Be part of Our Telegram channel to remain updated on breaking information protection

Bitcoin value has traded tightly between $90,200 and $90,700 over the past 24 hours, at the moment at $90,659 as of 12:34 a.m. EST. BTC has been holding regular above $90,000, with indecisive buying and selling between $89,000 and $94,000.

As President Donald Trump continues jarring markets with bulletins geared toward making properties extra inexpensive, the president has swiveled one more client burden by demanding that credit-card lenders cap rates of interest at 10% for a 12 months beginning January 20.

TRUMP: WILL NO LONGER LET CREDIT CARD COMPANIES TO CHARGE 20-30% INTEREST RATES

TRUMP: JAN 20 WILL CALL FOR ONE YEAR CAP OF CC INTEREST RATES TO 10%

— *Walter Bloomberg (@DeItaone) January 10, 2026

“Efficient January 20, 2026, I, as President of america, am calling for a one-year cap on Credit score Card Curiosity Charges of 10%,” Trump wrote on Fact Social, with out offering extra particulars.

Trump had earlier made this pledge through the 2024 marketing campaign, which he received.

“Please be told that we’ll now not let the American Public be ’ripped off’ by Credit score Card Corporations,” Trump added.

The cap would primarily have an effect on banks that challenge playing cards, reminiscent of JPMorgan Chase, Citigroup, and Capital One Monetary, by limiting their curiosity income. This will result in a problem in court docket, because it harms credit score entry and violates market rules.

Then again, BTC’s value beforehand peaked at $126,000 in early October however later confronted downward stress amid international monetary uncertainty. Can the Bitcoin value nonetheless get better to beat the $94,000 barrier?

Bitcoin Worth Evaluation: Technicals Assist A Rally In The Quick Time period

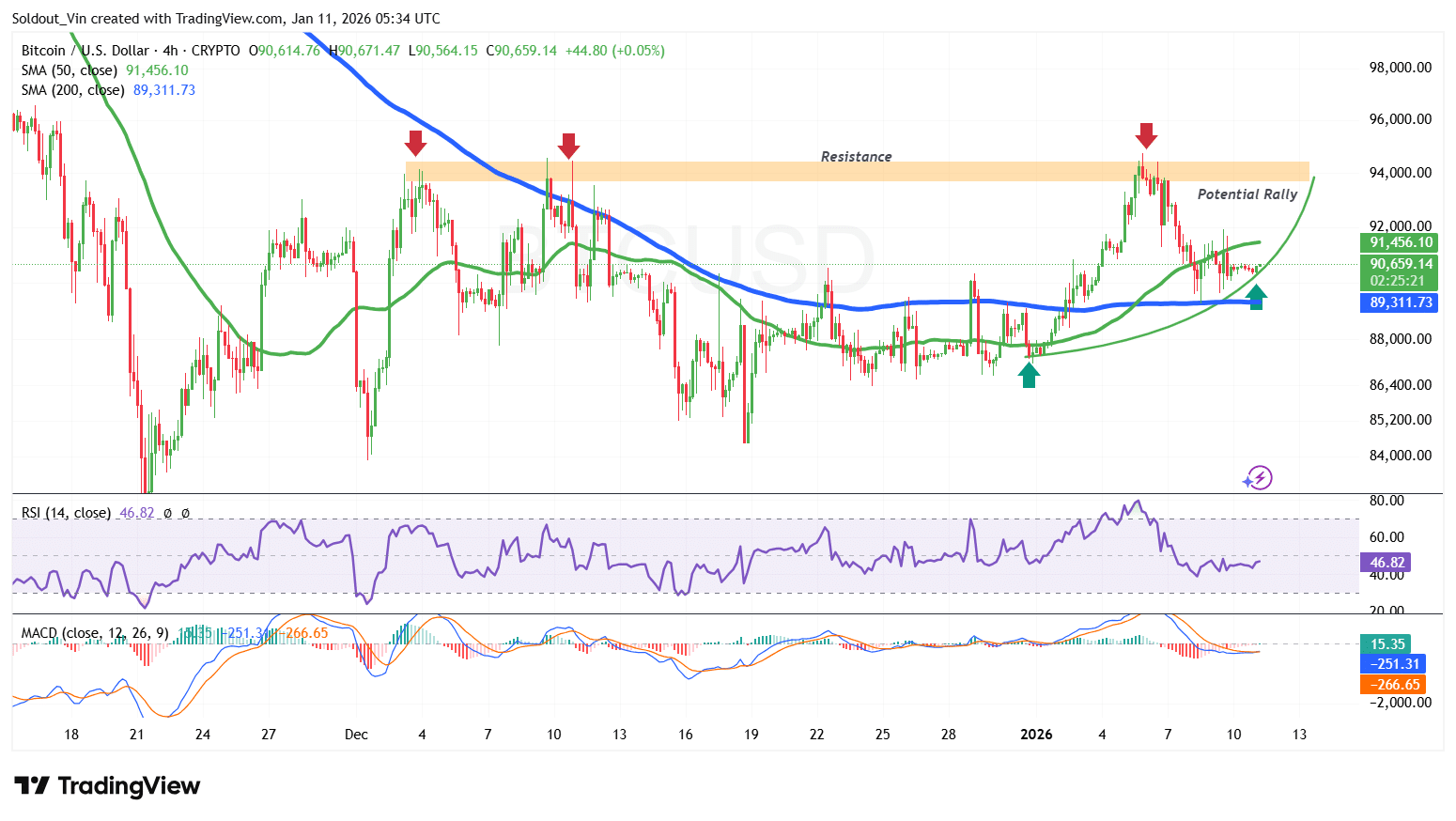

Based on the BTC/USD chart evaluation on the 4-hour chart, the BTC value is at the moment dealing with extended resistance on the $94,000 stage, with historic development actions suggesting an incoming rally.

Technicals are additionally supporting a surge, with Bitcoin buying and selling nicely above the 200-day Easy Transferring Common (SMA) ($89,311) and the shifting averages forming a golden cross round $89,271. The 50-day SMA at $91,456 serves as the subsequent overhead resistance, placing BTC underneath short-term stress.

In the meantime, the Bitcoin Relative Energy Index reveals a second of indecision, buying and selling across the impartial 46 stage, as the value continues to commerce throughout the $90,000 vary from January 7.

Nonetheless, the Transferring Common Convergence Divergence (MACD) has turned constructive, with the blue MACD line crossing above the orange sign line.

Because the technicals flip constructive, Bitcoin may surge above the 50-day SMA, with the value heading towards the $94,000 resistance space.

On the draw back, a drop under $89,000 may set off a downtrend, probably pushing Bitcoin to the $87,200 assist.

Associated Information:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection