Key Takeaways:

CleanSpark’s working effectivity noticed it add 6% extra Bitcoin to its stash in March.CleanSpark stays in a wholesome monetary state of affairs and has centered on Bitcoin regardless of inventory headwinds.The 4 strategic expansions it has finished in as many states replicate the corporate’s plans for future progress on this aggressive panorama.

One of many extra notable figures within the Bitcoin mining trade, CleanSpark, has urged a serious enlargement of its Bitcoin treasury. Their newest report reveals the corporate’s holdings elevated by about 6% in March. Whereas the inventory market presents challenges for Bitcoin miners, CleanSpark continues to methodically develop its Bitcoin place. This regular accumulation technique underscores CleanSpark’s confidence in Bitcoin’s long-term worth and resilience regardless of market volatility.

Mining Efficiency — Let’s Deep Dive

In February, CleanSpark mined 624 Bitcoins. With the Bitcoin worth at round $89,000 on the time of publication, that haul was value greater than $55.6 million. Much more impressively, they did so in February, a shorter month. Such output displays the corporate’s dedication to operational efficiency and mining experience. By sustaining excessive manufacturing ranges even throughout shorter months, CleanSpark showcases its skill to optimize mining operations effectively.

Considered one of CleanSpark’s major aspects is effectivity. Their common fleet effectivity was 17.07J/Th (Joules per Terahash) and peak effectivity was 16.82J/Th. Miners are notably on this metric. A extremely environment friendly mining fleet not solely reduces operational prices but in addition enhances profitability, making CleanSpark a powerful competitor within the trade. A decrease J/Th means extra power environment friendly and saves cash, leading to larger income. This makes them uniquely positioned in a area the place power utilization is a vital focus level.

Treasury Administration: A Lengthy-Time period Strategy

CleanSpark just isn’t solely actively mining and managing its Bitcoin holdings, but in addition strategically managing its treasury. In February, CleanSpark disposed of minuscule quantities from its Bitcoin — solely 2.73 BTC, at a mean worth north of $95,000 per BTC. Most of that mined Bitcoin went into their company treasury.

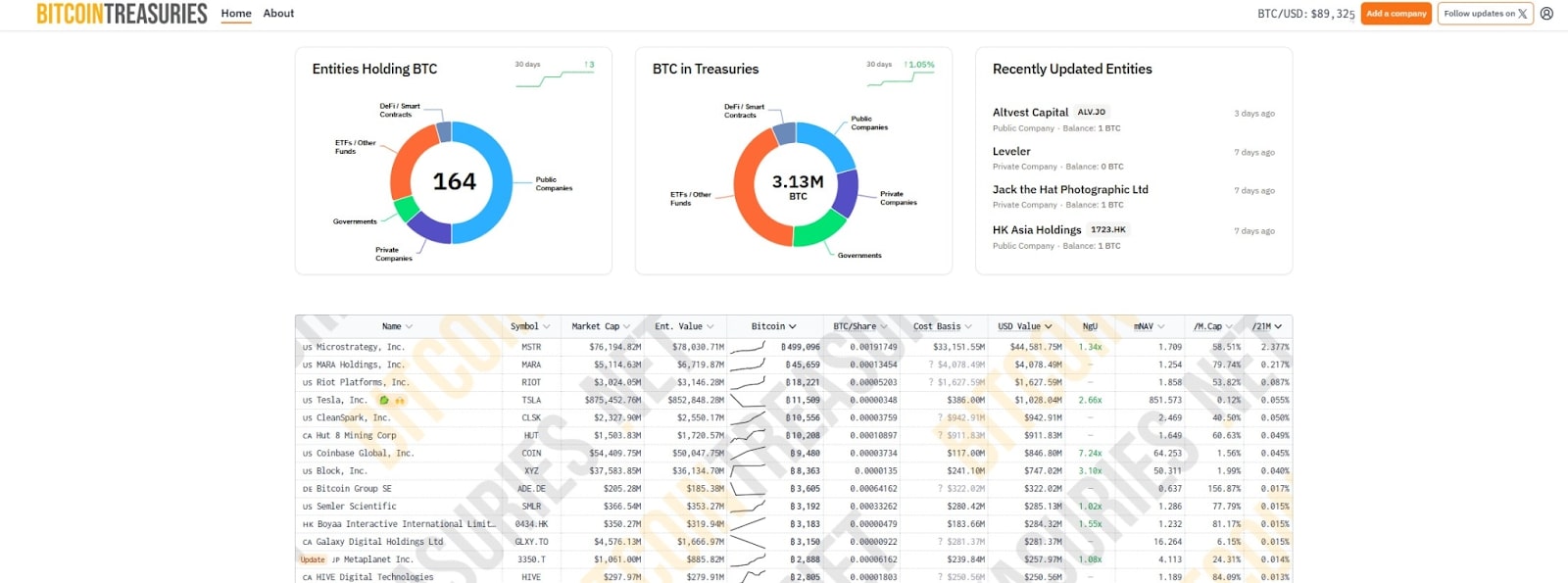

And as of Feb twenty eighth, CleanSpark owned 11,177 BTC. This places them amongst the biggest company holders of Bitcoin on the earth. Based on knowledge from BitcoinTreasuries.internet, CleanSpark has grow to be one of many largest BTC treasuries on the earth belonging to a single company.

CleanSpark is the fifth largest Bitcoin holder.

Creating the Foundation for Progress: Progress by Technique

CleanSpark isn’t merely sitting on its present mining operations. Certainly, the corporate was on the transfer, increasing its infrastructure all through a half-dozen states. These expansions will enable them to enormously develop their mining capabilities and fortify their place amongst friends out there. With an growing variety of miners getting into the sector, CleanSpark’s proactive method to enlargement ensures it stays forward of the curve.

Georgia: CleanSpark is ramping up its use of immersion cooling expertise in its present amenities. Conventional air-cooled rigs vent warmth into the atmosphere however will be troublesome to maintain cool on the community throughout hotter months.Wyoming: 35 MW (megawatts) of recent energy contracts signed in Cheyenne, with extra on the way in which. Bitcoin mining requires entry to dependable and inexpensive energy and this acquisition displays CleanSpark’s dedication to acquiring the ability needed for continued progress.Tennessee: A 48 MW facility is below development in Jackson. The brand new facility will add dramatically to CleanSpark’s hashrate and within the coming quarters will enable them to proceed to develop their rising presence within the mining area.

These expansions are usually not solely about growing Bitcoin manufacturing. They’re additionally about various the firm’s geographic footprint and lowering regional regulatory dangers; and making certain entry to different power sources. This tactical diversification is indicative of a soundly managed and future-oriented firm. By mitigating regulatory dangers and securing entry to cost-effective power, CleanSpark units itself up for sustainable long-term progress.

Extra Information: CleanSpark Hits 10,000 Bitcoin – What’s Driving Their Progress?

The Resourceful Monetary: Thriving In The Face Of Market Uncertainty

CleanSpark is financially doing nice. The mining firm posted a complete income of $162.3 million for the primary fiscal quarter of 2025, a staggering 120% improve year-on-year. The corporate additionally reported earnings of $241.7 million, or $0.85 per share, an unbelievable bounce from $25.9 million final yr.

It’s additional enhanced by a just lately accomplished $650 million convertible bond and the completion of an “at-the-market” providing program. CleanSpark now holds about $2.8 billion in property and $1.2 billion in liquidity owing to those monetary maneuvers.

CleanSpark’s emphasis on pure Bitcoin mining and treasury administration may elevate questions for some buyers preferring diversified income streams. Nevertheless, CleanSpark CEO Zach Bradford has defended this technique, arguing that focusing solely on Bitcoin mining permits the corporate to optimize its operations and maximize its publicity to Bitcoin’s potential upside.

CleanSpark’s monetary prudence, coupled with its strategic focus, positions it to climate market fluctuations extra successfully.