Cryptocurrency buying and selling can really feel overwhelming while you’re simply beginning out. Nevertheless it doesn’t need to be. With the correct instruments, a stable plan, and a transparent understanding of how crypto markets behave, you can begin buying and selling digital belongings confidently, at the same time as a newbie. This information exhibits you how one can commerce crypto from scratch, overlaying all the pieces from choosing your first coin to avoiding pricey errors. Whether or not you’re interested in day buying and selling or simply wish to learn to purchase and promote safely, that is the place you begin.

What Is Crypto Buying and selling?

Crypto buying and selling means shopping for and promoting cryptocurrencies to make a revenue. You attempt to predict value actions by analyzing market traits—similar to in inventory or foreign currency trading. The aim is easy: purchase low, promote excessive.

In contrast to conventional markets, crypto trades 24/7. Costs transfer quick, pushed by information, provide and demand, investor sentiment, and broader financial occasions. Merchants use instruments like charts and indicators to identify patterns and time their strikes.

Some commerce day by day, others maintain long-term. Both method, you’re all the time reacting to how the market behaves.

Why Commerce Cryptocurrency?

Buying and selling cryptocurrencies provides alternatives that conventional markets typically don’t. Right here’s why many select to commerce digital belongings:

24/7 market entry. In contrast to inventory markets, cryptocurrency exchanges by no means shut. You possibly can commerce anytime, together with weekends and holidays.

Volatility creates alternative. Crypto costs transfer rapidly. This provides merchants extra possibilities to revenue from short-term adjustments.

Low entry obstacles. You don’t want a big sum to start out. You possibly can commerce with as little as $10.

Numerous digital belongings. Hundreds of cryptocurrencies provide distinctive options and roles, giving merchants a wider vary of choices.

International market. Crypto buying and selling is borderless. You’re not restricted by country-specific exchanges or enterprise hours.

Turn out to be the neatest crypto fanatic within the room

Get the highest 50 crypto definitions it is advisable know within the trade without cost

Crypto Buying and selling vs. Inventory Buying and selling

Crypto buying and selling and inventory buying and selling each contain speculating on value actions, however how they work underneath the hood may be very completely different.

Cryptocurrency markets are decentralized, borderless, and run on blockchain networks. Trades settle in minutes and belongings will be self-custodied. In distinction, inventory markets are centralized, function via brokers, and depend on third-party custodians. Meaning crypto provides you extra management, but in addition extra duty for issues like safety and threat administration.

With shares, you’re buying and selling fairness—possession in a real-world firm, backed by financials, management groups, and regulatory filings. In crypto, belongings vary from utility tokens, to governance rights, to pure hypothesis. The worth behind every token varies extensively, and also you typically need to do extra due diligence your self.

Regulation is one other key distinction. Shares are closely regulated by nationwide authorities (just like the SEC within the U.S.). Crypto regulation remains to be growing, varies by nation, and in some instances, is nonexistent. This makes the crypto market extra versatile—but in addition riskier and fewer predictable for brand new merchants.

Methods to Begin Buying and selling Crypto

To start out buying and selling you want the correct instruments and a plan. Right here’s a step-by-step information that covers all the pieces you want, from making a crypto account to creating your first commerce.

Select a Crypto Trade

Begin by selecting a cryptocurrency alternate. That is the platform the place you’ll purchase, promote, and commerce digital belongings. Search for one that gives low charges, robust safety, and a user-friendly interface. It ought to assist your native foreign money and most popular fee strategies. Respected exchanges like Coinbase, Binance, and Kraken are good beginning factors when you’re uncertain.

Setting Up Your Account

When you’ve picked an alternate, create an account utilizing your e mail and a safe password. Most platforms will ask for identification verification via a KYC course of. This normally includes importing an official ID and a photograph to verify your identification. Some exchanges full this in minutes, whereas others might take longer. After verification, you’ll have full entry to buying and selling options.

Fund Your Account

To start out buying and selling, deposit cash into your account. Most exchanges assist funds by way of financial institution switch, card, or third-party providers. Some additionally allow you to deposit cryptocurrencies when you already personal some. Select the funding technique with the bottom charges and the quickest processing time. As soon as your steadiness is obtainable, you’re able to make your first commerce.

Select a Pockets

Storing your crypto safely is simply as necessary as buying and selling it. You should utilize the alternate’s built-in pockets, but it surely’s safer to retailer your belongings in a pockets you management. You may have a number of choices right here. Sizzling wallets are related to the web and are extra handy for energetic merchants. In the meantime, chilly wallets are offline and supply stronger safety for long-term holdings. Learners typically begin with sizzling wallets and later swap to chilly storage for higher safety.

Learn extra: High Cryptocurrency Wallets

Purchase, Promote, and Swap Crypto

To make your first commerce, choose a crypto buying and selling pair like BTC/USD or ETH/USDT. You possibly can place a market order in order for you the commerce to occur instantly on the present value. Should you’re ready for a particular value, use a restrict order (hyperlink).

Swapping helps you to alternate one cryptocurrency for an additional with out utilizing fiat foreign money, which is helpful for portfolio changes.

Monitor Your Account and Commerce Historical past

After you make a commerce, you’ll wish to monitor your account exercise. Most exchanges offer you entry to your commerce historical past, open orders, and steadiness adjustments. Use this knowledge to trace your earnings, losses, and buying and selling charges. Reviewing your historical past repeatedly helps you enhance your technique and spot traits in your efficiency.

Withdraw Your Cryptocurrency right into a Pockets

When you’ve accomplished a commerce, you’ll be able to depart your crypto on the alternate or transfer it to a private pockets. To withdraw, go to the withdrawal part, enter your pockets tackle, verify the main points, and full the transaction. Transferring your crypto off the alternate lowers the danger of shedding entry if the platform faces technical points, freezes, or there’s a safety breach.

Sorts of Cryptocurrency Buying and selling

There are two foremost methods to strategy the crypto market: long-term and short-term buying and selling. Don’t mistake these for lengthy and brief positions––it is a completely different idea.

Your technique relies on how typically you wish to commerce, how a lot time you’ll be able to commit, and what sort of threat you’re snug with. Consider it like utilizing a checking account: are you saving for years, or transferring cash round day by day?

Lengthy-Time period Buying and selling

Lengthy-term buying and selling means shopping for crypto belongings and holding them for months or years. The aim is to attend for the worth to extend considerably over time. Many freshmen select this technique as a result of it doesn’t require fixed monitoring of the crypto platform. It’s much like investing in shares or actual property. You consider within the venture behind the coin, comparable to Ethereum or Bitcoin, and also you count on it to develop in worth as adoption will increase.

Should you select this technique, you may commerce Bitcoin as soon as, then maintain onto it whereas ignoring short-term value swings. That method, you’re much less uncovered to the day-to-day noise of the market, however you need to be affected person and keen to see your funding dip within the brief time period. Safety turns into extra necessary right here—you’ll wish to retailer your belongings in a non-public pockets reasonably than depart them on the alternate.

Learn Extra: Finest Lengthy-Time period Cryptocurrencies for 2025

Quick-Time period Buying and selling

Quick-term buying and selling focuses on benefiting from small value adjustments over hours or days. You make trades often and depend on quick decision-making. This strategy fits people who find themselves snug spending extra time on a crypto platform, watching charts, and performing on short-term alerts.

A brief-term dealer may purchase a crypto asset within the morning and promote it that night if the value goes up. In contrast to a long-term holder, you’re not involved with the coin’s future potential—simply whether or not you’ll be able to earn a revenue from the present value motion. It’s extra like flipping foreign money than saving in a checking account.

This technique can generate faster features however comes with greater threat. Crypto costs transfer quick, and when you’re not paying consideration, losses can occur simply as rapidly as earnings. Learners can nonetheless do this strategy, but it surely’s important to start out small and deal with it like a talent to develop over time.

Selecting Your First Cryptocurrency for Buying and selling

Selecting your first crypto to commerce is likely one of the largest hurdles freshmen have to beat. Selection paralysis is already tough while you’re simply on the lookout for your subsequent Netflix present, and now there’s cash concerned!

It’s simple to chase headlines or leap on a coin that’s all of the sudden trending. However hype will not be a method. What you want is a coin that behaves predictably in most circumstances, with stable infrastructure and sufficient buying and selling exercise to allow you to purchase or promote with out points. The perfect beginner-friendly cash are well-supported throughout main buying and selling platforms, backed by energetic growth groups, and examined by real-world use.

In style Newbie-Pleasant Cash

These cryptocurrencies are extensively accessible, supported by most platforms, and actively utilized by day merchants and traders alike.

Bitcoin (BTC). Essentially the most traded and well-known cryptocurrency. It has excessive liquidity and is commonly used as a reference for market traits.

Ethereum (ETH). Identified for sensible contracts and an enormous developer base. Gives long-term potential and regular quantity.

Litecoin (LTC). A lighter, quicker model of Bitcoin. Typically used for smaller transactions with decrease transaction charges.

USD Coin (USDC). A stablecoin that doesn’t fluctuate a lot. Good for studying how trades work with out heavy threat.

Solana (SOL). In style amongst newer merchants because of its quick transactions and rising ecosystem.

What Makes a Good First Funding?

Your first crypto commerce ought to be easy to execute and straightforward to handle. That begins with liquidity. A coin that trades on two or three main platforms with constant day by day quantity provides you the flexibleness to enter and exit with out delays or value slippage. Should you’re counting on a tiny alternate or struggling to fill an order, you’re already including threat you don’t want.

Equally necessary is readability. Should you can’t clarify what the coin truly does in a single sentence, you shouldn’t be buying and selling it. That doesn’t imply memorizing the technical whitepaper, however you need to perceive the fundamentals: what the venture is for, who’s behind it, and the way it works. If the final replace was over a yr in the past, take that as a warning. Energetic initiatives depart a visual path.

Buying and selling quantity can verify whether or not value strikes are actual. Excessive quantity means stronger traits and fewer false alerts. That provides you a extra steady setting to follow getting into and exiting trades with confidence. Market cap can be value contemplating. Smaller-cap tokens typically transfer quicker, however not all the time for the correct causes. A single rumor can push the value up or down 20% in an hour. As a newbie, that form of volatility will be deadly on your funds.

Bear in mind: the aim together with your first funding isn’t to seek out the subsequent breakout. It’s to construct consolation with the buying and selling course of.

How To Commerce Crypto 101: The Fundamentals You Want To Know

Earlier than you place a commerce, it is advisable perceive how the market works. Crypto doesn’t transfer randomly—there are patterns, instruments, and knowledge that may provide help to make higher selections.

What Drives Crypto Costs?

Crypto costs change primarily based on provide and demand, however the forces behind that demand are distinctive. Information, laws, and macro occasions (like inflation or rate of interest adjustments) typically set off massive strikes. So does sentiment—concern and hype unfold quick in crypto.

On-chain exercise additionally issues. If extra individuals are utilizing a community (sending tokens, staking, or minting NFTs), that normally will increase the value. Restricted provide, token burns, or halving occasions (like Bitcoin’s) can cut back accessible cash and push costs greater.

Lastly, massive merchants (whales) can transfer markets with a single transaction. In a low-liquidity market, which occurs very often for cryptocurrencies, that issues greater than you assume.

Fundamental Chart Studying

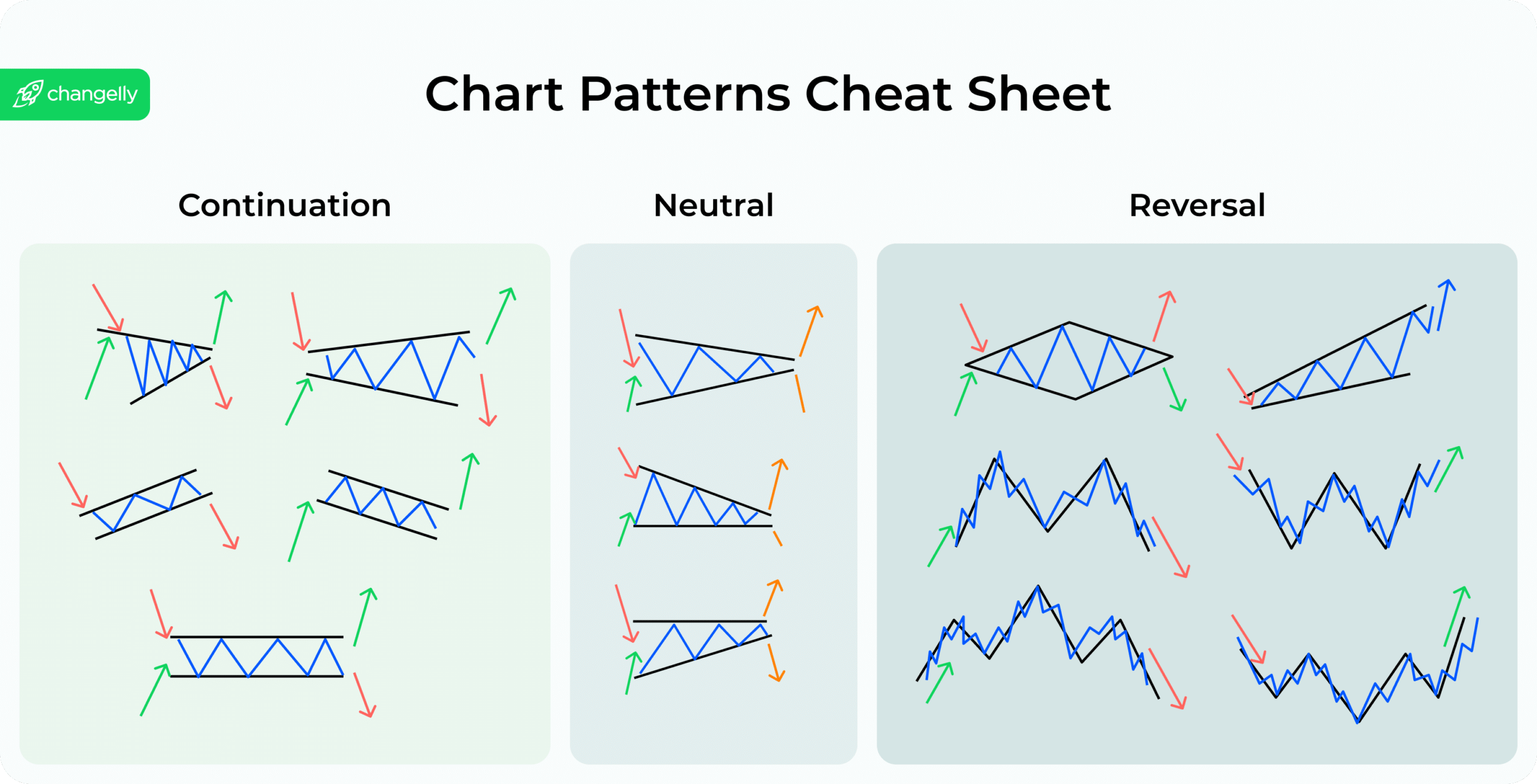

Charts provide help to see what the value has performed, and what it’d do subsequent. You’ll largely use candlestick charts, which present how costs transfer over time. Inexperienced candles imply the value went up throughout that timeframe; crimson means it went down.

You’ll additionally see assist and resistance ranges—these are zones the place the value tends to stall or reverse. Studying to identify them provides you an edge when deciding the place to enter or exit.

Technical Evaluation

Technical evaluation means utilizing chart patterns, quantity, and indicators to seek out buying and selling alternatives. It doesn’t predict the long run, but it surely helps you make extra knowledgeable selections primarily based on previous value habits. In style instruments embrace RSI, transferring averages, MACD, and Fibonacci retracements. These can assist you time trades and handle threat extra successfully.

Order Sorts

Each crypto commerce begins with an order, however not all orders are the identical. The kind of order you select determines how and when your commerce is executed.

Market orders are the only. You purchase or promote on the present market value. It’s quick, however you may pay extra (or get much less) than anticipated in a risky market.

Restrict orders allow you to set a particular value. The commerce solely occurs if the market hits that value. It provides you extra management, however there’s an opportunity your order gained’t be stuffed.

Cease-loss orders assist shield your draw back. If the value drops to a sure stage, the cease order turns right into a market order and sells your asset robotically.

Take-profit orders work the identical method, however on the upside. As soon as the value hits your goal, the asset sells and locks in any features.

You possibly can open a protracted place when you count on the value to rise: you’re shopping for low to promote excessive later. Should you count on a drop, you’ll be able to take a brief place, which suggests borrowing an asset to promote it now and shopping for it again at a lower cost. Shorting includes extra threat and normally requires a margin account.

Utilizing the correct order kind—and realizing when to go lengthy or brief—helps you commerce smarter, handle threat, and keep away from emotional selections.

When To Promote

Understanding when to promote is simply as necessary as realizing when to purchase cryptocurrency. Promoting too quickly means you miss potential features. Promoting too late might wipe out your earnings.

Set a transparent goal before you purchase. Resolve the value the place you’ll take revenue and stick with it. Emotional promoting results in unhealthy trades.

You should utilize technical indicators to seek out exit alerts. For instance, if the value hits a powerful resistance stage or an indicator like RSI exhibits the asset is overbought, it might be time to promote.

Don’t ignore fundamentals. If a venture’s management adjustments, growth stalls, or unhealthy information hits the market, promoting can shield your capital.

Have a stop-loss plan. This robotically sells your place if the value falls beneath a sure level. It limits your losses and removes the stress to make a split-second resolution.

Instruments for Crypto Analysis

You should utilize these instruments to remain knowledgeable and spot robust buying and selling setups:

CoinGecko / CoinMarketCap. Observe value, quantity, market cap, and venture stats

TradingView. Charting platform with technical indicators and drawing instruments

Glassnode / IntoTheBlock. On-chain analytics (pockets exercise, flows, and many others.)

Messari. Deep analysis studies on crypto initiatives

X (previously Twitter). Actual-time updates from merchants, devs, and analysts

Discord/Telegram. Group discussions, however be cautious of hype

In style Cryptocurrency Buying and selling Methods

There’s no single option to commerce cryptocurrency. Your technique relies on how a lot time you wish to spend watching the market, how snug you might be with threat, and what your buying and selling objectives are. Beneath are beginner-friendly methods that provide help to discover optimum entry factors, handle your crypto account, and reply to altering market circumstances.

HODLing (Lengthy-Time period Holding)

HODLing means shopping for a digital foreign money and holding it for months or years, no matter short-term value swings. You’re not making an attempt to time the market—you consider within the long-term worth of the asset and belief the community safety and adoption of the venture.

It’s a low-effort, low-stress technique, finest for folks with a very long time horizon and low buying and selling frequency. Bitcoin and Ethereum are the commonest cash held this manner.

Day Buying and selling

Day buying and selling includes shopping for and promoting crypto inside a single day to revenue from short-term value actions. You’ll want to remain energetic, watch the charts, and be taught to acknowledge patterns that sign when to enter or exit trades.

This technique requires self-discipline, quick decision-making, and a excessive threat tolerance. It’s not really helpful until you’re able to spend time studying how the market reacts minute-by-minute.

Swing Buying and selling

Swing merchants maintain positions for a number of days or even weeks. The aim is to catch “swings” in value—shopping for after a dip and promoting after an increase. You don’t want to observe your crypto account always, however you do have to comply with market circumstances and use primary evaluation instruments.

This technique strikes a steadiness between HODLing and day buying and selling, and it’s a great entry level for freshmen who wish to be extra hands-on.

Greenback-Price Averaging (DCA)

DCA means investing a set quantity right into a cryptocurrency at common intervals—regardless of the value. For instance, shopping for $50 value of Bitcoin each week.

This technique smooths out volatility. As a substitute of making an attempt to time the market, you unfold out your purchases and cut back the impression of sudden value adjustments. It’s a stable option to construct publicity with out making emotional selections.

Pattern Buying and selling Technique

Pattern buying and selling means figuring out the course of the market—up or down—and buying and selling in that course. If the value is rising, you search for a great entry and experience the pattern. If it’s falling, you may brief the asset or keep out completely.

To make use of this technique, it is advisable perceive how one can acknowledge patterns, comply with information that impacts digital currencies, and ensure traits with technical indicators. It’s extra superior than DCA or HODLing however nonetheless accessible to dedicated freshmen keen to be taught.

How To Defend Your Crypto Belongings

Buying and selling cryptocurrency opens new alternatives, but it surely additionally places your digital belongings in danger when you don’t take safety severely. Right here’s how one can shield what you personal, whether or not you’re day buying and selling or holding for the long run:

Use non-custodial walletsCustody providers are third events that maintain your crypto for you (like an alternate). Non-custodial wallets allow you to maintain your individual personal keys, supplying you with full management and full duty.

Allow two-factor authentication (2FA)This provides a second layer of safety past your password. Use apps like Google Authenticator or Authy, not SMS.

Write down your seed phraseStore it offline in a number of safe places. By no means put it aside in cloud storage or screenshots.

Look ahead to phishing scamsAlways double-check URLs, emails, and apps. By no means click on unknown hyperlinks or approve pockets entry from untrusted sources.

Use chilly wallets for long-term storageThese offline wallets are resistant to on-line assaults. Gadgets like Ledger or Trezor are good choices.

Maintain software program updatedWhether it’s your pockets app or browser extension, updates patch crucial safety vulnerabilities.

Threat Administration in Crypto

Threat administration is what separates a fortunate win from a constant buying and selling technique. In crypto, worth adjustments can occur quick, particularly when you’re day buying and selling or reacting to sudden information. And not using a plan, it’s simple to lose greater than you acquire.

Begin by defining how a lot you’re keen to threat on every commerce. Many skilled merchants by no means threat greater than 1–2% of their complete portfolio. This limits losses when the market strikes in opposition to you. Whether or not you’re buying and selling Bitcoin or swapping tokens for fiat foreign money, this rule helps protect capital.

Subsequent, perceive the position of stop-loss and take-profit ranges. These instruments allow you to automate your selections as an alternative of reacting emotionally. If a coin drops beneath your threat threshold, you promote. If it hits your goal, you lock in earnings. It’s easy, and it really works.

Don’t depend on borrowing or leverage till you perceive how crypto behaves. Crypto is nothing like conventional currencies—it’s quicker, extra risky, and fewer forgiving. Brokerage providers might provide superior options, however they gained’t shield you from unhealthy trades.

Even long-term holders want a threat plan. You’re nonetheless uncovered to market cycles, regulation shifts, and tech dangers. Diversify your belongings, keep up to date, and evaluation your portfolio repeatedly. As new alternatives come up, you’ll be in a greater place to purchase and promote with confidence.

Frequent Errors Learners Make When They Begin Buying and selling Crypto

New merchants typically repeat the identical avoidable errors. Listed here are the commonest errors:

Assuming day buying and selling is easyMost freshmen lose their cash quick. Timing trades with out expertise is more durable than it seems to be.

Buying and selling too many coinsFocus on one or two belongings at first, like Bitcoin, Ethereum, or Solana. Spreading your cash skinny results in confusion and poor selections.

Utilizing instruments you don’t understandIndicators gained’t assist when you don’t understand how they work. Be taught earlier than you depend on them.

Trusting value over fundamentalsPrice spikes typically imply hype, not high quality. Take a look at the venture, not simply the chart.

Specializing in the charts too muchThere’s a phenomenon referred to as evaluation paralysis, a scenario when merchants get overwhelmed by all of the charts and indicators, too afraid to make a mistake and thus not making any merchants. Do not forget that whereas analysis is necessary, charts aren’t all the pieces.

Treating crypto like gamblingRandom trades aren’t a method. Stick with established guidelines and evaluation each transfer.

Neglecting safety early onEven small quantities get stolen. Use robust passwords, wallets, and two-factor authentication from day one.

Last Ideas

Buying and selling cryptocurrency isn’t about luck—it’s about studying how markets transfer, defending your digital belongings, and constructing a method that works for you. Begin easy. Concentrate on cash with actual utility. Maintain your threat low and your safety tight. As your abilities develop, so will your means to identify alternatives and react with confidence. The crypto market strikes quick, however with the correct basis, you don’t need to fall behind.

FAQ

Is cryptocurrency buying and selling secure for freshmen?

It may be when you begin small and be taught the fundamentals. Crypto is very risky, so managing threat is crucial from the beginning.

How a lot cash do I would like to start out buying and selling crypto?

You possibly can commerce cryptocurrency with as little as $10. Most platforms have low entry limits, making it simple to start.

Can I lose all my cash in crypto buying and selling?

Sure, particularly when you ignore threat or attempt day buying and selling with no plan. Digital belongings can drop sharply with out warning.

What’s the distinction between investing and buying and selling crypto?

Investing means holding long-term primarily based on a venture’s potential. Buying and selling focuses on short-term value strikes to earn rewards extra often.

How do I do know which crypto is value shopping for?

Begin with belongings which have excessive buying and selling quantity, are listed on main exchanges, and behave predictably—like Bitcoin or Ethereum. Should you can’t clarify what the coin does or who’s utilizing it, don’t commerce it.

Disclaimer: Please observe that the contents of this text usually are not monetary or investing recommendation. The data supplied on this article is the writer’s opinion solely and shouldn’t be thought of as providing buying and selling or investing suggestions. We don’t make any warranties concerning the completeness, reliability and accuracy of this info. The cryptocurrency market suffers from excessive volatility and occasional arbitrary actions. Any investor, dealer, or common crypto customers ought to analysis a number of viewpoints and be accustomed to all native laws earlier than committing to an funding.