Ethereum is buying and selling at vital worth ranges after a pointy 10% decline from the $4,750 mark, reflecting rising uncertainty throughout the broader crypto market. The latest correction has pushed ETH towards the $4,300 help zone, a stage that bulls are actually fiercely defending to forestall a deeper retracement. Regardless of the pullback, on-chain knowledge suggests that giant holders stay assured, signaling that this dip could also be a part of a wholesome market reset relatively than the beginning of a downtrend.

Associated Studying

In line with latest knowledge, Bitmine continues its aggressive accumulation of ETH, including to its holdings whilst costs fluctuate. This regular influx from institutional gamers highlights robust conviction in Ethereum’s long-term fundamentals, notably because the community maintains dominance in DeFi and good contract exercise.

Nonetheless, sentiment amongst retail merchants stays combined. Some concern that sustained weak spot beneath $4,300 might set off one other wave of promoting stress, whereas others see this as a possible accumulation alternative earlier than the following main transfer. As Ethereum stabilizes at these ranges, the approaching days shall be essential to find out whether or not the market resumes its bullish momentum or enters a protracted consolidation section amid heightened volatility.

Ethereum Accumulation Continues As Bitmine Strengthens Its Place

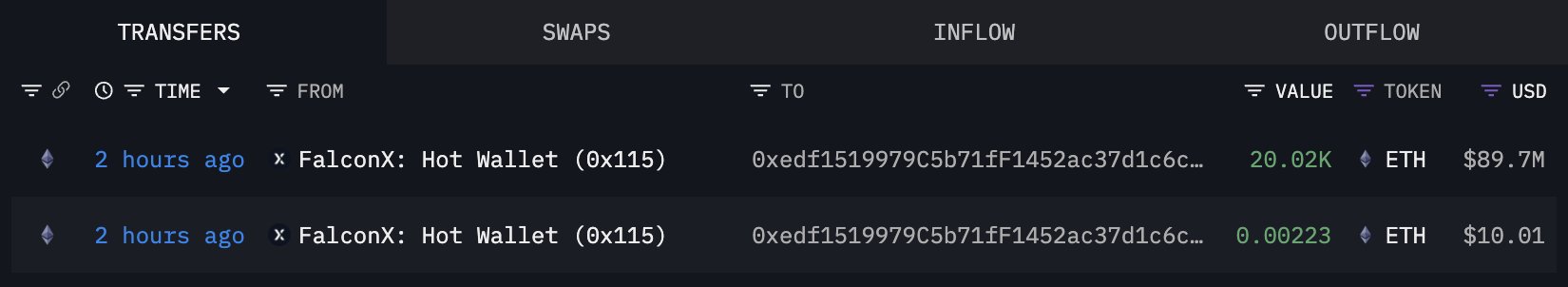

In line with knowledge shared by Lookonchain, institutional accumulation round Ethereum stays robust regardless of latest market volatility. Only a few hours in the past, Bitmine obtained one other 23,823 ETH (value $103.68 million) from BitGo, marking one more vital influx of capital. This transfer comes solely two days after Bitmine acquired 20,020 ETH ($89.7 million) by way of FalconX, underscoring their constant technique of constructing publicity throughout worth dips relatively than chasing rallies.

Such accumulation patterns are sometimes seen as an indication of confidence in Ethereum’s long-term fundamentals, notably from institutional traders who view ETH as a core asset inside the broader digital economic system. Whereas short-term sentiment stays cautious after the latest correction, these inflows counsel that good cash continues to see worth round present costs.

The approaching days shall be vital for Ethereum’s technical construction. Bulls should defend the $4,300 help zone to keep up momentum and arrange a possible restoration towards the $4,600–$4,750 resistance space. A robust protection right here might pave the way in which for a brand new all-time excessive, confirming renewed investor confidence and establishing $4,300 as a key accumulation stage.

Associated Studying

Bulls Defend $4,300 Help

Ethereum (ETH) is presently buying and selling close to $4,325, displaying indicators of consolidation after a ten% decline from its latest excessive of $4,750. The 12-hour chart reveals that ETH has fallen beneath the 50-day transferring common (blue line), signaling short-term weak spot, whereas the 100-day (inexperienced) and 200-day (pink) transferring averages are nonetheless trending upward — an indication that the broader uptrend stays intact.

The $4,300 stage now acts as a key help zone, with bulls making an attempt to determine a base and forestall additional draw back stress. If this stage holds, the following goal can be a retest of $4,500–$4,600, the place sellers are more likely to reappear. Nevertheless, a break beneath $4,250 might expose Ethereum to a deeper pullback towards the $4,000 psychological stage, an space that beforehand served as a robust accumulation zone in late September.

Associated Studying

Momentum indicators counsel that promoting stress is easing, aligning with the latest on-chain knowledge displaying continued accumulation from massive entities resembling Bitmine. This reinforces the concept institutional confidence stays robust, even amid volatility. For now, holding above $4,300 is vital — a profitable protection might mark the inspiration for Ethereum’s subsequent push towards new highs.

Featured picture from ChatGPT, chart from TradingView.com