Be a part of Our Telegram channel to remain updated on breaking information protection

The extended outflows streak for spot Bitcoin and spot Ethereum ETFs (exchange-traded funds) is a sign that institutional buyers have disengaged with the crypto house, in response to the analytics platform Glassnode.

In an X publish, the platform stated that the 30-day Easy Transferring Common (SMA) of internet inflows for each the BTC and ETH merchandise have turned and remained adverse since early November.

“This persistence suggests a part of muted participation and partial disengagement from institutional allocators, reinforcing the broader liquidity contraction throughout the crypto market,” Glassnode added.

BlackRock’s Spot Bitcoin ETF Manages To Document Some Inflows Amid The Streak

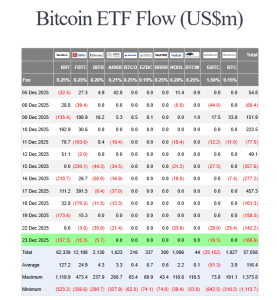

US spot Bitcoin ETFs are actually on a 4-day adverse flows streak, in response to information from Farside Traders. That is after buyers pulled one other $188.6 million from the merchandise within the newest buying and selling session.

US Spot BTC ETF flows (Supply: Farside Traders)

Amid the continued internet outflows for spot Bitcoin ETFs within the US, BlackRock’s product (IBIT) has managed to file some inflows. Whereas the fund suffered $157.3 million and $173.6 million outflows yesterday and on Dec. 19, respectively, it did see capital enter its reserves on Dec. 18, when the streak began, and on Dec. 22.

Traders added $32.8 million to IBIT on Dec. 18, and one other $6 million on Dec. 22.

The one different internet inflows recorded throughout the newest outflows streak got here from Constancy’s FBTC. On Dec. 19, buyers injected $15.3 million into the fund.

Ethereum ETFs Proceed Their Outflows After Ending Multi-Day Streak

Whereas spot BTC ETFs prolong their adverse flows streak to 4 days, the ETH ETFs have seen recent outflows after managing to interrupt a multi-day streak at the beginning of the week.

Throughout yesterday’s buying and selling session, buyers withdrew $95.5 million from the merchandise, Farside Investor information exhibits.

Ethereum ETF Circulate (US$ million) – 2025-12-23

TOTAL NET FLOW: -95.5

ETHA: -25FETH: 0ETHW: -14TETH: 0ETHV: 0QETH: 0EZET: -5.6ETHE: -50.9ETH: 0

For all the info & disclaimers go to:https://t.co/FppgUwAthD

— Farside Traders (@FarsideUK) December 24, 2025

A day earlier than that, the funds noticed internet each day inflows of $84.6 million, which had introduced an finish to what was a tough interval for the merchandise.

Earlier than that capital injection, the US spot ETH ETFs had been in an outflows streak that began on Dec. 11 and ended on Dec. 19. Throughout this era, $705.6 million left the funds, with a lot of those outflows coming from BlackRock’s ETHA product.

BlackRock Says Its Bitcoin ETF Was A Main Funding Theme In 2025

Whereas Glassnode says that the continuing outflows from spot BTC and ETH ETFs is indicative of an institutional retreat from crypto, different analysts have stated that BlackRock doesn’t appear fazed by the present market hunch.

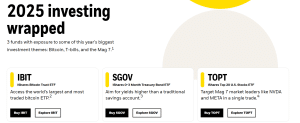

That’s after the asset administration large highlighted its spot Bitcoin ETF as certainly one of its three-biggest funding themes in 2025, alongside Treasury payments and the biggest US tech shares.

BlackRock lists its greatest funding themes in 2025 (Supply: iShares)

Nate Geraci, the president of NovaDius Wealth Administration, stated on X that BlackRock selecting IBIT as a serious funding theme suggests the agency is just not too involved about BTC’s greater than 30% drop from its all-time excessive.

Bloomberg ETF analyst Eric Balchunas echoed the same sentiment. He posed the query of how nicely IBIT might carry out in “ yr,” noting that the fund noticed $25 billion in year-to-date flows even whereas posting a adverse return for the yr.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection