Bitcoin is at present in a part of consolidation and disbelief after weeks of aggressive volatility and uncertainty. This era follows a collection of corrections and uninteresting consolidations, which frequently precede vital market strikes.

Traditionally, Bitcoin’s value motion tends to construct momentum throughout such phases, setting the stage for probably explosive progress.

Outstanding crypto analyst and investor TechDev has shared an intriguing evaluation evaluating Bitcoin’s present cycle to the Nasdaq’s historic efficiency. Based on TechDev, the parallels between BTC and the Nasdaq counsel that the crypto market might be gearing up for an thrilling upward trajectory.

As traders intently monitor these patterns, anticipation builds for the subsequent massive transfer in Bitcoin’s value. The approaching weeks might be pivotal in figuring out whether or not this consolidation part will result in one other robust rally.

Bitcoin Vs Nasdaq: Is a Macro Leg Imminent?

The Bitcoin market is at present grappling with vital uncertainty, regardless of the Federal Reserve (FED) Chairman Jerome Powell’s announcement final Friday, signaling a possible shift in coverage with an anticipated rate of interest minimize in September.

Whereas this information initially sparked optimism, the broader market stays apprehensive, reflecting the complicated dynamics at play.

Amid this uncertainty, nevertheless, some traders and analysts preserve a constructive long-term outlook for BTC. One such analyst is TechDev, who has just lately offered an intriguing evaluation evaluating Bitcoin’s present month-to-month chart to the Nasdaq’s two-month chart from 2014. At the moment, the Nasdaq was buying and selling round $12 earlier than embarking on an enormous macro bull run that ultimately reached its present ranges close to $70.

TechDev’s evaluation means that Bitcoin could also be on the cusp of an identical macro leg up, projecting a state of affairs the place Bitcoin may expertise a considerable rally, probably mirroring the Nasdaq’s historic rise. This comparability is especially compelling given the market construction and sentiment parallels between the 2 charts.

Whereas the fast market sentiment is cautious, with many merchants nonetheless cautious of potential draw back dangers, the long-term confluence indicated by TechDev’s evaluation gives a extra bullish perspective.

If Bitcoin follows a path just like the Nasdaq, it might be poised for a big upward trajectory within the coming months, defying the present market uncertainty and paving the way in which for brand new all-time highs.

BTC Worth Motion

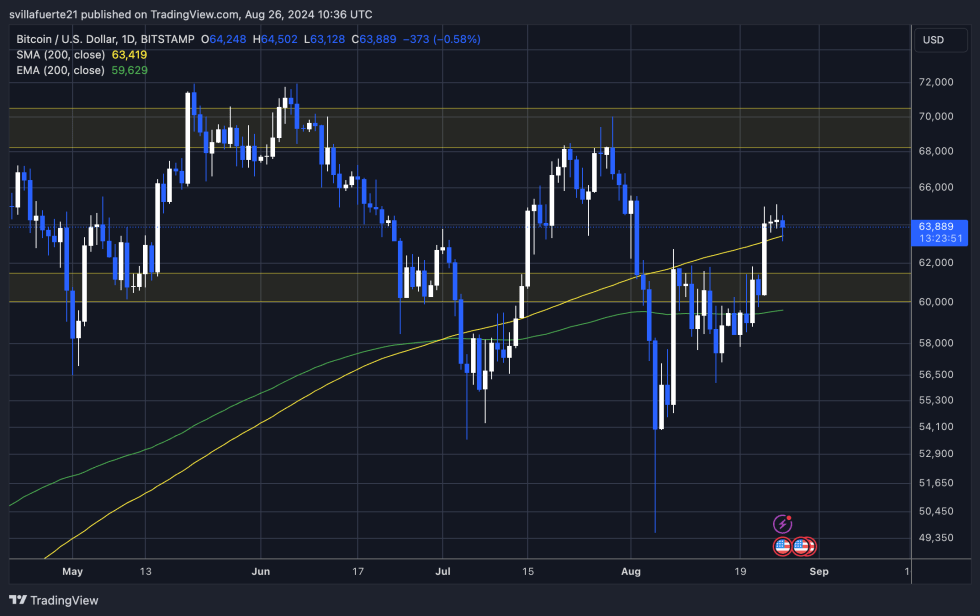

Bitcoin is buying and selling at $63,800 when writing, positioned above its each day 200 transferring common (MA) at $63,420. It is a vital improvement, as three consecutive each day candles have closed above this degree, signaling power for the bulls.

The 1D 200 MA is a important indicator for figuring out the continuation of a pattern, and holding above it means that BTC might be poised to maneuver towards greater ranges.

Nonetheless, the market isn’t with out its dangers. There’s nonetheless the chance that BTC may take a look at decrease demand round $61,300, which might nonetheless preserve the general bullish construction. Testing this degree is likely to be essential to collect momentum for the subsequent leg up, however dropping the 1D 200 MA can be regarding.

A drop under this important transferring common may point out weakening power within the present uptrend and probably sign a shift in market sentiment. Subsequently, holding above the 1D 200 MA stays important for sustaining Bitcoin’s bullish outlook.

Cowl picture from Dall-E, chart from Tradingview