In recent times, it’s grow to be tougher for buyers to diversify their portfolios out of the US. That’s for a lot of causes. Firstly, the sheer efficiency of US markets has made it tough for buyers to look elsewhere. Again-to-back years of 20%+ beneficial properties for the S&P 500 have made different markets look far much less enticing for buyers.

On prime of that, most non-US markets suffered from an financial downturn, together with China. This was a area as soon as wanted by fund managers and retail buyers alike, however a property disaster and sluggish financial system have seen buyers turning away.

Rising market equities can improve portfolio diversification for buyers closely uncovered to US and developed markets, because of traditionally low correlations, excessive share of home revenues, and differing financial and market cycles.

If we take a look at rising markets, India stands as one of many fastest-growing main economies. Its financial system is projected to increase by 6.6% over the fiscal 12 months 2024-2025, the very best price amongst key international economies. For comparability, China hit 5% GDP development final 12 months whereas the US financial system grew 2.5%. India’s development is about to proceed with forecasts for GDP development of between 6.7% and seven.3% in fiscal 12 months 2025-2026. India’s financial system is basically pushed by home consumption, in contrast to most different giant rising economies reminiscent of China, that are primarily export-led.

This development is underpinned by a rising center class, technological developments, and authorities reforms to reinforce the enterprise atmosphere. India lately unveiled a document USD$11.5 billion in tax cuts that gave the center courses vital reduction as Prime Minister Narendra Modi seeks to cushion the financial system in opposition to international headwinds.

Home and overseas investments within the area have grown considerably since fiscal 12 months 2020. The rising involvement of home buyers highlights India’s demographic benefit and increasing middle-class wealth. That is driving consumption, supporting the labour market, and reinforcing the resilience of India’s capital markets in opposition to international shocks.

This influx of home buyers helped offset the numerous lack of overseas capital inflows, which fell to virtually zero in 2024 amid a rotation to the US market. Nevertheless, with rising political uncertainty and frothy valuations over within the USA, this development might very nicely reverse.

The Indian market is buying and selling at a notable low cost in comparison with U.S. equities. Whereas the S&P 500 at the moment holds a P/E ratio of practically 25, its Indian counterpart—the Nifty 500—trades at a extra average 23.9. With inflation nicely inside the Reserve Financial institution of India’s goal vary and a impartial financial coverage stance, India might supply relative stability for buyers trying to hedge in opposition to the potential impression of tariffs on international markets.

Nevertheless, for these unfamiliar with rising markets, navigating India’s funding panorama will be advanced. That’s why we’ve put collectively an inventory of promising Indian firms to assist diversify your portfolio. Let’s dive in.

MakeMyTrip is like India’s Reserving.com, simply turbocharged. Its enterprise mannequin is all about connecting your journey desires with actuality. From transportation to accommodations and insurance coverage, they’ve all you want. What started as a small enterprise catering to US-India journey has since grown into India’s largest on-line journey company, commanding a 30% share of the air journey market and increasing its presence to 150 nations.

By prioritising aggressive development and making a seamless reserving expertise, they’ve managed to serve over 75 million clients and pull in $783 million in income previously 12 months. That development stemmed from air journey, seeing a 36% improve year-over-year as customers continued to journey extra following the pandemic. The corporate has continued to ship spectacular development, with revenues rising at a staggering 62.9% yearly over the previous three years. Wanting forward, analysts undertaking a 22.5% annual income development over the subsequent 5 years.

Discover MakeMyTrip inventory on eToro!

Shares have rallied over 100% within the final 12 months with the enterprise lately turning into worthwhile. The market expects to see earnings proceed to develop at 30% annually till 2028. It comes with a fairly lofty valuation at 72x ahead earnings which means it might want to preserve delivering on its development. However MakeMyTrip hasn’t seen a slowdown in journey demand and continues to learn from rising disposable incomes in India.

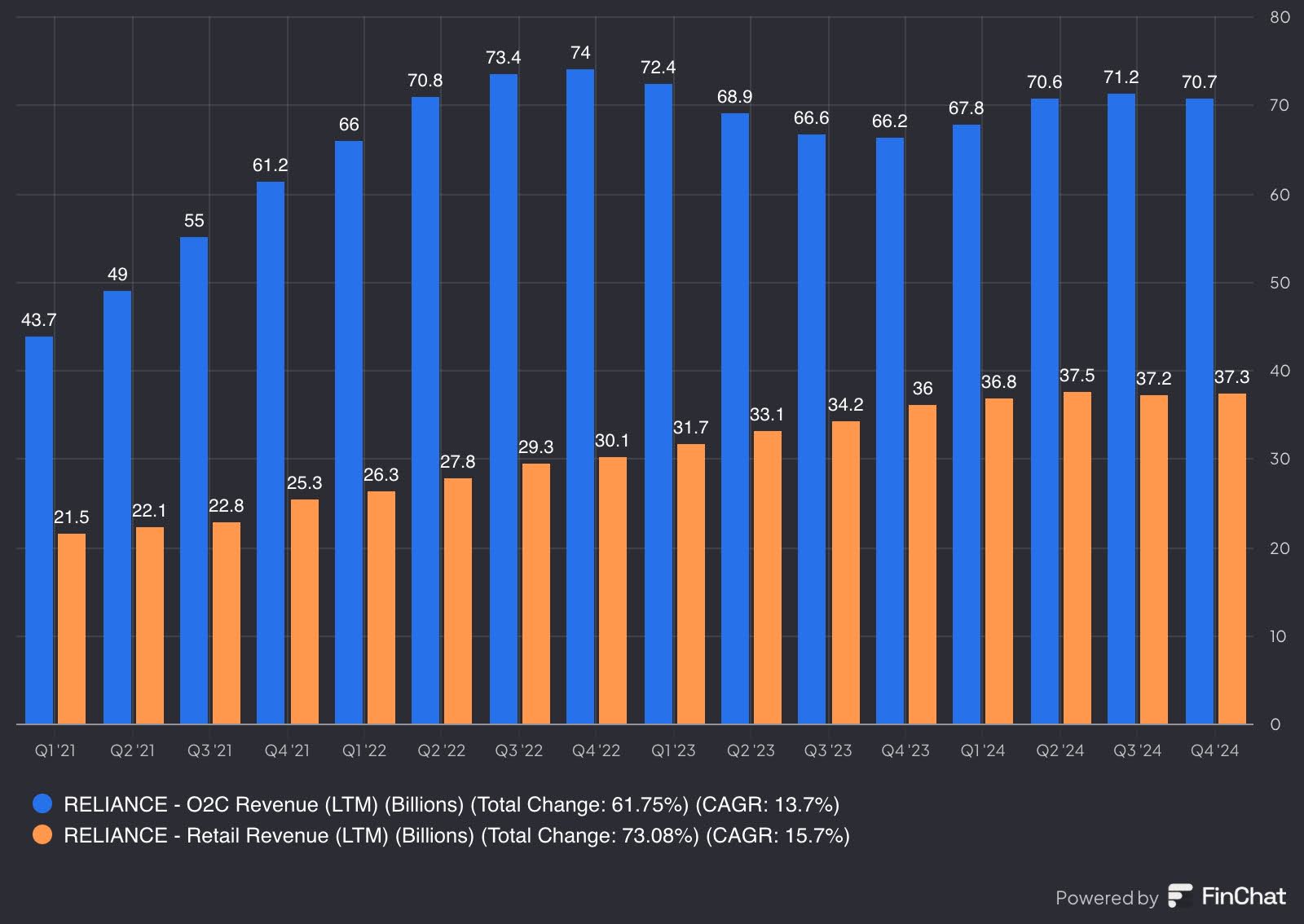

Reliance Industries, a Fortune 500 firm, is India’s largest non-public sector enterprise, having reworked from a textile and polyester producer right into a sprawling conglomerate. In the present day, its enterprise spans supplies, retail, leisure, oil & fuel, and inexperienced power, making it a key participant in India’s financial transformation. The corporate put India on the worldwide power map and spearheaded a nationwide retail and digital revolution. Underneath Mukesh Ambani’s visionary management, Reliance has aggressively expanded into e-commerce and digital companies, reshaping the nation’s enterprise panorama.

Reliance ranks because the 86th largest firm on this planet and the #1 in India, using practically 350,000 folks. It performs a vital position within the nation’s financial system, accounting for practically 10% of India’s complete merchandise exports. Regardless of its international attain, the corporate stays closely home, producing 65% of its income from India. The petrochemical enterprise stays its spine, contributing 61% of complete revenues, whereas retail, an more and more vital section, makes up 30%. This enterprise diversification has helped Reliance keep regular development, at the same time as international power dynamics shift.

Discover Reliance Industries inventory on eToro!

Reliance trades at a P/E ratio of 24.7x, barely under its long-term common of 27.8x, suggesting room for upside if earnings development continues. Over the previous few years, the corporate has delivered 9.6% annual income development and 12% annual web earnings development. Nevertheless, the inventory has declined 11% over the previous 12 months, primarily attributable to issues over regulatory scrutiny, margin pressures in its refining enterprise, and slower-than-expected monetisation of its digital and retail arms.

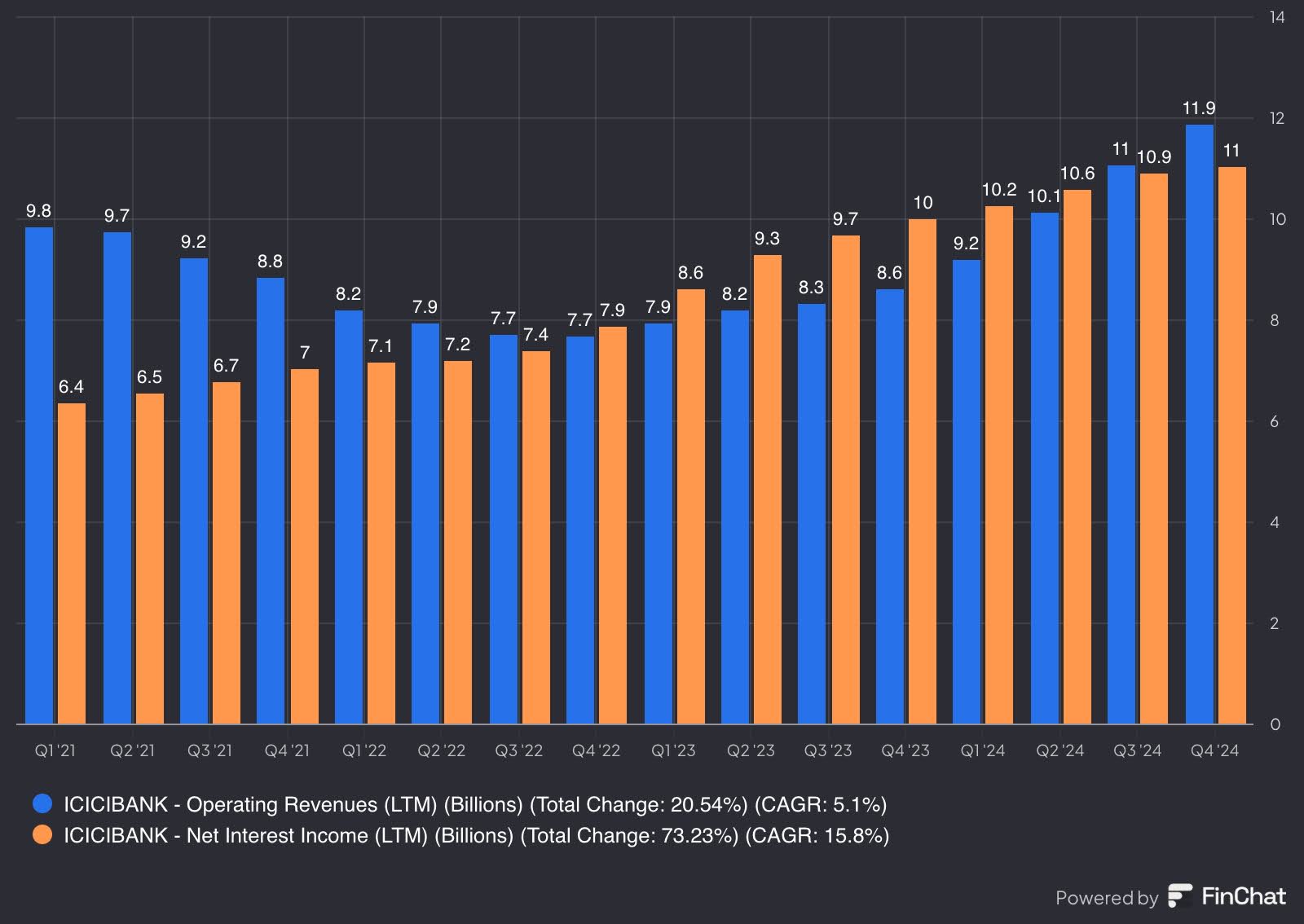

ICICI Financial institution, certainly one of India’s largest non-public sector banks, is usually thought to be the JPMorgan of India. It performs a vital position in India’s monetary ecosystem, providing a full suite of retail and company banking companies, together with loans, bank cards, wealth administration, and insurance coverage.

The financial institution has capitalised on India’s booming financial system, increasing its digital choices and benefiting from sturdy client demand for credit score. It has constantly outpaced trade development, pushed by its concentrate on expertise and fast development within the center class. The financial institution has a community of about 5,420 branches and a few 13,625 ATMs in India. Along with its rising on-line presence, ICICI has established itself as a pacesetter in India’s digital banking revolution.

Discover ICICI Financial institution inventory on eToro!

Over the previous 12 months, ICICI has delivered a powerful 27% income development, fueled by quickly rising deposits, mortgage issuance, and enterprise banking enlargement. Greater rates of interest in India have additionally labored in its favour, permitting the financial institution to earn over 8% curiosity on its mortgage portfolio—a big margin benefit in comparison with many international banks.

ICICI’s P/E ratio of 19 means that buyers anticipate its sturdy development trajectory to proceed. For context, JPMorgan trades at a P/E of 14, reflecting a extra mature, slower-growing market. In the meantime, ICICI’s inventory has gained 24% over the previous 12 months, a testomony to investor confidence in its long-term potential.

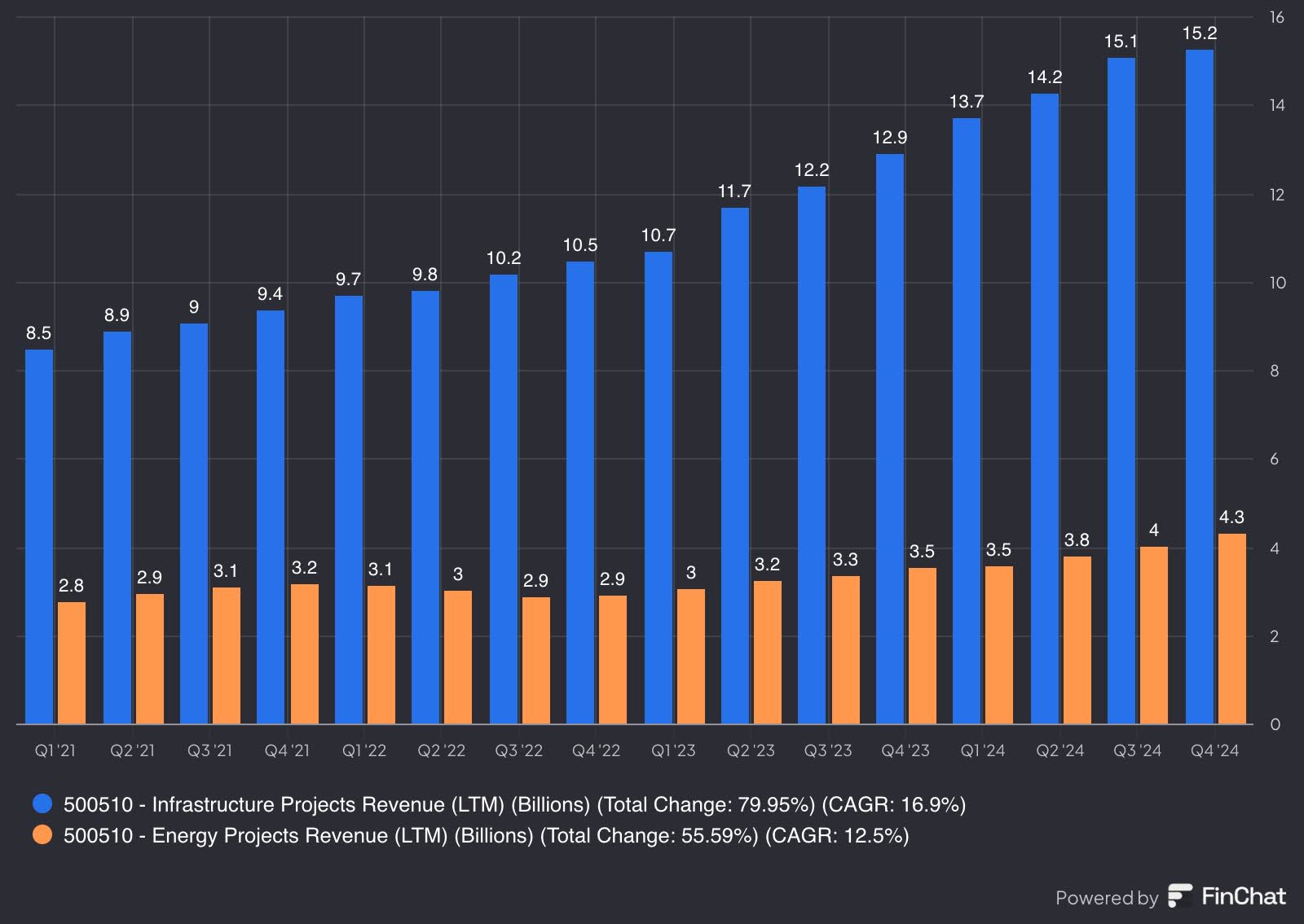

Larsen & Toubro (L&T) is one other big Indian conglomerate specialising in engineering, development, and manufacturing. As a key participant in India’s financial enlargement, L&T is answerable for large-scale infrastructure, power, and industrial tasks, each domestically and overseas. Through the years, the corporate has diversified into expertise, IT companies, and equipment manufacturing, reinforcing its place as a essential enabler of India’s modernisation.

A significant tailwind for L&T has been the Indian authorities’s aggressive infrastructure push, which continues to drive income development and profitability. With no indicators of this momentum slowing, the corporate is well-positioned to capitalise on rising demand for city growth, power tasks, and industrial enlargement.

Discover L&T inventory on eToro!

L&T reported a robust quarter, with order values surging 52% year-over-year. This sturdy order influx has fueled a 17% improve in income, highlighting sturdy demand throughout its core companies. Moreover, the corporate maintains a Return on Fairness (ROE) of 16%, reflecting strong profitability and environment friendly capital allocation.

Regardless of its sturdy fundamentals, L&T’s inventory has struggled, declining 6.5% over the previous 12 months. This pullback might current a chance for buyers trying to achieve publicity to India’s long-term infrastructure growth at a extra enticing valuation.

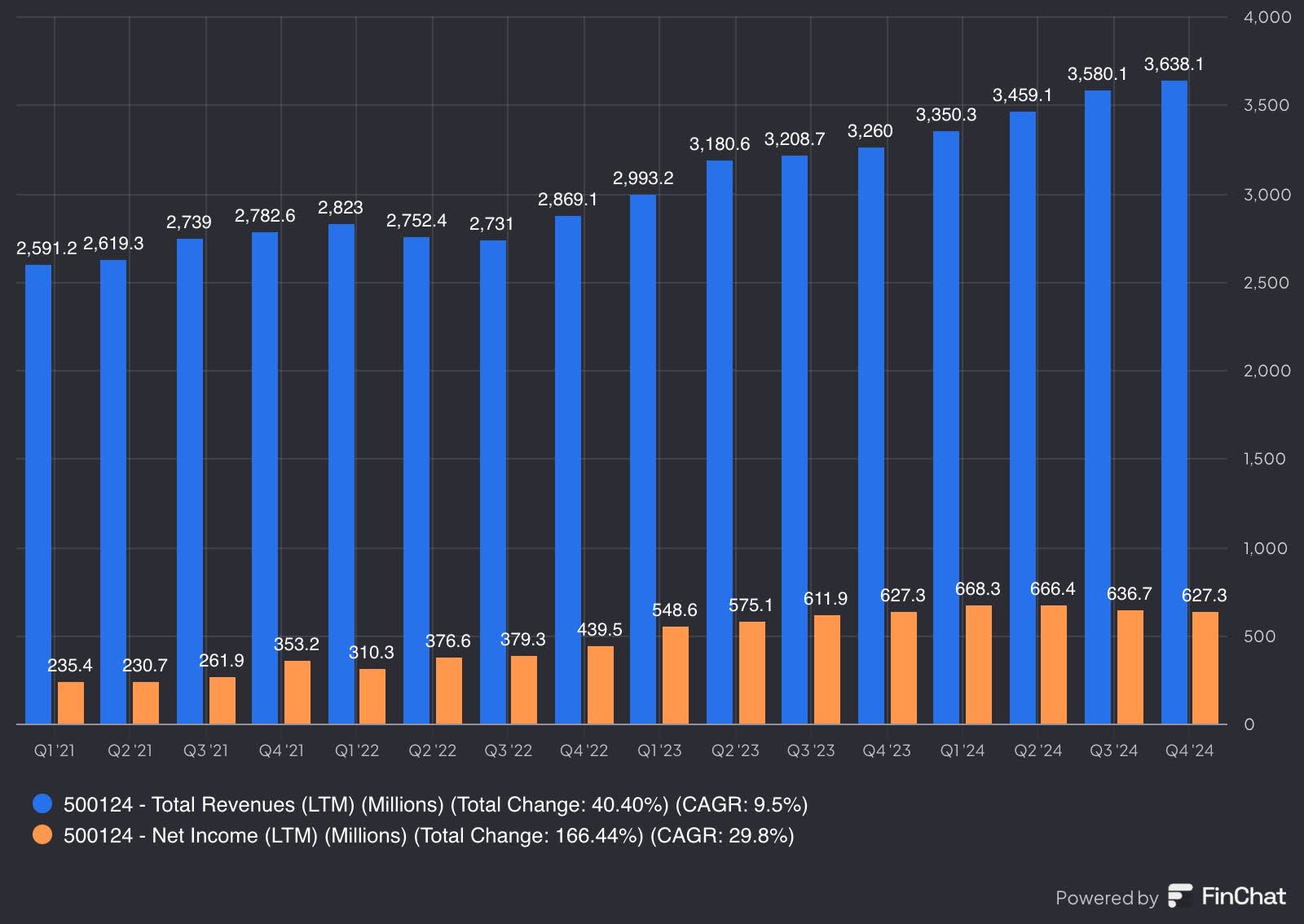

Dr. Reddy’s Laboratories is a serious pharmaceutical firm that manufactures and markets a various portfolio of over 190 medicines and 60 energetic pharmaceutical elements (APIs) utilized in drug manufacturing, diagnostic kits, essential care, and biotechnology. Whereas the corporate is headquartered in India, its operations span 76 nations, using over 26,000 folks. Nevertheless, the majority of its manufacturing amenities stay in India, giving it a price benefit.

Regardless of its Indian roots, Dr. Reddy’s has efficiently diversified its income streams, producing 80% of its gross sales from overseas markets. North America is especially essential, serving as the first marketplace for its generics section, which offers inexpensive options to patented medicine. This section alone contributes 88% of the corporate’s complete income, underscoring its significance to the enterprise.

Discover Dr. Reddy’s inventory on eToro!

