The large story within the crypto information as we speak is how surprisingly calm the market takes care of what may’ve been a a lot larger shake-up. BTC USD continues to be parked round $90,000, and ETH USD retains inching upward. These all occurred even after that sudden Chicago knowledge heart outage that briefly froze international buying and selling screens.

As soon as the Chicago knowledge heart problem was sorted out, markets snapped again, and shares even pushed increased on hopes the Fed may lastly ease charges. Someway, BTC and ETH barely flinched in opposition to USD via all of it.

7d

30d

1y

All Time

If something stands out this week, it’s how aggressively establishments are shopping for the dip. Ark Make investments scooped up $88 million price of Bitcoin, and BlackRock grabbed one other $68.8 million price of Ethereum. The establishments are exhibiting conviction whereas retails are in deep concern.

7d

30d

1y

All Time

Establishments Maintain Shopping for Whereas Liquidity Pours In: Can ETH USD Catch Up?

Following the conviction of the large boys, roughly $190 billion flowed again into the crypto market in only a week. A great signal that the larger gamers don’t suppose the social gathering’s over simply but.

USD Secure issuer Circle additionally minted one other 500 million USDC, bringing the entire to $1.25 billion over the past 2-3 days. This added liquidity is usually recycled again into BTC and main altcoins like ETH as soon as confidence returns to redeploy.

BREAKING:

Circle mints one other 500,000,000 $USDC. pic.twitter.com/JlkXsZXhQ6

— Crypto Rover (@cryptorover) November 29, 2025

Outdoors crypto, metals are on a tear. Gold is tightening into one other bullish consolidation, and Silver simply printed a recent all-time excessive at $56, up by nearly 90% since January.

When shares, metals, and threat belongings all begin heating up collectively, the spillover into BTC and ETH in opposition to USD tends to comply with, and lots of people watching crypto information as we speak count on precisely that.

However scroll via X and most crypto communities, and we are going to see the alternative sentiment: doomsday predictions, October cycle high theories, and warnings of an 84% crash.

Crypto Concern and Greed Chart

1y

1m

1w

24h

The humorous half? Each indicator that really nailed the 2013, 2017, and 2021 tops is silent. Pi Cycle High isn’t triggered. MVRV Z-Rating can be at an absurdly low 1.07, which is traditionally oversold. Puell A number of is underneath 1, that means miners are squeezed for the time being.

DISCOVER: 16+ New and Upcoming Binance Listings in 2025

BTC USD Primed for the Subsequent Transfer

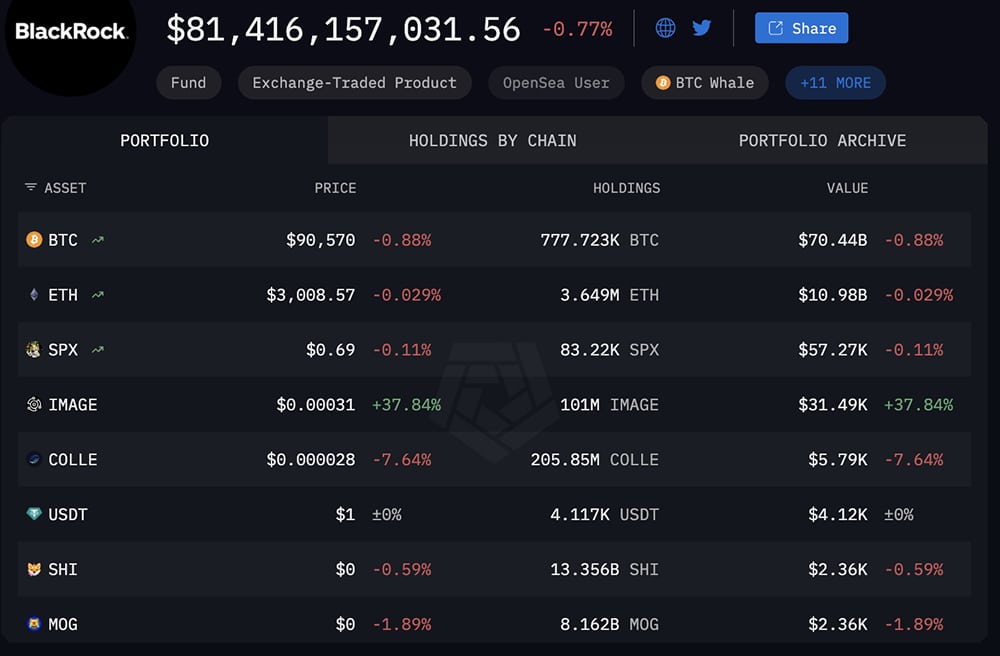

ETF flows inform the actual story within the larger image. Even with November’s report $3.79 billion in outflows, BlackRock nonetheless holds 777,000 BTC, and greater than 10 billion USD in ETH. We all know the establishments didn’t blink after the Chicago knowledge heart mess. The market continues to be bullish regardless of the present dip.

