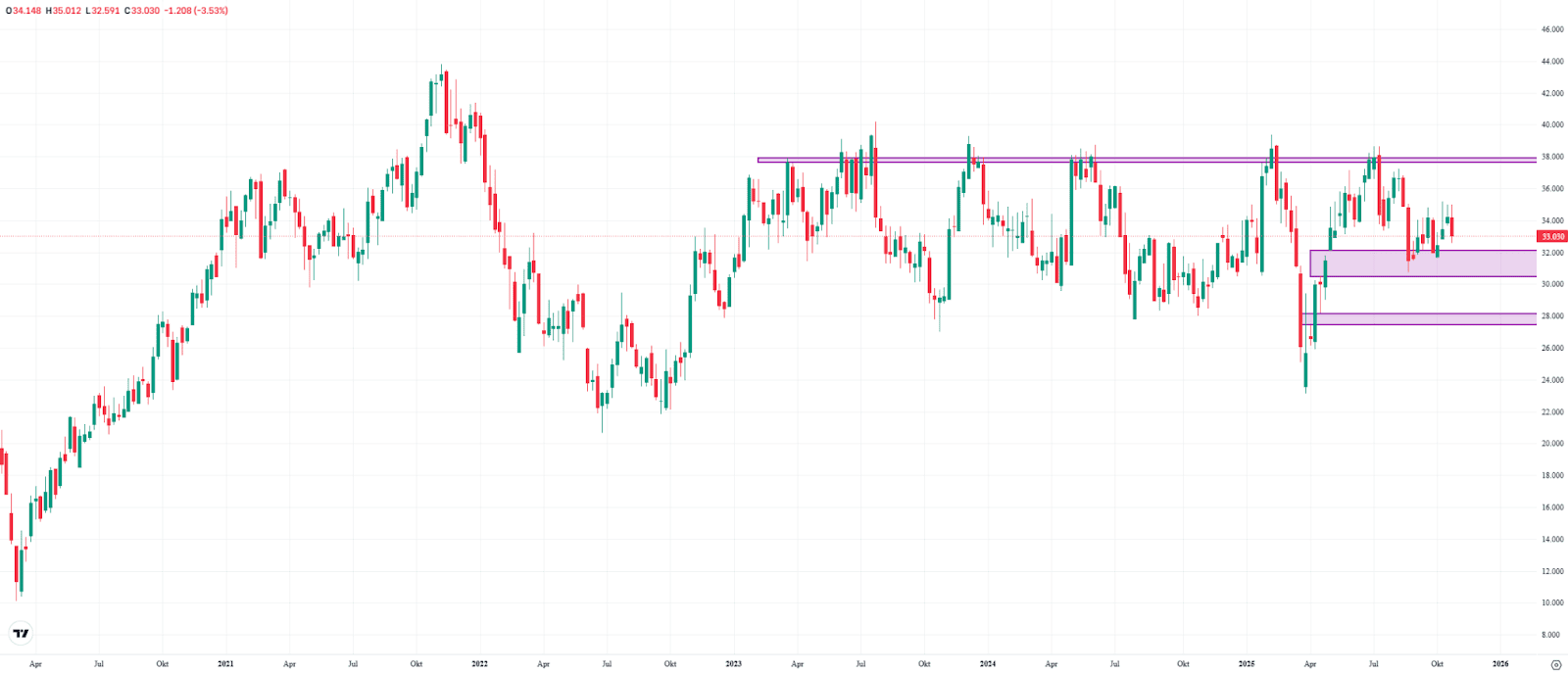

Bitcoin Slips: Can the $100,000 Degree Maintain?

Bitcoin fell about 7% final week after assist at $107,370 failed to carry. Sellers had already been placing stress in the marketplace in current weeks. The cryptocurrency danced not solely across the psychologically necessary $100,000 mark but additionally flirted with bear-market territory — at one level, the drop from the all-time excessive exceeded 20%.

Regardless of the pullback, the market confirmed some resilience. Bitcoin reacted to a widely known assist zone, the Truthful Worth Hole between $96,950 and $99,730, which was already defended in June. The weekly shut above the decrease boundary of this zone suggests a level of stabilization for now.

The long-term uptrend stays intact. Within the brief time period, nonetheless, the chart would solely enhance if Bitcoin regains the damaged assist at $107,370. If the $96,950 degree fails, the subsequent main assist zone might come into focus between $85,600 and $91,920.

Bitcoin, weekly chart. Supply: eToro

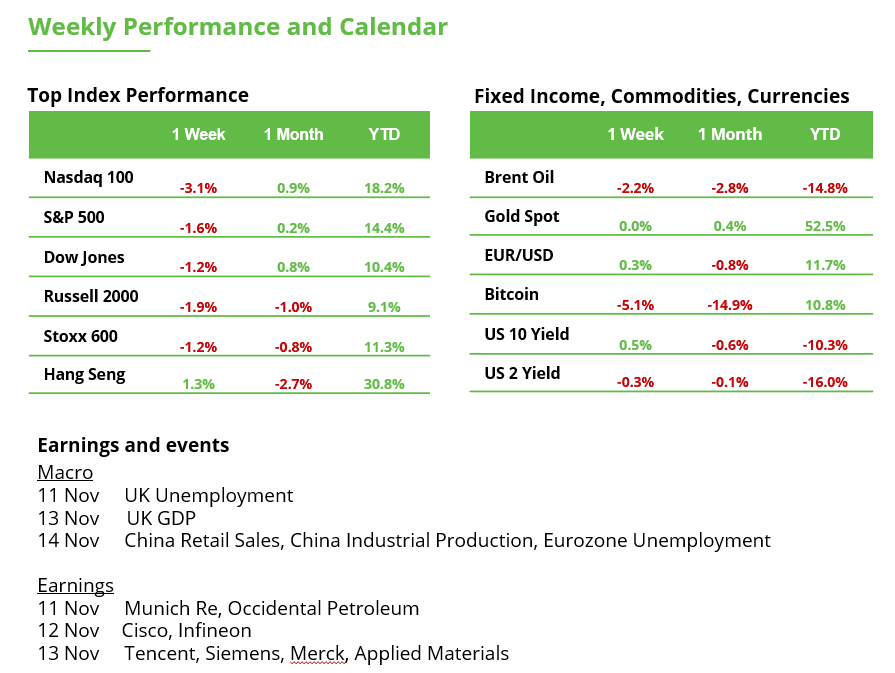

Infineon Forward of Q3 Earnings: Restoration Stalls, Stress Rises

Infineon shares fell about 3.5% final week, presently buying and selling round €33. This halted the three-week restoration part for now. Since September, the inventory has tried to rebound twice from the assist zone between €30.46 and €32.15, however to this point it hasn’t managed to check the medium-term resistance at €38. A degree that has blocked any sustained transfer towards document highs since March 2023.

From a technical perspective, the prospect of one other upward transfer stays so long as the decrease boundary of the Truthful Worth Hole at €30.46 holds. Nevertheless, if this assist breaks, traders must be ready for a possible decline towards the €27.44–€28.17 vary. Infineon will report its Q3 outcomes on Wednesday, which might mark a decisive “make-or-break” second for the inventory.

Infineon weekly chart. Supply: eToro

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any specific recipient’s funding aims or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.