Be a part of Our Telegram channel to remain updated on breaking information protection

Binance co-founder Changpeng Zhao, aka CZ, has clashed with Bitcoin critic Peter Schiff over claims he made about tokenized gold.

The confrontation originated from feedback Schiff made in a dwell stream with Threadguy that he plans a blockchain-based platform to launch a tokenized gold product that will have an edge over Bitcoin.

“As a result of gold will preserve its buying energy so ideally the one factor that is smart to placed on a blockchain is gold,” he stated.

Schiff added that his tokenized gold product will “do all of the issues that Bitcoin guarantees however can by no means do” and that merchants would be capable to buy the tokenized gold via a platform referred to as SchiffGold.

“After which you possibly can switch the amount of gold, immediately at very low value,” he stated. ”Less expensive and far faster than you possibly can switch Bitcoin. You’ll be able to pay or be paid in gold. And you may redeem it in bodily gold or finally you possibly can redeem it in a token.”

CZ Says Tokenized Gold Tokens Are A “Belief Me Bro” Product

CZ took subject with Schiff’s feedback on X.

”Most individuals ‘in crypto’ know this, most individuals ‘not in crypto’ could not perceive but,” he stated. ”Tokenizing gold is NOT ‘on chain’ gold.”

He defined that tokenizing gold includes trusting a 3rd get together to present you gold at some later date, ”even after their administration modifications, perhaps many years later, throughout a conflict, and many others.”

”It’s a ‘belief me bro’ token,” he stated, arguing that the extent of belief that’s required round tokenized gold is the rationale no “gold cash” truly took off.

Saying the plain. Most individuals “in crypto” know this, most individuals “not in crypto” could not perceive but.

Tokenizing gold is NOT “on chain” gold.

It’s tokenizing that you just belief some third get together will provide you with gold at some later date, even after their administration modifications, perhaps… https://t.co/KMYfz2dG04

— CZ 🔶 BNB (@cz_binance) October 23, 2025

Gold Has Worst Correction In Years

After recording a number of all-time highs this 12 months, gold has skilled its strongest correction in years this week.

That pullback noticed the gold worth drop from a excessive of $4,381 to a weekly low of $4,1115, triggering the lack of $2 trillion in market cap.

However Schiff continues to argue that the metallic is a greater choose than BTC.

“If gold can drop by 6.5% in someday on panic promoting, think about what can occur to Bitcoin,” he stated on X. ”Such a crash will not be imaginary for lengthy.”

Schiff stated the autumn within the gold worth received’t lead to capital rotation into Bitcoin, as many analysts forecast, and predicted as a substitute that the drop “could set off a mass exodus out of Bitcoin.”

As a substitute of gold’s sharp correction setting off a broadly hyped rotation into Bitcoin, it could set off a mass exodus out of Bitcoin. Look out under!

— Peter Schiff (@PeterSchiff) October 22, 2025

Bitcoin, in the meantime, has climbed greater than 1% prior to now 24 hours to commerce at $109,563.88 as of 6:03 a.m. EST.

CZ Predicts That Bitcoin Will Surpass Gold In Market Cap

At first of this week, the Binance founder predicted that Bitcoin may finally surpass gold’s market cap.

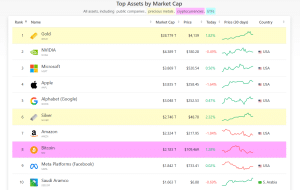

Prime property by market cap (Supply: CompaniesMarketCap)

Based on CompaniesMarketCap, gold’s capitalization stands at over $28.77 trillion, making it essentially the most helpful asset on this planet. Bitcoin’s capitalization stands at round $2.18 trillion, rating it as the eighth-biggest asset on this planet and greater than Fb father or mother Meta and Saudi Aramco.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection