The demand for crypto prop companies has exploded lately. As cryptocurrencies proceed to reshape monetary markets, merchants around the globe are in search of methods to take part with out risking vital quantities of non-public capital. Prop companies (brief for “proprietary buying and selling companies”) present an answer by giving merchants entry to funded accounts in change for passing analysis challenges and following particular buying and selling guidelines.

However with dozens of companies launching globally, how are you aware which one is best for you? On this article, we’ll look at the very best crypto prop companies in 2025, highlighting their revenue splits, guidelines, status, and distinctive options.

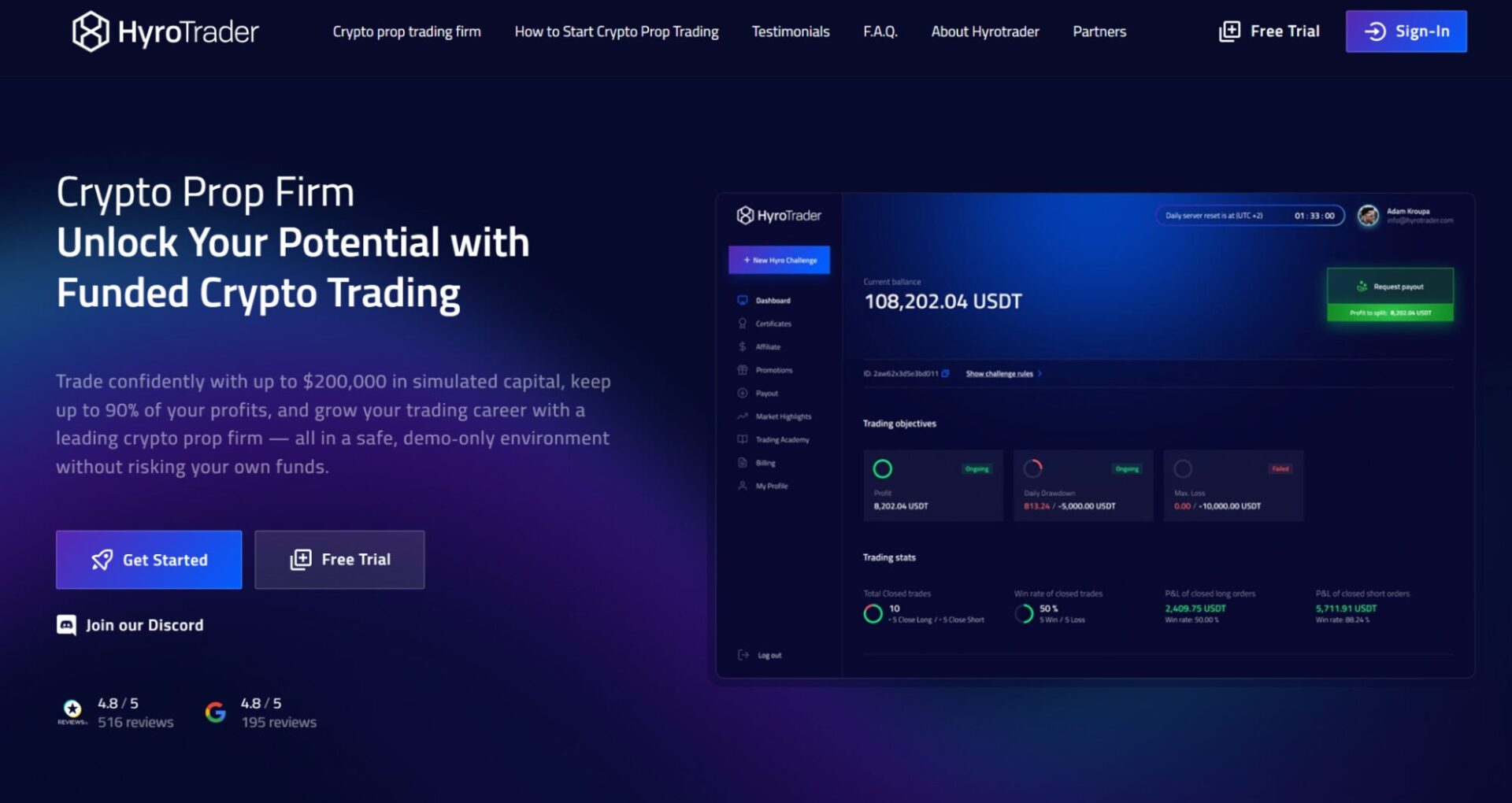

1. HyroTrader

HyroTrader has quickly positioned itself as a number one title within the crypto prop buying and selling house, providing merchants entry to capital with a construction that balances flexibility and transparency. Based in Prague and now increasing globally, HyroTrader differentiates itself by offering actual change execution via partnerships with platforms like ByBit. This implies merchants expertise real market circumstances fairly than inside simulations, which provides credibility and belief to its funding mannequin.

The agency provides revenue splits starting from 70% to 90%, with leverage as much as 1:100, and helps quick payouts that attraction to energetic merchants worldwide. HyroTrader’s give attention to sustainable, constant buying and selling makes it a beautiful alternative for disciplined members.

Key options of HyroTrader

Revenue break up from 70% to 90% primarily based on efficiencyLeverage as much as 1:100 on supported crypto devicesActual execution by way of direct change connection (e.g., ByBit)Quick payouts, with some merchants reporting same-day withdrawalsWorld attain with places of work in Prague and Dubai

2. FTMO

FTMO is without doubt one of the most revered names within the proprietary buying and selling business, initially established as a foreign exchange prop agency earlier than increasing into crypto. Recognized for its rigorous requirements and international status, FTMO provides merchants the chance to work with leverage as much as 1:100 and earn revenue splits of as much as 90%. The agency’s two-phase analysis course of is strict, requiring members to reveal each profitability and disciplined threat administration earlier than accessing funded accounts. Whereas this greater barrier to entry may be difficult for newer merchants, those that succeed acquire entry to one of the clear and well-regarded funding fashions within the business. With a big and energetic group, FTMO continues to draw severe merchants worldwide, although its analysis charges stay greater than some newer opponents.

Key options of FTMO

Revenue break up of as much as 90%Leverage as much as 1:100 (crypto pairs have limitations)Two-phase analysis course of with strict guidelinesWonderful international status and robust group assistLarger analysis charges in comparison with rivals

3. FundedNext

FundedNext has constructed a powerful presence within the prop buying and selling house by combining a number of funding fashions with an inclusive international attain. Whereas it began as a forex-oriented agency, it has expanded to assist crypto merchants, providing revenue splits of 80% to 90% with leverage as much as 1:100. Merchants can select between a standard two-phase analysis course of or an prompt funding choice, giving flexibility relying on their desire and talent stage. This flexibility makes it enticing to each skilled and aspiring merchants. FundedNext’s most important strengths are its number of applications and accessibility, although it might not scale accounts as shortly as some opponents. General, it gives a balanced choice for merchants seeking to develop inside a well-structured funding atmosphere.

Key options of FundedNext

Revenue break up between 80%–90%Leverage as much as 1:100Alternative of two-phase analysis or prompt fundingWorld accessibility for merchants worldwideSlower scaling in comparison with some rivals

4. BrightFunded

BrightFunded is a more recent entrant to the crypto prop buying and selling sector, positioning itself as a agency targeted on digital asset merchants. With revenue splits starting from 75% to 85% and leverage of as much as 1:100, BrightFunded gives aggressive phrases for these in search of to develop their crypto buying and selling careers. Its analysis course of is easier than some older companies, typically requiring solely a single section problem to qualify for a funded account. This streamlined construction appeals to merchants preferring fewer hurdles to entry capital. Whereas the agency has much less of a long run observe document in comparison with business leaders, it has shortly gained traction because of its crypto particular focus and quicker scaling alternatives.

Key options of BrightFunded

Revenue break up between 75%–85%Leverage as much as 1:100Single-phase analysis mannequinCrypto-focused funding applicationsRestricted historic observe document in comparison with bigger companies

5. Apex Dealer Funding

Apex Dealer Funding has lengthy been acknowledged within the futures buying and selling group, and it has expanded its choices to incorporate crypto associated devices. The agency is thought for its dealer pleasant atmosphere, together with excessive potential revenue splits that may exceed 90%. Apex provides versatile account constructions and fewer restrictive analysis guidelines in comparison with some conventional prop companies, which makes it interesting to merchants who need extra freedom of their methods. With its robust status and huge group, Apex gives credibility alongside alternative. Nonetheless, the number of account sorts may be advanced for newcomers, and its crypto choices are nonetheless evolving.

Key options of Apex Dealer Funding

Revenue break up exceeding 90% in some applicationsVersatile leverage on crypto-linked belongingsAnalysis guidelines are much less strict than these of many rivalsRobust status in futures and prop buying and sellingComplicated account constructions could also be difficult for inexperienced persons

6. E8 Funding

E8 Funding is one other rising title within the prop agency business that has prolonged its providers to crypto merchants. With a revenue break up of as much as 80% and leverage as much as 1:100, it provides phrases that stay aggressive inside the sector. The agency makes use of a two-phase analysis mannequin, designed to make sure merchants can deal with each revenue targets and threat controls. E8 Funding is famous for its transparency, offering clear guidelines and assist for its merchants. Its crypto providing, nonetheless, remains to be extra restricted in comparison with foreign exchange pairs, which can be a disadvantage for these seeking to commerce a variety of digital belongings.

Key options of E8 Funding

Revenue break up of as much as 80%Leverage as much as 1:100Two-phase analysis problemClear guidelines and dealer assistRestricted variety of crypto buying and selling pairs

7. The Buying and selling Pit

The Buying and selling Pit has earned consideration for its give attention to transparency and controlled partnerships, making it an interesting choice for merchants who prioritize credibility. The agency provides revenue splits starting from 70% to 80% and leverage as much as 1:100, with a multi-step analysis course of that assessments a dealer’s means to deal with a number of phases of development. Whereas its crypto providing remains to be comparatively restricted, The Buying and selling Pit’s robust infrastructure and dedication to dealer schooling make it a severe contender within the house. Its most important attraction lies in belief and stability, although crypto-focused merchants could discover its choice narrower than some rivals.

Key options of The Buying and selling Pit

Revenue break up between 70%–80%Leverage as much as 1:100Multi-step analysis course ofClear operations and controlled partnershipsSmaller crypto providing in comparison with others

8. MyFundedFX

MyFundedFX has change into widespread amongst merchants searching for inexpensive entry factors into the prop buying and selling business. With revenue splits of as much as 85% and leverage as much as 1:100, the agency gives aggressive circumstances for each foreign exchange and crypto buying and selling. MyFundedFX provides each one-step and two-step analysis choices, giving flexibility relying on the dealer’s fashion and desire. Its decrease analysis charges and broad accessibility make it particularly interesting for inexperienced persons or these testing the waters in prop buying and selling. Whereas it lacks the historical past of some bigger companies, its affordability and inclusion of crypto choices make it a stable alternative for aspiring merchants worldwide.

Key options of MyFundedFX

Revenue break up of as much as 85%Leverage as much as 1:100Alternative of one-step or two-step analysisInexpensive entry charges for merchantsMuch less established in comparison with business leaders

9. Fondeo

Fondeo is a smaller however rising crypto prop agency that has gained traction as a consequence of its straightforward entry and crypto-focused mannequin. Providing revenue splits between 75% and 90% and leverage as much as 1:100, Fondeo gives circumstances which are aggressive with bigger companies. It makes use of a simplified one step analysis course of, permitting merchants to qualify for funded accounts extra shortly. Whereas its group remains to be comparatively small in comparison with larger names, its give attention to crypto merchants offers it a distinct segment benefit. Fondeo is finest suited for individuals who need direct publicity to digital belongings in a prop buying and selling atmosphere.

Key options of Fondeo

Revenue break up between 75%–90%Leverage as much as 1:100One-step analysis problemCrypto-focused funding mannequinSmaller dealer group in comparison with bigger companies

10. The Funded Dealer

The Funded Dealer has gained reputation for its gamified method to prop buying and selling, interesting to youthful and extra engaged communities. Whereas it’s primarily forex-focused, it has launched crypto buying and selling choices to satisfy rising demand. Merchants can entry revenue splits starting from 80% to 90% with leverage as much as 1:100, alongside analysis challenges that fluctuate relying on account kind. The platform’s strengths embody its energetic group and interesting applications, however crypto merchants could discover its providing narrower in comparison with devoted digital asset companies. Nonetheless, it gives a inventive and respected various for these serious about each foreign exchange and crypto.

Key options of The Funded Dealer

Revenue break up between 80%–90%Leverage as much as 1:100Versatile analysis challengesGamified platform with robust group attractionRestricted depth in crypto choices

What Is a Crypto Prop Agency?

A crypto prop agency gives merchants with entry to capital to commerce cryptocurrencies, derivatives, or futures. As an alternative of risking their very own funds, merchants function with the agency’s cash. Income are shared between the dealer and the agency, whereas losses are absorbed by the agency (inside set guidelines).

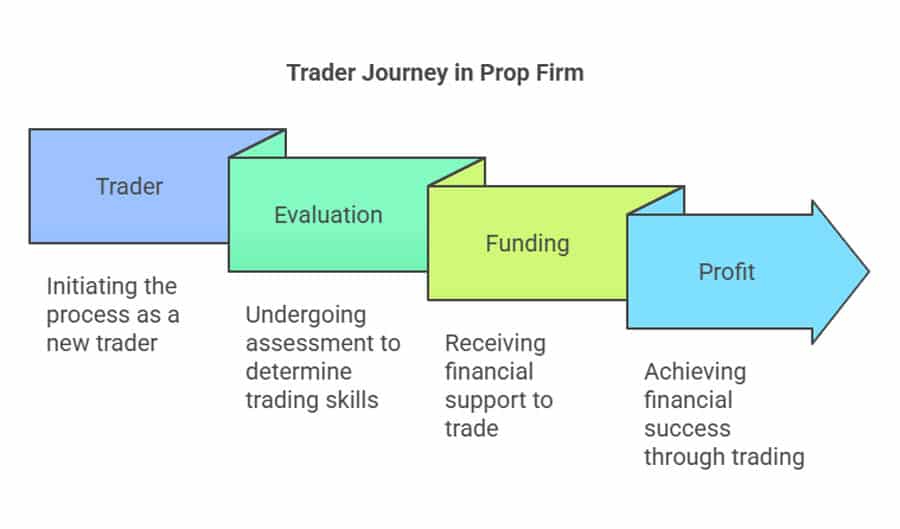

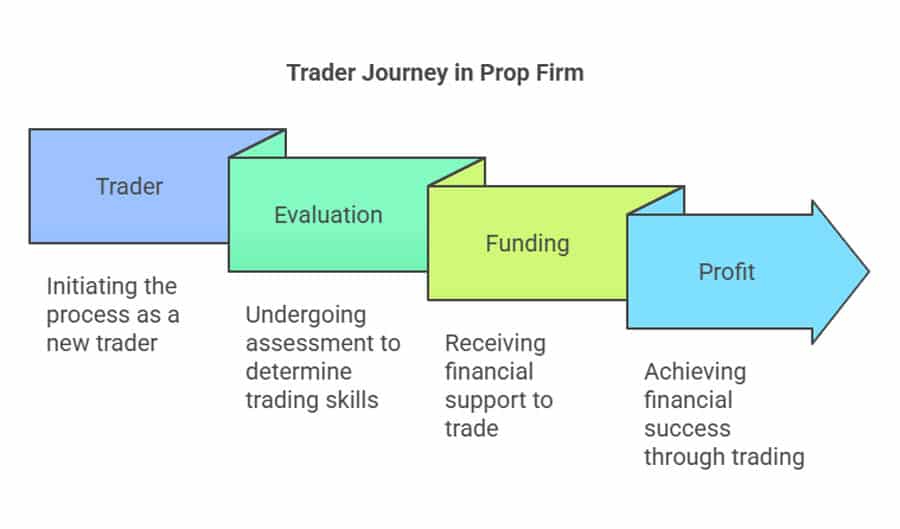

How do Crypto Prop Corporations Work?

Crypto prop companies comply with a structured course of designed to guage merchants and supply them with entry to funded accounts. Whereas every agency has its personal particular guidelines and fashions, the core journey is mostly comparable throughout the business. Merchants begin with an analysis stage to reveal their talent, then progress to funded accounts the place they share income with the agency. Over time, constant performers could even qualify for bigger capital allocations. Beneath is an in depth take a look at every stage within the course of.

Analysis section:

Step one is proving your self via an analysis problem. Most companies require merchants to hit particular revenue targets with out exceeding most drawdown limits. This stage is designed to check threat administration, consistency, and technique self-discipline. Challenges may be one step or two steps, relying on the agency. Whereas the method could really feel restrictive, it ensures solely expert merchants advance. Passing the analysis demonstrates you can handle threat successfully, which builds confidence for each you and the agency offering the capital.

Funded account:

As soon as the analysis is handed, merchants acquire entry to a funded account both a reside buying and selling account with actual capital or a simulated atmosphere tied on to market circumstances. The funded stage is the place the chance turns into actual. Merchants can now function with bigger positions and pursue significant income with out exposing private financial savings to vital threat. This association permits merchants to give attention to efficiency whereas the agency gives the monetary backing. Nonetheless, merchants should proceed following the agency’s guidelines to keep up their funded standing.

Revenue sharing:

All crypto prop companies function on a profit-sharing mannequin, the place each the dealer and the agency profit from profitable trades. Sometimes, merchants retain between 70% and 90% of the income, whereas the agency takes the rest to maintain operations and canopy threat. The precise break up typically depends upon the agency’s insurance policies and the dealer’s efficiency over time. A good profit-sharing construction aligns the incentives of each events: the dealer is rewarded for talent and self-discipline, whereas the agency income solely when the dealer succeeds. This shared curiosity mannequin is the muse of the prop buying and selling relationship.

Scaling alternatives:

Many prop companies additionally present scaling alternatives for constant and worthwhile merchants. This implies account sizes can enhance steadily as a dealer proves their reliability, permitting them to handle bigger capital allocations and earn greater payouts. For instance, a dealer who persistently meets revenue targets with out violating threat guidelines would possibly see their funded account develop from $50,000 to $200,000 or extra over time. Scaling applications create a profession pathway for merchants, turning brief time period alternatives into long run skilled development. In addition they reinforce self-discipline, since solely constant efficiency unlocks greater capital entry.

Execs and Cons of Crypto Prop Corporations

Like every buying and selling mannequin, crypto prop companies include clear benefits and potential drawbacks. For a lot of merchants, these companies supply a singular pathway to entry capital and take part in high-volume buying and selling with out risking private financial savings. Nonetheless, in addition they impose guidelines and challenges that won’t go well with everybody. Understanding either side of the equation is crucial earlier than committing to a agency, as this helps set real looking expectations and reduces the danger of disappointment. Beneath, we break down the primary advantages and limitations of becoming a member of a crypto prop agency.

Execs of Crypto Prop Corporations

Entry to capital:

The most important benefit of prop companies is entry to buying and selling capital. As an alternative of risking your personal financial savings, you may commerce with the agency’s funds when you go the analysis. This considerably lowers the barrier to entry for aspiring merchants, enabling them to function with bigger account sizes than they may fund independently. For expert merchants, this implies a chance to show small methods into significant income with out private monetary publicity.

Revenue-sharing mannequin:

Prop companies reward profitable merchants with beneficiant revenue splits, sometimes between 70% and 90%. This construction permits merchants to maintain the vast majority of their earnings whereas the agency retains a smaller portion to maintain operations. In contrast to conventional brokers, the agency’s success is tied on to the dealer’s success, which creates a powerful alignment of incentives. For disciplined merchants, this mannequin may be extra profitable than self-funded buying and selling, particularly when mixed with scaling alternatives.

Danger administration construction:

Analysis guidelines could really feel restrictive, however they implement important buying and selling self-discipline. By requiring merchants to respect drawdown limits and keep away from reckless methods, prop companies assist foster sustainable buying and selling practices. This advantages each events the agency limits its threat, whereas merchants study to handle capital with professional-level self-discipline. For newer merchants, these structured guidelines can act as a coaching floor to construct stronger habits.

World alternatives:

Many crypto prop companies function on a worldwide scale, giving merchants from practically any nation the prospect to take part. This accessibility permits people worldwide to compete on equal phrases, no matter their monetary background. Some companies even supply multilingual assist and region-specific sources, making it simpler for worldwide merchants to reach the funded atmosphere.

Cons of Crypto Prop Corporations

Analysis challenges:

Passing the analysis section may be troublesome, notably for newer merchants. Strict guidelines on drawdown, revenue targets, and buying and selling fashion typically result in disqualification, even for merchants with stable expertise. Whereas these challenges guarantee self-discipline, they will additionally discourage those that wrestle beneath stress. In some instances, repeated makes an attempt imply paying a number of analysis charges, which might add up over time.

Ongoing restrictions:

Even after securing a funded account, merchants should comply with the agency’s buying and selling guidelines intently. Restrictions could embody limits on most place sizes, banned methods (akin to hedging or Martingale), and obligatory cease loss utilization. For merchants preferring full flexibility, these limitations can really feel constraining. Breaking a rule, even unintentionally, typically ends in quick disqualification from the funded program.

Revenue sharing with the agency:

Though merchants hold a majority of income, they need to nonetheless share a portion with the agency. For some, this seems like giving up hard-earned good points that might have been stored in the event that they traded independently. Whereas the trade-off is entry to extra capital, merchants ought to weigh whether or not the diminished share is value it in the long term, particularly as they acquire expertise and contemplate self-funding.

Agency reliability dangers:

Not all prop companies are equally dependable. For the reason that crypto prop business is comparatively new, some companies lack long-term credibility or monetary stability. Merchants threat becoming a member of companies that shut down unexpectedly or delay payouts. Status, transparency, and verified proof of payouts ought to all the time be a part of the analysis course of when choosing a agency. With out cautious due diligence, merchants may discover themselves tied to a agency that fails to ship on its guarantees.

The best way to Select the Finest Crypto Prop Agency

Choosing the appropriate crypto prop agency could make a major distinction in your buying and selling journey. Whereas many companies promote excessive payouts and fast entry to capital, it’s essential to guage them rigorously to keep away from hidden pitfalls. The most effective companies supply clear guidelines, sustainable profit-sharing constructions, and quick, dependable payouts. Merchants must also contemplate their private buying and selling fashion, whether or not they want excessive leverage, wider asset selection, or extra lenient analysis guidelines. Moreover, agency status is essential: group suggestions, impartial critiques, and transparency about payouts all present precious alerts. By weighing these components, merchants can establish companies that not solely supply alternatives but additionally align with their objectives and threat tolerance.

Revenue break up:

One of the vital essential concerns when evaluating a prop agency is the revenue break up construction. This determines how a lot of your buying and selling income you really hold. Whereas most crypto prop companies supply merchants between 70% and 90%, the precise share typically depends upon efficiency, consistency, and account kind. The next revenue break up means extra retained earnings for the dealer, nevertheless it’s equally essential to verify that the agency really honors these payouts persistently. Some companies promote excessive splits however have hidden circumstances, so all the time verify the high-quality print and confirm via dealer critiques.

Leverage:

Leverage straight impacts how a lot shopping for energy a dealer has and, due to this fact, how massive their positions may be relative to account measurement. Many crypto prop companies present leverage starting from 1:10 as much as 1:100. Larger leverage can amplify income but additionally magnifies threat, making robust threat administration important. In case you’re a dealer who prefers scalping or day buying and selling methods , greater leverage could also be enticing. Nonetheless, conservative merchants could worth stability over aggressive publicity. All the time make sure the leverage provided aligns together with your technique and threat tolerance.

Analysis guidelines:

Earlier than getting access to funded accounts, most companies require merchants to go an analysis course of. These guidelines fluctuate by agency however sometimes contain hitting revenue targets with out exceeding each day or total drawdown limits. Stricter analysis guidelines are designed to encourage disciplined buying and selling and filter out high-risk habits, however they will additionally make it tougher for brand new merchants to qualify. Some companies supply single-phase evaluations, whereas others use two-step challenges and even prompt funding choices. Understanding these guidelines helps set real looking expectations and prevents unintentional violations that might disqualify you.

Payout velocity:

Quick and dependable withdrawals are essential when selecting a prop agency. Whereas many companies promise fast payouts, precise dealer experiences can differ considerably. Some platforms course of requests inside 24 hours, whereas others could take a number of days or longer. Delayed payouts may be irritating and undermine belief within the agency, particularly in crypto, the place volatility strikes shortly. All the time verify impartial critiques to verify whether or not a agency’s payout timeline matches its guarantees, and prioritize companies that persistently ship immediate withdrawals.

Status:

A prop agency’s status ought to carry vital weight in your decision-making. Within the comparatively new and fast-growing crypto prop buying and selling sector, transparency isn’t all the time assured. Search for companies with optimistic group suggestions, verifiable proof of payouts, and partnerships that add legitimacy. Unbiased critiques, social media discussions, and dealer boards are glorious sources of unfiltered opinions. A well-regarded status not solely alerts reliability but additionally reduces the danger of encountering sudden closures or disputes over payouts.

World accessibility:

Lastly, merchants ought to be certain that the agency they’re contemplating really accepts members from their nation or area. Some prop companies function globally, whereas others have restrictions primarily based on rules or operational limitations. For instance, U.S. merchants could face limitations with sure companies as a consequence of compliance necessities. World accessibility can also be about buyer assist. Search for companies that provide multilingual sources and responsive service for worldwide merchants. The broader the attain, the higher the possibilities that the agency can accommodate your wants no matter the place you commerce from.