Binance founder Changpeng Zhao’s blunt reminder about shopping for low and promoting excessive landed at a tense time for crypto merchants. His line — “Promote when there may be most greed, and purchase when there may be most concern” — was posted as markets confirmed recent indicators of pressure and debate over whether or not now’s a shopping for second or one other stall.

Associated Studying

CZ’s Message Meets Excessive Concern

In line with the Crypto Concern & Greed Index, sentiment not too long ago climbed to twenty, shifting out of “Excessive Concern” after a streak of low readings. The index had hit a yearly low of 10 on Nov. 22 and the market had spent eighteen days caught in excessive concern.

Unpopular opinion, however it’s higher to promote when there may be most greed, and purchase when there may be most concern. 🤷♂️

— CZ 🔶 BNB (@cz_binance) November 29, 2025

Analysts referred to as that stretch unusually deep. Matthew Hyland described it because the “most excessive concern degree” of the cycle, and different merchants argued that calling it excessive was being beneficiant.

Bitcoin Holds However Temper Is Fragile

Based mostly on experiences, Bitcoin was buying and selling at $91,780, a far cry from the all-time excessive of $126,000 reached in October. Costs stay up from 2024 lows of simply over $40,000, but confidence is skinny.

Santiment tracked on-line chatter and located talks centered extra on volatility and institutional strikes than on pleasure. The Altcoin Season Index sat at 22/100, a transparent signal that merchants are favoring security.

Market Psychology Overrules Charts

Merchants reacted quick to CZ’s publish. One person stated emotion typically beats logic in actual buying and selling. One other famous that markets have a tendency to maneuver on psychology nicely earlier than technical alerts line up. That hole between what merchants know and what they do was on full show: many agree with the rule, and few really comply with it when costs slip.

Historical past Presents A Trace, Not A Assure

Studies have disclosed that some analysts see a sample. Nicola Duke identified that within the final 5 years, each time the market reached excessive concern, Bitcoin discovered an area backside inside weeks.

Whereas previous stretches can supply context, they don’t promise the identical outcome now. Bitwise researcher André Dragosch warned that present pricing displays a recession-level international development outlook — probably the most bearish setting since 2020 and 2022 — which raises actual danger for consumers.

Associated Studying

Bitcoin Coinbase Premium Turns Constructive After 29 Days

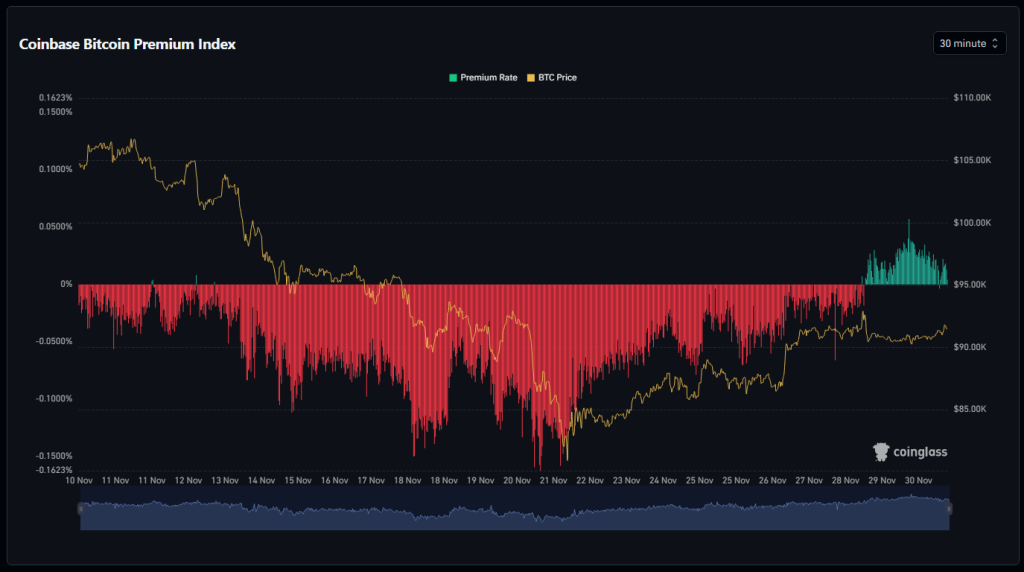

In the meantime, the Bitcoin (BTC) Coinbase premium lastly flipped again into constructive after practically a month of staying within the crimson.

Information from Coinglass on the thirtieth confirmed the premium at 0.0255%, marking the primary constructive studying in 29 days. For nearly a month, the detrimental premium had advised that promoting stress dominated the US market, with merchants and traders leaning towards warning.

The Coinbase premium tracks how Bitcoin’s worth on Coinbase, a significant US alternate, compares to the worldwide common. When it’s constructive, it means the US worth is above the worldwide common.

That is typically seen as an indication that purchasing is selecting up within the US, extra establishments are getting concerned, greenback liquidity is recovering, and general investor confidence is enhancing.

Featured picture from Gemini, chart from TradingView