Key Takeaways:

In early March, the US misplaced over 1,200 crypto ATMs, one of the vital important drops recorded.Senator Durbin’s proposed laws focusing on crypto ATM fraud could also be a contributing issue.The worldwide crypto ATM market is stagnating resulting from evolving laws and elevated scrutiny.

Whereas the cryptocurrency world is continually evolving, the disappearance of greater than 1,200 crypto ATMs throughout the USA in early March has raised questions and issues. This sharp drop-off occurred simply days after Illinois Senator Dick Durbin launched the Crypto ATM Fraud Prevention Act, a invoice designed to fight fraud involving these machines. Was this merely a coincidence, or an indication of deeper points rising within the crypto ATM market?

Vanishing ATMs: The Numbers Behind the Disappearing ATMs

Information from Coin ATM Radar confirmed that the worldwide Bitcoin ATM community noticed a internet lack of ~1,100 machines on this time-frame. The US alone was accountable for an astounding 1,233 of these removals. New installs in international locations like Europe, Canada, Spain, Poland, Australia and Switzerland met these losses, however there was no downplaying the US losses.

Web Change within the Variety of Cryptocurrency Machines Put in and Eliminated Month-to-month within the US. Supply: Coin ATM Radar

Why the Sudden Exodus? Senator Durbin’s Invoice Casts a Shadow

The timing of this mass removing is tough to ignore. Senator Durbin launched the proposed laws on February twenty fifth particularly to sort out fraud within the ATMs supplied by crypto brokers. Motivated by a type of reviews and an incident involving a constituent, the invoice seeks to show the damaging impression scams can have in actual life.

The Crypto ATM Fraud Prevention Act would implement just a few necessities, together with:

Obligatory warnings to customers concerning potential scams: That is supposed to tell customers and lift consciousness concerning the dangers related to crypto ATMs.Mechanisms to reduce fund loss: The invoice goals to introduce safeguards that might cease customers from dropping their funds in a rip-off.Stronger enforcement instruments: Equipping legislation enforcement with the instruments to hint unlawful transactions will empower them of their ongoing investigations of crypto ATM-related crimes.

The introduction of the invoice will virtually definitely have despatched ripples via the crypto ATM trade. Simply the specter of better regulation and scrutiny may definitely push a few of these operators to tug their machines off the community, notably for anybody who’s straddling on the sting of compliance.

US Dominates Crypto ATM Market, However For How Lengthy?

There are at the moment extra crypto ATMs throughout the USA than anyplace else on the planet. As of March third, the variety of machines based mostly in the nation reached a whopping 29,731, accounting for nearly 80% of the worldwide crypto ATM community. Canada is subsequent, with 3,085 ATMs (8.3%) and Australia is third with 1,467 ATMs (3.9%).

World Distribution of Crypto ATMs Put in by Nation and by Continent. Supply: Coin ATM Radar

Regardless of main the pack, the latest drop calls into query the destiny of crypto ATMs in the US. How will the trade reply to that rising regulatory stress throughout the context of a public that’s extra conscious than ever of potential dangers?

