Key Takeaways:

BlackRock’s iShares Bitcoin Belief (IBIT) now holds over 3.25% of all Bitcoin in circulation, making it the single-largest holder amongst spot ETFs globally.IBIT has absorbed over $69.7 billion value of BTC, dominating over 54.7% of the US spot Bitcoin ETF market.Institutional accumulation is rising sharply, whereas retail participation slows, signaling a shift in Bitcoin market dynamics.

BlackRock’s embrace of crypto has advanced from a symbolic second to a market-moving pressure. A Bitcoin ETF began by the asset administration large simply over a 12 months in the past has hit a historic milestone: over 3.25% of the mounted 21 million provide of Bitcoin. Nonetheless, there’s a story behind the figures: it issues a flip of the stability of energy, altered funding developments and the rising affect of classical finance within the crypto world.

The Numbers Behind BlackRock’s Bitcoin Play

IBIT’s Fast Accumulation and Market Share

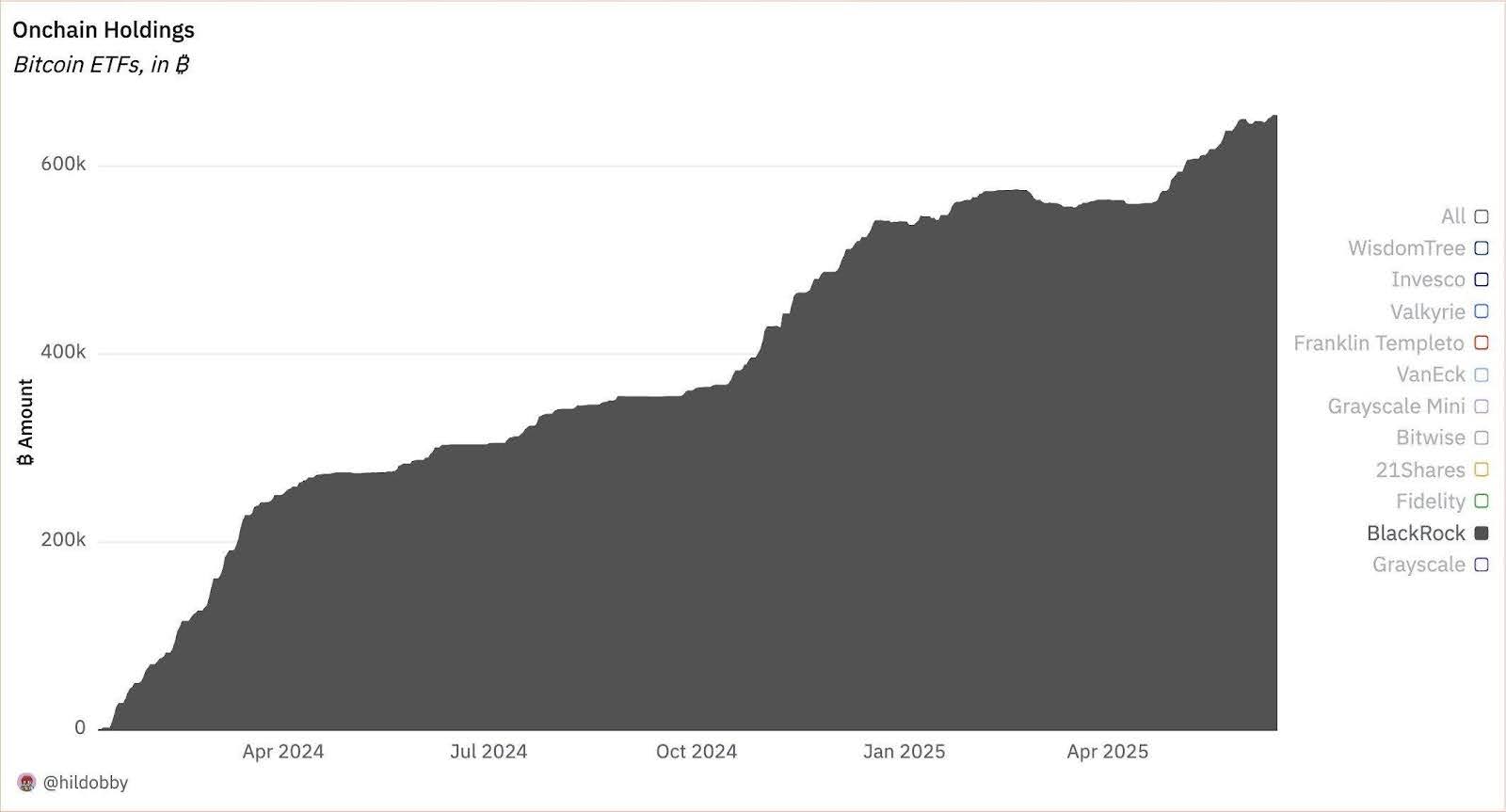

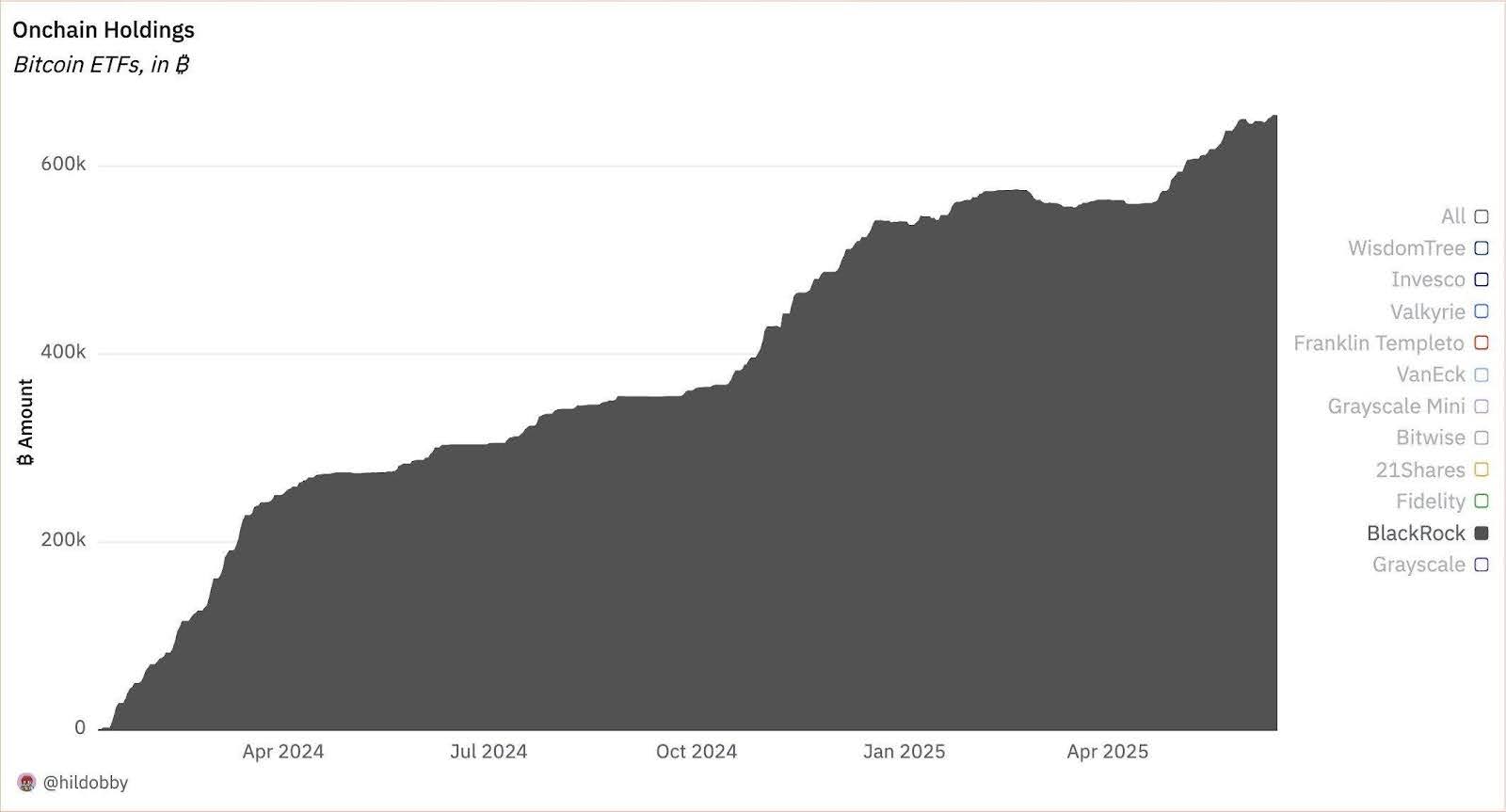

By the center of June, 2025, BlackRock, which takes over the iShares Bitcoin Belief (IBIT) affords, is allegedly sitting on in extra of three.25 p.c of the combination variety of Bitcoins, a quantity over 682,500 BTC, the worth of which equates round $69.7 billion.

The ETF already instructions over a half (54.7%) of the US spot Bitcoin ETF market, and has left Constancy’s FBTC and ARK 21Shares in its mud. After the spot Bitcoin ETFs had been accepted by the USA Securities and Change Fee in January 2024, BlackRock has been on an aggressive purchase spree, main different funds in day by day web inflows.

To place the size in perspective:

3.25% of 21 million BTC is a big holding for a single regulated funding product.That locations IBIT among the many prime 25 ETFs on this planet by belongings, in contrast with legacy funds that observe the S&P 500 index and a world bond index.

The velocity is as putting as the quantity. IBIT was in a position to cowl that sum in lower than 18 months and there have been no indicators of liquidation and outflows. BlackRock has additionally not offered any BTC since June 2024 in accordance with analysts, indicating that it holds a robust long-term bullish sentiment.

Learn Extra: BlackRock Information for Digital Shares in $150 Million Cash Market Fund to Use Blockchain Tech

Provide Shock and Bitcoin’s Subsequent Part

The Position of ETFs in Decreasing Liquid Provide

One among Bitcoin’s defining options is its mounted provide of 21 million cash. Estimates counsel that as much as 20% of BTC could already be misplaced or locked in long-term holdings. With IBIT’s 3.25% share, and all US Bitcoin ETFs mixed holding 6.12%, greater than 1.28 million BTC is now tied up in regulated autos.

This tendency has a critical implication by way of liquidity:

ETFs are black holes to Bitcoin – as soon as an asset is sucked into it, it’s not often traded within the spot markets.This limits the availability resulting in the potential value stress when the demand is excessive.The provision squeeze, attributable to the ETF, is all of the extra pronounced when connected to the slowdown within the printing of Bitcoin that’s occasioned by halving occasions, a slowdown that takes place after each 4 years.

IBIT’s constant accumulation, alongside eight straight days of web inflows in June totaling $388 million, reveals no signal of slowing. This implies that institutional demand may change into a structural function of the market, not only a momentary narrative.

Learn Extra: BlackRock Engages Anchorage Digital to Improve Crypto Custody and Tokenized Asset Infrastructure

The ETF Shift: What’s Totally different in Bitcoin’s Market Now

Bitcoin Turns into an Asset Class

Mainstream finance had typically dismissed Bitcoin for greater than a decade. Now, it’s uneventfully making its means into the strategic asset allocation of a few of the world’s most conservative traders.

BlackRock’s motion isn’t just in regards to the crypto hype. It’s half of a bigger shift:

Pension funds, sovereign wealth funds and endowments gaining publicity to Bitcoin by way of regulated ETFs.BlackRock model is legit and likewise a supply of belief particularly to advisors who could purchase shoppers with risk-averse behaviors.

As this pattern strengthens, anticipate the next:

Extra merchandise with related construction to IBIT with a possible concentrate on going after multi-asset publicity with BTC within the middle.The market matures and its volatility within the long-term horizons turns into decreased underneath the stewardship of establishments.Fewer speculative bubbles pushed by retail FOMO (concern of lacking out), and extra value motion formed by macroeconomic components and fund flows.