Over the previous three years, Dr. Reddy’s has delivered strong 14% annual income development, with earnings outpacing gross sales. Due to a wholesome web margin of 17%, earnings have expanded at a sturdy 33% annual price over the identical interval. Nevertheless, regardless of its monetary power, the inventory has declined 5% over the previous 12 months. At a P/E ratio of 17x, Dr. Reddy’s trades nicely under its five-year common of 22x earnings and lags behind opponents, which commerce at a mean P/E of 23x. This low cost might point out undervaluation, nevertheless it additionally displays market issues—significantly the aggressive pressures from GLP-1 weight problems medicine, that are reshaping the pharmaceutical panorama.

With a historical past courting again to 1806, the State Financial institution of India (SBIN) is India’s largest business financial institution and a dominant drive within the nation’s banking sector. Holding a 25% market share, SBI leads in dwelling, auto, and schooling loans, cementing its place because the go-to financial institution for hundreds of thousands of Indians. It additionally has a robust worldwide presence, working 241 branches throughout 29 nations, making it a worldwide banking participant.

SBI has efficiently embraced digitization, launching YONO (You Solely Want One), a monetary tremendous app that integrates banking, investments, and digital companies right into a single platform. With its deep attain in each rural and concrete markets, the financial institution performs a vital position in India’s monetary inclusion efforts, catering to a broad buyer base.

Not like ICICI Financial institution, which has a extra diversified lending mannequin, SBI is primarily a retail financial institution, with over 90% of its deposits and 55% of its loans originating from retail purchasers. This sturdy deposit base offers a secure funding supply, decreasing its reliance on unstable company lending.

Discover SBIN inventory on eToro!

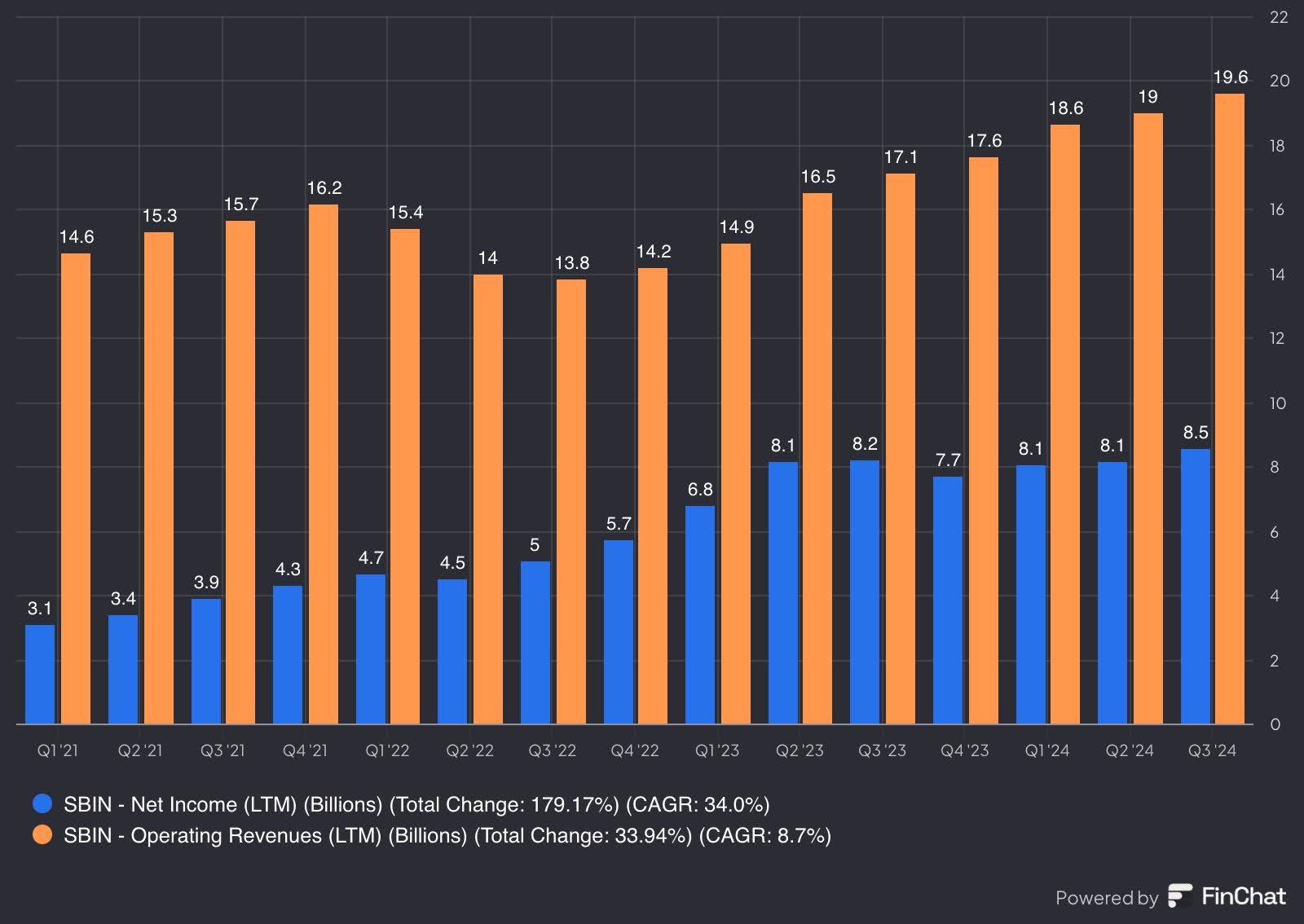

Over the previous 12 months, deposits grew 11%, whereas earnings surged 21% year-over-year. Taking a look at an extended horizon, revenues have expanded at a 15% annual price over the previous three years, whereas earnings have grown at a exceptional 44% per 12 months. This development has been fueled by rising credit score demand and better curiosity earnings, as elevated rates of interest have boosted financial institution profitability.

Regardless of these sturdy fundamentals, SBI stays undervalued in comparison with its friends. The inventory has gained 12% over the previous 12 months however remains to be buying and selling at a P/E ratio of 8.3x, nicely under its five-year common of 10x and considerably cheaper than opponents, who commerce round 15x earnings on common. Moreover, the financial institution affords a gradual dividend yield of 1.8%, offering an earnings stream for buyers.

HDFC Financial institution is India’s largest non-public sector financial institution by property and market capitalization, standing alongside ICICI Financial institution and the State Financial institution of India (SBI) as one of many nation’s “too huge to fail” monetary establishments. HDFC cemented its place because the chief in housing financing by merging with the Housing Growth Finance Company (HDFC Ltd.) in 2023, making a monetary big with deep penetration in India’s mortgage market.

It serves greater than 68 million clients worldwide and offers a wide range of wholesale, retail, and depository monetary companies by greater than 6,340 branches and a few 18,130 ATMs, together with money deposits and withdrawal machines all through India.

Past housing finance, HDFC has constructed a various monetary ecosystem with subsidiaries spanning banking, insurance coverage, mutual funds, and different monetary companies. The corporate’s development is pushed by the rising demand for housing loans in India’s city and semi-urban areas. The financial institution continues to increase its choices, capitalizing on its sturdy model and in depth franchise community to remain forward.

Discover HDFC financial institution inventory on eToro!

