Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value has surged 7% within the final 24 hours to commerce at $92,844 as of 5:56 a.m. EST on a 21% enhance in day by day buying and selling quantity to $86.22 billion.

That BTC value surge began quickly after Vanguard reversed its lengthy‑standing ban on buying and selling Bitcoin ETFs on its platform, opening the door for thousands and thousands of conservative, lengthy‑time period buyers to realize simple publicity to the main crypto.

Bloomberg ETF analyst Eric Balchunas referred to the transfer because the “Vanguard Impact,” noting that Bitcoin jumped round 6% instantly after the US market open on the primary day Vanguard purchasers may commerce Bitcoin ETFs.

THE VANGUARD EFFECT: Bitcoin jumps 6% proper round US open on first day after bitcoin ETF ban lifted. Coincidence? I feel not. Additionally $1b in IBIT quantity in first 30min of buying and selling. I knew these Vanguardians had a little bit degen in them, even among the most conservative buyers… pic.twitter.com/OKyihvEqqD

— Eric Balchunas (@EricBalchunas) December 2, 2025

Balchunas additionally highlighted that BlackRock’s IBIT spot Bitcoin ETF noticed round $1 billion in buying and selling quantity inside the first half-hour of that session.

Bitcoin Value Boosted By ETF Demand

ETF circulation information from Farside Buyers reveals that US spot Bitcoin funds have flipped again into web inflows. That is after a tough November, when redemptions exceeded $4.3 billion. Current day by day prints present cash returning to key merchandise like IBIT and FBTC.

Pushing the operating whole of web creations larger once more and hinting that the worst of the promoting strain could also be over for now. Analysts be aware that even modest optimistic flows can have an outsized affect on the Bitcoin value. It is because spot ETFs should purchase precise Bitcoin available in the market, eradicating provide at a time when new issuance is already restricted after earlier halving occasions.

If the present multi‑day influx streak continues, particularly with Vanguard accounts now in a position to entry these funds, it may act as a gradual bid below the market and assist any makes an attempt by BTC to reclaim the $100,000 area.

Bitcoin On‑Chain Indicators Present Therapeutic

On‑chain information suppliers reveals that the newest market crash drove a considerable amount of quick‑time period speculative cash into loss. Nevertheless, lengthy‑time period holders principally stayed put. This means that the selloff was extra about leverage and weak arms than a change in lengthy‑time period conviction.

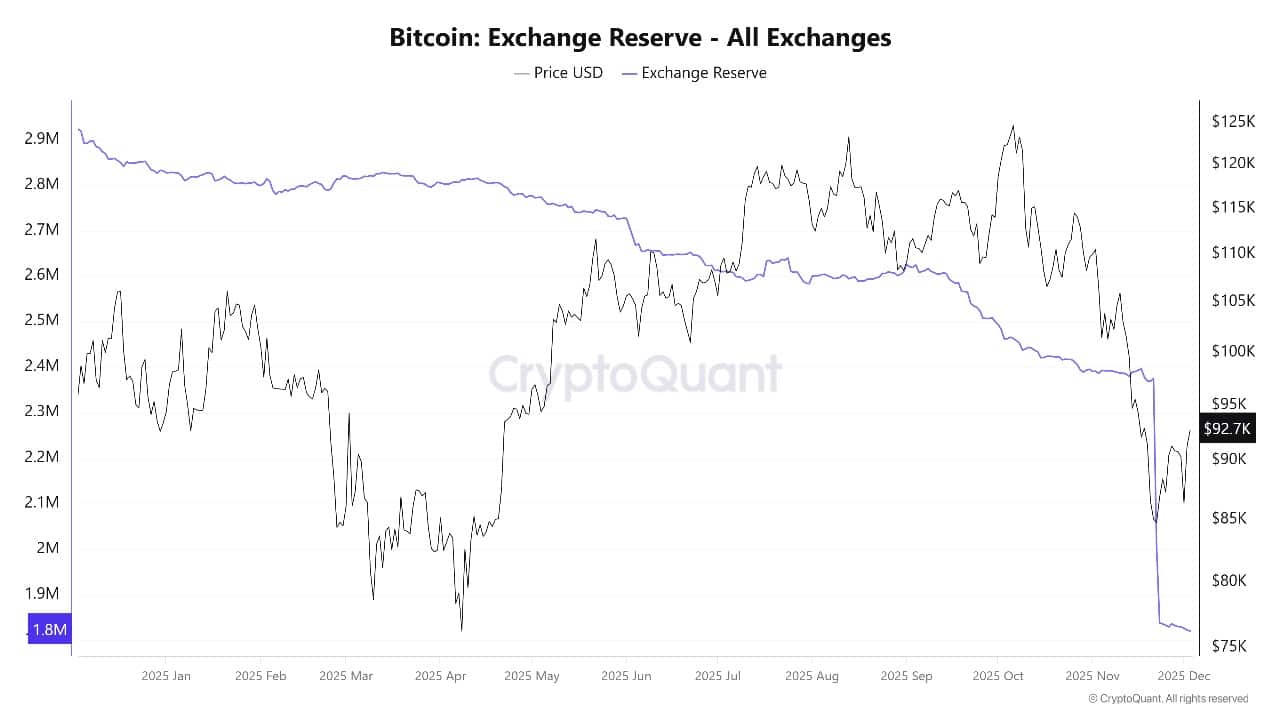

Trade balances have began to tick decrease once more in addition to cash transfer again into chilly storage, which normally alerts renewed accumulation slightly than ongoing panic promoting.

Bitcoin Trade Reserve (All Exchanges) Supply: CryptoQuant

Bitcoin Value Prediction: Key Ranges To Watch

The day by day chart reveals Bitcoin rebounding from a current low close to $80,000, with the value now buying and selling round $92,800 and attempting to push again above a descending resistance line that began from the November prime.

The 50‑day easy transferring common (SMA) sits simply above $100,000, whereas the 200‑day SMA is larger close to $110,000, making a technical zone that bulls must reclaim to substantiate that the broader uptrend is again in full management.

The RSI is recovering from oversold territory towards the mid‑40s to low‑50s space. In the meantime, the MACD is attempting to show upward from detrimental values, and the ADX across the excessive‑30s reveals the current downtrend was robust however might now be dropping steam.

BTCUSD Evaluation Supply: Tradingview

If consumers can push BTC above the downward sloping inexperienced resistance channel proven on the chart, the subsequent upside targets sit close to $109,500 (across the 200‑day SMA) after which the prior vary highs round $126,000, which match the higher inexperienced pattern line.

On the draw back, fast assist is discovered slightly below $90,000 alongside the mid‑channel line, with stronger assist nearer to $74,000.

A transparent break under that decrease inexperienced assist band on the chart would warn that the current bounce has failed and open the door to a deeper correction earlier than bulls strive once more.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection