$BGEO.L is a retail and business financial institution from Georgia. The group comprehends two completely different entities, primarily: Georgian Monetary Companies (GFS), via Financial institution of Georgia (AFS); and Armenian Monetary Companies, via Ameriabank.

Key Highlights:

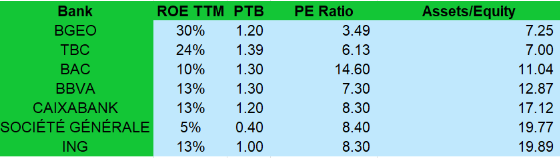

The group has a Return on Fairness of over 30%, means above most friends.

The inventory is at the moment priced at under 4 occasions earnings, making it a hidden gem

AFS was just lately acquired at a ridiculous worth

The enterprise:

The enterprise of the corporate is principally centered in Georgia and Armenia. The Financial institution of Georgia at the moment has a market share by whole loans of over 37%, working in a duopolistic state of affairs with TBC. This a part of the enterprise has a ROE of over 36%, whereas rising its mortgage e-book by over 23% per yr.

Ameriabank was just lately included into the group. It has a ROE of over 20% and it’s at the moment rising its mortgage e-book by 6% on a relentless foreign money. The administration of the corporate sees an enormous alternative in Armenia, in order that they’ll deal with progress within the area. The present market share of Ameriabank is nineteen.6%.

Supply: Firm’s Q3 2024 earnings launch

Ameriabank’s acquisition was made on the finish of 2024 for 0.65 occasions e-book worth (Worth-to-book, or PTB ratio), or 2.6 occasions earnings. That implies that in three years of earnings, the corporate will get again the worth it paid, which is an insane worth for a number one financial institution.

Valuation:

The corporate is at the moment buying and selling at a PE ratio of three.49 occasions. That’s about half of its principal competitor within the area, TBC, regardless of having grown revenues over 35% in the course of the previous 3 years, in contrast with 20.9% progress for TBC. Additionally, the ROE of the corporate is among the many highest of any peer, together with massive well-known banks.

Supply: Finchat

This ROE doesn’t come as a consequence of extra leverage. Quite the opposite, the corporate is amongst the bottom leveraged banks on this planet, with an assets-to-equity ratio of seven occasions. Mainly, BGEO obtains greater than twice the profitability of ING with nearly one-third of the leverage.

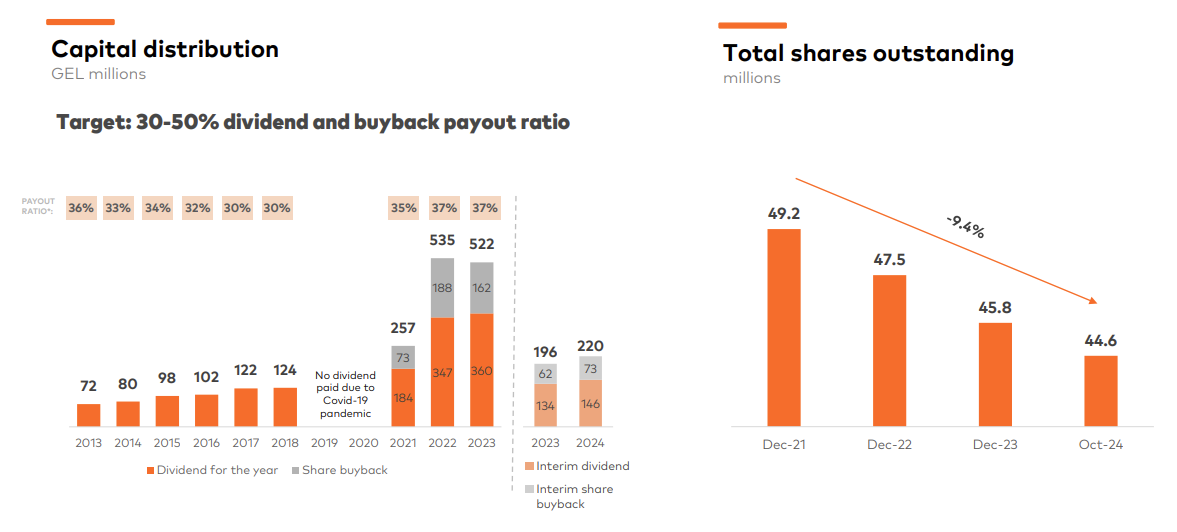

Concerning its dividend coverage, the corporate is dedicated to paying out 30% to 50% of the web earnings in dividends and buybacks. At the moment, the corporate is paying a dividend of 4%. However that’s not all: it has additionally managed to scale back the quantity of shares excellent by 9.4% in 3 years.

