Earlier right now, Coinbase introduced the launch of “Bitcoin-Backed Loans” utilizing Base, its native blockchain. However there’s one downside. (Truly, two.)

These loans usually are not backed by Bitcoin, nor are they even on the Bitcoin blockchain.

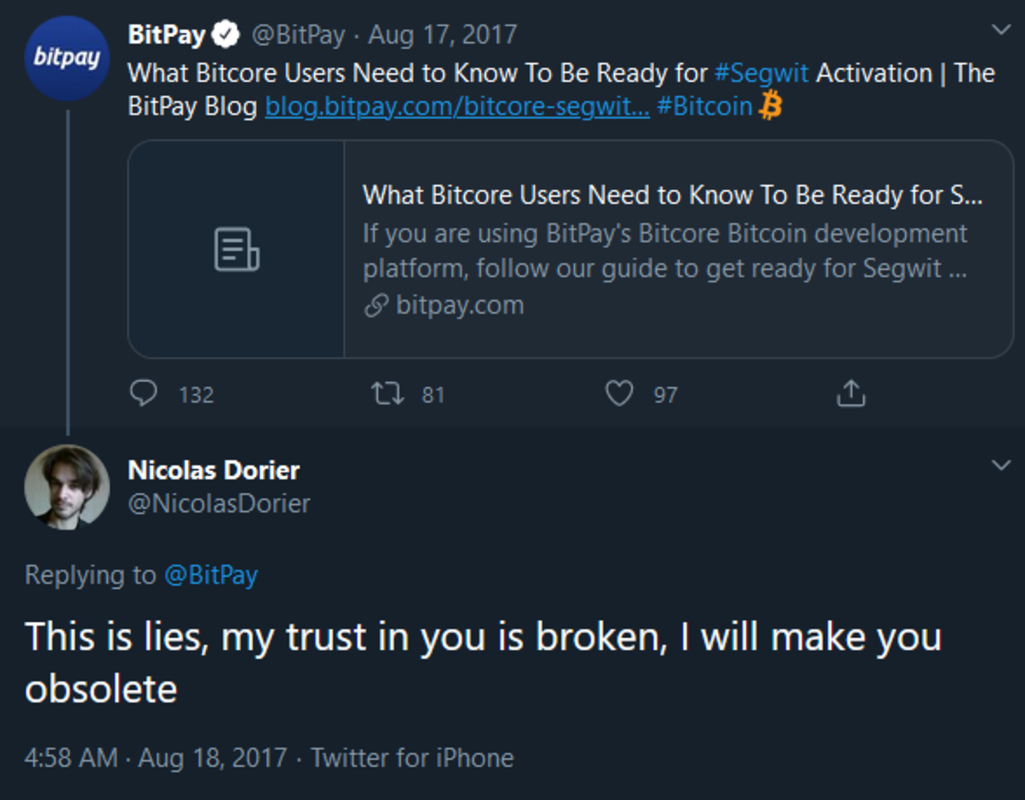

It’s disappointing that, in 2025, corporations are nonetheless willingly omitting key particulars to mislead Bitcoin holders into giving up custody of their cash.

Right here’s the reality: these loans are collateralized by cbBTC, Coinbase’s Bitcoin-wrapped product designed to compete with wBTC and tBTC. This isn’t Bitcoin. Actually, cbBTC is arguably essentially the most centralized of those “wrapped” BTC tokens. To grasp the belief assumptions related to wrapped BTC, I like to recommend this wonderful submit by the Bitcoin Layers staff: Analyzing tBTC In opposition to wBTC and cbBTC.

Right here’s the TL;DR:

“The BTC backing the cbBTC token is held in reserve wallets managed by Coinbase, a US-based centralized custodial supplier. Coinbase holds funds backing cbBTC in chilly storage wallets throughout a lot of geographically distributed places and moreover has insurance coverage on funds they custody.”

Moreover, as a substitute of issuing these loans on a blockchain even remotely associated to Bitcoin (equivalent to Bitcoin sidechains or Bitcoin L2s), Coinbase is issuing them by way of Morpho Labs, a DeFi platform finest described as an AAVE competitor. Whereas Morpho is a well-established platform—and I don’t doubt its safety—it has no connection to Bitcoin.

I, for one, stay up for seeing precise Bitcoin-backed loans issued on the Bitcoin community itself. Many L2 groups are working exhausting to make this a actuality, striving to attenuate belief assumptions—and even eradicate the necessity for bridging altogether (bullish!).

Why do we want native Bitcoin-backed loans within the first place? Take into account this: many Bitcoiners right now face stringent tax rules that impose hefty liabilities on long-term holders who promote their Bitcoin to fund important purchases like a home or a automotive. Taking out a mortgage backed by BTC permits people to keep away from triggering these tax occasions.

Furthermore, most Bitcoiners are assured that Bitcoin’s worth shall be considerably increased sooner or later than it’s right now. So why would anybody promote an asset with such promising long-term potential? Bitcoin-backed loans allow holders to retain publicity to Bitcoin’s upside whereas accessing the liquidity wanted to satisfy life’s monetary calls for.

In right now’s market, the choices for Bitcoin-backed lending are restricted. You may both depend on centralized corporations (just like the respected staff at Unchained) or flip to “DeFi” protocols, which are sometimes centralized themselves and, in some instances, riskier than centralized alternate options like Unchained. Nevertheless, there may be at the moment no really Bitcoin-native resolution—no choice for Bitcoiners to keep up custody of their cash whereas accessing loans.

Some corporations, like Lava.xyz, are starting to deal with this hole. Nevertheless, their market share stays a small fraction of the volumes dealt with by present DeFi platforms. (Regulate Lava—they’re poised to make waves in 2025!)

One quote from the unique announcement stood out to me:

“The mixing of Bitcoin-backed loans on Coinbase is ‘TradFi within the entrance, DeFi within the again,’” stated Max Branzburg, Coinbase’s vp of product, in an announcement to The Block.

Let’s name it what it truly is: centralized within the entrance, and centralized within the again.

It’s time to go away these deceptive choices behind and convey true Bitcoin Finance (BTCfi) to customers—not simply advertising buzzwords and half-truths.

As an alternative of claiming: Bitcoin backed on-chain loans let’s say: multisig-backed derivatives loans on a centralized chain.

This text is a Take. Opinions expressed are fully the writer’s and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

Articles I write could focus on subjects or corporations which might be a part of my agency’s funding portfolio (UTXO Administration). The views expressed are solely my very own and don’t symbolize the opinions of my employer or its associates. I’m receiving no monetary compensation for these takes. Readers shouldn’t think about this content material as monetary recommendation or an endorsement of any specific firm or funding. All the time do your personal analysis earlier than making monetary choices.