With the continued battle within the Center East, many eager traders have turned to investing in crude oil, hoping for a surge because of the Strait of Hormuz being getting ready to closure. Nevertheless, half-hour into buying and selling, oil costs have been solely up by 3%.

Over 20% of the world’s oil flows by means of the Strait of Hormuz, and whether it is certainly closed at any level, oil costs would seemingly spike. Many traders are eyeing $100 per barrel, a stage that hasn’t been seen since July 2022.

Twenty-five years in the past, if Iran had threatened to shut the Strait of Hormuz, the value of crude oil would have spiked 50%. At the moment, no one cares. Totally different world. #CrudeOil pic.twitter.com/TRDVQndnzO

— Dave Reiter (@TradesByDave) June 22, 2025

Oil Costs Sluggish To React To The Ongoing Battle In The Center East

Whereas many have been anticipating oil costs to spike on opening at 6 pm ET, simply half-hour into buying and selling, oil was up by barely 3%, following the US navy’s in a single day strikes on Iranian nuclear amenities on Sunday.

This sort of assault, coupled with the continual menace that the Strait of Hormuz will shut at any time, has led many traders to purchase crude oil shares in anticipation of an enormous upside transfer.

Nevertheless, at 6:27 p.m. ET on June 22, Brent crude was buying and selling up 3.17% at $79.45 per barrel, whereas the US crude benchmark, West Texas Intermediate (WTI), was buying and selling up $3.18 at $76.19 per barrel in the course of the early New York buying and selling session.

Earlier incidents of this stage have triggered far larger strikes in crude markets. A couple of examples embody when Iran-linked militants struck Saudi Aramco’s Abqaiq facility in September 2019, quickly halting 5% of world oil output, Brent futures spiked almost 20% in a single day, marking the most important one-day value soar in historical past.

DISCOVER: The 12+ Hottest Crypto Presales to Purchase Proper Now

One other such occasion got here following the US drone strike on Iranian Navy Officer Qassem Soleimani in early 2020, costs surged a round 4% amid fears of regional retaliation. At the moment’s lukewarm response additional highlights how rather more insulated markets have grow to be from geopolitical occasions.

The coordinated US airstrikes hit Fordow, Natanz, and Isfahan in a single day, inflicting seen harm on enrichment and analysis infrastructure. Tehran has promised retaliation, however vitality markets are betting that escalation stays restricted.

President Trump had introduced that each one three nuclear websites had been fully worn out; nevertheless, it has since come out that Fordow wasn’t destroyed, and the Iranians might have even moved the Uranium deposits earlier than the assault.

No important transfer in oil costs will seemingly come till the Iranians determine on the Strait of Hormuz. In the event that they determine to disrupt or shut the Strait, barrels of crude oil may run towards $100, a value not seen for the reason that Russian invasion of Ukraine started in 2022.

Oil Not Spiking Like Many Believed As Bitcoin Reclaims $100,000 – Is BTC The WW3 Hedge?

(COINGECKO)

Late yesterday, Bitcoin dropped to $98,500, main many to imagine {that a} slide towards $80,000-85,000 was coming. Nevertheless, lower than two hours later, BTC shortly reclaimed $100,000, and is now buying and selling at $101,900.

This continued energy from Bitcoin, in comparison with Oil costs not reacting fairly as market contributors had assumed they might, is making the main digital asset stand out as a go-to funding throughout this era of battle within the Center East.

Beforehand, Iran and Israel getting into heavy battle towards each other, with the added caveat of the US getting concerned, would’ve acted as a black swan occasion in crypto, and Bitcoin would have crashed, dragging the remainder of the market with it.

Nevertheless, BTC’s refusal to settle under $100,000 is extremely bullish, which can also be buoyed by BlackRock’s persevering with to publish constructive web inflows into its Bitcoin ETF. Different asset managers, resembling Constancy, have additionally been experiencing wholesome inflows into their very own BTC ETF.