Supply: Firm’s Q3 2024 earnings launch

In my view, the corporate ought to commerce at a PE a number of of 6 occasions, according to its peer TBC. This is able to imply a direct upside of 73%. However extra apparently, the corporate expects to extend its annual mortgage e-book progress by 15%. If we translate this to EPS progress, which is under the historic common, we might have a two-year upside of 129%, or an Annual Price of Return of over 50%, disregarding the impact of dividends and buybacks.

Dangers:

Geopolitical state of affairs: Georgia has had up to now points with Russia, they usually nonetheless have a dispute for 2 areas. This may very well be probably harmful for the corporate.

Political instability: Georgia has just lately gone via elections, and there have been many protests about them. It could lead on probably to a worse surroundings to do enterprise and will have an effect on instantly the financial system.

Foreign money danger: The corporate does enterprise primarily in GEL (Georgian Lari), AMD (Armenian Dram), and USD (US Greenback). Nevertheless, the corporate trades within the UK. If the native currencies depreciate, that might have an effect on earnings in GBP. Additionally, some loans are in USD, which may have an effect on delinquency charges if the USD turns into stronger.

Mitigating foreign money danger:

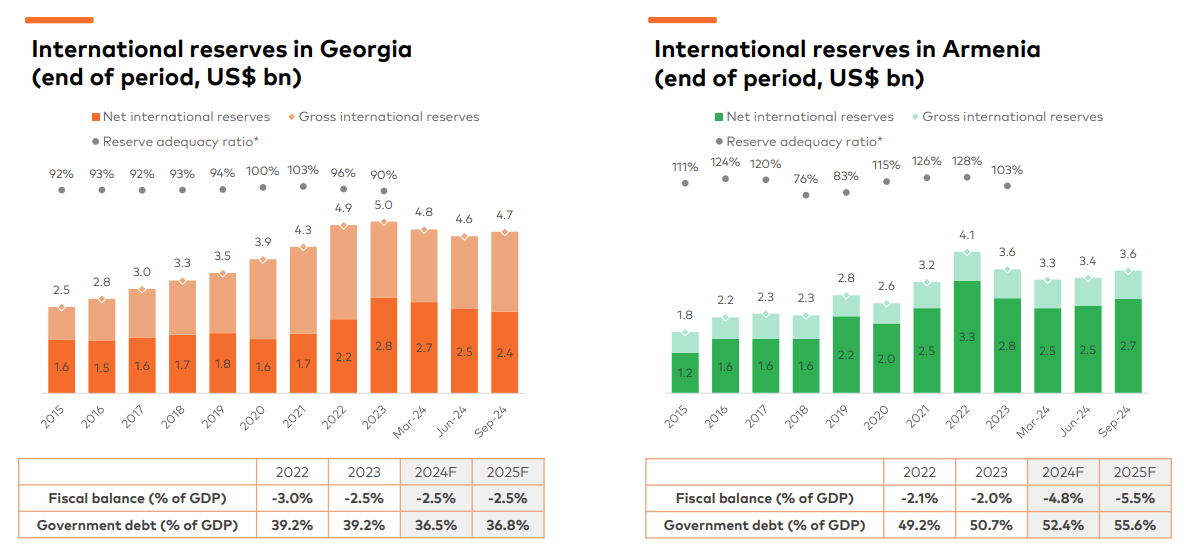

Each currencies, AMD and GEL have been good performers throughout 2024 in comparison with the USD. At the moment, each international locations have inflation of close to 0.5%, whereas having rates of interest of 8% and 6.75% for Georgia and Armenia, respectively. Additionally, worldwide reserves in each international locations stay excessive, supporting robust currencies.

