Be a part of Our Telegram channel to remain updated on breaking information protection

A gaggle of crypto and fintech executives has urged the Trump administration to cease banks from charging charges for entry to their buyer knowledge, arguing that it stifles innovation and buyer alternative.

In a current letter despatched to the President, the group claimed to share the Trump administration’s “dedication to a dynamic, aggressive US economic system,” however stated this “shared imaginative and prescient for financial freedom is below direct menace from the nation’s largest banks.”

That’s after JPMorgan informed fintechs and knowledge aggregators that depend on the financial institution’s buyer knowledge that entry to shopper data will now not be freely out there. PNC Monetary Providers Group Inc. is contemplating charging comparable charges as properly. These charges are set to influence the market in September, in response to the group.

The letter included participation from executives akin to Andreessen Horowitz Basic Accomplice Alex Rampell, Blockchain Affiliation CEO Summer season Mersinger, Gemini co-founders Tyler and Cameron Winklevoss, and Plume Community founder and CEO Christopher Yin.

Robinhood Chairman and CEO Vlad Tenev, Stripe co-founder and CEO Patrick Collison, and Shopify CEO and founder Tobi Lütke additionally joined the hassle.

Trump Administration’s Mission To Construct A Fashionable Financial system Underneath Menace

Trump campaigned to make the US the crypto capital of the world forward of the Presidential elections final 12 months.

The crypto business, which was then below assault by the US Securities and Change Fee (SEC), backed Trump’s marketing campaign to the tune of tons of of tens of millions of {dollars} in an effort to result in change.

“Your Administration has acted decisively to appropriate the misguided insurance policies of the previous, and is laying the groundwork for the US to construct a very Twenty first-century economic system,” the group wrote, earlier than saying that this tough work by the Trump administration “is being actively threatened” by large banks.

2/ We’re asking @POTUS to cease the nation’s largest banks from imposing these exorbitant charges, which might preserve People from linking their financial institution accounts to the monetary instruments and providers they need to use.

— Monetary Know-how Affiliation (@fintechassoc) August 14, 2025

By “exorbitant” new account entry charges, the group alleges these large banks try to “stop customers from connecting their accounts to higher monetary merchandise of their alternative.”

If the Trump Administration doesn’t step in quickly, the group argues it’ll lead to a “harmful authorized interpretation” {that a} buyer’s proper to their account data doesn’t imply that they will freely share entry to the information with “a trusted utility performing on their behalf.”

That can undermine the “long-standing precept of shopper alternative,” the group of crypto and fintech executives argued.

“We urge you to make use of the total energy of your workplace and the broader administration to forestall the most important establishments from elevating new limitations to monetary freedom,” they wrote.

This points is centered round an “open banking rule” that was finalized in October final 12 months by the Client Monetary Safety Bureau (CFPB) below the previous Joe Biden Administration. This rule permits prospects to freely share financial institution knowledge with fintechs.

Whereas the rule was welcomed by the crypto neighborhood, main banking business teams opposed it. They subsequently sued the CFPB.

Trump initially signaled that he would facet with the banks and kill the rule. Nevertheless, he backtracked his resolution in direction of the tip of July amid stress from crypto lobbyists, and finally selected to maintain the rule in place.

His administration then informed a decide that the rule will keep in place till it creates a brand new one which aligns higher with the President’s insurance policies.

Banking Teams Hit Again At Executives’ Claims

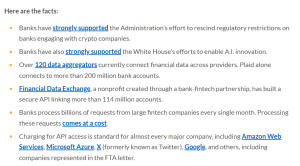

Banking teams, led by the American Bankers Affiliation, countered the letter in a press launch and accused the crypto and fintech executives of making an attempt to “undermine free markets and interact in authorities worth fixing.”

In line with the banking teams, the fintech and crypto executives try to perpetuate an “absurd” double commonplace whereby they will cost charges for data entry however nonetheless anticipate banks to supply the identical service without charge.

Banking teams state what they consider are the details (Supply: American Bankers Affiliation)

The bankers additionally responded to allegations by the crypto and fintech execs that the banks’ proposed charges are an anti-competitive maneuver designed to “consolidate energy.”

In line with the bankers, their account data entry charges align with the usual observe for firms that supply API entry to knowledge.

They highlighted that Amazon Internet Providers, Microsoft Azure, X (previously Twitter), Google, and others do it. In line with the banking teams, even among the firms that signed the letter despatched to Trump do it as properly.

The bankers went on so as to add that they’ve “strongly supported” the Trump Administration’s efforts to “rescind regulatory restrictions on banks partaking with crypto firms.”

Trump Targets Debanking With New Government Order

The conflict between the crypto and conventional banking industries comes after Trump signed an govt order earlier this month which seeks to punish banks that prohibit providers to sure prospects. Throughout the former Biden Administration, this usually included firms working within the crypto house.

Underneath the brand new order, federal banking regulators are required to take away the “fame danger” language from their steerage to lending establishments. This broad idea, in response to crypto and different companies, compelled mainstream lenders to show them away previously.

The order additionally instructs regulators to analyze whether or not banks have any insurance policies that allow them to take part in “illegal debanking.”

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection