Crypto scalping is among the most intense methods in cryptocurrency buying and selling. Whereas some buyers maintain onto digital belongings for months or years, scalpers favor fast entries and exits to reap the benefits of tiny value actions.

This text will break down what crypto scalping is, the way it works, instruments, professionals and cons, and the way it compares to different buying and selling types. Whether or not you’re a curious newbie or a dealer trying to sharpen your edge, this text supplies every thing it’s good to know.

What Is Crypto Scalping?

Crypto scalping is a short-term buying and selling method that entails executing a number of fast trades in a single day to revenue from small value actions in a cryptocurrency’s worth. The objective isn’t to chase large features however fairly to build up small, constant earnings that may add up over time.

In different phrases, scalping in crypto buying and selling is all about pace, quantity, and precision.

Scalpers usually make dozens and even a whole bunch of trades per day, holding positions for seconds to a couple minutes. This high-frequency type depends closely on liquidity, technical indicators, and, more and more, automation by way of crypto buying and selling bots.

How Does Crypto Scalping Work?

Crypto Scalping targets tiny value actions in high-liquidity crypto markets, counting on fast entries and exits, generally inside seconds. Scalpers make quite a few trades, aiming for small, constant earnings that add up over time. They use tight stop-losses to manage threat and rely closely on technical indicators like RSI, MACD, and Bollinger Bands for split-second choices. Many crypto scalping methods use leverage to spice up potential features from small fluctuations, although this will increase publicity to threat. This high-speed method calls for precision, self-discipline, and a stable grasp of market instruments.RELATED: All You Must Know About Leverage Buying and selling in CryptoHow Scalping Compares to Day Buying and selling and Swing Buying and selling

When contemplating buying and selling types in crypto, it’s vital to know how crypto scalping compares to different fashionable methods like day buying and selling and swing buying and selling. Every method differs in timeframe, commerce quantity, threat degree, and potential revenue per commerce. Beneath is a short breakdown of those three methods:

1. Scalping

Scalping in crypto buying and selling entails opening and shutting trades inside seconds to minutes. Merchants execute dozens and even a whole bunch of trades every day, aiming to capitalize on very small value actions. Whereas every revenue is minor, the excessive frequency of trades permits these small features so as to add up.

2. Day Buying and selling

Day buying and selling extends the timeframe barely, with merchants holding positions for minutes to a couple hours, however at all times closing them inside the identical buying and selling day. In comparison with scalping, day merchants execute fewer trades, however they aim bigger value actions. The danger is mostly extra reasonable, and there’s extra time for evaluation and strategic pondering. Whereas day buying and selling nonetheless requires attentiveness and fast execution, it permits for a bit extra respiration room than scalping.

3. Swing Buying and selling

Swing buying and selling is a medium-term technique the place positions are held for a number of days to even weeks. Merchants intention to revenue from bigger market traits or value “swings”, fairly than minute-by-minute volatility. Resulting from longer timeframes and decrease commerce quantity, this technique tends to be much less dangerous, although not with out its challenges. Swing merchants usually mix technical and basic evaluation, and so they’re much less involved with short-term noise. This method is well-suited for merchants who can’t monitor markets continually and like a extra affected person, much less time-intensive buying and selling type.

Scalping vs. Day Buying and selling vs. Swing Buying and selling

Instruments and Bots Utilized in Crypto Scalping

Know-how is a key pillar of success in crypto scalping. Right here’s what scalpers use:

1. Crypto Buying and selling Bots

One of the crucial highly effective instruments in crypto scalping is the usage of crypto buying and selling bots. These automated applications execute purchase and promote orders based mostly on pre-set methods, technical indicators, or market situations. Bots are particularly helpful for scalpers who have to act quick and commerce across the clock with out being glued to their screens.

By eradicating the necessity for handbook execution, bots assist cut back emotional buying and selling and human error. A few of the most generally used bots amongst scalpers embrace 3Commas, Pionex, Cryptohopper, and Altrady, all of which provide automation, technique customization, and efficiency monitoring.

2. Buying and selling Platforms

Choosing the proper buying and selling platform is important for scalping success. Scalpers want platforms with low latency, high-speed execution, and minimal buying and selling charges, since even slight delays or excessive prices can wipe out potential earnings. Platforms like Binance, Bybit, and Kraken are fashionable decisions resulting from their robust liquidity, dependable infrastructure, and user-friendly interfaces.