Supply: Firm’s Q3 2024 earnings launch

Additionally, though Georgia could sound like an unique nation, it really ranks the 53rd least corrupt nation, out of 180, for Buying and selling Economics. As a reference, Italy is the 52nd of the rank, Spain at the moment obtains the forty sixth place, the US is the twenty eighth, and Mexico is the one hundred and fortieth.

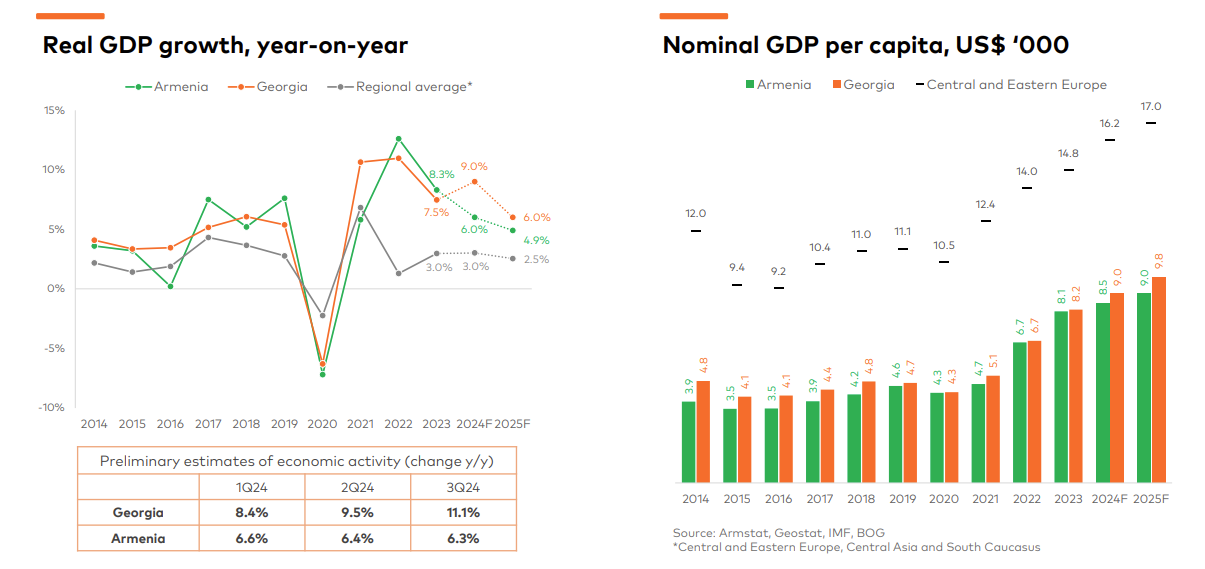

The GDP of each international locations, Georgia and Armenia, has been rising quickly, though it’s nonetheless considerably decrease on a per capita foundation than Central and Japanese European international locations, which exhibits that each economies nonetheless have loads of room to develop.

Supply: Firm’s Q3 2024 earnings launch

Conclusion:

Though the geopolitical danger is perhaps scary, $BGEO.L is a stable enterprise, with spectacular returns on fairness, progress, profitability, and capital administration. Even when we have to watch for the earnings releases for the market to comprehend the expansion potential that the corporate affords, we’re nonetheless sitting at, at the least, a 7.5% shareholder yield (dividends plus buybacks). If the corporate paid out 50% of the web earnings, the shareholder yield can be about 12.5% as of as we speak’s earnings.

With the above being the bear case, the corporate has additionally traded up to now at over 9 occasions earnings. For the bull case, contemplating 9 occasions earnings for a greater than the common enterprise is affordable, even when it’s positioned in an rising market. This is able to give us an prompt upside of 160% from the present worth.

All in all, shopping for such an excellent enterprise for lower than 4 occasions earnings seems to be like a no brainer to me. All of the cheap eventualities supply nice upside, and that’s why I’m shopping for $BGEO.L for my portfolio.

Catalysts:

Enchancment of the political rigidity in Georgia

Earnings releases that show the corporate’s worthwhile progress, each in Georgia and Armenia

Would you make investments on this financial institution? Or do you suppose that the chance outweigh the potential advantages?

I personal a place in $BGEO.L on the time of writing.

This communication is for data and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a suggestion of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out taking into consideration any explicit recipient’s funding goals or monetary state of affairs, and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product are usually not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.