$AERGO demonstrated exceptional resilience following its delisting from the Binance spot market on March 28, 2025, skyrocketing 10x to $0.57, bolstered by exercise on Upbit and Binance Futures. This sudden turnaround, echoed by important value will increase in $ARDR (280%) and $ARK (60%) throughout Binance’s April “Vote to Delist” marketing campaign, underscores how Binance’s Monitoring Tags and delisting occasions can create unstable, high-risk, high-reward situations for merchants.

$AERGO’s Value Rebound

On March 21, 2025, Binance introduced AERGO’s spot market delisting, efficient March 28, sending its value down 6% to $0.06845. Whereas most delisted cash are likely to fade into obscurity, $AERGO, the native token of a hybrid blockchain platform backed by Samsung’s Blocko, managed to defy expectations. After being delisted by Binance, $AERGO skyrocketed 10x to a peak of $0.57 with a $920 million quantity surge earlier than being relisted on Binance Futures.

Examine this occasion to different delisted tokens like BAL and CREAM, eliminated on April 16, 2025. They plummeted, with $CREAM dropping a major market cap.

AERGO’s edge? Excessive Upbit quantity sustained liquidity with $250M on 9/4, as said by GEM DETECTER, turning a delisting dip right into a speculative frenzy. Merchants who noticed this pattern-volume spikes on South Korean exchanges, caught an enormous wave, proving that not all delistings spell doom.

Parallel Surges of $ARDR and $ARK

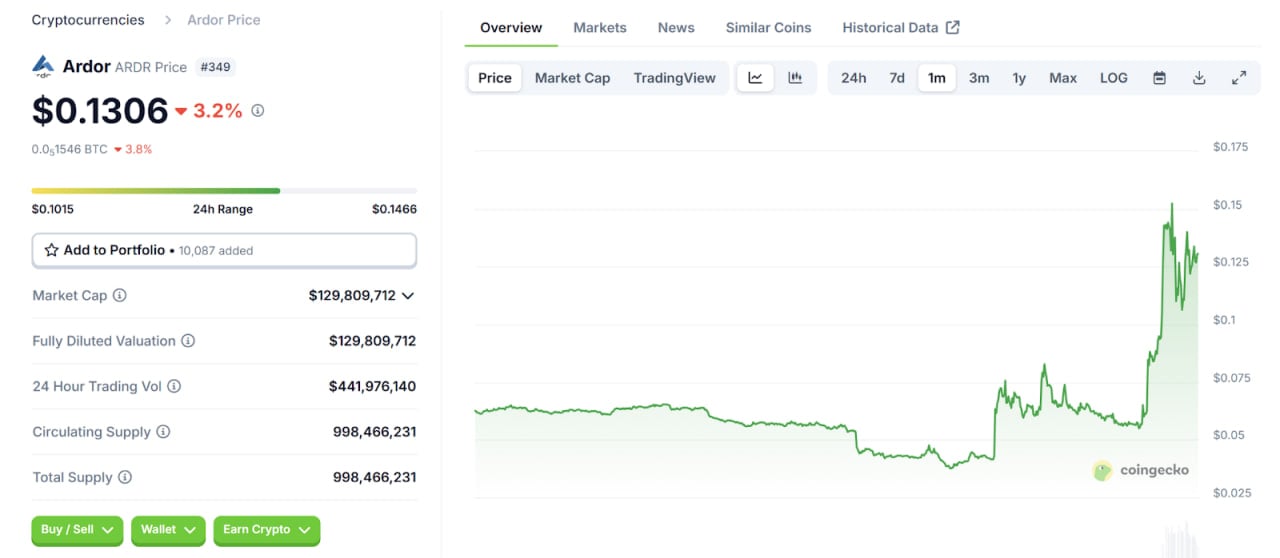

The same script performed out with $ARDR and $ARK, included in Binance’s second “Vote to Delist” marketing campaign from April 10-16, 2025. Regardless of receiving 3.6% and 5.8% of votes, respectively, neither $ARDR nor $ARK has confirmed delisting, but their costs skilled a major surge.

Supply: Coingecko

Not like different tokens within the 2nd “Vote to Delist” Batch like $PDA and $VOXEL, which noticed substantial declines, $ARDR surged 280% to $0.15 by April 16, with a 1,100% quantity spike. $ARK, much less dramatic, doubtless climbed to $0.52, rising by practically 60%. Each these tokens are dealer favorites on Bithumb, the place excessive buying and selling volumes maintain liquidity. Just like $AERGO’s Upbit-driven rally ($250M quantity on April 9), Bithumb’s ARDR/KRW and ARK/KRW pairs noticed huge exercise.

Nonetheless, the hype didn’t final. $AERGO crashed 63% to $0.18 inside 24 hours. $ARDR doubtless dipped 10-15%, whereas $ARK stagnated or slid barely. These corrections spotlight the volatility of delist-driven pumps. When momentum fades, merchants chasing information usually undergo, notably if tasks lack sturdy fundamentals.

Leveraging Binance’s Danger Indicators

Via the instances above, Binance’s Monitoring Tags could be thought of a goldmine for merchants. These flags mark cash susceptible to delisting as a result of low liquidity, weak growth, or regulatory pink flags.

The Vote to Delist marketing campaign, just like the one ending April 16, amplifies volatility, creating pump-and-dump setups. To capitalize, monitor tagged cash by way of Binance bulletins, then examine Bithumb and Upbit quantity on CoinMarketCap or CoinGecko. A surge, like in $AERGO, $ARDR, and $ARK, usually precedes a rally.

Don’t overlook to remain proactive: Monitor Binance Sq. for delist updates and Korean Upbit and Bithumb trade information for quantity clues. $AERGO, $ARDR, and $ARK present what’s doable, however timing and threat administration are every little thing.