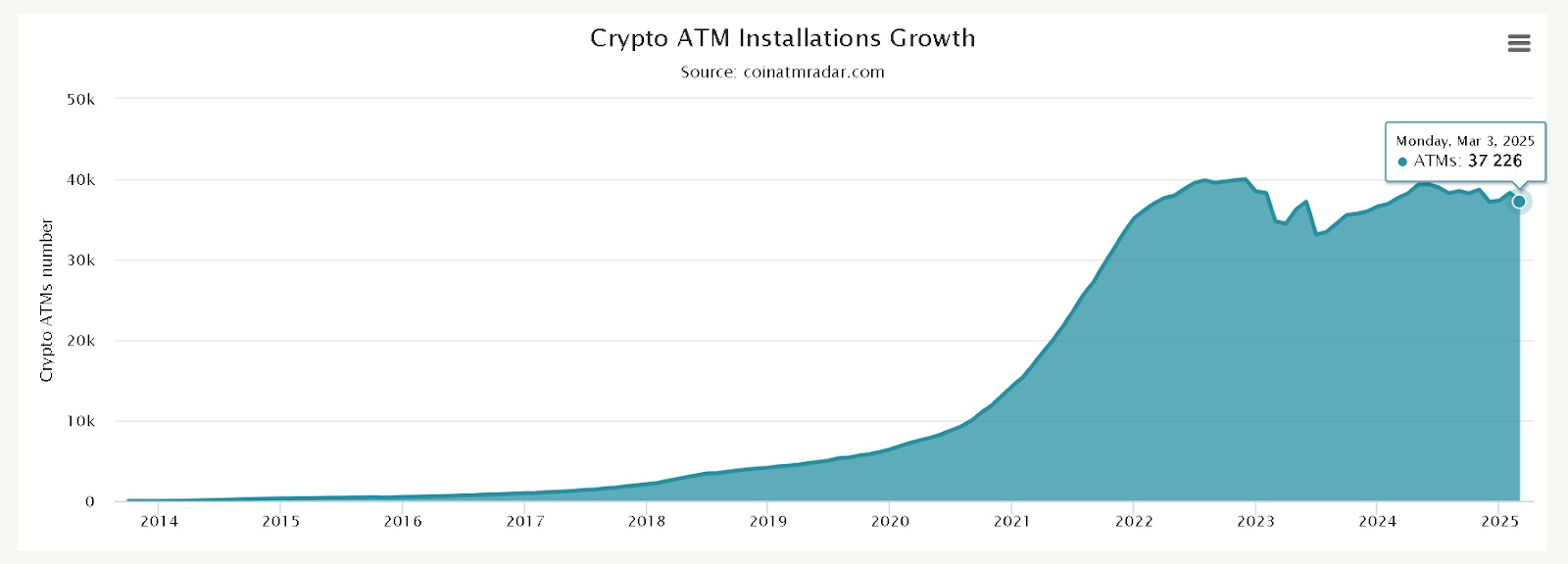

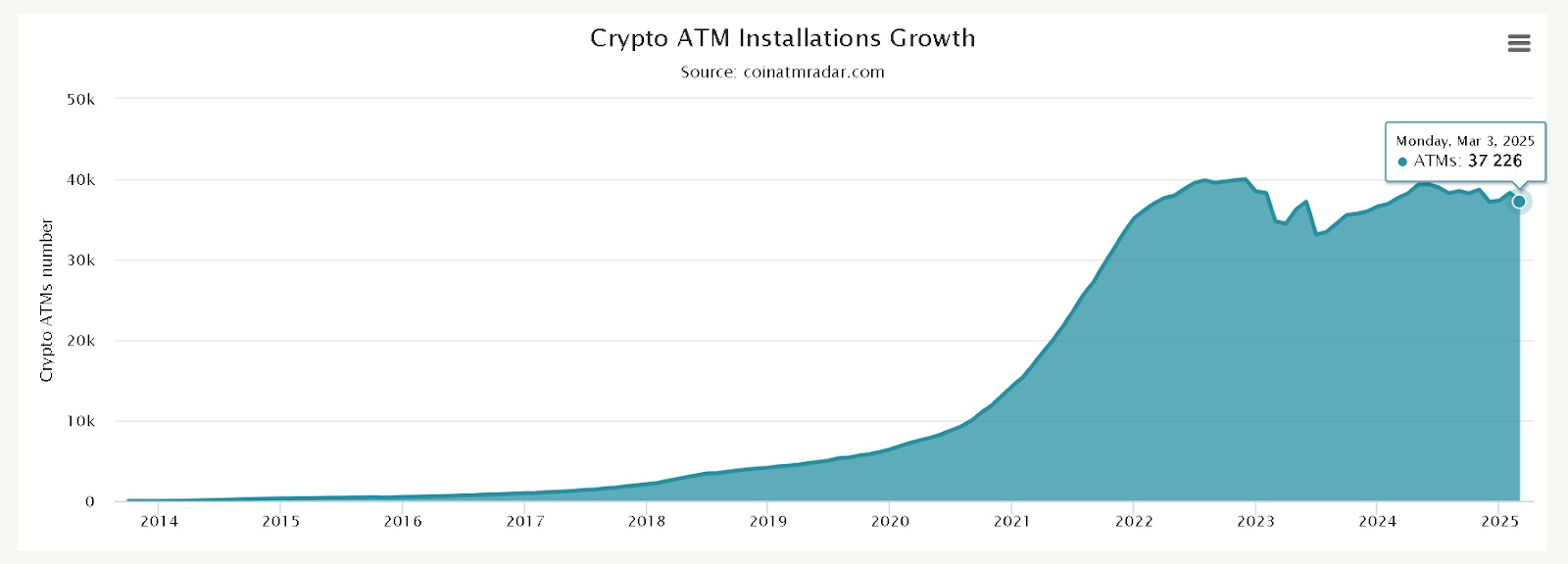

Crypto ATM Development Hit Onerous with Regulatory Crackdown

As soon as hailed as one of many high-velocity frontiers of the digital forex world, the expansion of crypto ATMs has basically flat-lined since mid-2022. This slowdown may be blamed on a mixture of things, comparable to altering laws and crackdowns on unregistered companies.

For instance, the UK authorities issued the primary legal sentence for unlawful crypto ATMs. On this occasion, it was a well timed reminder that driving these machines with out correct registration and compliance may have critical authorized ramifications.

Cumulative variety of Bitcoin machines put in worldwide over time. Supply: Coin ATM Radar

The Darkish Facet of Comfort: Crypto ATM Scams

The reality of the matter is, crypto ATMs, as handy as they’re, can pose a danger which scammers have exploited to prey on customers which will not concentrate on the dangers concerned. Widespread ones embody the next:

Romance scams: Victims are tricked into on-line relationships after which pressured to make use of ATMs to ship cryptocurrency.Impersonation Scams: Fraudsters faux to be authorities officers or customer support representatives, coercing victims to make crypto ATM deposits below the guise of paying off faux money owed.Funding scams: Victims are promised excessive returns on investments and are instructed to deposit cryptocurrency into ATMs.

Such scams exhibit a transparent and determined want for extra regulation and person training to keep away from monetary exploitation.

Extra Information: Australia to Crack Down on Crypto ATM Suppliers Resulting from Cash Laundering Danger

A Sufferer’s Story: The Human Toll of Crypto ATM Fraud

