Deutsche Financial institution warns of a USD collapse resulting from tariffs and geopolitical shifts. Bitcoin might surge as a safe-haven asset, with BTCUSD rising to contemporary highs.

The world is carefully watching U.S. tariff insurance policies. If these insurance policies falter, Bitcoin and different greatest cryptos to purchase might face challenges in a risk-on atmosphere. With deal with Donald Trump, Deutsche Financial institution strategists imagine the world is within the early phases of a serious geopolitical and monetary shift that would considerably impression international markets, immediately benefiting Bitcoin and different property.

(BTCUSDT)

Discover: 9+ Finest Excessive-Threat, Excessive–Reward Crypto to Purchase in April 2025

Deutsche Financial institution Says USD Underneath Menace

In a be aware to shoppers, George Saravelos, head of FX Analysis, warned that the USD’s position as a reserve forex and secure haven is beneath menace. Alongside strategist Tim Baker, Saravelos intensified these considerations, citing a cascade of structural adjustments in U.S. monetary and financial coverage that would result in a “megashock” in international markets.

This potent mixture of tariffs, which now defines U.S. commerce with the remainder of the world, rising political instability, and the U.S. reassessing its international management might gas a sustained downtrend within the greenback. “The preconditions at the moment are in place for the start of a serious greenback downtrend,” Saravelos and Baker declared.

Analysts fear that top U.S. tariffs will improve enterprise prices, particularly for corporations reliant on imported items or uncooked supplies, forcing these prices onto customers. This creates an inflationary atmosphere, exacerbated by the Trump administration’s more and more confrontational commerce insurance policies.

https://twitter.com/relai_app/standing/1910638139707699453

Worse, excessive tariffs, notably with China, are prone to persist, as Treasury Secretary Scott Bessent indicated a complete settlement might take years. This prolongs uncertainty and heightens volatility, slowing momentum of crypto costs, together with these of the perfect Solana meme cash to purchase in Q2 2025.

Furthermore, resulting from Trump’s criticism of the Federal Reserve and Jerome Powell, the central financial institution could yield to political strain and minimize charges past the 2 projected reductions.

In the event that they yield to strain, excessive inflation and low borrowing prices might improve worth pressures, pushing Bitcoin to new highs as traders look to guard their capital.

https://twitter.com/FedGuy12/standing/1914293454114570619

USD Declines, Will Bitcoin Fly?

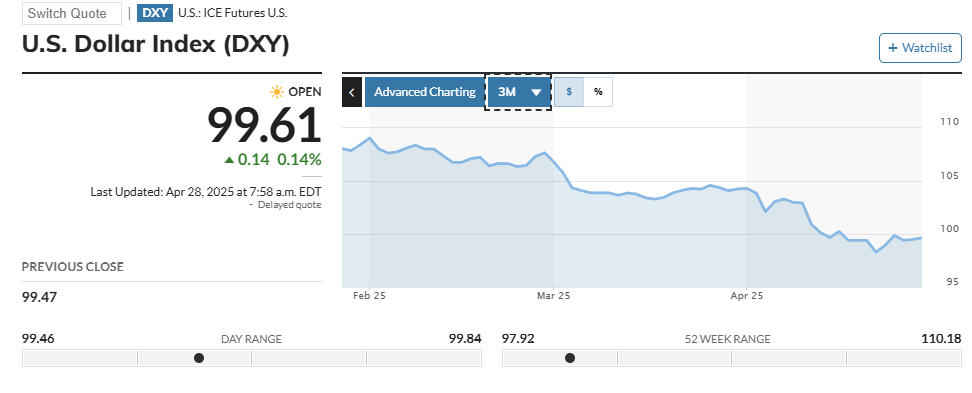

The USD Index is in a free fall, dropping beneath 100 to just about 99 in April 2025. It’s now down 8% from its 2025 highs.

(Supply)

Goldman Sachs analysts forecast the buck might lose almost 10% in opposition to the euro, yen, and pound by year-end.

https://twitter.com/ceodotca/standing/1915906196692754458

Amid U.S. commerce wars, Goldman Sachs estimates a forty five% recession danger, up from 35%. Tariffs, the financial institution famous, will erode residents’ actual revenue, squeezing an already fragile economic system.

Because the USD weakens, Jay Jacobs of BlackRock believes geopolitical fragmentation might create a “megaforce” shaping international finance for many years. In response, Jacobs added, traders will flock to decentralized, non-sovereign shops of worth, notably Bitcoin. Among the greatest new cryptos to put money into in 2025, like Hyperliquid (HYPE), might soar because of this.

“Immediately associated to this geopolitical fragmentation is the rise of Bitcoin as folks search stability amid destabilization and demand different property,” Jacobs noticed.

He famous that Bitcoin is decoupling from tech shares. It’s presently trending on an uncorrelated trajectory as a secure haven and digital gold.

DISCOVER: 17 Subsequent Crypto to Explode in 2025: Professional Cryptocurrency Predictions & Evaluation

Deutsche Financial institution Predicts USD Decline, BTCUSDT To New Highs?

Deutsche Financial institution and Goldman Sachs forecast USD decline resulting from Trump’s tariffs

Analysts predict a “megashock” from U.S. commerce wars and political instability

Excessive tariffs on China and past might increase shopper costs

Trump’s criticism of the Fed could result in aggressive fee cuts, weakening the USD

The submit Deutsche Financial institution Warns of Geopolitical Fragmentation Megashock for BTCUSD as Trump Weakens Greenback appeared first on 99Bitcoins.