Choosing one of the best crypto indicators can considerably enhance your buying and selling success by revealing hidden market traits, essential assist and resistance zones, and doable shifts in momentum. Whether or not you’re a newbie testing your first technique or a seasoned dealer refining superior strategies, realizing the basics of technical evaluation is an important step. In contrast to basic evaluation, which digs right into a crypto’s underlying undertaking or tokenomics, technical evaluation focuses on historic worth knowledge, buying and selling quantity, and chart patterns.

This strategy is very helpful within the crypto market, recognized for dramatic worth fluctuations and unprecedented volatility. The next information showcases a number of high-impact indicators—each easy and complicated—and affords a basis on find out how to combine them right into a worthwhile, adaptable buying and selling technique. By monitoring indicators tailor-made to cost actions you may create extra knowledgeable buying and selling selections relating to one of the best occasions to enter or exit a place. Let’s get into it.

What’s Technical Evaluation?

Technical evaluation focuses on assessing particular historic knowledge, like buying and selling quantity or worth actions, to higher predict upcoming worth actions. By decoding recurring patterns in candlestick charts, development strains, and numerous oscillators, merchants acquire a clearer view of market momentum or potential reversals.

In contrast to basic evaluation, which examines a crypto undertaking’s core know-how or partnerships, technical evaluation primarily hones in on chart patterns and statistical metrics. Merchants will steadily mix a number of indicators to refine their methods, mitigate false alerts, and adapt to market volatility.

As an illustration, a shifting common would possibly spotlight a development’s path, whereas an oscillator just like the relative energy index (RSI) can assist spotlight overbought or oversold circumstances. However when mixed, these instruments are able to slicing by way of the market noise so you can also make extra goal, well timed selections. That stated, no chart or formulation can utterly get rid of danger, and each single commerce will nonetheless require considerate danger administration and private self-discipline.

Forms of Indicators for Crypto Buying and selling

Now we’re going to try a variety of technical indicators and chart ideas essential for recognizing worth actions, gauging market momentum, and planning a well-rounded buying and selling technique. Every software helps you interpret historic worth knowledge in another way, so combining a number of indicators can cut back false alerts and refine entries or exits.

1. Line Charts

A line chart shows a crypto’s closing worth over time, forming a steady line that helps visualize the general development. As a result of it solely tracks one knowledge level (sometimes the shut worth), it affords a transparent, uncluttered view of market path. Merchants usually begin with line charts to determine broad traits earlier than diving deeper.

Supply: CoinMarketCap

2. Bar Charts

:max_bytes(150000):strip_icc():format(webp)/BTCBarChart-47451c53e9e746958f52c9dac2e4d07a.jpg)

Supply: TradingView

Bar charts broaden on line charts by displaying every interval’s open, excessive, low, and shut (OHLC). Every bar represents a time interval, displaying intraday fluctuations extra exactly. The left tick marks the open worth, whereas the appropriate tick reveals the shut. By seeing highs and lows, you may gauge shopping for and promoting strain extra precisely.

3. Candlestick Charts

Candlestick charts present a visible snapshot of open, excessive, low, and shutting costs, however with color-coded “candles” reflecting bullish or bearish motion. Inexperienced or white candles point out the next shut vs. open, whereas pink or black present a drop. Candlesticks highlight patterns that may reveal potential development reversals or market sentiment shifts.

Supply: CoinMarketCap

4. Assist ranges

Assist ranges are worth factors the place downward traits usually pause or bounce upward. They kind when shopping for curiosity overpowers promoting strain at particular worth zones. Merchants watch assist for potential low-risk entry factors, putting stop-loss orders slightly below in case the asset breaks decrease. Failing to carry assist could recommend an additional decline.

:max_bytes(150000):strip_icc():format(webp)/BTCSupportandResistance-a7002ab381634b48b1848e1ece7a9993.jpg)

Supply: TradingView

5. Resistance ranges

Resistance is the alternative of assist. Continuously costs will stall or reverse downward after they attain a serious resistance line. Sellers are inclined to dominate at these ranges, hindering the asset from shifting increased. As soon as the value breaches sturdy resistance and holds above it, that zone can turn out to be a brand new assist space, indicating potential bullish momentum.

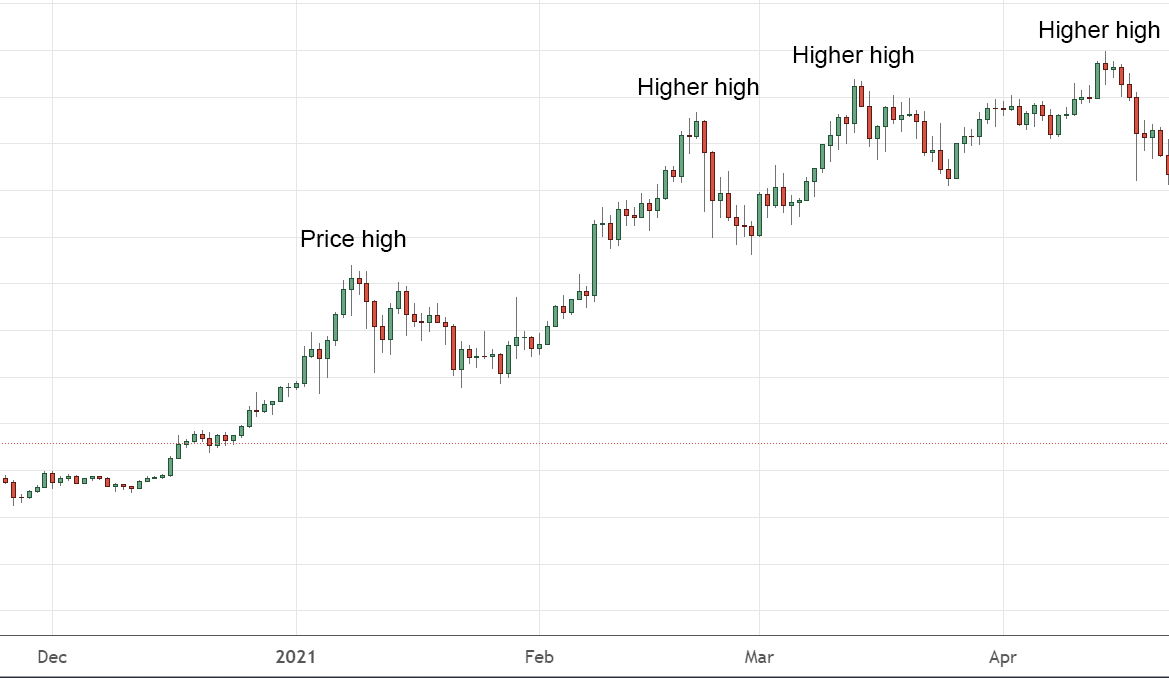

6. Upward Tendencies

Supply: Swyftx Be taught

An upward development is characterised by increased highs and better lows, indicating sturdy shopping for exercise. Merchants could observe this development till it visibly breaks assist or kinds a reversal sample. In a sustained bullish market, you need to use further indicators, like shifting averages, to validate momentum and try and journey the development profitably.

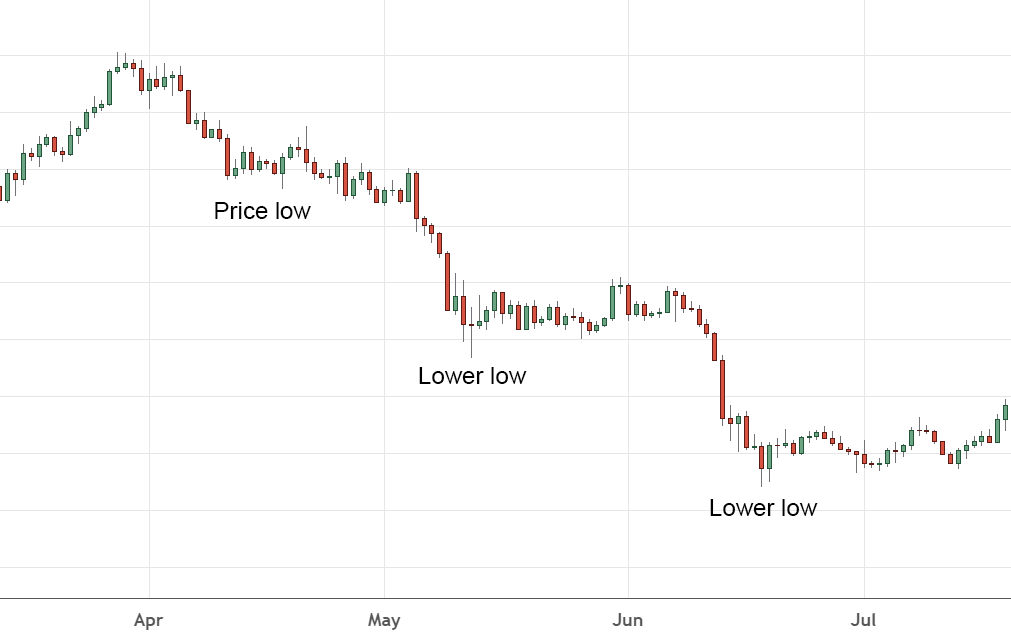

7. Downward Tendencies

Supply: Swyftx Be taught

A downward development reveals decrease highs and decrease lows, signifying constant promoting strain. As costs regularly fall, look ahead to breakouts above key resistance ranges to substantiate a possible reversal. Many merchants short-sell or keep away from shopping for in a downtrend, ready for a big break of the descending line or a confirmed backside formation.