3. Technical Indicators

Technical indicators are the spine of scalping methods. They supply merchants with real-time insights into market traits, momentum, and potential reversals. Scalpers generally depend on indicators reminiscent of Shifting Averages (MA) to determine traits, the Relative Energy Index (RSI) to detect overbought or oversold situations, and MACD to identify shifts in momentum. Moreover, instruments like Quantity Oscillators assist gauge the power behind a value transfer, whereas Bollinger Bands are used to trace volatility and predict potential breakouts. These indicators permit scalpers to make quick, knowledgeable choices with a better degree of confidence.

4. Indicators and Alerts

One other useful useful resource for crypto scalpers is the usage of alerts and alerts. These are real-time purchase or promote prompts based mostly on automated market evaluation or professional insights. They assist merchants catch fast alternatives that match their methods with out having to continually monitor the market themselves. Indicators can come from buying and selling communities, premium companies, or be built-in instantly into buying and selling bots. By combining dependable alerts with technical instruments, scalpers can react quicker and extra strategically in a market the place timing is every thing.

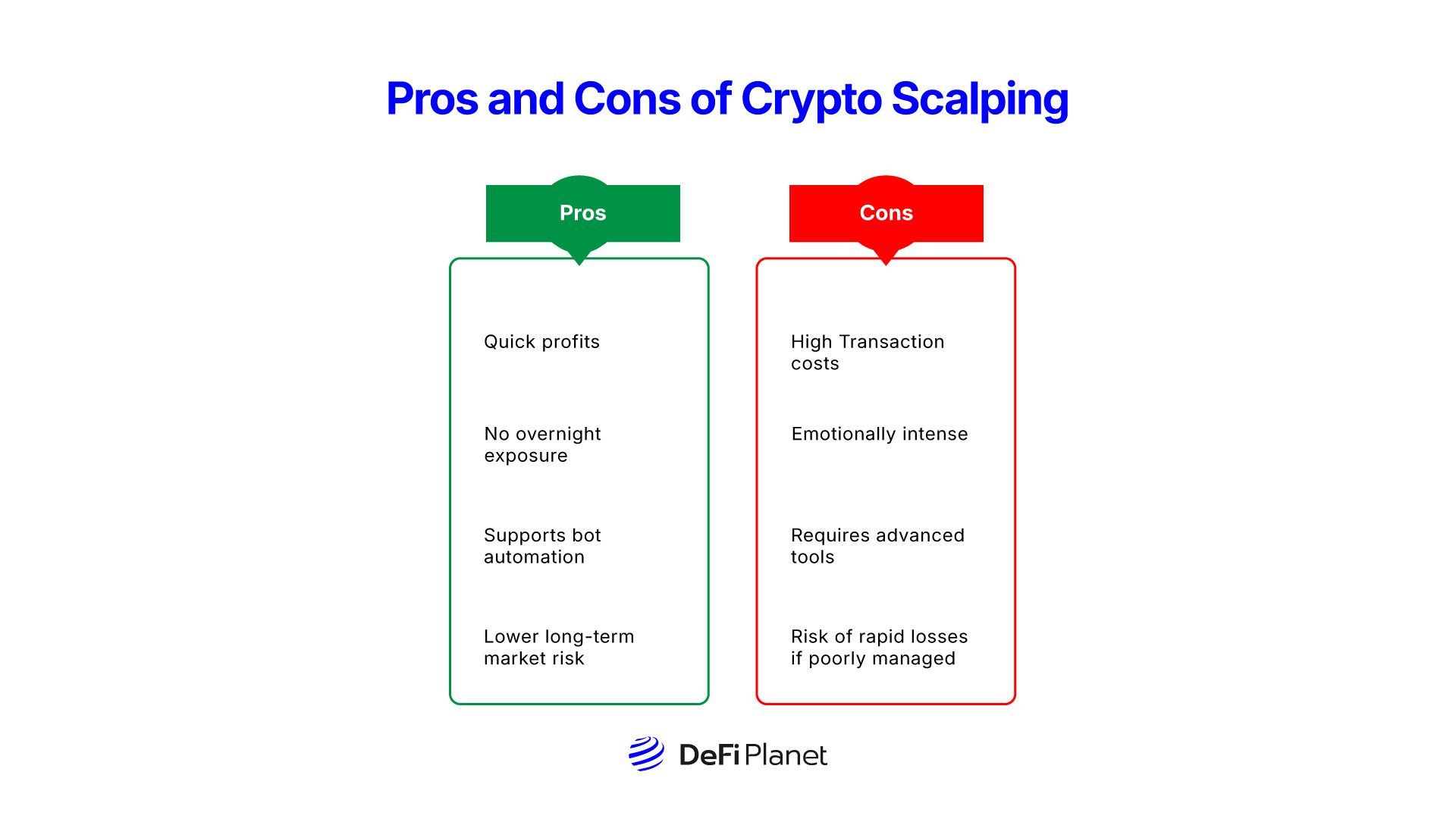

Professionals of Crypto Scalping

1. Fast earnings from small actions

Scalping permits merchants to make earnings from tiny value fluctuations a number of occasions a day. These frequent wins can add up rapidly over time, particularly in unstable markets.

