Analyst Weekly January 12, 2026

Ethereum is doing loads, even when the token value doesn’t present it but. Exercise on the community is hitting data, stablecoins are at all-time highs, and actual use instances like tokenisation are beginning to scale. Extra of this exercise is occurring on cheaper “Layer 2” networks that also depend on Ethereum beneath.

So why isn’t ETH transferring? As a result of the community is selecting scale over short-term earnings.

Current upgrades made it less expensive for Layer 2s to make use of Ethereum. That’s nice for customers and builders, nevertheless it additionally means fewer charges flowing to Ethereum itself. In easy phrases: Ethereum lowered its costs to verify everybody retains constructing on it, even when that hurts income right now.

This creates a mismatch. Utilization is powerful, however worth seize is weak. Ethereum doesn’t have a requirement downside, somewhat, it has loads of spare capability. When provide is excessive and demand hasn’t caught up but, costs keep underneath strain.

Why do that in any respect? As a result of Ethereum is turning into core infrastructure. Round half of all stablecoins, about $165bn, sit on Ethereum. It’s trusted, liquid, and seen as comparatively impartial and regulator-friendly. In a world the place digital {dollars} have gotten monetary plumbing, that positioning issues.

Consider it like Amazon in its early years: not centered on earnings, however on turning into unavoidable. As soon as demand lastly fills the obtainable capability, charges and pricing energy don’t have to be pressured. They arrive naturally.

Funding takeaway: Ethereum right now seems much less like a damaged community and extra like one in a transition part. The wager for traders is easy however not risk-free: if demand retains rising, right now’s weak worth seize may flip into sturdy pricing energy later. The danger is that this by no means occurs and Ethereum stays necessary, however not very worthwhile for ETH holders.

For now, the community is taking part in the lengthy recreation. The market simply hasn’t priced that in but.

The Quiet Shift Powering Banks and Homebuilders

In case you are nonetheless watching markets by way of the lens of “what number of fee cuts are coming,” you is perhaps lacking the true story. This 12 months’s greatest market driver might not be the worth of cash, somewhat, how cash is transferring by way of the system.

Behind the scenes, coverage is shifting in a means that quietly helps banks, mortgages, and housing-related shares. It’s much less flashy than a fee lower, however traditionally, it may be simply as highly effective.

QT Has Ended; Reserves Are Rising

Quantitative tightening, the regular shrinking of the Fed’s steadiness sheet, has successfully come to an finish. As an alternative of draining liquidity, the Fed is now managing its steadiness sheet in a means that enables financial institution reserves to rise, significantly during times when the system usually tightens, like tax season.

Why does this matter? As a result of reserves are the uncooked materials of the monetary system. When reserves are rising, monetary circumstances are inclined to ease, even when coverage charges keep greater for longer. Because of this focusing solely on fee cuts misses the purpose. Liquidity is already enhancing, simply quietly.

Deregulation: Why Liquidity Out of the blue Issues Once more

Liquidity solely helps if banks can really use it. Over the previous few years, tighter rules restricted how a lot banks may develop their steadiness sheets, even when reserves have been obtainable.

That’s beginning to change. Monetary deregulation, particularly round leverage and capital necessities, permits banks to do one thing very fundamental once more: intermediate. They’ll maintain extra authorities bonds, put money into mortgage-backed securities, and help lending with out always working into regulatory limits.

This doesn’t imply banks out of the blue tackle extreme threat. It merely means the plumbing works once more. And when the plumbing works, liquidity begins to matter.

Banks Transfer From Downside To Plumbing

For banks, this shift is significant. Rising reserves mixed with regulatory reduction flip banks from a constraint right into a conduit. As an alternative of scuffling with balance-sheet limits, banks can develop by way of quantity, extra lending, extra securities, extra exercise, somewhat than counting on wider spreads or riskier conduct.

From an investor’s perspective, this reduces the draw back dangers which have weighed on financial institution shares. Banks don’t want a credit score growth to learn; they only want a system that stops combating them.

The Quiet Pressure Behind Decrease Mortgage Charges

That is the place on a regular basis traders really feel the affect most clearly: mortgages.

