Be a part of Our Telegram channel to remain updated on breaking information protection

BlackRock’s spot Bitcoin ETF (exchange-traded fund) IBIT is exhibiting “utopia-esque” returns even after the $19 billion crypto market flash crash.

That’s in keeping with Bloomberg Intelligence ETF analyst Eric Balchunas, who famous the fund has surged 76% up to now yr regardless of the latest droop. It’s additionally up 37% up to now six months.

Based on knowledge from Google Finance, IBIT’s worth fell over 3% on Oct. 10 and one other 3% in after-hours buying and selling in response to US President Donald Trump saying further tariffs of 100% on China’s exports.

IBIT worth (Supply: Google Finance)

Traders Ought to “Zoom Out” To See IBIT’s True Efficiency

IBIT is designed to trace the value of the main crypto, Bitcoin (BTC), whereas additionally offering traders with a regulated method to purchase the digital asset.

Commenting on IBIT’s efficiency since its inception final yr, Balchunas mentioned that the fund has proven stellar returns.

He criticized traders for the entire “angst and whining” across the ETF’s efficiency following the newest crypto market correction that worn out over $19 billion in trades in a matter of hours.

Throughout that correction, Bitcoin plummeted under the $120K mark and trades at $111,338.31 as of 12:32 a.m. EST, CoinMarketCap knowledge reveals. Like IBIT, BTC is up greater than 77% over the previous yr.

$IBIT’s one yr return continues to be 84% after the pullback. A lot angst and whining for what’s utopia-esque returns. Every day worth charts are the media’s finest pal however an investor’s worst enemy. Zoom out. pic.twitter.com/YH6xqUKux8

— Eric Balchunas (@EricBalchunas) October 11, 2025

“Every day charts are the media’s finest pal however an investor’s worst enemy,” Balchunas mentioned, earlier than telling his over 370.8K followers to “zoom out” once they have a look at the fund’s efficiency as a way to see the larger image.

IBIT was closing on $100 billion in property below administration milestone earlier than the flash crash with about $99.5 billion in funds.

“It’s nonetheless inevitable milestone imo however wild simply how shut it received,” Balchunas wrote. “Two steps ahead, one step again in impact.”

IBIT Pulls In Capital As Different US Spot Bitcoin ETFs Bled On Friday

IBIT has been the spot Bitcoin ETF of selection for US traders, and has seen the vast majority of cumulative inflows because the funds hit the market final yr.

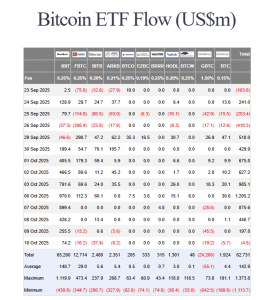

Information from Farside Traders reveals that IBIT has seen $65.260 billion in cumulative inflows as of Oct. 10, with Bitcoin’s appreciation including about $34 billion to the ETF’s AUM. The subsequent-biggest is Constancy’s FBTC, which has seen $12.714 billion in cumulative inflows.

US spot Bitcoin ETF flows (Supply: Farside Traders)

IBIT can also be on a nine-day influx’s streak. That is after the funding product pulled in one other $74.2 million on Friday, whereas the opposite funds both recorded outflows or no new flows on the day.

Since Sept. 30, IBIT has seen over $4.4 billion added to its reserves. Its finest day throughout this era was on Oct. 6, when traders added $970 million to the product’s reserves.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection