What’s received Adobe inventory right down to a decade-low valuation? The Day by day Breakdown digs into the spooky decline in ADBE inventory.

Earlier than we dive in, let’s be sure you’re set to obtain The Day by day Breakdown every morning. To maintain getting our every day insights, all it is advisable to do is log in to your eToro account.

Deep Dive

Adobe Programs has been a trending subject on social media this yr, seemingly missed within the broader tech rally regardless of its constant enterprise development. Regardless of Adobe’s integration of AI into its merchandise, issues persist concerning the potential adverse impression of AI on its enterprise.

Nonetheless, the corporate has continued to carry out properly. Adobe skilled some margin stress between 2021 and 2023 however has since rebounded to the mid-30% vary. Over the previous decade, Adobe has persistently achieved at the least 10% annual income development with out considerably sacrificing its margins, resulting in a compound annual development price (CAGR) of roughly 26% in earnings over the identical interval.

Future Progress Projections

Whereas Adobe has demonstrated robust development traditionally, future development shouldn’t be anticipated to be as aggressive. In accordance with Bloomberg, analysts mission the next:

Earnings development: 13% this yr, 12.2% in 2026, and 12.3% in 2027.

Income development: 10.2% this yr, 9.3% in 2026, and 9.3% in 2027.

Analysts at the moment have a consensus worth goal of ~$457.50 on ADBE inventory, implying nearly 34% upside to in the present day’s inventory worth. The disconnect between the inventory worth and what buyers really feel is a good worth has many buyers puzzled.

Wish to obtain these insights straight to your inbox?

Enroll right here

Diving Deeper — Valuation and Dangers

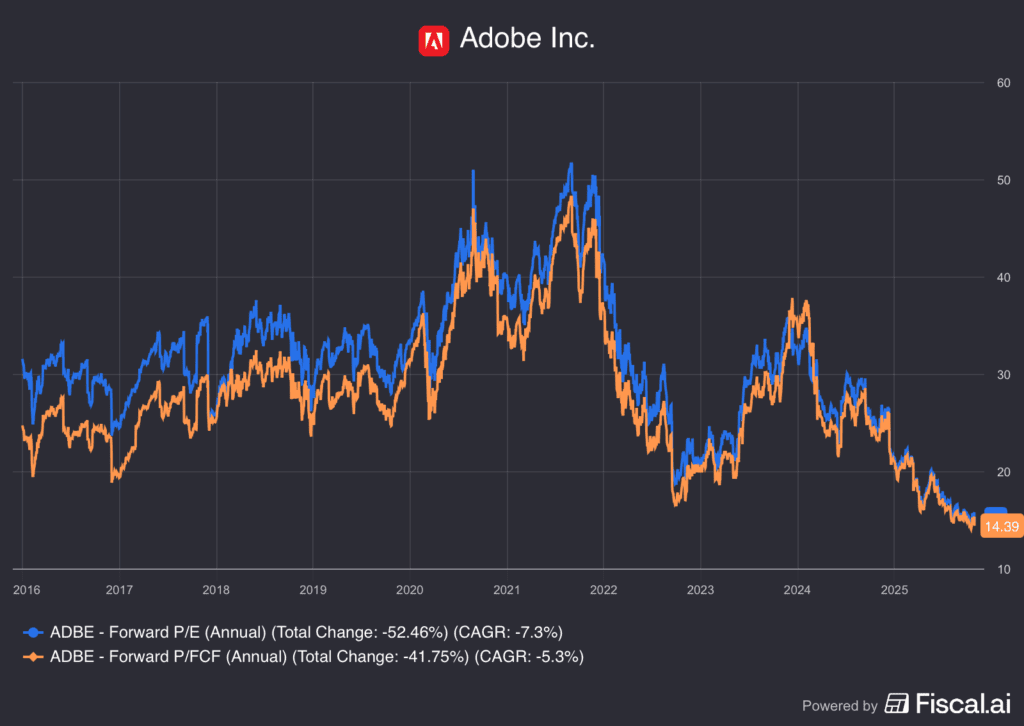

As a result of the enterprise has continued to chug alongside however the worth of Adobe inventory has not, the valuation has come down considerably over time. Beneath is a take a look at the ahead price-to-earnings ratio and the ahead price-to-free-cash-flow ratio. Each are are at 10-year lows.

Dangers

Buyers see the corporate is rising, however they’ll’t ignore what else they see; ChatGPT and different AI functions are actually creating footage and movies. If gross sales and margins have been to come back below stress, that would trigger additional concern of the inventory.

Adobe has been an underperformer amid this bull market because it lingers close to its 2023 lows and is down about 30% thus far this yr. Some buyers will see that as a chance, whereas others will discover it to be a pink flag, given the efficiency of the S&P 500 and Nasdaq 100. In the end, buyers should determine if the valuation and enterprise are compelling sufficient and if the present fears are justified or overblown.

Disclaimer:

Please notice that as a consequence of market volatility, a number of the costs might have already been reached and eventualities performed out.