On-chain information exhibits the Bitcoin Market Worth to Realized Worth (MVRV) Ratio has shaped a cross that could be thought of a bearish sign.

Bitcoin MVRV Ratio Has Declined Beneath 200-Day SMA Not too long ago

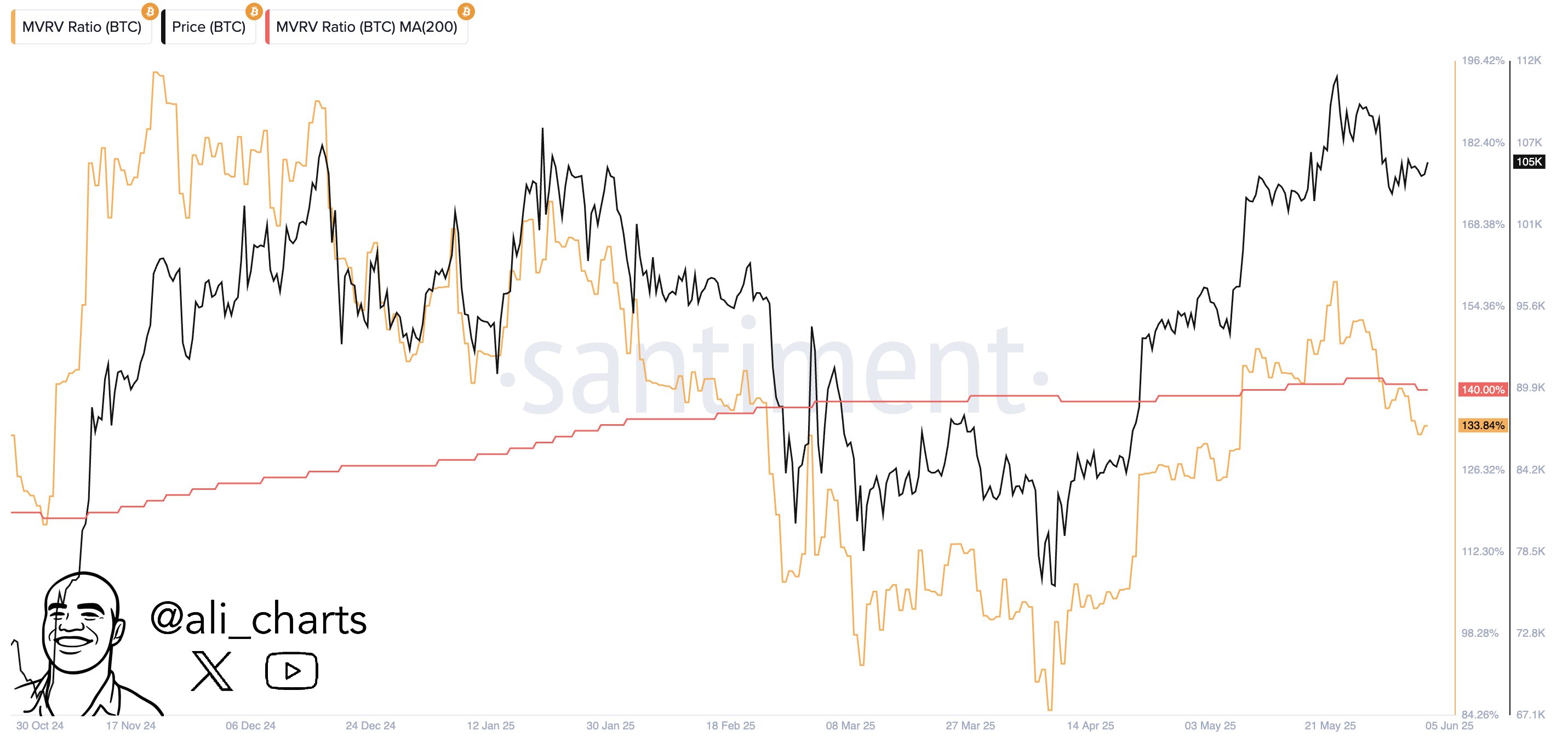

As identified by analyst Ali Martinez in a brand new put up on X, the Bitcoin MVRV Ratio has crossed beneath its 200-day easy transferring common (SMA) not too long ago. The “MVRV Ratio” refers to an on-chain indicator that measures the ratio between the BTC Market Cap and Realized Cap.

The Realized Cap here’s a capitalization mannequin for the cryptocurrency that calculates the entire worth of the asset’s provide by assuming the ‘actual’ worth of every particular person token to be equal to the spot worth at which it was final moved on the blockchain. This mannequin is completely different from the standard Market Cap, which merely takes the worth of all tokens equal to the present spot worth.

For the reason that final switch of any coin is prone to symbolize the final time it modified fingers, the worth at its time could possibly be thought of as its present value foundation. As such, the Realized Cap is only a sum of the acquisition worth of all tokens in circulation.

One method to interpret the mannequin is as a measure of the entire quantity of capital that the traders have put into Bitcoin. Alternatively, the Market Cap will be checked out as the worth the holders are carrying within the current.

For the reason that MVRV Ratio compares the 2 fashions, it principally tells us in regards to the profit-loss scenario of the traders as an entire. Beneath is the chart shared by the analyst that exhibits the development on this indicator, in addition to its 200-day SMA, over the previous 12 months.

The 2 strains appear to have gone by means of a crossover in current days | Supply: @ali_charts on X

As is seen within the graph, the Bitcoin MVRV Ratio has been notably above the 0% mark not too long ago, which suggests the traders as an entire have been sitting on important revenue.

The metric naturally went up because the asset’s rally earlier took the worth to a brand new all-time excessive (ATH) and it managed to surpass as 200-day MA. Not too long ago, nevertheless, the bearish flip within the coin has meant that the indicator has fallen again beneath the road.

The final time that the MVRV Ratio dropped beneath its 200-day SMA was in February. From the chart, it’s obvious that this crossover proved to be bearish for the cryptocurrency.

It now stays to be seen whether or not this identical sort of crossover will find yourself proving one other dangerous omen for Bitcoin or not.

BTC Value

On the time of writing, Bitcoin is buying and selling round $105,000, down 1% within the final week.

Seems to be like the worth of the coin has rebounded from its newest plunge | Supply: BTCUSDT on TradingView

Featured picture from Dall-E, Santiment.web, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our group of high know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.