As an instance the damaging energy of crypto ATM fraud, allow us to have a look at Sarah’s (identify modified for privateness) story. Sarah, a single mom in dire monetary straits, was approached on-line by an alleged rich businessman searching for a romantic relationship. Finally, he earned her belief and inspired her to put money into a profitable cryptocurrency alternative. He instructed her to deposit money in a crypto ATM, guaranteeing big returns. Sarah, hoping to enhance her monetary scenario, did as she was instructed, solely to discover out that the funding was a complete hoax and that she misplaced her cash.

Tales like Sarah’s are far too frequent, and so they underscore the significance of measures like Senator Durbin’s invoice to guard susceptible people from falling sufferer to those schemes.

Extra Information: Senator Durbin Introduces New Invoice to Fight Crypto ATM Fraud

Go along with the Circulation: Embracing the Regulatory Ambiguity

The way forward for crypto ATMs is now an enormous query mark. Although they supply a fast means for some to get entry to cryptocurrency, additionally they create dangers for shoppers and have develop into a refuge for illicit exercise. As crypto companies worldwide really feel the warmth from regulators, operators should observe swimsuit and implement compliance-first methods in the event that they need to survive in the long term.

It’s apparent that the times of crypto ATM proliferation with out regulation are over. We now have a reckoning, and solely those that can regulate will survive. Whether or not that interprets to much less ATMs, extra safety, or a whole overhaul of enterprise insurance policies, one factor is for positive, we will likely be seeing a really totally different crypto ATM sector within the coming years.