Ethereum marked its tenth anniversary with a serious milestone, company treasuries now maintain over 2.73 million ETH valued above $10 billion, accounting for two.26% of its circulating provide.

Firms like SharpLink Gaming and Bitmine Immersion Applied sciences now lead as the biggest holders, even surpassing the Ethereum Basis.

This progress comes amid mounting institutional curiosity, with Ethereum ETFs attracting over $65 million in every day inflows and $21.5 billion in belongings underneath administration. The in-kind creation/redemption mannequin accepted by the SEC has added additional enchantment, providing tax effectivity for giant buyers.

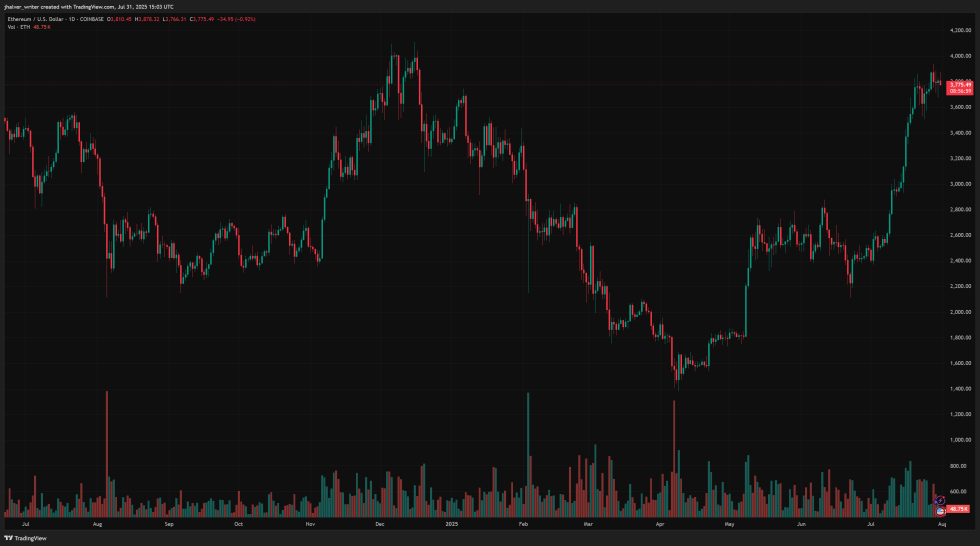

ETH’s worth developments to the upside on the every day chart. Supply: ETHUSD on Tradingview

XRP and Solana ETFs Might Arrive by October

The U.S. Securities and Trade Fee (SEC) has launched a Generic Itemizing Requirements framework permitting a dozen digital belongings to qualify for ETF approval in the event that they’ve traded futures contracts on designated exchanges for six months. This consists of Ethereum, XRP, Solana, Cardano, Dogecoin, and Shiba Inu.

Solana’s ETF approval might come as early as October 10, whereas XRP’s is anticipated shortly after. In keeping with market analysts, approval odds for XRP, Solana, and Litecoin ETFs exceed 95%.

The SEC has additionally accepted combined Bitcoin-Ethereum ETPs, expanded choices contract limits, and launched tax-friendly redemption strategies. These modifications slash paperwork by eliminating the standard 19b-4 rule change course of, streamlining ETF listings to a 75-day assessment.

SEC Delegates Energy to CFTC, Goals to Lead World Crypto Adoption

The SEC has successfully outsourced ETF approval authority to the Commodity Futures Buying and selling Fee (CFTC) by basing eligibility solely on futures buying and selling historical past.

SEC Chair Paul Atkins emphasised that the Fee will now “lead the cryptocurrency revolution,” pushing for future-proof regulation whereas defending buyers.

Regardless of criticism of Coinbase Derivatives’ monopoly in qualifying futures markets, the SEC’s determination marks a regulatory shift, doubtlessly positioning the U.S. as a worldwide middle in crypto innovation.

With 72 crypto ETF purposes pending, the approaching months might usher in one of the crucial bullish eras for institutional crypto adoption in U.S. historical past.

Cowl picture from ChatGPT, ETHUSD chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.