(supply – BlackRock, Arkham)

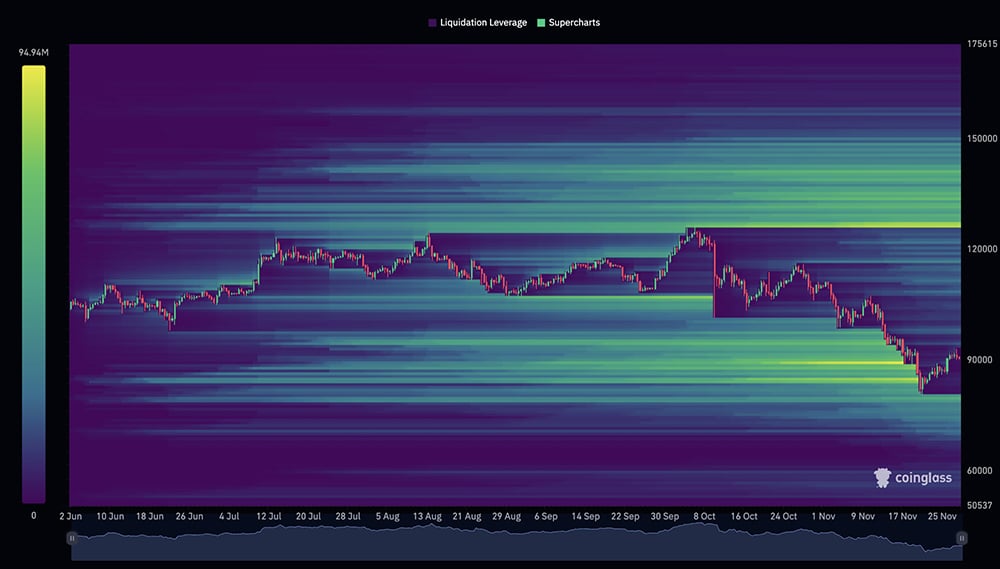

This latest 36% pullback over six weeks was the harshest of the cycle, and it caught nearly everybody off guard after months of gradual bleeds. However structurally, there’s nothing damaged. The identical weekly divergences that launched earlier rallies are forming once more. If BTC USD pushes towards $112,000, greater than $15 billion in brief positions may get worn out in a single large squeeze.

(supply – Liquidation Warmth Map, Coinglass)

So, regardless of the noise, the crypto bull run doesn’t look finished. Right this moment, with crypto liquidity rising, huge cash nonetheless shopping for as seen in every single place within the information, and indicators refusing to point out a high, the setup favors continuation.

It’s Saturday, and I’m bullish, as at all times.

DISCOVER: 10+ Subsequent Crypto to 100X In 2025

Be a part of The 99Bitcoins Information Discord Right here For The Newest Market Updates

Barcelona Crypto Nightmare: How a Large Cash Sponsorship Grew to become a Large Cash Legal responsibility

A brand new crypto partnership meant to regular FC Barcelona’s funds has as a substitute grow to be a public headache inside days.

FC Barcelona is dealing with rising criticism after confirming in mid-November {that a} Samoa-based firm, Zero-Data Proof (ZKP), would act because the membership’s “Official Cryptographic Protocol Accomplice.”

However by November 26, the membership moved to distance itself from a digital token launched by the sponsor, insisting it had “no connection in any respect” to the asset.

The controversy broke in Barcelona over the previous 24 to 48 hours as followers and observers questioned who controls ZKP and why the membership authorized the association.

World partnership with @ZKPofficial, new Official Blockchain Know-how Accomplice of FC Barcelona. #BarçaxZKP

— FC Barcelona (@FCBarcelona) November 14, 2025

Learn the total story right here.

QNT Crypto Alternate Provide at Document Lows: The London-Based mostly Quant Community Is Slowly Climbing in a Purple Market

Quant community, or QNT, has been quietly pushing increased at the same time as a lot of the crypto market stays pink. Whereas main cash wrestle to carry help, Quant has managed to nudge its approach towards the mid $90s after an 11% leap, giving it an uncommon little bit of power in a dark week.

Quite a lot of this comes right down to Quant Community’s slow-burn progress with Overledger, the London-based firm’s interoperability system that goals to attach blockchains with the normal monetary rails that establishments nonetheless depend on.

Between shrinking trade provide and rising consideration from the crypto neighborhood, there are just a few causes QNT crypto retains climbing whereas every part else appears heavy.

7d

30d

1y

All Time

Learn the total story right here.

The submit Crypto Market Information Right this moment, November 29: BTC USD Secure at $90,000, ETH USD Grinding Up as Chicago Knowledge Middle Chaos Ends appeared first on 99Bitcoins.