Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value surged 4% previously 24 hours to commerce at $110,959 as of three:49 a.m. EST on buying and selling quantity that skyrocketed 120% to $60.1 billion.

That rise within the BTC value comes as Michael Saylor says that Bitcoin treasury firms like Technique can convert $100 million into BTC virtually instantaneously. He additionally lately hinted at one other Technique Bitcoin purchase.

Crucial orange dot is all the time the following. pic.twitter.com/N5GQOdqr6y

— Michael Saylor (@saylor) October 19, 2025

In an interview on the Market Disrupters podcast on Saturday, Saylor stated that Bitcoin’s funding cycle is a thousand occasions sooner than that of expertise, actual property, oil, fuel, or “anything you’ve ever seen earlier than in your life.”

Technique is the biggest company BTC holder, with 640,250 cash on its stability sheet. Its holdings within the crypto now accounts for practically 2.5% of the BTC’s whole provide.

Saylor’s remarks and his trace of one other Technique purchase come as Bitcoin managed to rise again above $110,000 earlier right now. This rise coincided with a broader crypto market rebound as merchants appear to be regaining confidence amid charge minimize hopes.

With the US-China tariff warfare nonetheless a threat, can the value of BTC proceed hovering, or will it retrace again?

Bitcoin Worth Eyes New Highs As Uptrend Stays Intact

The BTC value continues to indicate resilience after a short pullback from the $120,000 space, sustaining its long-term bullish trajectory.

Following a profitable rebound close to the $100,000 assist zone, the Bitcoin value now trades round $110,959, signaling renewed bullish curiosity inside a well-established uptrend.

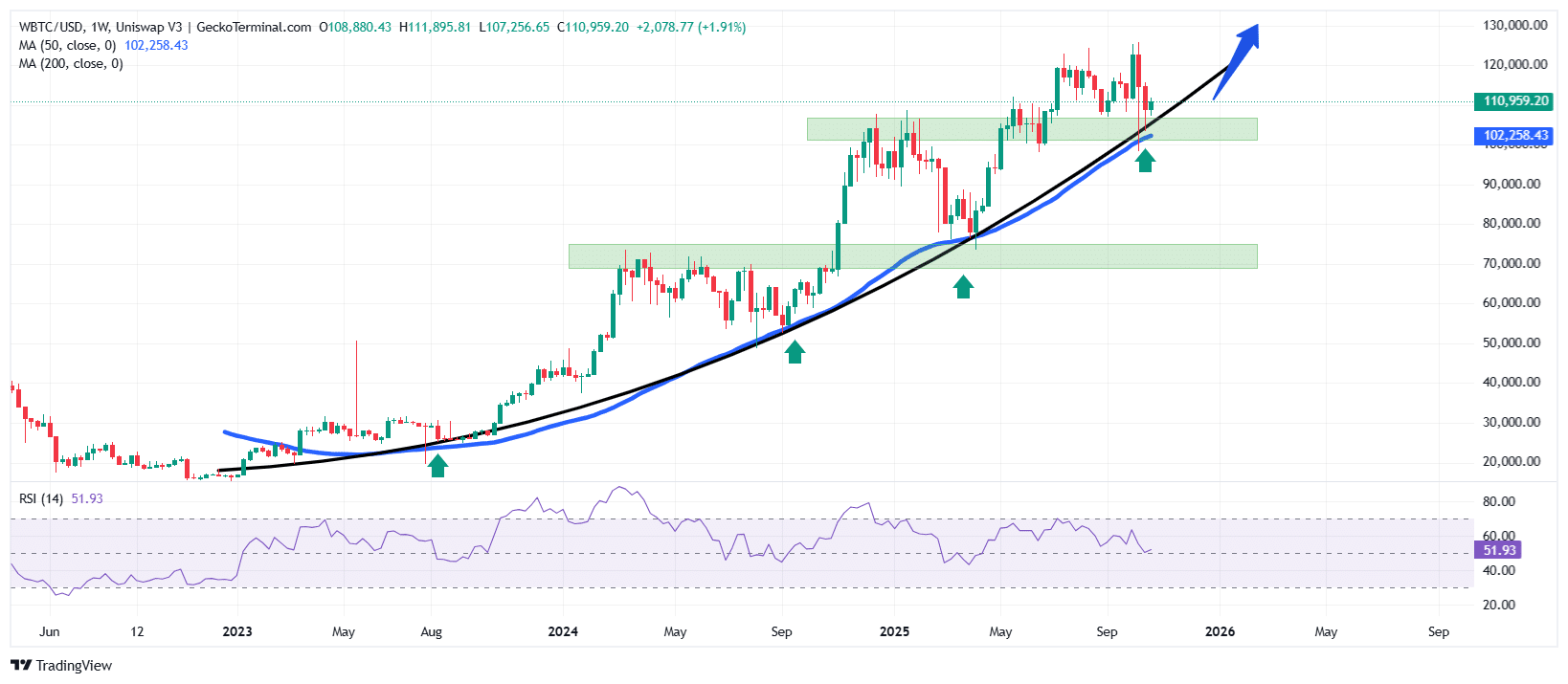

On the weekly timeframe, the value of BTC has been respecting its parabolic curve since mid-2023, with a number of rebounds (indicated by inexperienced arrows) confirming sturdy market demand on dips. Every retest of this sustained assist has produced larger lows, showcasing the market’s constant bullish construction.

At the moment, the 50 Easy Transferring Common (SMA) on the weekly chart is at $102,258 and trending upward, whereas the value of Bitcoin stays properly above it. This positioning of the asset’s value reinforces the continuing bullish momentum, indicating that medium- and long-term traders proceed to favor accumulation over distribution.

Moreover, key horizontal demand zones round $70,000–$75,000 and $95,000–$100,000 have performed essential roles in stabilizing the value throughout latest corrections. The newest bounce from this higher assist space means that patrons are defending it aggressively, conserving the general construction intact.

Weekly chart for WBTC/USD (Supply: TradingView)

In the meantime, the Relative Energy Index (RSI) sits round 51.93, which signifies that Bitcoin goes by means of a interval of consolidation throughout the broader uptrend. This impartial studying means that neither patrons nor sellers presently dominate, usually a precursor to a powerful continuation transfer.

Bitcoin Worth Prediction: $130,000 In Sight As Bulls Exert Stress

Given the construction of the chart, the general pattern stays bullish, with larger highs and better lows forming constantly since early 2023. If the Bitcoin value maintains assist above $102,000, it might quickly try to interrupt by means of resistance close to $115,000, opening the trail towards $130,000.

Conversely, if promoting stress intensifies and the value of Bitcoin falls beneath $100,000, the following main assist zone lies on the $90,000 degree, a previous demand zone.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection