Introduction: A Market on the Brink of Transformation

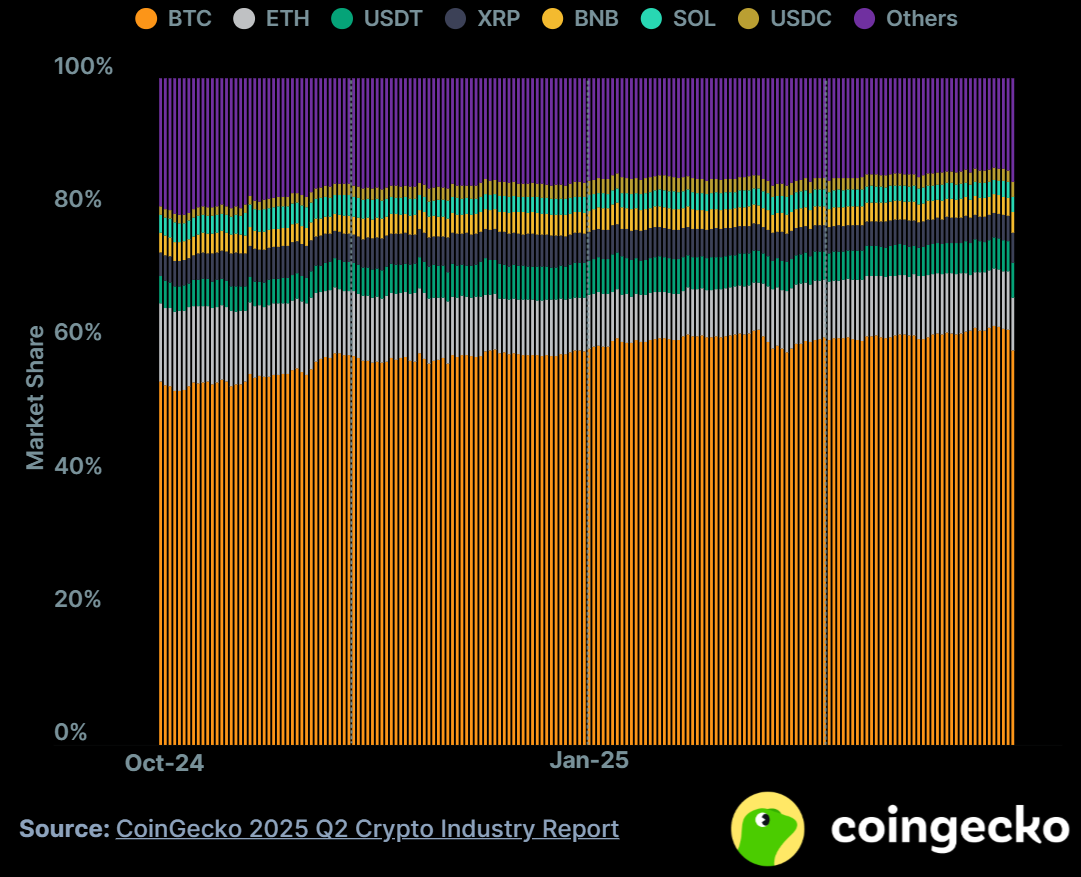

In September 2025, CoinGecko introduced that decentralized exchanges (DEXs) had handed a cumulative buying and selling quantity of greater than 2.5 trillion in 2025, which is the very best cumulative buying and selling quantity ever on non-custodial buying and selling platforms. On the similar time, Glassnode statistics indicated that an extra of 18 % of the Ethereum provide is at present staked as governance or DeFi protocols, highlighting a powerful pattern towards centralized finance (CeFi) giving strategy to user-sovereign ecosystems.

This rise of decentralized autonomous exchanges (DAEs) and governance-driven platforms is not only a pattern—it’s the subsequent logical step within the crypto business’s evolution. Whereas the primary technology of DEXs proved that on-chain buying and selling was doable, the brand new wave of DAEs goals to show that on-chain governance and possession fashions can outcompete conventional custodial buildings.

The query isn’t whether or not decentralized governance will matter—it’s how quickly it can develop into the dominant paradigm for the international crypto trade panorama.

Why Governance Issues for the Way forward for Exchanges

Governance is the spine of trustless monetary ecosystems. Decentralized autonomous exchanges, not like centralized ones, the place executives and regulators set insurance policies, have guidelines programmed into sensible contracts and modified by neighborhood consensus.

Messari factors out that the charges of governance token participation have elevated 40% yearly, particularly in protocols like Uniswap and Aave. This reveals elevated person exercise and want to affect the way forward for monetary protocols.

Governance fashions be sure that:

You’re going to get an important clear expertise so that each one proposals, votes, and outcomes are verifiable on-chain.Additionally, now the token holders are going to resolve on buying and selling charges, liquidity incentives, and protocol upgrades.Decentralization places in place a diminished publicity to censorship, capricious regulation enforcement, or govt vice.

Nonetheless, centralized fashions are related to threats: custodial management, dependency of regulation, and a single level of failure.

Decentralized Autonomous Exchanges (DAEs): What Units Them Aside

Whereas DEXs like Uniswap and Curve have already popularized automated market makers (AMMs), DAEs take the thought a step additional. They aren’t solely decentralized in execution but in addition autonomous in operation. This implies:

Enforcement of guidelines by absolutely automated, immutable sensible contracts.Ecosystems which are self-sufficient on charges of the transactions and treasury allocations.The built-in governance through which the customers decide the upgrades, income distribution, and partnerships.

Chainalysis estimates that DAEs comprise about 38% of the entire transaction quantity in DeFi in 2025, indicating a rise in confidence in platforms that don’t depend on the participation of centralized intermediaries.

It’s a change through which the customers are buying and selling on platforms that also they are co-owners of, moderately than buying and selling on platforms owned by companies

Market Tendencies: Hybrid Governance and Layer-2 Integration

The mix of the layer-2 scaling resolution and the decentralized trade is likely one of the most thrilling tendencies. DAEs have enabled governance-based buying and selling to be accessible to retail buyers via Ethereum rollups, resembling Arbitrum and zkSync, which have enabled a discount of gasoline charges by greater than 90 %.

In keeping with the information launched by CoinGecko, over the primary half of 2025 alone, the buying and selling volumes on the layer-2 DEXs have elevated by 65% which will be attributed to the financial savings in prices in addition to the improved person expertise.

Hybrid governance fashions are additionally rising, the place DAEs mix algorithmic decision-making with human-driven voting. As an illustration:

Snapshot voting instruments permit token holders to suggest upgrades with out rapid on-chain execution, reducing prices.Selections have gotten democratic with diminished whale dominance via quadratic voting methods.

Such a mixture is a sensible compromise between effectivity and fairness.

The Position of the Conventional Crypto Alternate

Whereas decentralized platforms are rising, centralized platforms nonetheless dominate buying and selling quantity, particularly for institutional buyers. A crypto trade like Coinbase or Binance gives:

Liquidity depth unmatched by most DEXs.Regulatory compliance that permits institutional participation.It can additionally present a user-friendly expertise.

Because the business is now a mature business, governance is now not an extra technical facet, however it’s a aggressive benefit.

The business’s future shouldn’t be a zero-sum battle. As a substitute, we’re seeing integration. Main centralized exchanges are experimenting with DAO governance options, whereas DAEs are adopting compliance frameworks to draw greater capital inflows.

This convergence means that the time period “crypto trade” will more and more seek advice from platforms that blur the road between centralized management and decentralized autonomy.

Governance Fashions: DAOs, Treasuries, and Voting Programs

1. DAO-Led Exchanges

Many DAEs are structured as Decentralized Autonomous Organizations (DAOs). Token holders vote on protocol upgrades, charge buildings, and liquidity mining packages. For instance, Uniswap’s governance treasury holds billions in funds that may be allotted by neighborhood choice.

2. Treasury Administration

Treasuries have gotten strategic battle chests. Aave, for example, makes use of governance-controlled treasuries to fund ecosystem improvement, liquidity incentives, and grants. Messari reviews that governance treasuries throughout DeFi now exceed $20 billion in property beneath administration, rivaling conventional enterprise funds.

3. Voting Mechanisms

Token-weighted voting: Traditional mannequin, however vulnerable to whale affect.Quadratic voting: Reduces the affect of huge holders, rewarding distributed participation.Delegated governance: Specialists or neighborhood leaders are delegated votes to enhance choice high quality.

The success of governance fashions will decide which DAEs thrive in the long term.

Challenges of DAEs and Governance Fashions

Regardless of their promise, DAEs face hurdles:

Low turnout charges: Glassnode reviews that in most governance methods, lower than 12 per cent of all token holders take part in voting.Regulatory uncertainty: Governments can take into account the governance tokens to be securities and it poses compliance difficulties.Good contract vulnerabilities: Fallacies will proceed to be a big menace, as Chainalysis estimates that over $1.2 billion of cash was stolen by DeFi exploits in 2024 alone.

These issues will end in a continued lack of institutional-grade DAEs.

The Street Forward: A Imaginative and prescient for 2030

Sooner or later, DAEs and exchanges involving governance are prone to develop into a few of the predominant pillars of the crypto financial system. By 2030, we are able to anticipate:

DAEs of institutional high quality: Utterly compliant, audited, and controlled decentralized methods.Cross-chain governance fashions: Permitting DAEs to span Ethereum, Solana, and past.Consumer-owned infrastructure: The place communities—not companies—seize the lion’s share of trade income.

Simply as Bitcoin redefined cash, DAEs might redefine how exchanges themselves are owned and operated.

Conclusion: Governance because the New Aggressive Edge

You realize what? The way forward for exchanges is real-time rewritten. The centralized giants are nonetheless important, however decentralized autonomous exchanges are producing a brand new story, which is grounded in transparency, possession, and neighborhood governance.

Governance has ceased to be a buzzword however a survival tactic. The platforms that allow their customers to resolve, vote, and allocate assets are going past innovating; they’re reinventing the character of being an trade.

For buyers and merchants, the message is obvious: the subsequent technology of exchanges received’t simply be locations to commerce—they are going to be platforms you personal a bit of. And within the fast-moving crypto world, proudly owning the foundations is simply as helpful as enjoying the sport.