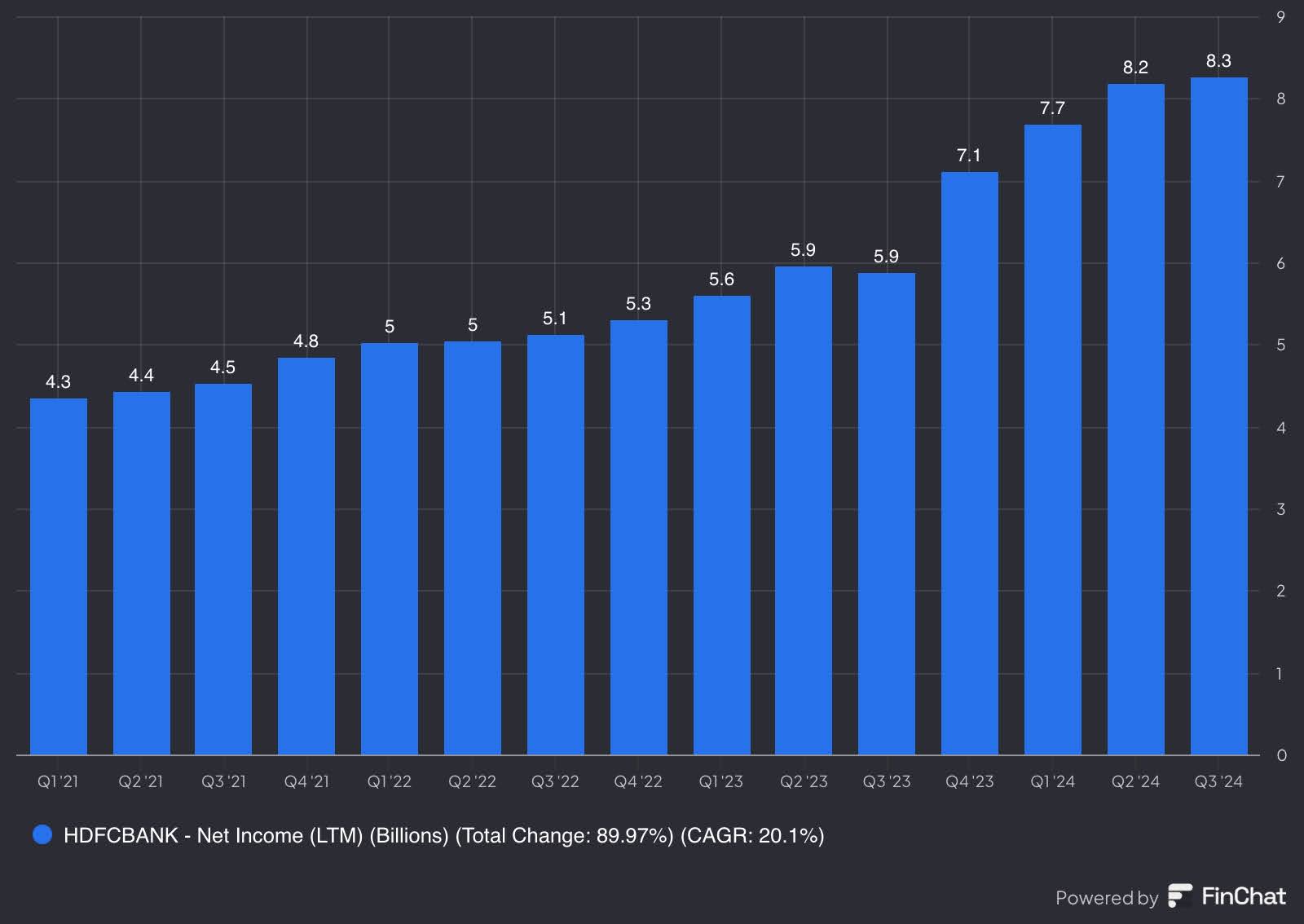

Regardless of the continued post-merger integration, HDFC’s financials stay sturdy. Over the previous 12 months, revenues have grown 16%, whereas earnings have risen 18% yearly. Given its measurement and disciplined administration, HDFC additionally ranks amongst India’s best-capitalized banks, reinforcing its monetary stability.

HDFC Financial institution has been on a robust bull run, with shares rising 22% over the previous 12 months. But, its valuation stays enticing. The inventory trades at a P/E ratio of 16x, under its five-year common of 19.7x, suggesting room for a number of enlargement. Wanting on the price-to-book (P/B) ratio, which displays what buyers are keen to pay for every greenback of the financial institution’s property, HDFC is at the moment valued at 2.6x, under its long-term common of three.2x. This means that, regardless of the current rally, the financial institution might nonetheless have extra upside.

As you possibly can see, India offers many funding alternatives throughout totally different sectors. With comparatively enticing valuations and brilliant development prospects, India often is the very best rising market to diversify your portfolio. Take a look at these seven shares now!

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding targets or monetary scenario, and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product should not, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.