2. Doesn’t require holding belongings in a single day

Since all trades are closed inside minutes or hours, scalpers keep away from the dangers that include in a single day value swings or sudden market information.

3. May be automated utilizing crypto buying and selling bots

Many scalpers use crypto buying and selling bots to execute trades routinely based mostly on preset methods, decreasing the necessity for fixed handbook monitoring.

4. Much less publicity to long-term market dangers

Scalpers deal with short-term actions, so they’re much less affected by broader market downturns or macroeconomic occasions that impression long-term buyers.

Cons of Crypto Scalping

1. Excessive transaction charges can eat into earnings

Frequent buying and selling means paying buying and selling charges time and again. With out a low-fee platform, these prices can rapidly cut back or remove your features.

2. Mentally and emotionally demanding

Scalping requires excessive ranges of focus, quick decision-making, and fixed monitoring, which may result in stress, fatigue, and burnout.

3. Requires quick web, instruments, and response time

To succeed, scalpers want ultra-fast execution, real-time information feeds, and dependable web. Any lag in pace can result in missed alternatives or sudden losses.

4. Excessive threat of losses if not executed correctly

Scalping leaves little room for error. With out a stable technique, tight threat administration, and fast reactions, just a few unhealthy trades can result in vital losses.

Professionals and Cons of Crypto Scalping

Prime Scalping Suggestions for Freshmen

1. Select low-fee platforms

As a result of crypto scalping entails executing dozens and even a whole bunch of trades every day, excessive buying and selling charges can rapidly eat into your earnings. At all times select exchanges with low charges, tight spreads, and environment friendly order execution to maximise features.

2. Use demo accounts to apply earlier than risking actual funds

Earlier than getting concerned in actual trades, apply with a demo account to get acquainted with the platform, take a look at methods, and construct confidence. It helps you keep away from pricey errors whereas studying in a risk-free setting.

3. Grasp technical evaluation

Understanding charts, indicators, and market patterns is important for scalping. Instruments like RSI, MACD, and shifting averages allow you to time entries and exits exactly, which is vital in such speedy buying and selling.

4. Use stop-loss orders religiously

Cease-losses assist defend your capital by routinely closing trades that transfer towards you. In scalping in crypto buying and selling, fast losses can pile up in the event you don’t management threat with correct stop-loss ranges.

5. Keep away from over-leveraging

Whereas leverage can amplify earnings, it additionally magnifies losses. Scalpers should use leverage cautiously, sticking to modest ranges that received’t blow up their accounts on a single unhealthy commerce.

6. Maintain feelings out of buying and selling

Scalping calls for self-discipline, fast pondering, and strict execution. Emotional choices like revenge buying and selling or FOMO can derail your plan and switch small errors into large losses.

8. Set life like revenue targets

Scalping isn’t about hitting jackpot trades. Intention for small, constant features that compound over time. Greed usually results in holding trades too lengthy and lacking your ultimate exit.

9. Monitor information and occasions

Market sentiment can shift quickly resulting from breaking information, tweets, or laws. Staying knowledgeable helps you anticipate sudden volatility and modify your technique accordingly.

In Conclusion,

Should you’re contemplating making an attempt out this technique, do not forget that whether or not finished manually or utilizing crypto buying and selling bots, crypto scalping technique calls for ability, self-discipline, and lightning-fast execution.

Whereas it’s not with out dangers, the suitable information and instruments could make scalping in crypto buying and selling straightforward and decently worthwhile.

Disclaimer: This text is meant solely for informational functions and shouldn’t be thought of buying and selling or funding recommendation. Nothing herein must be construed as monetary, authorized, or tax recommendation. Buying and selling or investing in cryptocurrencies carries a substantial threat of economic loss. At all times conduct due diligence.

If you wish to learn extra market analyses like this one, go to DeFi Planet and comply with us on Twitter, LinkedIn, Fb, Instagram, and CoinMarketCap Group.

Take management of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics instruments.”