Bitcoin has set a brand new all-time excessive (ATH) above $118,000, however on-chain knowledge from Glassnode reveals BTC quantity stays low regardless of the breakout.

Bitcoin Quantity Nonetheless At Traditionally Low Ranges

Only recently, Glassnode had revealed that quantity associated to Bitcoin had dropped to yearly lows, doubtlessly hinting in the beginning of a summer season lull. Now, following the breakout to new highs, the on-chain analytics agency has shared up to date knowledge in a reply to an X person, showcasing how quantity has modified since.

From the chart, it’s seen that each the Spot and Futures Volumes, similar to Bitcoin buying and selling exercise occurring on the spot and futures platforms, respectively, plummeted on the finish of June and remained low into early July.

Associated Studying

With the most recent value breakout, nevertheless, each metrics have seen a rise, suggesting exercise has famous an uplift throughout each the spot and futures markets. That mentioned, whereas there has certainly been an uptick in buying and selling, volumes nonetheless stay low when in comparison with historical past.

Traditionally, rallies have often solely been sustainable once they have been in a position to seize mass consideration from the merchants. It is because the contemporary exercise is what finally ends up offering gasoline for these runs to maintain going.

“The takeaway right here is that BTC hit an ATH regardless of skinny liquidity – price taking note of,” notes the analytics agency. It now stays to be seen whether or not the exercise enhance would proceed within the coming days or if the lull is right here to remain.

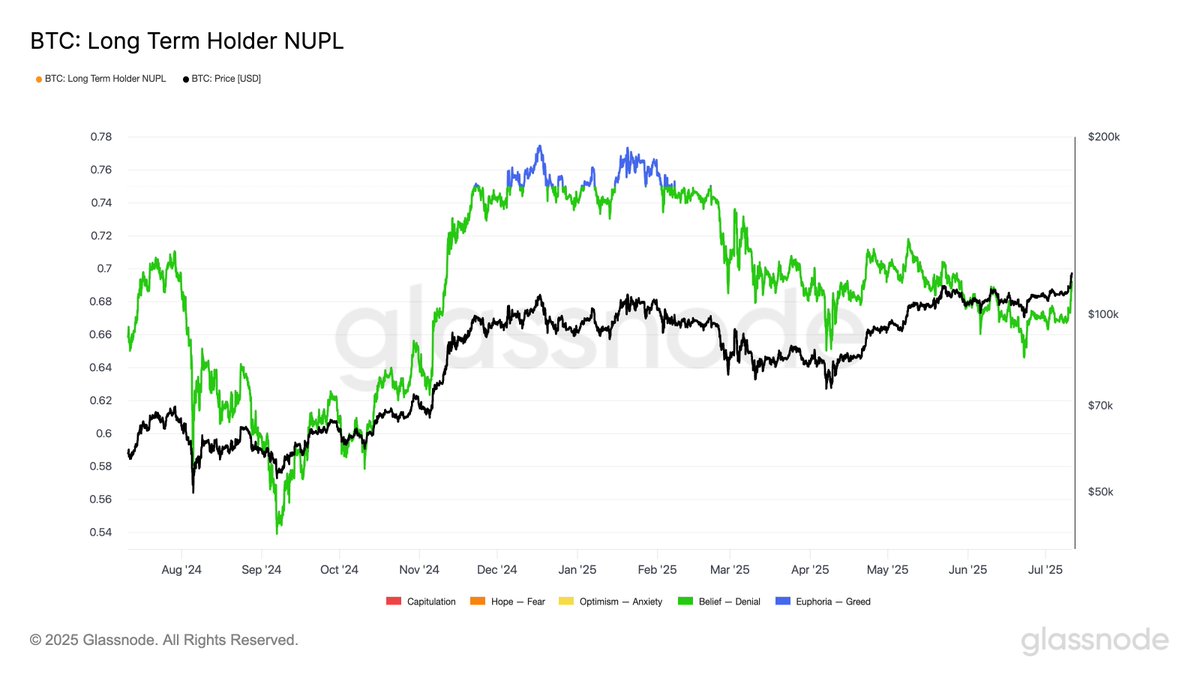

In another information, a key Bitcoin indicator nonetheless stays outdoors the euphoria zone, as Glassnode has identified in one other X submit. The metric in query is the Web Unrealized Revenue/Loss (NUPL) of the long-term holders.

The NUPL measures, as its title suggests, the web quantity of unrealized revenue or loss that the BTC buyers are at the moment holding. Right here, the NUPL of the long-term holders (LTHs) particularly is of curiosity, who’re the buyers holding their cash for greater than 155 days.

Under is a chart that reveals the pattern within the Bitcoin LTH NUPL over the previous 12 months.

As displayed within the graph, the Bitcoin LTH NUPL has noticed an increase alongside the most recent value rally as LTH earnings have grown. Nonetheless, regardless of this, the indicator stands at 0.69, which is underneath the 0.75 degree that has traditionally separated euphoric markets.

Associated Studying

“This cycle has seen simply ~30 days above the 0.75 threshold, in comparison with 228 days within the earlier cycle,” says the analytics agency. The metric was final above this degree in February.

BTC Value

On the time of writing, Bitcoin is floating round $118,000, up over 9% within the final week.

Featured picture from Dall-E, Glassnode.com, chart from TradingView.com