On-chain knowledge exhibits round 77.9% of all Dogecoin provide is in revenue proper now. Right here’s the way it stacks up towards the likes of Bitcoin and XRP.

Dogecoin In contrast Towards The Relaxation In Whole Provide In Revenue

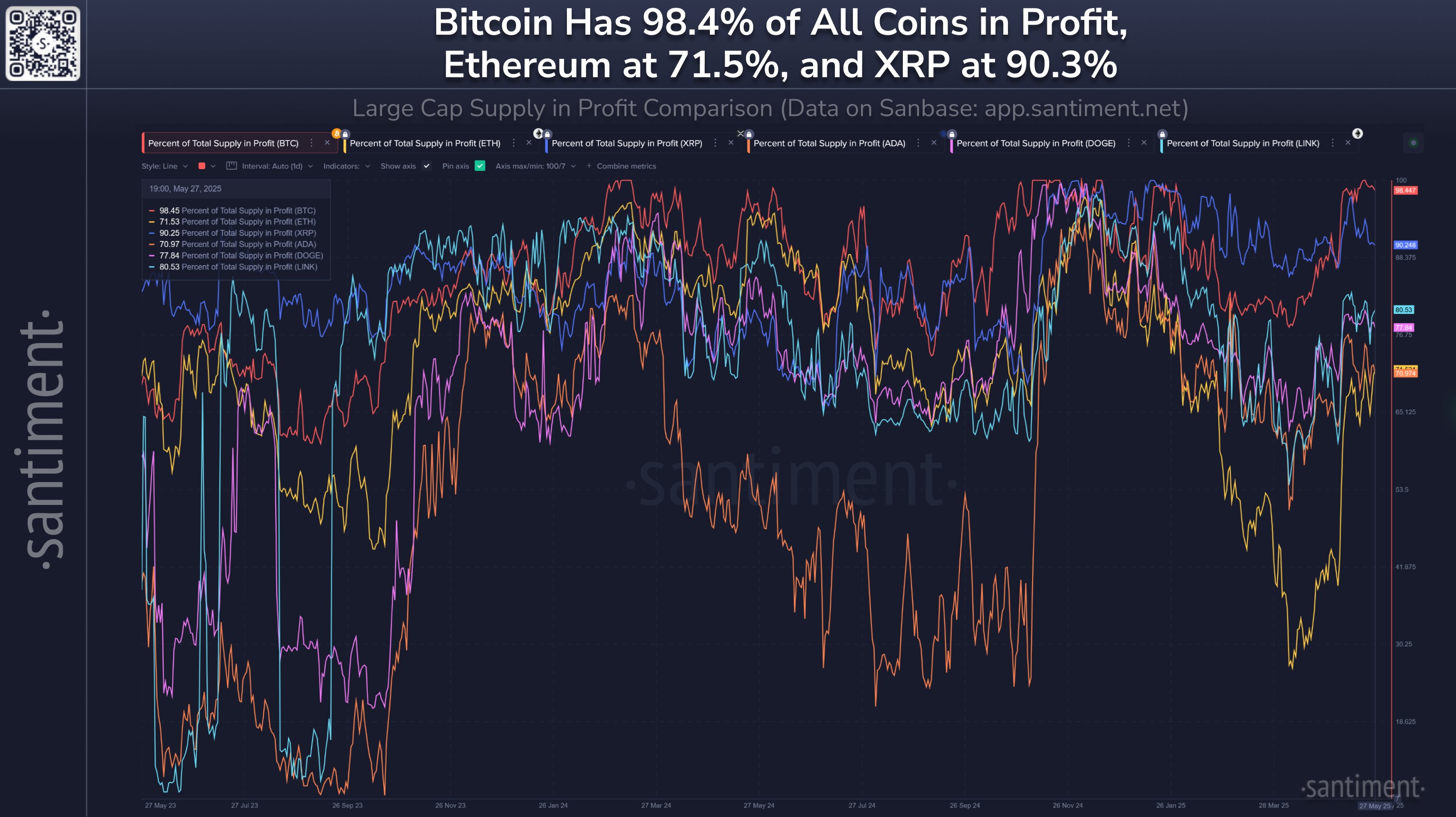

In a brand new publish on X, the on-chain analytics agency Santiment has shared how among the prime cash within the cryptocurrency sector, like Bitcoin and Dogecoin, presently evaluate towards one another when it comes to the P.c of Whole Provide in Revenue indicator.

The “P.c of Whole Provide in Revenue” tells us, as its identify already suggests, the proportion of a digital asset’s whole provide in circulation that’s being held at some unrealized acquire.

This indicator works by going by the on-chain historical past of every token on the community to see what value it was final moved at. If the earlier transaction value is lower than the present spot worth for any coin, then that individual coin is assumed to be holding a revenue proper now.

The P.c of Whole Provide in Revenue counts up all tokens satisfying this situation and determines what a part of the whole provide they make up for. Now, here’s a chart that exhibits how this determine is presently in search of six prime cash: Bitcoin (BTC), Dogecoin (DOGE), Ethereum (ETH), XRP (XRP), Cardano (ADA), and Chainlink (LINK).

Appears just like the metric’s worth has typically gone up throughout the sector not too long ago | Supply: Santiment on X

As displayed within the above graph, all of those cryptocurrencies, apart from XRP, have witnessed a notable uptick within the proportion of Whole Provide in Revenue over the previous month.

The king of the sector when it comes to the indicator is Bitcoin, with round 98.4% of its provide being within the inexperienced. BTC has been in all-time excessive (ATH) exploration mode not too long ago, so this excessive degree isn’t a shock, contemplating that 100% of the availability enters right into a state of revenue on the prompt a brand new ATH is ready.

Even if XRP hasn’t seen a lot progress within the metric not too long ago, its profit-loss stability remains to be the second-best amongst these belongings, with over 90% of the availability sitting on some acquire.

Chainlink and Dogecoin rank third and fourth on the checklist, with the P.c of Whole Provide in Revenue standing at 80.5% and 77.9%, respectively. Ethereum, the second-largest coin by market cap, has carried out comparatively poorly on the indicator, with its worth of 71.5% notably behind the others. That mentioned, from a progress potential perspective, ETH’s profitability is probably not as dangerous because it appears.

Typically, buyers in revenue usually tend to take part in promoting, so at any time when a major a part of the community is within the inexperienced, a mass selloff with the motive of revenue realization can grow to be possible. This may naturally facilitate the formation of tops.

Naturally, this doesn’t imply Bitcoin, with its excessive profitability, is certain to hit a prime within the close to future; its rally can proceed as long as the demand facet stays robust sufficient to soak up any profit-taking. However cash on the decrease finish, like Ethereum, Cardano, and Dogecoin, may have, in concept, extra room to run, ought to circumstances align.

DOGE Worth

Dogecoin has been caught in sideways motion not too long ago as its value remains to be floating across the $0.22 mark.

The worth of the coin seems to have been consolidating throughout the previous few days | Supply: DOGEUSDT on TradingView

Featured picture from Dall-E, Santiment.web, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluation by our staff of prime know-how consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.