Introduction

Video games Workshop ($GAW.L) is a British firm that has returned 16.1% per 12 months because it began buying and selling on the inventory market in 1994, for a complete return of over 3.000%. This can be a nice compounder that the market has neglected as a result of folks miss the power of a loyal fan base.

Supply: Finchat

Key highlights

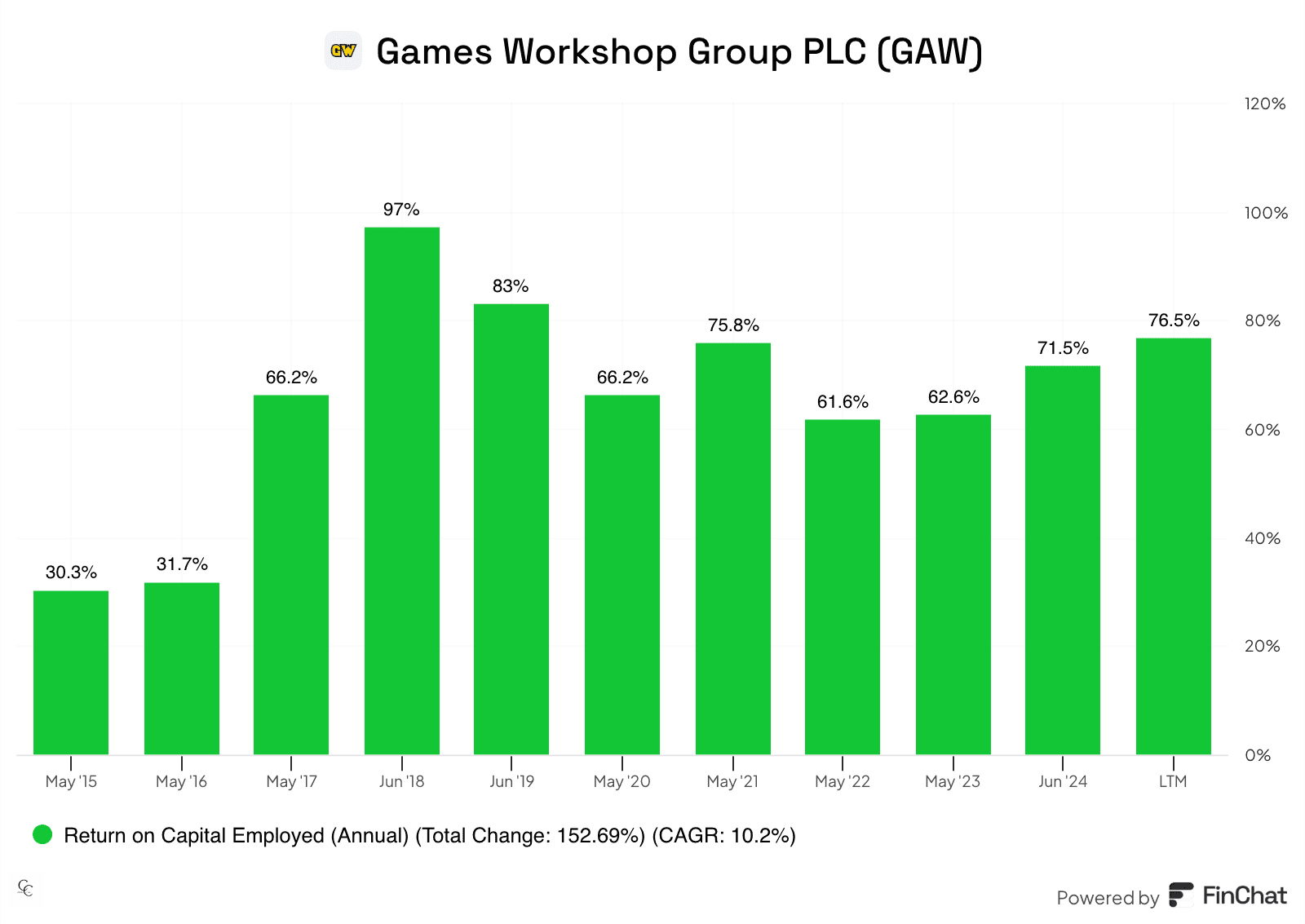

Video games Workshop is without doubt one of the firms with the best Return on Invested Capital within the inventory market.

The corporate distributes to shareholders all its extra capital

Income with out price? Sure, Video games Workshop has a hidden gem.

Enterprise Mannequin Overview

Video games Workshop has a really boring enterprise that received’t make it to the information. Its enterprise consists of promoting boxed video games, portray and modeling figures, and books, amongst many different bodily merchandise designed and manufactured throughout the firm. These merchandise can solely be developed by Video games Workshop as a result of they personal the rights to the Model they promote (Warhammer). To promote these merchandise, the corporate has its personal shops, typically managed by one particular person. Additionally they collaborate with third-party shops to which they supply their merchandise. Each gross sales channels have grown during the last years.

The corporate has an impressive monitor file of being worthwhile, rising, and distributing to shareholders the surplus capital that it generates. Previously 5 years, the corporate has grown by over 15% per 12 months and delivers at present a dividend yield of over 4%.