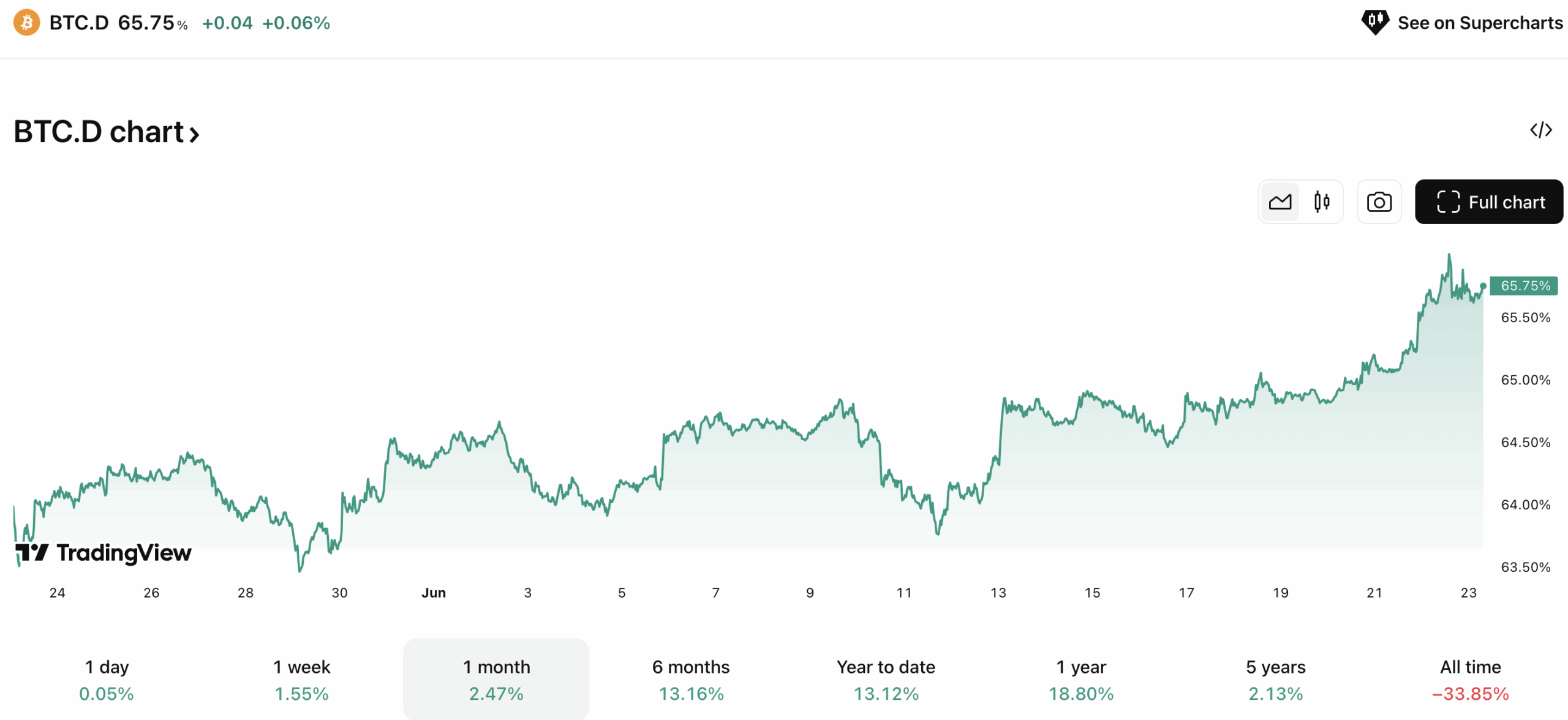

One other sign that Bitcoin is the main funding asset proper now could be the continued rise of BTC dominance (BTC.D), which measures its share of the entire crypto market cap. As most altcoins proceed to bleed and Bitcoin holds regular, BTC.D has risen from 64.8% to 65.8% within the final three days alone.

(TRADINGVIEW)

Whereas the rise of BTC.D highlights the weak spot in altcoins proper now, it additionally demonstrates the energy of Bitcoin and its newfound standing as a hedge on the pending conflict.

All eyes will now be on the US TradFi markets opening at present and any recent announcement from President Trump on the US’s plans relating to the Israel/Iran battle.

There’s optimism that the battle could possibly be drawing to a detailed after no reported missile assaults from Iran in a single day and Israel stating they don’t want to be drawn right into a conflict of attrition.

Any information of a ceasefire or outright finish to this bloody battle within the Center East will seemingly see an enormous surge throughout the crypto market, which may catapult Bitcoin to recent highs, lastly turning the $110,000 stage into help earlier than starting the long-awaited run towards $150,000.

EXPLORE: 20+ Subsequent Crypto to Explode in 2025

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

The publish Are Oil Costs Set to Skyrocket Over Iran-Israel Battle: What Does This Imply For Bitcoin Value in June? appeared first on 99Bitcoins.