8. Consolidation Tendencies

Supply: Cryptohopper

Consolidation, or sideways motion, occurs when the market has low volatility and the value strikes inside a decent vary. This part usually precedes extra dramatic strikes, with the breakout path setting the stage for future worth motion. Throughout consolidation, some merchants reduce, whereas others anticipate entry factors close to key assist/resistance.

9. Shifting Common Convergence Divergence (MACD)

Supply: TradingView

MACD makes use of two exponential shifting averages, the sign line and the MACD line, together with a histogram that reveals the hole between them. When the MACD crosses above the sign line, it alerts potential bullish momentum; a drop under would possibly suggest a bearish flip. MACD helps determine adjustments in development energy and path.

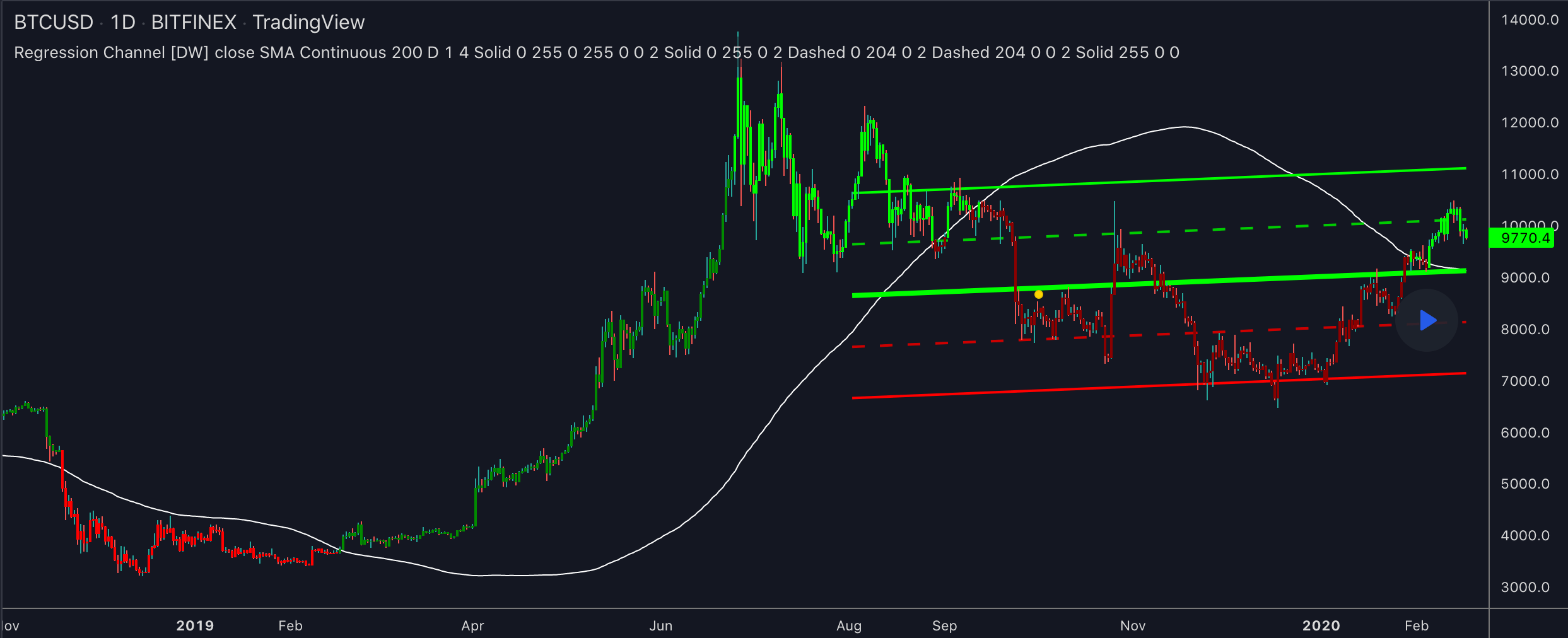

10. Shifting Averages (MAs)

Shifting averages clean out worth knowledge, revealing the underlying development. Easy shifting averages (SMAs) weigh all knowledge equally, whereas exponential shifting averages (EMAs) give current costs extra emphasis. MA crossovers, like a shorter MA crossing above an extended one, will usually precede adjustments in market momentum and could be a highly effective market momentum indicator.

11. Common Directional Index

Supply: TradingView

The typical directional index (ADX), measures the depth of a development from 1 to 100. Values under 20 sign a weak or sideways market, whereas readings over 40 usually imply a stable development, both bullish or bearish. Merchants typically pair ADX with different indicators to substantiate that the market is really trending, not whipsawing.

12. Relative Energy Index (RSI)

Supply: TradingView

The RSI ranges between 0 and 100, highlighting overbought and oversold circumstances. A studying above 70 could point out overbought territory, which implies a dip might be on the best way, whereas an RSI underneath 30 suggests oversold ranges, hinting at a doable bounce. This momentum oscillator can assist merchants resolve when to enter or exit positions to keep away from chasing extremes.

13. Bollinger Bands

Supply: TradingView

Bollinger Bands envelop a shifting common with two normal deviation strains above and under it. When the bands widen, market volatility is excessive; after they contract, volatility drops. Costs that break above or under the bands sometimes sign overextended circumstances or rising traits, aiding in recognizing potential reversal zones.

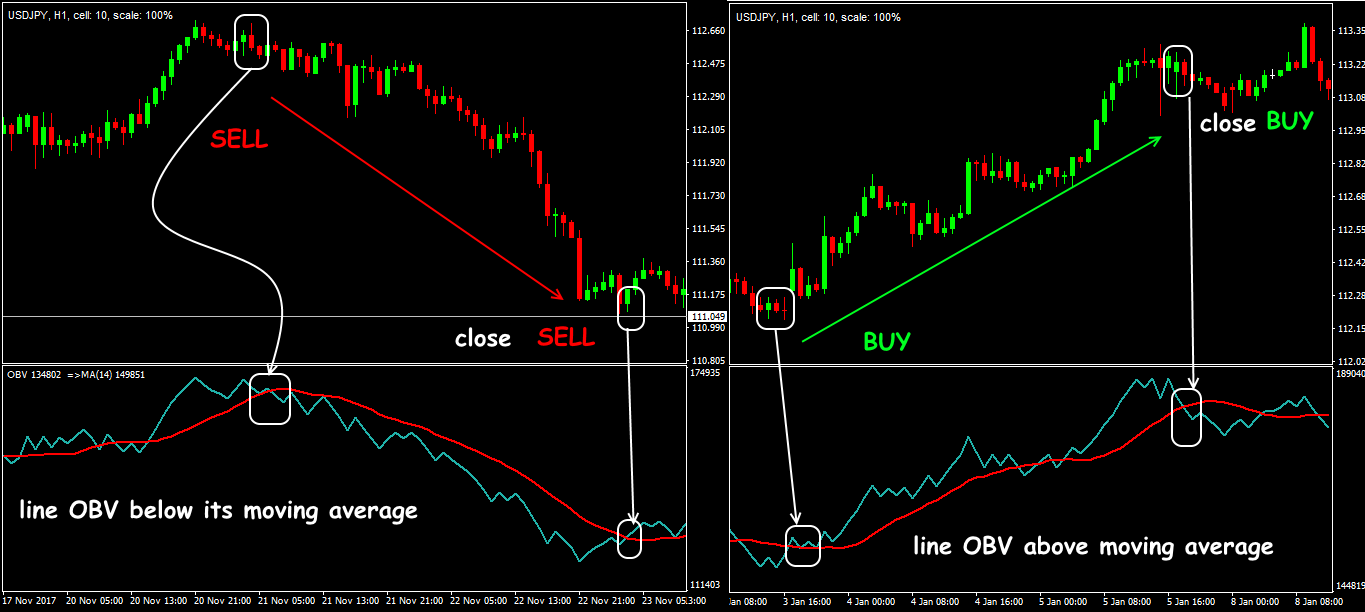

14. On-Steadiness-Quantity (OBV)

OBV connects buying and selling quantity with worth path to evaluate whether or not shopping for or promoting strain dominates. If the value kinds increased highs whereas OBV strikes decrease, it’d point out weakening momentum, which could be a enormous pink flag for some merchants. Alternatively, surging OBV can verify an ongoing rally, signaling that quantity backs the present development.

15. Superior Oscillator

Supply: TradingView

Developed by Invoice Williams, the Superior Oscillator contrasts short-term and long-term worth momentum. Plotted as a histogram round a zero line, constructive bars suggest bullish momentum, whereas detrimental ones recommend promoting energy. Merchants look ahead to the “twin peaks” or “zero line crossover” alerts to anticipate doable development reversals or continuations.

16. Fibonacci Pivot Factors

Supply: TradingView

These pivot factors apply Fibonacci retracement ranges to typical pivot-level calculations, offering potential assist and resistance ranges. Some merchants choose them to straightforward pivots, believing Fibonacci ratios can map out extra exact reversal zones. In crypto, the place market sentiment can shift abruptly, these ranges function goal reference factors for entries/exits.

17. Parabolic SAR

Supply: TradingView

Quick for “cease and reverse,” Parabolic SAR spots a trailing indicator that hovers under bullish worth motion and above bearish motion. When the indicator flips place, it might sign a possible development reversal. Merchants usually mix Parabolic SAR with different momentum-based instruments to tell apart real alerts from routine pullbacks or rallies.

The place to Discover Crypto Charts?

TradingView

TradingView stands out as a complete charting resolution, providing an unlimited vary of technical indicators from primary shifting averages to custom-coded oscillators constructed by its thriving group. It’s generally utilized by crypto merchants, however the identical interface applies seamlessly to shares, commodities, or foreign exchange.

Supply: TradingView

The extremely interactive nature of the platform fosters collective studying and enchancment by letting you share the charts, scripts, and methods of others. For these coping with a number of crypto pairs, TradingView’s multi-chart setup can save time and enhance analysis depth, enabling you to trace international market traits in a single streamlined dashboard.

CoinMarketCap

Whereas not as subtle as TradingView, CoinMarketCap stays a go-to web site for fast knowledge on market capitalization, worth fluctuations, buying and selling quantity, and general market rating. Its charting perform is primary but adequate for top-level evaluation, letting you notice multi-day or multi-month traits at a look. Customers can simply evaluate totally different tokens, handle a watchlist, and discover related hyperlinks.

Supply: CoinMarketCap

Although superior merchants could look elsewhere for deeper chart overlays, CoinMarketCap’s streamlined interface fits those that want fast reference factors or need to verify broader crypto efficiency.

The way to commerce crypto with a technical indicator

Buying and selling with indicators includes greater than merely recognizing a crossover or an overbought studying. It is best to mix at the very least one development indicator with a momentum or volume-based software to validate alerts.

As an illustration, in case your MACD line crosses above its sign line in a market that’s making increased highs, this mix affords added confidence in a bullish transfer. All the time take note of your danger tolerance when sizing positions, and be prepared for false alerts in a extremely unstable surroundings.

Setting protecting stop-loss orders is one other very important step. You would possibly place a cease slightly below a confirmed assist stage in case worth motion reverses.

Monitoring basic developments and market sentiment helps you keep away from solely counting on charts. A sudden regulatory announcement or shock itemizing can rapidly nullify an indicator-based entry.

Regulate your methods in keeping with the crypto’s liquidity, as smaller tokens could also be susceptible to whipsaw worth shifts. Lastly, assessment every commerce after it closes. Preserve notes on why you entered and the way the indicator carried out.

Over time, you may refine your strategy to adapt to altering market circumstances and keep away from repeating errors.

Conclusion

Every of those indicators can provide precious insights into ongoing worth motion, however no single software ensures constant good points. The crypto market stays a fast-moving area with vital swings. Combining a number of indicators and verifying them with basic observations usually yields extra balanced selections.

You also needs to keep updated on macro developments and be conscious of your personal buying and selling psychology. By approaching crypto with the right combination of technical analysis, technique, and self-discipline, you may higher put together your self for each alternatives and potential pitfalls.

FAQs

What’s the greatest indicator for cryptocurrency?

No single indicator excels for all eventualities. Many merchants favor combos like shifting averages for recognizing traits and RSI for momentum. This layered strategy usually lowers the possibility of deceptive alerts.

What’s the most correct crypto predictor?

Accuracy is determined by market circumstances, volatility, and dealer ability. Some depend on MACD or Bollinger Bands for dynamic suggestions. Others combine a number of indicators with broader analysis to extend reliability.

Do crypto indicators work?

Indicators can assist make structured selections, however they don’t seem to be foolproof. Market sentiment and exterior elements can override technical patterns. Combining a number of instruments and adjusting for brand new occasions is usually one of the best strategy.