Be part of Our Telegram channel to remain updated on breaking information protection

The BNB value is up 3.60% during the last week, outpacing the worldwide cryptocurrency market, which is up 1% to a market capitalization of $3.195 trillion. Within the final 24 hours, BNB value is up a fraction of a share buying and selling at $895.95 as of 12:57 a.m. EST.

From a technical perspective, BNB is poised for a breakout, following Grayscale Investments’ procedural step of registering a statutory belief for a proposed BNB exchange-traded fund (ETF) in Delaware.

As consumers face resistance within the $900-$920 vary, the main target now could be on whether or not Grayscale’s endorsement will spark a sustained BNB surge.

Grayscale Registers BNB ETF In Delaware

Grayscale Funding registered a statutory belief for a proposed BNB ETF in Delaware on January 8, 2026, in accordance with the State’s document.

The Wall Road agency in search of registration lays the groundwork for formal functions to federal regulators.

🚨BREAKING: Grayscale simply registered for a $BNB ETF in Delaware pic.twitter.com/83cxkit4TZ

— DustyBC Crypto (@TheDustyBC) January 9, 2026

Furthermore, ETF registration might open the door to elevated institutional curiosity and better market accessibility for BNB, thereby fostering its progress and acceptance as a legit funding car.

As extra traders acknowledge the potential of an ETF, they might reinvigorate their curiosity in BNB, which in flip might affect its market standing.

Can the BNB value decide up on this bullish outlook?

BNB Worth Evaluation: Falling Wedge Sample Indicators Potential Bullish Breakout

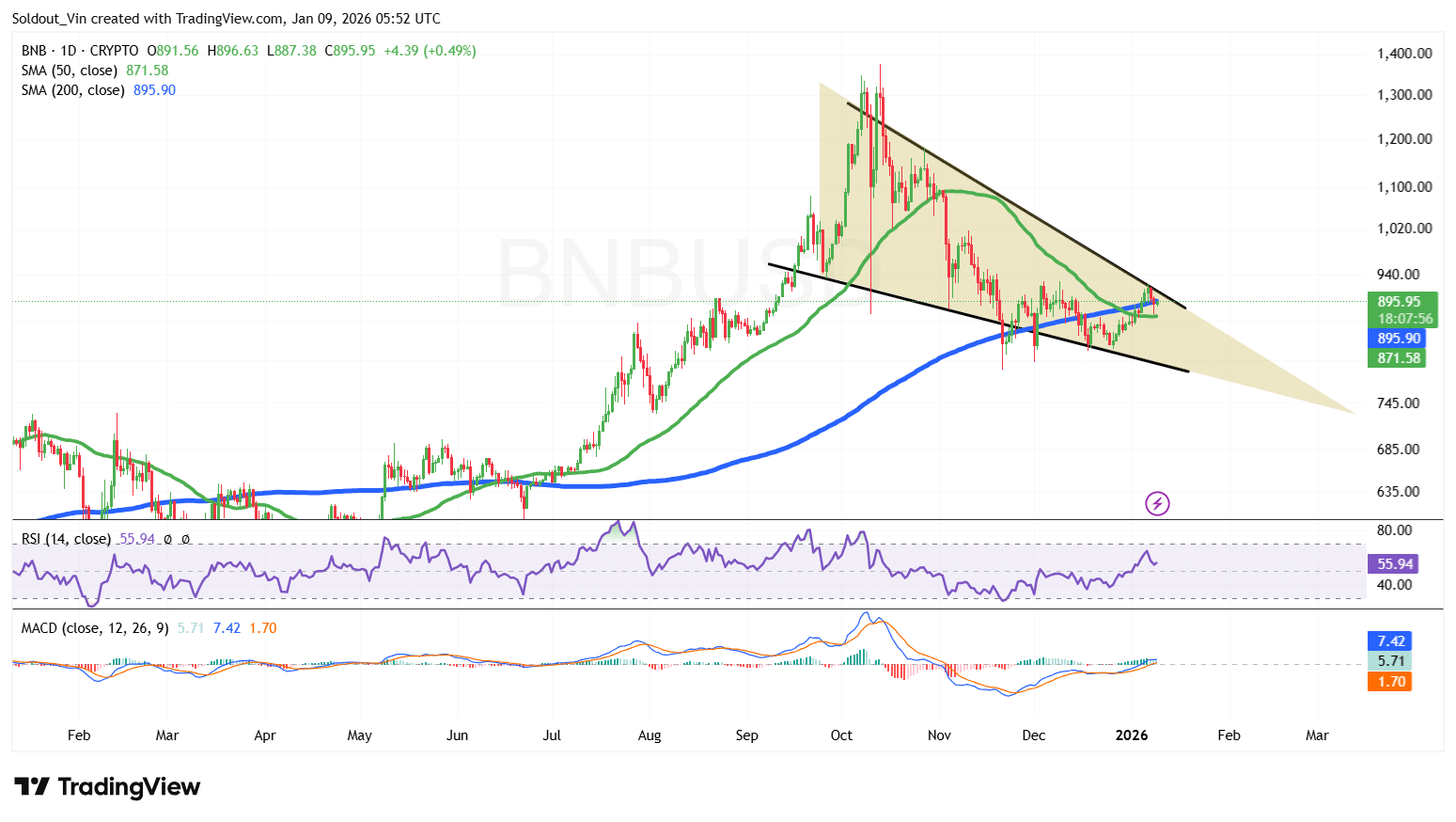

After a mid-year rally in 2025 that noticed the BNB value soar to an all-time excessive of round $1,369 in October, the asset then entered a sustained downtrend, confined inside a falling wedge sample.

With the path of the uptrend and the following downtrend, the Binance Coin value is setting a basis for an incoming uptrend above the wedge, because it now trades throughout the higher boundary of the wedge.

BNB has additionally crossed above each the 50-day and 200-day Easy Shifting Averages (SMAs), $871.58 and $895.9, respectively, a sign that bullish stress could also be selecting up.

The Binance Coin Relative Energy Index (RSI) has fallen from the 60 degree however is now exhibiting indicators of a rebound, at present at 55, which can point out that consumers are regaining momentum.

If consumers push the worth of BNB above the $920 resistance and the higher boundary of the wedge, the following potential space of focus would be the earlier demand areas round $1,008 and $1,114.

The Shifting Common Convergence Divergence (MACD) fuels this sentiment, because the blue MACD line has now crossed above the orange sign line. On the similar time, the inexperienced bars construct above the impartial line, a sign of elevated bullish stress.

Conversely, if this resistance fails and bears regain management, the BSC ecosystem token might drop again to the $830 assist space, which has been examined a number of occasions.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection