A latest report by River reveals that Individuals dominate Bitcoin in complete provide, mining, and funding, highlighting its place as the worldwide chief within the cryptocurrency ecosystem as of Might 2025.

America has solidified its place as the worldwide chief within the Bitcoin ecosystem, in keeping with a complete report by River. The information underscores America’s important affect throughout varied sides of Bitcoin, from possession and mining to enterprise funding and ETF investments.

Individuals Dominate in Bitcoin Possession, Mining, and Funding

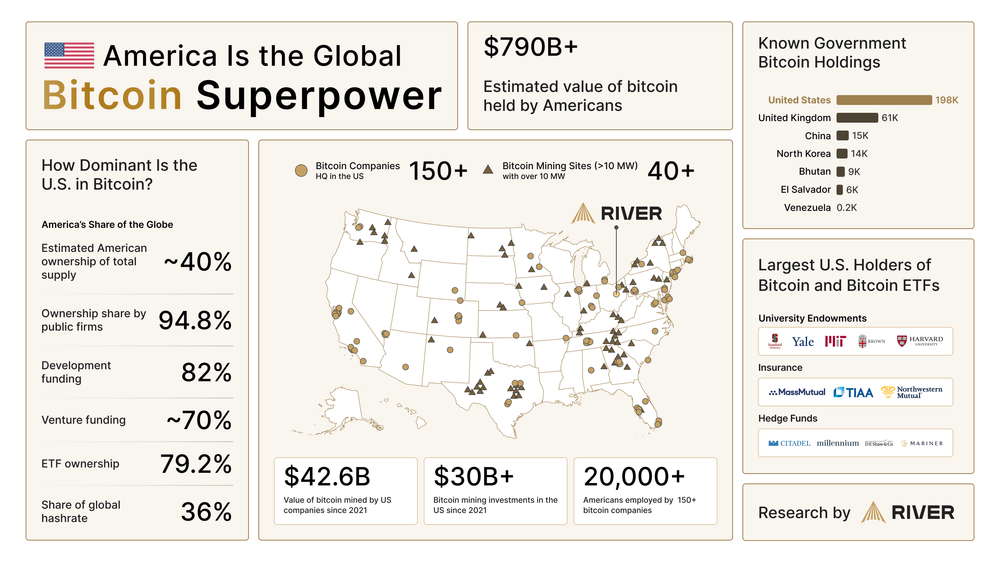

River’s report paints a transparent image of America’s commanding presence within the Bitcoin ecosystem. Roughly 40% of Bitcoin’s complete provide, estimated at $790 billion, is held by Individuals, a determine that underscores the U.S.’s substantial possession stake.

Learn extra: 2025 Crypto Possession Report: 70% of American Adults Personal Cryptocurrency

Supply: River

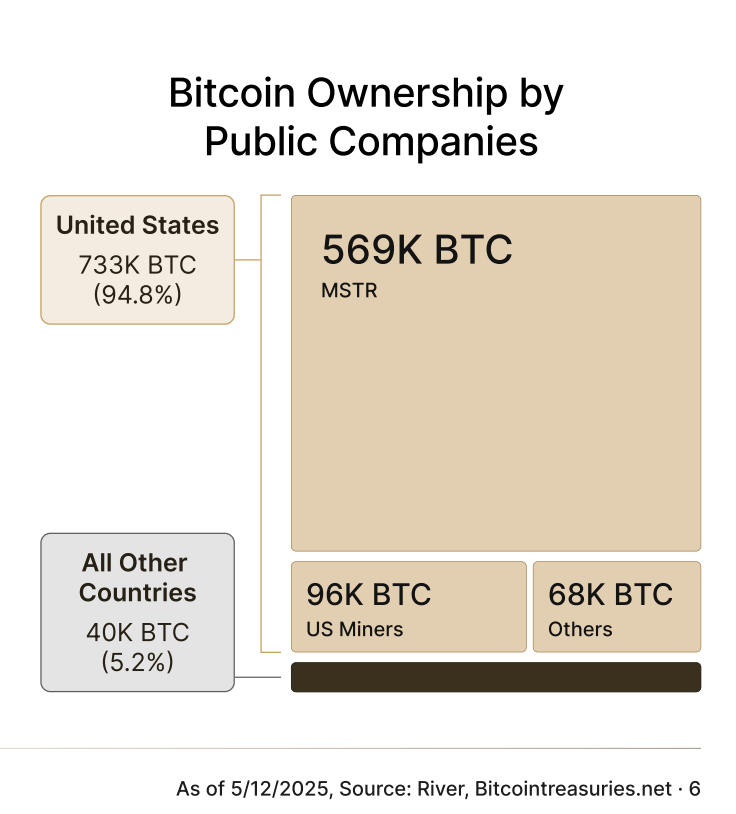

This dominance extends to company holdings, with 94.8% of Bitcoin BTC owned by public companies globally belonging to U.S.-based corporations.

Since 2021, American corporations have added $42.6 billion price of Bitcoin to their treasuries, reflecting a rising development of company adoption. MicroStrategy, as an illustration, has been a pioneer on this area, holding over 576,230 BTC.

The U.S. additionally leads in Bitcoin mining, controlling 36% of the worldwide hashrate with over 40 mining websites exceeding 10 MW capability. This can be a important shift from 2021, when China dominated with over 50% of the hashrate. The U.S.’s rise in mining energy coincides with China’s 2021 crackdown on crypto mining, which drove miners to North America.

Moreover, the report highlights that over 150 Bitcoin corporations are headquartered within the U.S., using greater than 20,000 Individuals, additional solidifying the nation’s position as a hub for crypto innovation.

Furthermore, 79.2% of Bitcoin ETF possession is held by U.S. traders, with main monetary establishments like BlackRock and Constancy main the cost. As of Might 14, 2025, Bitcoin ETFs have reached ATH with over $41 billion in inflows.

Considerations Over Centralization Dangers

The U.S.’s overwhelming affect in Bitcoin indicators a maturing market the place institutional and company involvement is driving progress. The 40% possession by Individuals means that the U.S. has a vested curiosity in Bitcoin’s success, doubtlessly influencing regulatory selections. As an example, the Securities and Trade Fee (SEC) has taken a extra favorable stance on Bitcoin ETFs since 2024, a shift that aligns with the rising financial stake of American traders.

Nevertheless, this focus of possession additionally raises issues about centralization in a decentralized ecosystem, as a small group of U.S.-based entities might exert important affect over Bitcoin’s market dynamics.

The dominance in mining and company adoption highlights the U.S.’s strategic positioning within the Bitcoin economic system. With 36% of the worldwide hashrate, the U.S. performs a vital position in securing the Bitcoin community, however this additionally ties Bitcoin’s vitality consumption to American infrastructure, elevating environmental issues.

On the funding entrance, the 70% share of enterprise funding and 82% of growth funding point out that the U.S. is shaping Bitcoin’s technological evolution, doubtlessly prioritizing improvements that align with American monetary pursuits, comparable to ETF merchandise and custody options.