Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Ethereum has lastly damaged by means of a key resistance stage, buying and selling above $1,900 after pushing previous the long-standing $1,850 barrier. This transfer marks the start of a breakout many hoped for—however few anticipated to reach so quickly. After weeks of hesitation, bearish stress, and unsure momentum, ETH is displaying renewed energy simply as broader market sentiment begins to shift.

Associated Studying

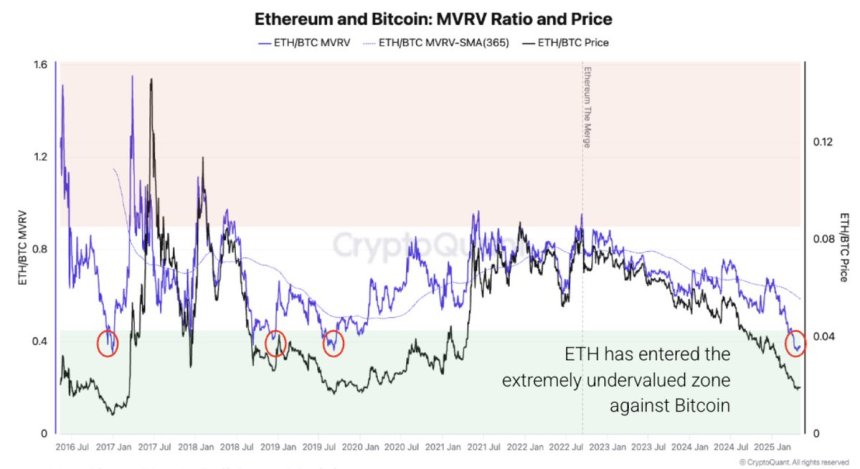

Including weight to the breakout, new insights from CryptoQuant reveal that Ethereum is now extraordinarily undervalued in comparison with Bitcoin, the primary time this has occurred since 2019. Traditionally, such ranges of ETH/BTC undervaluation have preceded intervals of sturdy Ethereum outperformance. Whereas value motion is main the best way, on-chain knowledge is reinforcing the bullish case, signaling that ETH could also be getting into a positive section in its cycle.

This renewed upside comes amid low expectations and broad skepticism, making it all of the extra impactful. As ETH trades above $1,900, merchants and buyers are watching intently for follow-through and potential continuation towards $2,000 and past. If historical past is any information, Ethereum’s current transfer could not simply be a short-term spike—it could possibly be the start of a bigger development reversal, particularly because the ETH/BTC valuation hole begins to shut.

Ethereum Flirts With $2,000 As Undervaluation Sparks Bullish Hopes

Ethereum is now approaching the crucial $2,000 mark, a stage that, if reclaimed and held, would verify a technical breakout and probably usher in a broader bullish section. After weeks of sluggish motion and bearish stress, ETH is gaining momentum and displaying indicators of energy throughout each value motion and on-chain metrics. A detailed above $2,000 would mark a serious shift in sentiment, signaling renewed confidence amongst buyers and merchants alike.

Nonetheless, dangers stay. Ongoing tensions between the US and China proceed to inject uncertainty into international markets, and the US Federal Reserve has proven no signal of pivoting. With rates of interest anticipated to stay elevated and quantitative tightening (QT) nonetheless in impact, the macroeconomic backdrop stays a headwind. Ought to these geopolitical and financial components ease, Ethereum’s breakout may acquire sustained traction.

In keeping with CryptoQuant, the Ethereum-to-Bitcoin MVRV (Market Worth to Realized Worth) ratio highlights that ETH is now extraordinarily undervalued in comparison with BTC—the primary time this has occurred since 2019. Traditionally, such situations have led to sturdy intervals of Ethereum outperformance.

Nonetheless, the bullish setup faces some inner friction. Provide stress, weak on-chain demand, and flat community exercise may stall momentum if market sentiment doesn’t enhance additional. Whereas Ethereum’s present push is encouraging, affirmation will solely include sustained motion above resistance and stronger fundamentals. Till then, ETH stays at a crucial juncture, with the potential to guide the subsequent leg of the crypto rally—or slip again into consolidation if exterior and inner pressures persist.

Associated Studying

ETH Value Evaluation: Technical Particulars

Ethereum is buying and selling at $1,933 after a robust breakout above the $1,900 resistance zone, marking its highest stage since early April. On the 4-hour chart, ETH surged from round $1,850 with elevated quantity, breaking a multi-week consolidation vary. This transfer confirms bullish momentum and places the $2,000 psychological stage clearly in sight.

The breakout is additional supported by the worth now trending properly above each the 200-period EMA ($1,791) and the 200-period SMA ($1,700). These long-term transferring averages had beforehand acted as resistance however have now been flipped into potential dynamic help. The energy of this rally signifies renewed shopping for curiosity and a possible shift in market sentiment.

Nonetheless, the subsequent problem lies in sustaining this upward momentum. Ethereum should maintain above the $1,900–$1,920 stage to keep away from a fakeout and ensure this breakout as sustainable. A clear push by means of $2,000 would additional validate the bullish construction and open the door to increased targets.

Associated Studying

Total, the chart displays a decisive technical breakout, backed by quantity and construction. If bulls stay in management and macro situations stay regular, ETH could possibly be making ready for a stronger development continuation within the days forward.

Featured picture from Dall-E, chart from TradingView