Bitcoin enters the weekend in an unsure place, struggling to interrupt above its all-time excessive of $112,000, whereas altcoins face rising stress and retrace to decrease ranges. After every week of volatility, BTC failed to shut Friday above the important thing resistance, casting doubt on rapid bullish continuation. Nevertheless, analysts stay cautiously optimistic as worth motion nonetheless holds above main assist, and a robust weekly shut may shift sentiment decisively.

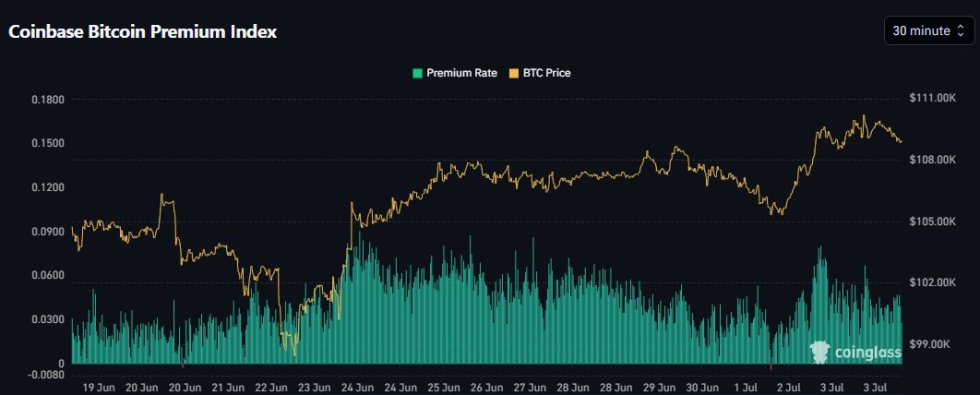

High analyst Daan highlighted that for the reason that market’s restoration two weeks in the past, we’ve seen a constant Coinbase premium—a bullish sign typically linked to identify shopping for stress from US-based buyers. This premium had beforehand traded down amid heightened uncertainty surrounding Center Jap geopolitical tensions however has since rebounded, reflecting improved market confidence.

Now, merchants are intently watching the weekend worth motion to find out whether or not Bitcoin can reclaim $112K and enter worth discovery, or if one other rejection will ship it right into a deeper consolidation section. With key macro narratives easing and on-chain indicators enhancing, the weekend may present a vital clue about Bitcoin’s short-term trajectory—and whether or not altcoins can observe with renewed energy.

Bitcoin Vary Tightens As Market Awaits Breakout Sign

Bitcoin is making ready for a decisive transfer, one that might set off renewed bullish momentum throughout the crypto market, notably for altcoins. For the previous a number of days, BTC has been consolidating in a well-defined vary between $103,000 and $110,000. A transparent breakout above this resistance or breakdown beneath assist is anticipated to spark a swift transfer, as merchants await affirmation of the following directional development.

The broader macroeconomic surroundings has develop into extra favorable. With uncertainty from world geopolitical tensions subsiding and US fiscal insurance policies gaining readability, the stage seems set for Bitcoin to enter a bullish section over the approaching months. Nevertheless, dangers nonetheless linger. US Treasury Yields are rising once more, and inflation has not stabilized, elements that might inject volatility and hesitation into threat markets.

Daan identified a constant Coinbase premium for the reason that restoration started two weeks in the past—a bullish indicator suggesting persistent spot demand, notably from US-based consumers. This premium had weakened throughout the wave of Center Jap issues, nevertheless it has since rebounded and held regular. Daan provides that that is supported by robust ETF inflows, an indication of institutional confidence.

Nonetheless, warning is warranted. If Bitcoin stalls whereas ETF inflows stay excessive, that might mark a neighborhood prime, as seen in earlier cycles. For now, so long as worth continues to observe the energy of inflows and maintains assist above $103K, the bulls stay in management. A break above $110K may open the gates to new all-time highs, whereas a lack of assist may result in a pointy correction and delay broader restoration throughout the crypto panorama.

BTC Each day Chart Evaluation: Eyes On $112K Breakout

Bitcoin continues to commerce inside a key vary between $103,600 and $109,300, consolidating slightly below its all-time excessive close to $112,000. As proven on the each day chart, BTC has held above the 50-day easy transferring common (SMA), which at the moment sits at $106,469, performing as dynamic assist throughout latest pullbacks. This means ongoing energy within the development, regardless of short-term volatility.

The chart additionally reveals that worth has examined the $109,300 resistance stage a number of occasions since March, however with no decisive breakout. Quantity throughout these retests has been comparatively muted, suggesting that bulls could also be ready for stronger affirmation earlier than committing to a sustained breakout transfer. On the draw back, $103,600 stays an important assist stage, traditionally offering a springboard for rebounds all through the final two months.

The 100-day and 200-day SMAs at $98,544 and $96,364, respectively, are nonetheless trending upward, reinforcing the long-term bullish construction. If Bitcoin can decisively shut above $109,300 on robust quantity, worth discovery may shortly observe, with $120,000 and past as potential targets. Nevertheless, failure to carry present ranges could open the door for a retest of $100K or decrease, making this range-bound section vital for the market’s subsequent route.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.