Mortgage charges aren’t set instantly by the Fed. They rely closely on mortgage spreads, or the distinction between mortgage yields and authorities bond yields. These spreads are influenced by who’s shopping for mortgages.

Proper now, the Fed is stepping again from shopping for mortgage-backed securities. Usually, that will push mortgage charges greater. However one thing else is occurring on the similar time. Fannie Mae and Freddie Mac are growing their purchases of mortgage-backed securities by roughly $200 billion: virtually precisely the quantity the Fed is letting roll off its steadiness sheet.

On the similar time, banks, freed up by deregulation, are in a position to maintain extra of those securities as effectively. The result’s easy: extra consumers for mortgages. Extra consumers imply tighter spreads, and tighter spreads imply decrease mortgage charges, even when broader rates of interest don’t fall a lot.

Why Homebuilders Are Paying Consideration

For homebuilders, this setup is quietly highly effective. Housing doesn’t want mortgage charges to break down: it simply wants them to cease being prohibitive. Even modest declines in mortgage charges can enhance affordability sufficient to unlock pent-up demand from consumers who’ve been ready on the sidelines.

Provide stays tight, family formation continues, and builders have already tailored to a higher-rate surroundings. That makes homebuilders particularly delicate to incremental enhancements in financing circumstances: the sort pushed by mortgage mechanics, not headline-grabbing coverage bulletins.

When mortgage markets stabilize, housing exercise often follows with a lag.

The Takeaway For Traders

The large lesson is that markets don’t at all times transfer on the loudest indicators. Typically they transfer on the quiet ones. Rising reserves, looser regulation, and shifting demand within the mortgage market don’t make headlines, however they modify conduct: first in banks, then in housing, and finally within the broader economic system.

For traders, this argues for wanting past rate-cut countdowns and paying nearer consideration to the place liquidity is flowing. If these developments proceed, banks and homebuilders might profit effectively earlier than the broader market narrative catches up.

So:

Don’t fixate on fee cutsBalance sheet enlargement and deregulation are doing extra of the work at this level.

Banks profit from being allowed to functionRising reserves + regulatory reduction scale back threat and enhance intermediation.

Mortgage mechanics matter greater than housing headlinesSpreads, not subsidies, are driving charges.

Homebuilders stay quietly effectively positionedSmall enhancements in mortgage charges can have outsized results.

US Banks Kick Off Earnings Season: Tailwind For The Etf?

The SPDR S&P Financial institution ETF received off to a powerful begin to the brand new 12 months. Within the first full buying and selling week, the index gained 3.6% to $63.25. On Friday, it even reached a brand new file excessive at $63.99. Within the closing buying and selling hours, nonetheless, some gentle profit-taking set in.

This seemingly displays not solely the same old warning forward of the weekend, but additionally rising consideration on the upcoming US earnings season. As at all times, the most important US banks would be the first to report, offering early indicators for all the sector. If the general set of outcomes is optimistic, the ETF may shortly set its sights on one other file excessive.

If profit-taking continues, two help zones (truthful worth gaps) come into focus. The primary zone, which has already performed a task in current weeks, lies between $60.65 and $62.03. Two weeks in the past, the ETF briefly slipped as little as $59.92. Beneath that, a second help zone is positioned between $58.04 and $58.49.

Solely a break beneath each zones would point out a possible development reversal. The 20-week transferring common additionally runs between these two help areas, including additional technical significance.

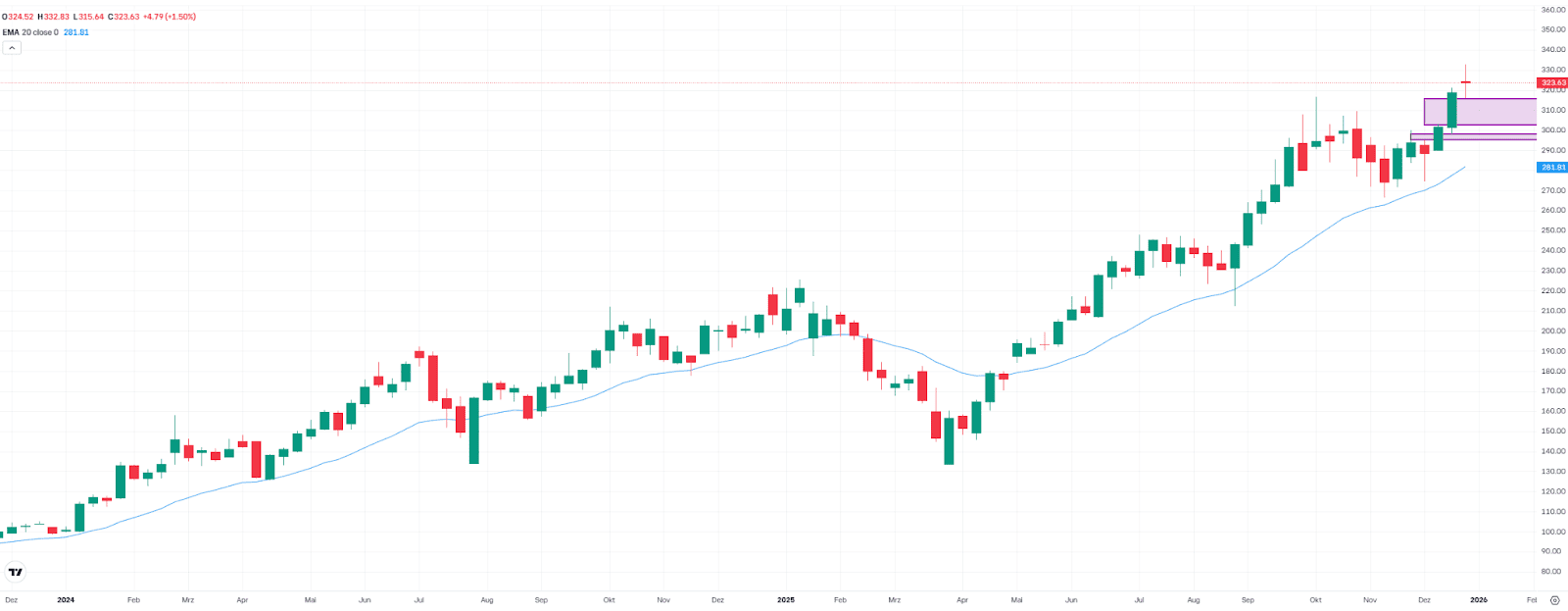

SPDR S&P Financial institution ETF, weekly chart. Supply: eToro

TSMC Earnings: Tailwind For New Highs Or Time For A Pause?

TSMC will report new figures on Thursday. They’ll present whether or not the world’s largest contract chipmaker can proceed to substantiate its position as a key beneficiary of the AI growth. The market’s focus is much less on the previous quarter and extra on the outlook for capital expenditure in 2026.

Sturdy outcomes would help the view that large AI investments are more and more reaching the true economic system, somewhat than remaining purely a stock-market theme. On the similar time, skepticism is rising. With funding momentum remaining sturdy, the chance will increase that the standard cyclicality of the semiconductor business may return within the medium time period, particularly if AI purposes are monetized extra slowly than presently anticipated.

For the reason that April low, the inventory has risen by round 140%, reaching a brand new file excessive of $332.83 simply final week. If the numbers impress, one other push to contemporary highs may comply with shortly.

Within the occasion of a pullback, two technical help zones (truthful worth gaps) come into play at $302.90–315.64 and $295.25–298.20. The inventory may subsequently face up to a extra pronounced pullback with out jeopardizing the uptrend. Particularly because the 20-week transferring common is presently a lot decrease at round $282 and would supply further help.

TSMC, weekly chart. Supply: eToro

This communication is for info and schooling functions solely and shouldn’t be taken as funding recommendation, a private suggestion, or a proposal of, or solicitation to purchase or promote, any monetary devices. This materials has been ready with out bearing in mind any explicit recipient’s funding goals or monetary scenario and has not been ready in accordance with the authorized and regulatory necessities to advertise unbiased analysis. Any references to previous or future efficiency of a monetary instrument, index or a packaged funding product aren’t, and shouldn’t be taken as, a dependable indicator of future outcomes. eToro makes no illustration and assumes no legal responsibility as to the accuracy or completeness of the content material of this publication.