Please see this week’s market overview from eToro’s international analyst crew, which incorporates the newest market knowledge and the home funding view.

In focus: Tariff Warfare; This fall earnings season in full swing

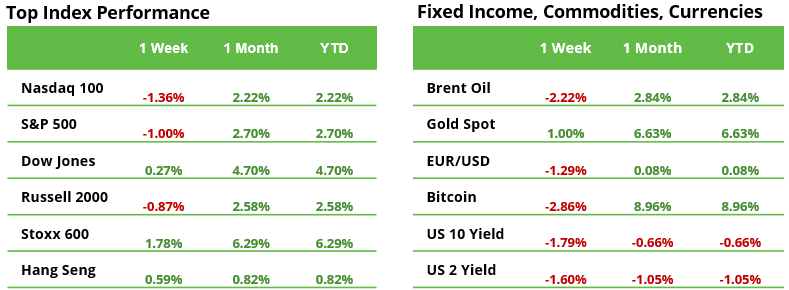

By no means a boring second in markets. Final week, markets have managed to recuperate from DeepSeek-related sell-offs however got here underneath strain later within the week as a consequence of President Trump’s tariff proposals. The Nasdaq 100 completed the week at -1.4%, the S&P 500 -1.0%, whereas European markets surged by +1.8%. In the meantime, Bitcoin was down -2.9%, Brent oil -2.2%, and gold gained +1.0%.

This week, traders will carefully monitor developments in Trump’s tariff technique and the anticipated retaliatory measures from key buying and selling companions as tariffs on Canada, Mexico, and China are anticipated to take impact on February 4th. Market members will assess the broader financial fallout and inflationary dangers tied to those measures. Additionally on the radar are important occasions together with Eurozone inflation knowledge launch, the Financial institution of England’s fee determination, the U.S. January jobs report, and a busy earnings week that includes main firms like Amazon, Google, and PayPal.

Enthusiasm in European Equities Reached Highest in Two Years

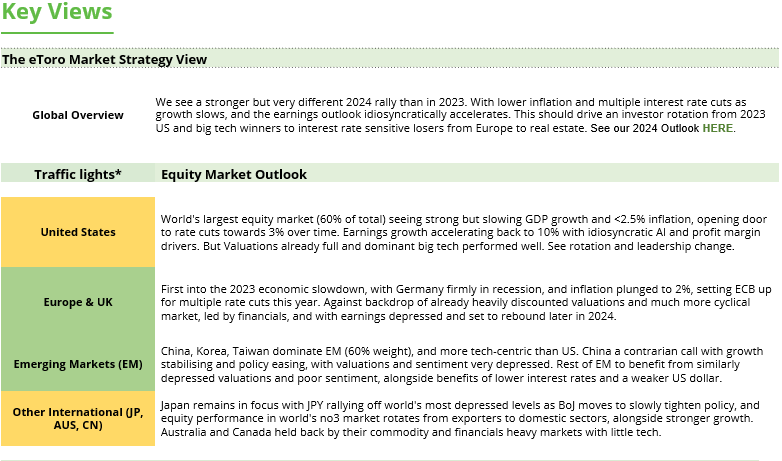

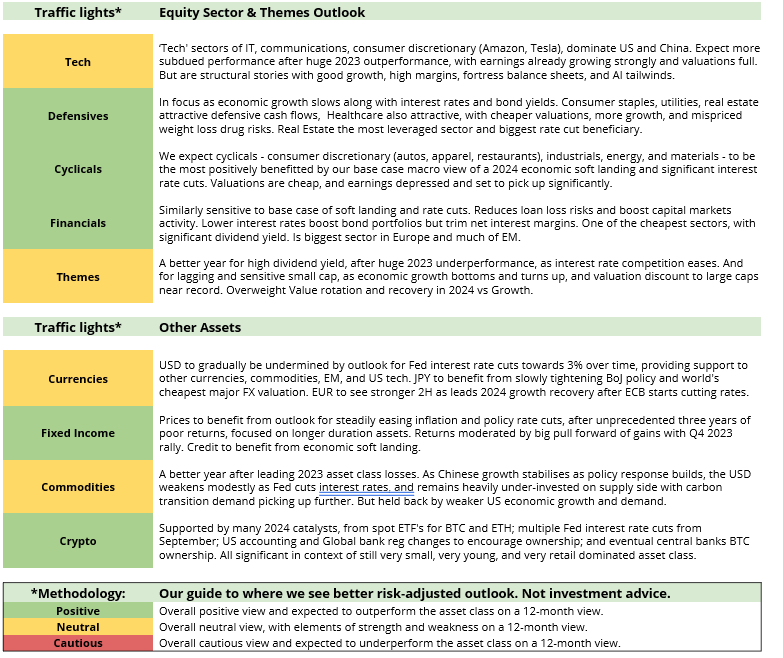

Investor sentiment for European equities has turned optimistic in January, exhibiting the strongest momentum relative to the US equities in two years. Enthusiasm is clear in investor surveys: Financial institution of America’s newest international fund supervisor report reveals a pointy pivot towards Europe, with the biggest month-to-month enhance in publicity since 2015 and the second-largest ever. Notably, the survey predates Trump’s inauguration.

So, why the renewed enthusiasm regardless of ongoing financial stagnation and political uncertainty throughout main European economies? One key issue is valuation: the 12-month ahead P/E of European shares stands at 13.5x, considerably decrease than World (18.0x), U.S. (22.0x), and Japan (13.6x). This valuation hole stays even after excluding the most costly “Magazine 7” shares from U.S. indices. If Europe experiences optimistic developments—equivalent to peace in Ukraine or restored political stability, significantly in Germany and France, and manages to keep away from tariffs from the Trump administration—this undervaluation might translate right into a rewarding funding alternative.

Focus of Week: Strategic Investments in Commodities

Latest market dynamics have highlighted the distinct function commodities play in funding portfolios. Their behaviour differs from conventional property like equities or bonds as a consequence of their reliance on real-time macroeconomic forces—primarily provide and demand—relatively than projections of future money flows. This provides them a novel function in portfolios, significantly throughout heightened coverage uncertainty.

Inflation Safety: Commodities have traditionally maintained a robust correlation with inflation, making them a strong hedge in opposition to sudden value surges. Over the previous 30 years, they’ve proven an inflation beta of 6 to 10, which means that even a small allocation to commodities can present outsized inflation safety for a broader funding portfolio.

Diversification and Threat Discount: Commodities might supply diversification as a consequence of their low correlation with conventional asset courses like equities and bonds. This may occasionally assist scale back total portfolio danger and enhances stability. In equity-heavy portfolios, commodities might play a vital function by counterbalancing equities’ adverse skew—the place equities face sharp losses throughout downturns—by means of optimistic skew. Commodities typically expertise massive, event-driven value good points, significantly throughout provide disruptions, pure disasters, or geopolitical shocks. These good points can assist offset losses in different areas of the portfolio, offering safety throughout crises.

Occasion-Pushed Good points: Commodities, particularly inside the power and agricultural sectors, profit from optimistic occasion dangers. For instance, sudden provide shocks—equivalent to oil provide disruptions or coverage adjustments—may cause sharp value spikes, boosting returns in periods when different property could also be underperforming.

General, commodities act as a multi-faceted asset class, offering inflation safety, diversification, and resilience throughout market shocks, making them an important part of a well-rounded funding technique.

Earnings and occasions

Macro

3 Feb. Eurozone Inflation, US ISM Manufacturing PMI

6 Feb. BoE Price Determination, US Jobless Claims

7 Feb. US Unemployment, Michigan Shopper Expectations

Earnings

3 Feb. Palantir

4 Feb. PayPal, Superior Micro Gadgets, PepsiCo, Google, Pfizer

5 Feb. Walt Disney

6 Feb. Amazon

This communication is for info and training functions solely and shouldn’t be taken as funding recommendation, a private advice, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out making an allowance for any explicit recipient’s funding targets or monetary state of affairs and has not been ready in accordance with the authorized and regulatory necessities to advertise impartial analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product will not be, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.