Detailed Funding Thesis

Regardless of rising constantly and delivering one of many highest ROICs within the capital markets, Video games Workshop retains being an ignored firm. One of many “secrets and techniques” of the corporate’s success is its Mental Property. They personal all of the rights to the Warhammer franchise. This fashion, they’re the one firm allowed to promote miniatures of the franchise, which could be very worthwhile because it’s a really intensive Interest.

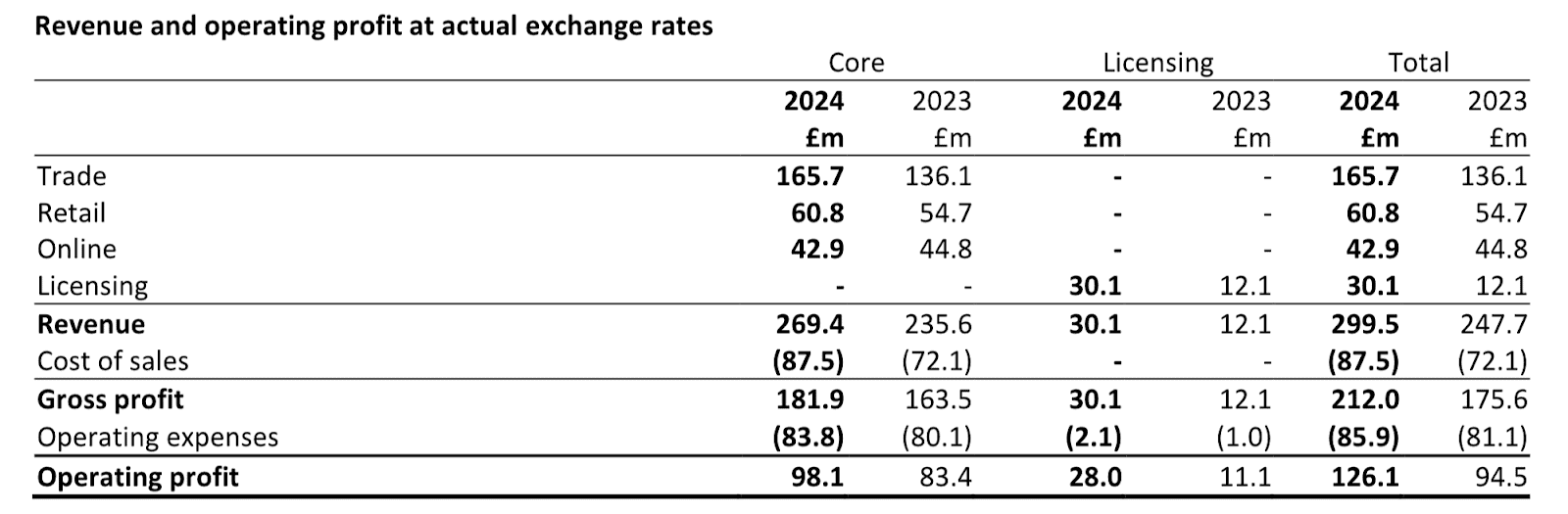

However past this, the corporate additionally licenses third events to, primarily, develop video games utilizing the model’s title. These offers are normally executed in two totally different levels. Within the first stage, the corporate collects and acknowledges income for a hard and fast a part of the event of the sport. The second half, which gives upside, is acknowledged yearly relying on the gross sales of the sport. Principally, the contracts have a hard and fast half, which doesn’t have price in any respect for the corporate, and a variable half relying on the success of the sport that comes, once more, and not using a price related.

With this construction, the gross margin of the corporate’s bodily merchandise within the first half of their 2025 fiscal 12 months is over 67%, and the gross margin of the licenses is 100%. How can an organization be unsuccessful with these margins?

Supply: Video games Workshop H1 2025 earnings launch

For a great motive, the corporate’s Return On Invested Capital is kind of excessive constantly:

Supply: Finchat

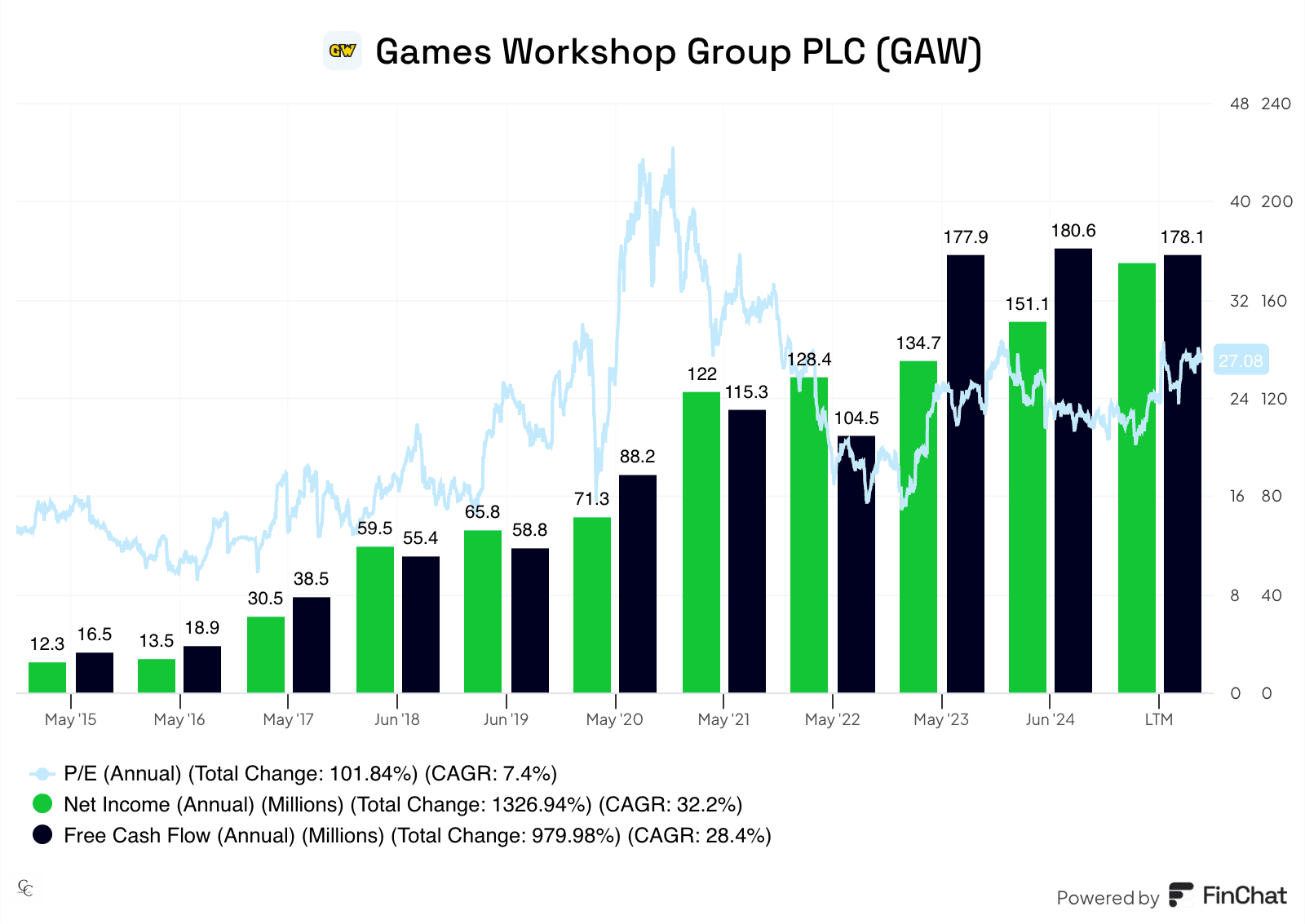

I wouldn’t say that the a number of that the market is at present paying for the corporate is low. And it isn’t, traditionally talking. Nonetheless, the corporate has no debt, and the overall money of the corporate is greater than its liabilities, displaying an infinite power in its steadiness sheet. We must always solely be apprehensive, then, about how a lot this firm is ready to generate sooner or later, at excellent profitability charges.

Supply: Finchat

In my view, the corporate has the flexibility, IP, pricing energy, and sufficient demand for his or her merchandise to maintain rising income double-digit within the mid-teens for a few years. Thus, even with no a number of enlargement, the corporate can comfortably ship 15% per 12 months within the coming 5 to 10 years, which is an above common return.

After all, if the worth fell, to about 15 instances earnings, the potential can be larger. However I’m comfortably holding this excellent enterprise at 27 instances earnings. Additionally, if the corporate retains delivering, which it has executed for a few years, progress and revenue progress can surpass my expectations. In that sense, the corporate’s administration has said of their newest buying and selling replace that this 12 months’s outcomes are forward of the board expectations. In that case, we may additionally see a number of enlargement from this level, including to the potential return of the inventory.

Catalyst

Larger progress in Licencse income, which provides on to the underside line.

Market’s recognition of the upper high quality of the enterprise

Finally, time to let this excellent enterprise compound our cash over time.

Conclusion

Video games Workshop is without doubt one of the finest firms on the earth, from a return on funding capital perspective. Firms of comparable high quality are sometimes traded within the inventory market at above 40 instances earnings, so the market just isn’t totally recognizing the distinctive high quality of this enterprise. Paying what’s now a mean value we’re shopping for a manner above common enterprise, with potential to develop.

We’re additionally protected on the draw back, because the firm has one of many strongest steadiness sheets I’ve ever analyzed. Moreover this, the administration pays out the surplus money that the corporate generates, so we’re sitting at a 4% dividend yield for an organization rising double-digit for years, and for a few years to return.

Danger Components

Video games Workshop just isn’t a retailer, however in the long run, the promote merchandise to retail prospects. Therefore, a change in client’s preferences might harm the corporate. Additionally, a slowdown of the enterprise may trigger a number of contraction. So in case these two issues occur on the similar time, we may expertise a sudden drop within the firm’s value.

I maintain a place in GAW.L on the time of writing.

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of or solicitation to purchase or promote any monetary devices. This materials has been ready with out considering any specific recipient’s funding aims or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index, or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.